Ruth B. Ginsburg – 2003

advertisement

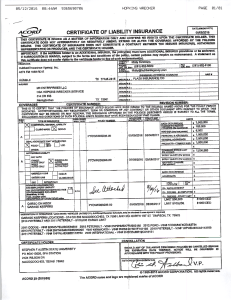

F!NAi'lC!.AL DISCLOSURE REP' • !

I

Reper! ...'?.equirtd by the Sthie

U1 Gtwe..'7mtenr Act �l' !978,

(S fl.S."C App. §§161- '}J)

FOR CALE!''JAR YEAR 21)03

'

:!. Court or Organtz.tlon

supreme Court

G$NSBURG,

of

. .'! Da

he

O{Jlqert

May 10, 2004

United states

RUTH !l.

(Anic/<llljutlgu lndica.te active or-:4tlllU;

magistra;<jutlge:s illdk4Iefu11· ""

S.

R<port Typ.(cliecl<approprlat<type)

_ Nomination

Associate Justice

_Initial

1. Cbamben or Office Address

B.

of the United States

On e First street, NE

Washington, DC

0543

Supreme Court

Dale ____

x.. Annual

1/1/03 - 12/31/03

_Final

Oa the bads of the informatiOn nnained !n this Report U<l

·ai:iy modificatlons perajni g th.,.... it ts, in my opinion,

ln compliance witti applicabte lam •mi regulation£.

I. POSmONS. (llq>oning in4iv1d...1on1y: _,pp. g;.11 ofl...,,,,Cllrms.)

POSmON

NAME OF ORQANIZATION!BITT1TY

NONE (No reportable positions.)

·

2

3

Il. AGREEMENTS. (Report/Jig individual only: '"'PP· 14·16 oflllSl1'Udion:s.)

·

0

PARTIES A.ND TERMS

DATE

NONE (No reportable agreements.)

Cl

(/)

(") .

, ...,,

2

{_') ....:...

m. NON-INVESTMENT INCOME. (Reporting 1nt1Maualaiui spouse::seepp. n-u ofl-•M-) :::=;??.:

;:c, {2

SOURCE AND TXPE

;QAig

·

A. Filer's Non-Investment Income

D

1

.

NONE (No reportable non-investment income.)

,_,

=

c.--_;

m

::r::

::'·"""

-<

m

0GRoS

-o

..,..,.

COME

rn

0

N

..!O'

See Attachrnect A

2

3

B.

·

$

Spo use ' s Non-Investment Income ff you were married during any portion of the reporting year, please complete this

section. (dollar amount not

required except for honoraria)

.

lJ

,...----,

1

2

•

.

NONE (No reportable non-investment income.)

'

l<il'l:Ai'l'C!AL DISCLOSURE RE.PORT

r;-iarn:: o:f?mon:\z nrng

i GI SBURG, RUTH

i

B.

5/10/

'4

IV. REil\'IBURSEl\tIENTS - transportation, lodging, food, entertair.ment

(hwludes those 10 spouse and dependent children. .See pp. 25-27 ofITISlnlc.tians.)

D

1

DESCRIPTION

SOURCE

NONE (No such reportable reimbiirse::nents.)

See Attachllient B

2

3

QI

4

(/)

0

s

o-

6

c::E;

.AO

rri_

-

(l:>Z

.c..

N

=

""='

a:

o>

""11J

7

:::!!

V. GIFrS.

(Includes those to spouse and dependent children. See pp. 28-31

DCatherine

SQURCE

ofInstructions.) 1

-

Q

""

·Si!

DESCRIPTION

;a

m

(")

m

<

-

I ii

0

VA[.1Jll

NONE (No such reportable gifts.)

l

2

3

& Wayne Reynolds

and American Academy of Acllievement

Blanket

est. $500

$

See Attachment C

4

$

' VI. LI.ABILITIES.

GJ

s

(Includes those ofspouse and dependent children See pp. 32-33 ofInstructions.)

CREDITOR·

NONE

DESCR1PTION

VALUE CODE*

(No reportable liabilities.)

l

2

3

4

5

g;o : 7?.i>;ooq1 ' ;.

!JQo,ooJ:::S'5;oQl;l;ooq."'i

p;ooo;· orK ;:"Ili;;:c:p·. : 1·1':

I

l

FINA1'iCLU. DI.SCLOSIJRE REPORT

}I.a.me ·:_'.]'m:on :Reportit:

Gil SBtJRG 1

UTH

B ..

