Team 1 Planbook

advertisement

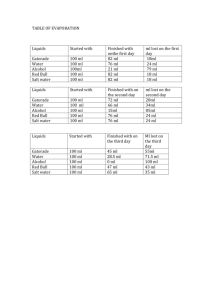

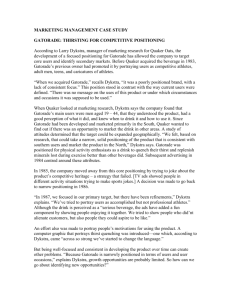

TABLE OF CONTENTS Executive Summary................................ 2 Company Analysis..................................3 Industry Analysis...................................9 Market Analysis.....................................11 Perceptual Map.....................................14 Product Analysis...................................15 Consumer Analysis................................19 Competitor Analysis...............................22 Past and Present Marketing Efforts..........26 Brand Equity and Positioning..................29 Communication Strategy........................30 SWOT....................................................34 Conclusion............................................36 1 EXECUTIVE SUMMARY Our objective is to provide guidance and market advice for Gatorade’s Heritage program. We are focusing on Gatorade’s current positioning within the non-carbonated beverage industry, as well as within the context of its parent company, PepsiCo. This planbook is a summary of comprehensive secondary research, market analysis and consumer data that can potentially influence the strategies and sales performance of Gatorade in future advertising efforts. Some important highlights include: • Gatorade’s Heritage campaign seeks to celebrate the rich history of the drink, which prides itself on being scientifically catered toward fueling and hydrating athletes. • In 2009, Gatorade refocused its marketing efforts to intensely cater toward the “competitive athlete” after sales dropped sharply. The CEO wanted to address the problem of Gatorade becoming a “social drink,” it wasn’t meant to be consumed on a couch. • Gatorade is a leader in monitoring consumer attitudes, and the company made history when it developed Mission Control-- a global analytic tool that tracks conversations about Gatorade through all social media channels. • The sports drink industry is projected to grow by up to 52 percent between 2013 and 2017. • • Gatorade has recently started to include more alternative competitive sports-- such as cheerleading and swimming-- in its social media communications, resulting in higher consumer engagement than previous efforts. Somebody should bring me lots of lemon lime Gatorade . I will love them forever #hydrate #gatorade #waterisflavorless @countrygal214 To accomplish the objective of this analysis we have created a target profile, analyzed Gatorade’s brand essence, examined the current positioning and conducted a SWOT analysis. 2 COMPANY ANALYSIS PEPSICO Gatorade is owned and operated under the umbrella of PepsiCo. The company portfolio consists of 22 brands including Aquafina, Tropicana, Naked Juice, Lipton, and snack food brands such as Ruffles, Fritos and Lay’s. THE PEPSICO MISSION “Our mission is to be the world’s premier consumer products company focused on convenient foods and beverages. We seek to produce financial rewards to investors as we provide opportunities for growth and enrichment to our employees, our business partners and the communities in which we operate. And in everything we do, we strive for honesty, fairness and integrity.” THE VISION: “PERFORMANCE WITH A PURPOSE” “At PepsiCo, we’re committed to achieving business and financial success while leaving a positive imprint on society - delivering what we call Performance with purpose.” GUIDING PRINCIPLES • • • • • • Customer care Sell only products it can be proud of Speak with truth and candor Win with diversity and inclusion Balance short term and long term goals Respect others and succeed together “I think innovation as a discipline needs to go back and get rethought and revived. There are so many models to talk about innovation, there are so many typologies of innovation, and you have to find a good innovation metric that truly captures the innovation performance of a company.” - Indra Nooyi, CEO of Pepsi 3 PEPSICO SALES GATORADE POSITIONING WITHIN PEPSICO As one of the leading brands in PepsiCo’s portfolio, the Gatorade brand strives to exceed all of Pepsi’s goals and deliver a product that empowers and enables athletes. The Gatorade brand is the essence of the PepsiCo Vision “Performance with Purpose.” 