AECL Siemens Power Generation Westinghouse Electric Co. URS

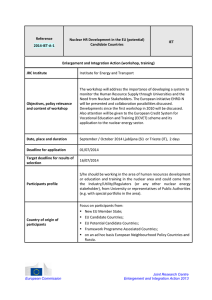

advertisement