5/10/04

IV. REThIBlJRSEMENTS

transportation, lodging, food, entertrinment

(Includes lhase tD spouse and dependent children. See pp. 25-27 ofInstr11<::1Ums.)

-

D

l

DESC!UPTION

SOURCE

NONE (No such reportable reimbursements.}

See

Attachment

B

2

3

4

5

6

7

'

V. GIFTS. (Includes those to spouse and dependent children. See pp. 28-31 ofInstructions.)

D

DESCRIPTION

SOURCE

NOl'<'E (No such reportabl e gifts.)

l

See

VALUE

Attachment

$

C

2

$

3

$

4

$

VI. LIABILITIES. (Includes those ofspouse and dependent children See pp. 32-33 ofInstructions.)

DESC!UPTION

CREDITOR

NONE (No reportable liabilities.)

2

3

4

5

.: , i

:$

. -t�s;oaQ;OQFSO,

VALUE CODE*

v

.,;.,

paga 1

1- ...-

•

I

FINA.:"'iClAL DISCLOSURE REPORT

GINSBURG 1 F.I.'T!3: B

May 1.0,

Vll. Page 1 INVESTh1ENTS and TRlJSTS- income, value, transactions

.

2004

(lndud.:rhoseof·

- and d<p<nd.ni clri/dn11. Su pp. 3'-$7 "'/IU/rucJlons.)

.

A.

·

ll.

-

D=ripdon of,...;,,,

(includmg !l'llS! ISSCU)

"JE."'

D

(J)

I

TYi"'

I

l Amt

! Codei

: (A·li)

mrtor

.jnL)

T..,,,,,..;o os dwmi ICpOrting period

rcpo<tinz period

I

f.l)

'

(l)

Val'ue·

I CO<le2

! Q·P)

NONE

Value:

Ma!lod

Cod<.J

:

(Q--V.l

·

(l)

I

{lt

•

'

buy, sell.

I

i;net1:r.

rc<lemptioo)

·

If not =mp< from disclO<UT<

'.I v 1ic I Ji

iMonlh- Codcl

. O.y ;

(l·P)

lxlyr:r/seller

(If priv.u: -..)

I

N

' '

INT.

A

K

T

'

- Riggs

'

Morgan Pri.rne M oney

.

T

'at'l Bank, D.c.

. JP

!deai.or

C<xl<I

j (A•H) .

I

I

.

g Account

interest bearing)

'·

-1

!l

-

organ Guaranty 1rust Co., }.'YC

Check

-

(No repo lc income., .usc:ts.

or trans.ct1ons.)

Checking Account -

.

(l)

I

c.

°""' ""'""

Jllcndof

duri

a}Ur eocl

l

'Plae1

eampt,1rompriordisr;lon.n:.

NONE

·

I

. .

'

INT.

D

Pl

T

larket Fund

i.

r

JP Morgan Prime Money

c

INT.

N

T

A

NONE

M

T

E

INT.

0

T

!arket Fund

i.

Shares of common stock,

!illennium Chemicals Inc .

)

.

Morgan.Intermediate

'

I

(and ce pital gains)

lX Free Income Fund

I

?. JP Morgan Prime Money

B

J;NT.

A

INT.

arket Fund

.N

T

K

'I

f.

.

3. JP'M.organ

Tax Free

oney Market Fund

.

,_

lC. Shares,of common stock and

shares of pref erred stock of

rhe Racquet Club of Easthampton,

I

gift tc 5/2t

NONE

M

Q

pubEe

charity

L-ic.

11. Cl as s A shares and Class

B

NONE

J

v;

shares in AVI Holding.Corp.

!

I

2

3

i

'

B--Sl.001-$2.500

G-'"$100,001-Sl,000,000

c-;2,;01-ss.ooo

HI •Sl ,000,00J -SS,iYJ0,000

MS.OOl·S.15.000

z..

orc thM ss.ooo>ooo

K-S!l.OOl·S50,DOO

J-SIS.ilOOor 1"'3

)'M.l50,00 l -tS00,000 MlOO,OOl·Sl.000,000

(S.."<0>1.Cl.DJ)

P:Fru.000,00!-SS0,000,000

R-cn.t (n:al cmi: only)

V•lue Nietl!od Codo:r:

V

er

(Sec Cot C2)

Book value

V<SS0,001· SJ00,000

Pl•Sl ,OOO.OO!·Sl,001),000

N•Mor! than SSll.000.000

M=SI00.00l-S2SMOO

P:l«SS,000,00J-SlS,OOO,OOO

S•Ass=ncnt

T

lncomc/Galn Codes; A=il,000 or ld3

F-$50,001· SlOO,OOC

(Se: O>i. Bl. 04)

Vl\.lue C.Odes:

\),tPPr.lis•1

W,Est1m1ti:li

arl:ct

E:SIS,001-SSO.OOO

i

I

l

1

..