4 HISTORY OF GATORADE Gatorade prides itself on being “born in the lab.” In 1965 at the University of Florida, the football team’s assistant coach sat down with a group of physicians and asked them how it was possible that the summer heat could be affecting his players so profoundly. The doctors determined that two key factors were causing the players to fade: the fluids and electrolytes lost through sweat weren’t being replaced and the large amounts of carbohydrates the players’ bodies needed were not being replenished. The Florida Gators created their own scientific solution to replenish the body with electrolytes lost during exercise, and called the concoction “Gatorade.” GATORADE AT A GLANCE Gatorade can be found on the sidelines of more than 70 Division I colleges as the official sports drink of men and women’s intercollegiate sports. In 1983, Gatorade became the official sports drink of the National Football League—a title it holds to this day. Gatorade is the official sports drink of the National Basketball Association, Association of Volleyball Professionals, and Professional Golf Association, Major League Baseball, Major League Soccer, and numerous other elite and professional organizations and teams. In 2001, Gatorade developed the Gatorade In-Car Drinking System to withstand 130-degree heat and keep professional racecar drivers hydrated during races. THE STATS Soon after the magic elixir, now known as Gatorade, was introduced to the Florida Gators, the team started winning games against heavily favored opponents in unprecedented heat and finished out the season 7-4. The following year the Gators won the Orange Bowl for the first time. Word about Gatorade quickly spread, and the rest is history. That’s my kind of 6-pack #gatorade @Sports_Life 5 6 GATORADE SPORTS SCIENCE INSTITUTE Founded in 1985, the Gatorade Sports Science Institute (GSSI) is committed to helping athletes optimize health and performance through research and education in hydration and nutrition science. GSSI scientists study the effects of nutrition on the human body before, during and after exercise. For more than two decades, hundreds of amateur, elite and professional athletes have participated in testing with GSSI and in studies with university research partners around the world. GSSI’s headquarter lab, mobile and satellite laboratories and on the field-testing enable a rich variety of athletic research. GSSI collaborates with universities and researchers around the world to undertake research in exercise science and sports nutrition. The Institute is internationally recognized for its research and education offerings, which serve nearly 100,000 subscribers in more than 145 countries. GSSI has awarded more than 100 Student Research Grants to research fellows and graduate students throughout North America, Latin America, Australia, Asia and Europe. Gatorade has specific research-based stance on what stages of physical activity the sports fuel should be consumed. The science and research that is involved stems from the GSSI. 7 PERSONALITY & BRAND PRESENCE Gatorade focuses heavily on the ball-and-stick sports – baseball, basketball and football. The brand's personality can be summed up simply: competitive and intense. Gatorade sees itself appealing to the athletes who have the need to compete embedded into their very DNA. It doesn't position itself as the brand to enjoy when sitting on the couch – it is the brand to help consumers power through the second half of the game. Gatorade has just begun to pursue opportunities to include other types of athletes. Gatorade will be launching a program called Road to Brazil to support the 2014 FIFA World Cup, meeting a major challenge that the company identified: the world’s most popular sports fuel isn’t fueling the world’s most popular sport. Additionally, Gatorade’s branded social media content is beginning to feature sports like cheerleading and swimming. Athletes are responding enthusiastically and sharing the content to their own social media networks. LOGO EVOLUTION TRADITION: THE GATORADE SHOWER The tradition began with the New York Giants football team in the mid-1980s. According to several sources including Jim Burt of the Giants, it began on October 20, 1985, when the Giants beat the Washington Redskins 17-3. Burt poured a cooler of Gatorade on coach Bill Parcells after being angry over the coach’s treatment of him that week. This was the beginning of the now famous, celebratory “Gatorade shower.” 8 INDUSTRY ANALYSIS NON-CARBONATED BEVERAGE (NCB) INDUSTRY TRENDS WHAT IS AN NCB? Non-carbonated beverages are drinks that do not have carbon dioxide. Non-carbonated drinks include bottled water, tea, coffee, milk, fruit juice and sports drinks. This category is one of the fasted growing and more saturated categories in the market. SPORTS DRINK INDUSTRY Within the non-carbonated beverage industry falls the category of sports drinks. A sports drink is considered any beverage that has been modified with vitamins or electrolytes to aid athletes in performance. Although the NCB industry is all-inclusive to beverages lacking carbonation, Gatorade’s direct competitors are water, flavored waters and other specifically sports-marketed beverages. Other beverages in the NCB category such as milk, coffee, tea and juice are considered indirect competitors. The market for sports drinks is very price sensitive, which