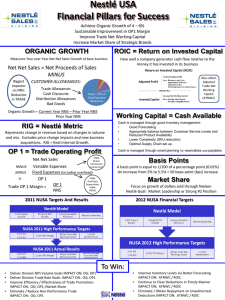

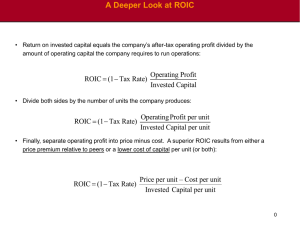

SOE Economic Profit Analysis

advertisement