FM12 Program

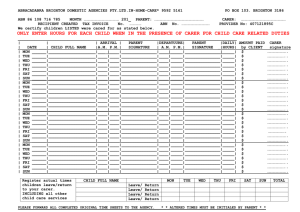

advertisement