Financial Statement Analysis

advertisement

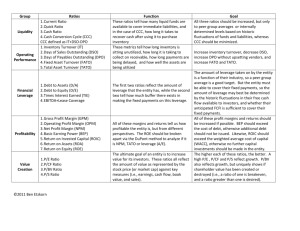

Financial Statement Analysis Financial Statement Analysis 40 Common‐Size Financial Statements • Balance sheet items as a percentage of ______________________. • Income statement items as a percentage of ______________________. 41 Suzie Q Corporation Balance Sheet December 31, 2014 Assets: Current Assets: Cash Accounts Rec. Inventory Total CA Fixed Assets: Net Fixed Assets Total Assets $ 80 140 155 $375 265 $640 Liabilities & Equity: Current Liabilities: 12.5% Accts. Payable 21.9% Notes Payable Total CL 24.2% 58.6% Long‐term Debt: Common Stock 41.4% Retained Earnings 100.0% Total Liab. & S.E. $ 95 110 $205 120 40 275 $640 14.8% 17.2% 32.0% 18.8% 6.2% 43.0% 100.0% 42 FINC 3610 ‐ Yost Financial Statement Analysis Suzie Q Corporation Income Statement For Year Ended December 31, 2014 Sales Cost of Goods Sold SG&A Expenses Depreciation EBIT Interest Expense EBT Taxes Net Income $910 470 210 60 $170 40 $130 52 $78 100.0% 51.6% 23.1% 6.6% 18.7% 4.4% 14.3% 5.7% 8.6% 43 Classification of Financial Ratios • Short‐term Solvency or Liquidity Ratios • Long‐term Solvency or Financial Leverage Ratios • Asset Management or Turnover Ratios • Profitability Ratios • Market Value Ratios 44 Short‐term Solvency (Liquidity) Ratios • Current Ratio • Quick (Acid‐Test) Ratio • Cash Ratio • Net Working Capital to Total Assets • Interval Measure 45 FINC 3610 ‐ Yost Financial Statement Analysis Long‐term Solvency (Financial Leverage) Ratios • Total Debt Ratio • Debt‐equity Ratio • Equity Multiplier • Long‐term Debt Ratio • Times Interest Earned (TIE) Ratio • Cash Coverage Ratio 46 Asset Management (Turnover) Ratios • Inventory Turnover and Days’ Sales in Inventory • Receivables Turnover and Days’ Sales in Receivables • Net Working Capital Turnover • Fixed Asset Turnover • Total Asset Turnover 47 Profitability Ratios • Profit Margin • Return on Assets • Return on Equity 48 FINC 3610 ‐ Yost Financial Statement Analysis Market Value Ratios • *Earnings Per Share (EPS) • Price‐earnings (PE) Ratio • Price‐sales Ratio • Market‐to‐book Ratio • Tobin’s Q • Enterprise Value – EBITDA Ratio 49 DuPont Identity • ROE = • With leverage, ____ is greater than ____. • Breaks ROE down into: – Profitability – Asset Use Efficiency – Financial Leverage 50 Uses of Financial Statements • Ratio Analysis • Common Size Statements • Trend Analysis • Cross‐sectional Analysis • The DuPont Identity 51 FINC 3610 ‐ Yost Financial Statement Analysis Limitations of Financial Statements • Benchmarking • Effects of Inflation • Seasonal Factors • “Window Dressing” • Differing Operating and Accounting Practices • The Big Picture 52 Suggested Problems • Concepts Review and Critical Thinking Questions – 2, 5, and 7 • Questions and Problems: – 7, 12, 17, 22, 26, and 27 53 FINC 3610 ‐ Yost