FINA,7'!CTAL D!SCLOSlJR.E REPORT

i

VIL Page 1 INVESThIENTS and TRUSTS

:;p<J>LU and <iepc

...

w driid=L

o..cript;,,n ofAss<tt

{inclll<lin: tTUS! meal

oj'JIUtrW:li<>N.)

A.

-;:;,•priof'

llfkr

l'lm:l:

e:umpl

D

12.

S.t pp. 3M7

rem

B.

Income

dwi

I

I

udi """''

db:lOSJll"f!.

!

{A·Hl I

i

' Codcl

NONE {No rcporU!:ile income, met£,

er trans.actions.)

liooo<

oll'=oo

·

GINSBURG,

RUTH'B.

c.

Onm nlue

II end of

od

period

div ..

rent or

·

inL)

I

.0)

(l)

Typo

(<.g..

May

I

lO, 2004

- income, value, transactions (Includes,;.""' of·

n:;parti"i

-·

1,.I./

(i) '

! Amt

..,.-�--;

Val""

M<1liod

Codc.l '

Value

i Codc2

(Q-W)

i (J·P)

T....o..U

(I)

i

'

'

. Type

redemption}

'

I

duringreportlAgpcriod

If oat <><i:mpt a- <f"""=

o%J v I d:fu II

; (l·l')

n.y

IMon<lt-

CO<!c2

j

I

1

I

1

e.g..

b")',SCll,

merge,

I

. I

.

o.

I (A·HJ

Code!

•

.

i

-ll

1cr.:JUiyot

bu)i<rlscllcr

(ir privlw: <=s>ction)

:::

.·

'

. .. .

' .;

!

7.5.472% general partner

foi;erest in -Wegona 1974

14.

flssociates,

'

I

which holds a

1.08116% limited pa'..."'tnership

p'-ship N

distri: .

. :a

w

r

interest in Starrett City

;>.ssooiates and a 9.89009% . .

lir ted,partnership interest

'

in Manhattan Plaza AssOci tSs;

these limited.partnerships

onst;i:ucted

anCI operate

nousing project ·in New

York City.

..

.

.

I

l

.

-

'

.

I

I

)

.

I

l

I

lncomcJGaln Codes: A=S LOC.-J: or k:ss

F=S5fi100 -Sl00,000

(SeeO:>L BJ,04)

2

(Se.Cot.Cl.DJ)

3

Y>.lue Cod«;

;alue r.-f.ct-.OC C

,S" Cot. w)

B=S I.00 l ·S1.SOO

G.sl 00,00I../I1,000,000

!(•SI 5,00l·SS0,000

.1-Sl.5.(l(l<.) Of !css.

Q<SS00,001-Sl,000,000

1-M25Mlll-S500,000

P3=Ul.ooo,oo 1-sso,000, 000

: kApprilial

lFBooi: nlue

CcSl.50l·S5.000

HI mS 1,000, 00 l-SS,OOll, 000

L-Sl0,001· SlOO;OOO

P 1-Sl ,000. 00 I ·55,000, 000

P¥-Mo..: "'"' 550,000.llO:l

R><C-OSI (real "'1ale only) S...Asses.s.rn:nt

V

\11;- tim>tetl

!'f

ws.001.s1s,ooo

H2-Mor:: than SS.000,000

.r2"'1S,D00100:-

1m.OC<i

M=il00.00 l ·S250.000

T<>sli!MaJttt

E St5,00l·S5MOO

.

I

-------

FINA..

I

cl.\.L DISCLOSURE REPORT

VII, page

"-"'""""' '

Gil:lS3URGr

ROTE -s.

.

May 10, 2004

---- --------------'-·----------- -- -..L..

VIL Page 1 L"iVESTMENTS and TRUSTS- income, value, transactions fmclude11hono/

aJVi dt:p.«ndent diikln.n. St:t pp. )-I-Ji ofln.:rructiaN,)

o.

