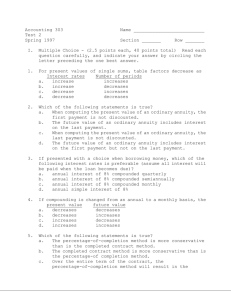

CHAPTER 11

advertisement