T"""""'oru during zeponing pcnod

15.

17.5% general partnership

NONE

interest in Wegoma 1975, which

holds a 16. 660% limited partner­

ship i nterest in Regency· Ill

Associates which constructed

·

and operates an apartment

project in ·Richardson,

TX

.

.

.

'

.

16.

i

17.

18.

TIAA/CREF Retirement Accounts

.(including SRA)

A

made while ·law school professor

a'id rollovers to IRAs from otl:\er

retirement accounts}

19. TIAA/CRE:F Retirement

Pl

INT·.

and l"RE!F

(contributions

'

!

I

'

'l'

port·olio

appr• ciatio;

in acct.

(ace.rues·

orio

A

Accounts

to. re irem<nt)

!NT.

Pl.

T

(including rollovers tc IRAs from ar..d 1 REF

port olio

other retire. en accounts

Pl

rnent frcm

appr d.atio l

1121

. (acc. ues in acct.

prio.

ollcvei

:

1(\IO.

invest- ,

to re,_ire:me nt)

20.

'

21. Fried; Frank, Harris,

hriver &

ac obson (law firm);

Value is retirement accounts

.at :year end

E

INT.

(accru =s

in accJ;:.

prior

T

1'.'ede:mp-

. on/

ti

roll eve

0

2

l

A s1.ooo or le-ss

F=S50.00l-SIOO,OOO

Vlll ue CMes:

(Sec Col. Cl. D3)

1-$15.000 or icsl

N"ilSO,IXH·S500.000

B=S!.OOl·S1.500

G-

100.001-Sl,OOO.COO

K•s:;,OOJ-Sl0,000

O<iS00,001-Sl,000,000

P:>=SlS,000,001-Sl0,000,000

Valt>: Meti>OO Co&:s: Q-App:llisal

!!<'Boo \'llJue

(See Co!. C2)

R«ist (""1l

V

a

CS'.ale only)

rolled over

Pl

l

to #19

\

r e tire :nent)

Income/Gain Cixl<s:

(£«Col. Bl. D4)

10/0:

C-sl,.SOI ·Sl.IJOO

HlwSJ ,OOO,OOl-SJ,000, 000

Wl0..001- SIOO:OOO

PI •SI ,000.001-$5,000,iXl()

P""Mor: than SS<l,ll00. 000

D=Sl.001-$1 l,OOO

H2'4-lorc than Sl.000,000

11

------ -

E=S I S,001-Sl0.000

Pmco;;;;i��-�-;;;-����-:--�,l�--;r:.,���.-._�-:1II,. page

4

1"!

FINA."'lcill DISCLOStJRE REPORT

\111 Page 1 INv"'ESTMENTS and TRUSTS

income, value, transactions

-

JPUl4• fiNi d.:putdenl cirildnA See pp, J.f.J7 o/ln.ttrvctfr:m:i.)

-

I

a.flu 41tJdi U:Ul

rom: ;>riM d'w:JtJ$jl!YJ,

..

repomng

(2)

(I)

I

. I Amt ..

! CO<!<!

: (A-fl)

I

D

NONE

I

B.

lnootDC

OUri

D=oiption of"""""'

(includini: lnlSI """"')

mpl

May 10, 2G04

rinc!ude: '"""

01.

l

A.

P/iJca

!

R:JTH B.

GINSBURG.

c.

Gt= "'""'

.,end of

I

I

I

Type

(e.g..

di'v..

. r<ntor

·inq

Fled

[.!)

(!)

•

Valoc

Code!

! ('.1-?)

i

!l)

Vrloo

Method

Codcl :

.(Q-WJ

•

'

TrP<

.I

g period

I 12J

. 0...,

!Momlr

m:::rg:•:r .

m

Vil1><

Codcl

I

i

!

If not =mpt fronufuclosm

I Jl .

I ...

: Code·!

mkmptioo) . . ll>y : (J-?) )(A•H) ,

(e.g..

buy, ><II,

i

·(Ne reportable: income, mets.,

or transactions.)

-I

D.

cns during

T

ld t.r

buy<:V,.lla

or privi!< lrW"'lion}

!

.1

I

.

. .

.

22·.

"

.

Martin D.

23.

P.C.,

Ginsburg,

a professional corpor-·

atiOn

(leg l services)

which

is counsel to Fried, Fran.1<!

Barris,

Shrive

& Jacobson

(Value is equity .value af

P.c:

plus unfunded retire-

t accounts

m

-

i;-efl

cted

to

III)

Pl

u,w

I

n a swe .

.

r

,.

at year end)

24.

I

25.

' .

26.

.

27

,.

.

.

1

'

•.

28.

29.

I

'

'

I

I

I

I

l

'

l

3

L'1com.e/Gain Codes: A-=Sl.000 or less

F=S50,001· SI00,000

(S« Col. 91. D4)

Ml.001.S2.500

C-"'SI 00,001-SJ,000,000

K->15,001-$5-0,lliN

,--sis.000 or loss

()-1500,DGl·Sl.OOO.DOO

250,001-ilOO.OOO

..5,00IJ,OOl·S50,000,0'"1

?

R.Cc" (:coJ es-.ate onJy)

Value M"1hod COO.S: 0-Appr.iis al

cr

V

{S.:e Co!. C2)

D=.B-Ock value

-

Vt.Jue Co<los.

(S<:e Col. Cl. Dl)

C.-S:Z.501-Sl,OOO

H l si ,000,00 I -SS,000, 000

D=Sl,OOl-S!l,000

H:l'<More than Sl.000,000

l.-SJ0,001· SJ00.000

J>l •Sl,000.001-S5,QOO, OOO

i'l

P<!=Mo"' th i Sl-0,000. 000

" .

M=SIOO.O!L

·S250.0IXI

,000,00 I ·S'.ll ,000,000

E=Sts,ooi-m.ooo

: :-htMa<nnas

_FIN

.A.1N _CIA

·

_L

E

_v_._RE_ _P_o_ R_T

_n_ 1L

_s_c_ _o_s_TI_iR

-'-

G-N

I ·s__s_u_RG_,

,

1

R

D _:TH

·_

·

·_ B_ .

o<

J

M _}__

' ol _, 2 vo ·4

-l._a

-_

VII. Page l IN'v.ESTMEl'fTS and TRUSTS - income, value, transactions

,1,,,,1..Jes lhou ,i.

;puus< and d.:p<NU:•t <ilildmo. s,, pp, J<-S7 a{/""""'//""'-)

30.

31.

'

I

I

32. TI.AA

-

CREF

Mutual

Funds

A

K

INT.!

T

DIV.,

l'<ppiet::iatior

..

33.

TIA.A

-

CREE' Mucual Funds

A

L

• INT .. ,

buy

()'Ol

K

•

.L

( investit nt)

DIV.,

. ppre·

T

buy

ilO,Ol

iinvestiwmt)

oiatior

'"

.

.

.

.

!l

!

.

l

E Sl 5,00!-SlO.iXXJ

l

tnl0,001· SI 00.il".Al

pi MSl ,000. 001-Sl,000,000

P4'>Mcn: thar. 550,000.000

I

I

of?

A..'-ICT.AL DISCLOSURE REPORT

GINSBURG,

5/10/04

RUTS ?o

vlil. ADDITIONAL Th"FORM.ATION OR EXPLANATIONS (IndiCllte part of Report.)

IX. CERTIFICATION.

I certi.'Y that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is

accurate, t:ue, and complete to the best of my knowledge and belief; and that any infoxmation notreported was withheld because it met applicable

statutory proYisions permitting non-disclosure.

I for.her certify 1bat earned income from outside employment and honcraria and the acceptance of gifts which have been reported are in

compliance \\itb the p ovisions of5 U.S.C. app., § 501 et. .seq., S U.S.C. § 7353 and Judicial Conference regulations.

·

D e

Signature

NOTE:

May 10,

2004

JVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES ORFAilS TO FILE THIS REPORT MAY BE

SUBJECT TO CIV1L AND CRlMINAL SANCl10:-l"S (5 U.S.C. App,§

104.)

5/10/04

GINSBURG, RuTH B.

ATIACBlVIENT A

Ill Non-Investment Income

Source and Type

3/11/04

Gross Income

enter

Danv ers, MA

(publication royalty- year 2002 publication)

(S)

Martin D. Ginsburg, P.C.

(Professional Corporation-Law Salary)

(S)

Georgetovm University

(Professor of Law- Salary)

(S )

Millennium Chemicals Inc.

(Fee for serving as a director)

.$241.44

5110104

GJNSBtrn.G, RUTH B.

ATTACHMENT B

IV. Reimbursements and Gifts

Travel in.2003 (air tickets, lodging, and meals provided by

organizations inviting Ruth Bader Ginsburg to participate

in professional or educational programs)

·

Univ. of Colorado

School of Law

Boulder, CO

Janua.ry 24-26

Thomas Jefferson

School of Law

San Diego, CA

February 5-8 - Jefferson Memorial Lecturer

Univ. of Louisville

Brandeis School of Law

Louisville, KY

February 11-12 - Brandeis Lecturer

Georgia State Univ.

Law School

Atlanta, GA

February

Harvard Univ.

Law School

Cambridge, MA

May 2 - Speaker at Celebration 50 (commemorating 50tb anniversary

of women's graduation from the Law School)

Yale University

May 25-26

-

Tribute to Byron R White

12-14 Henry J. Miller Lecturer

-

·

-

Honorary degree recipient

New Haven, CT

Luxembourg, Germany

July 5-8 - European Court of Justice Conference

Florence, Italy

July 9-11 - L a Pietra Conference

Univ. of Puerto Rico

July 12-20 - Distinguished Lecturer in

School of Law

summe r

program

Barcelona, Spain

Columbia University

School ofLaw

. 3 - Celebration of 10th Anniversary of my

September 11-1

appointment to the Supreme Court of the Ullited States

New York, NY

University cf Idaho

College of Law

Moscow, Idaho

September 17-20

-

Bellwood Lecturer

-2-

Oklahoma Bar Association

Septei:nber21-23

-

Women in Law Conference Speaker

Oklahoma City, OK

Speaker at the Inauguration of Jeffrey S.

Cornell University

October 16

Ithaca, NY

Lehman as President

Philadelphia Bar Ass'n

October 23

Philadelphia, PA

-

-

Luncheon Speaker

GL."" SBURG, RU":'H B.

ATTACHME:\� C

V. Other Gifts

5110104

In the Fall of 1993 two Washington, D.C. city clubs, T'ne University Club and The City

Tavern Club, extended honorary memberships to me. In the Spring of 1996, the Lotos Club of

New York City awarded me an honorary membership. An honorary n:ernber is not required to pay

either dues or an initiation fee. None of these Clubs has been or is likely to be a litigant in the Court

and membership was not invited to exploit my position as a Justice.

Advisory Opinion No. 47 (1975) of the Judicial Conference Advisory Committee, addressing

complimentary memberships, concludes that (1) receipt of a complimentary membership i s permitted

under Canon 5C, and (2) the value of the membership, if in excess of$100, should be reported on the

finaru:ial disclosure form as a permitted gift.

The University Club's 1993 initiation fee for a resident member 35 years of age or older was

$4,000, and in 2003 monthly dues charged resident members 35 years of age or older were$150.

The City Tavern Club's 1993 initiation fee for a resident member was $625, and in 2003

monthly dues charged resident members were $150.

·

The Latos Club's 1996 initiation fee for a nonresident member was$2,000, and in 2003 annual

dues charged nonresident members was $1, 100.

I designated the following:

Thomas Jefferson School of Law's Third Annual Women inLaw Conference, $1,500

honorarium for the Thomas Jefferson School of Law Memorial Lecture, February 5-8, 2003.

Arena Stage, Jewish Social Service Agency, Sbarsheret, Signature Theatre, and Catholic

University Summer Opera,$5,000 honorarium ($1,000 designated to each) for the University of

Louisville Brandeis School ofLaw Lecture, February 11-12, 2003.

Georgia State University College of Law's Twentieth Anniversary Law Scholarship Fund,

$2,500 hononirium for the Georgia State University College of Law Miller Lecture, February 12-14,

2003.

Beginning \\-i.th Children Foundation, Inc., Glimmerglass Opera, Santa Fe Opera, Signature,

Theatre, and Washington Performing Arts Society,$5,000 honorarium ($1,000 designated to each)

for the University of Idaho College of Law Bellwood Lecture, September 17-20, 2003.

All of the payments listed abOve were made to charities in my name in lieu of compensa­

tion for lectures sponsored by the listed law schools. All of the charities are qualified recipients

under§ 50l(c) (3) of the lntemal Revenue Code. Each of the law schools is an accredited

educational institution and the lectures, delivered to overflow audiences including most of the

schools' students, were part of the schools' educational offerings.