might explain why the less expensive Powerade market share grew from 14.3 percent to 23.4 percent from 2006-2011. In addition, Mintel suggests Gatorade has suffered from consumer confusion and push back because of its frequent rebranding efforts. Flavor, brand, size and price are the top motivators for purchase of sports drinks, according to Mintel. Consumers also prefer to buy their Gatorade products cold, which is why Mintel estimates that point of purchase refrigerators account for 37 percent of total Gatorade sales. Endorsements from sports leagues and athletes is important to less than one quarter of the total sample, but this is still an important marketing tool for targeting core users. My supplement is #Gatorade, water and food. @Adbi_runs 9 INDUSTRY MOTIVATORS Although Gatorade likes to brand itself as a performance-based fuel for rehydration, Mintel’s survey shows that 64 percent of respondents say they use Gatorade as a thirst quencher/refreshment beverage, 42 percent consume it as an anytime beverage and 40 percent just drink it because they like the taste. Sports drink consumers are not commonly considered “athletes” – one in five would actually define themselves as a couch potato. About 6 in 10 consumers who don’t buy sports drinks say it’s simply because they believe water is enough to meet their needs. Since flavor is an important factor to consumers, Gatorade needs to convince these water-drinkers that they may prefer the taste of Gatorade as opposed to plain water. HEALTH CONCERN: SUGAR Thirst-quenching ice bath anyone? #gatorade @JoshKim17 Half of sports drinks consumers are motivated by all-natural ingredients, according to Mintel. This is because of rising health concerns. Although consumer demand for natural beverages continues to climb, there are very limited options in the sports drink market. Mintel says that while consumers desire all-natural sports drinks, they are unwilling to go the extra mile to make a special trip to a natural foods store to purchase all-natural sports drinks. Dietitians and health advocates continue to target sports drinks for high sugar content. Placing natural sports drinks among regular sports drinks in the aisle would let consumers know these options exist and likely increase sales. 10 MARKET ANALYSIS More than $40 billion in sales of sports and energy drinks were reported in 2010. The global sports and energy drink market is expected to reach $52 billion by 2016. It is one of the fastest growing and most innovative segments in the beverage market. The global sports and energy drink market is expected to grow in volume by more than 3 percent every year. ECONOMIC FORCES The 2007 recession and the slow subsequent recovery hit the sports drink industry hard. Many uncommitted buyers reduced or completely stopped purchasing Gatorade and other sports drinks. However, sales of sports drinks grew 21 percent from 2007 to 2012, and Mintel predicts the market will grow by 52 percent from 2013 to 2017. Although Gatorade and other sports drinks have mostly avoided soda bans in schools, critics have started making a case to ban all sugary beverages in schools. Mintel suggests that in addition to low-sugar and low-calorie positioning, sports drinks that feature natural sweeteners have the potential to grow the market because consumers are looking to cut artificial ingredients, without sacrificing taste. Participation in high school sports increased for the 24th consecutive year in 2012-13 and passed the 7.7 million mark for the first time, according to the National Federation of State High School Associations. More than 55 percent of students enrolled in U.S. high schools play sports within the school setting, providing supports for Gatorade’s current target of 13 to 17-year-old athletes. The competitive level of these athletes is a topic worth exploring. 11 THE MARKETING MIX PLACE Gatorade is a warehouse delivered brand and thus has a strong presence in supermarkets, small groceries, drug stores and delis. It also has strong distribution in immediate consumption channels such as convenience stores. A growing number of non-traditional retail outlets such as sporting goods stores have also helped Gatorade’s immediate consumption. Gatorade.com sells four flavors of 24 packs online for $49.24: Fruit Punch, Cool Blue, Fierce Grape and Lemon Lime. PRICE 64 fl oz = $2.79, 32 fl oz = $2.19, 24 fl oz = $1.99, 20 fl oz = $1.79, 12 pack of 12 oz = $5.98 The price of Gatorade varies per store but gravitates around the prices shown above. Stores might also run promotions on multiple bottles of Gatorade. For example, Walgreens runs a 2/$4 promotion on the 32 fl oz bottle size. PROMOTION • IN STORE Gatorade takes advantage of physical store displays. It utilizes attractive wrap around end-caps with a large product capacity. The refrigerated “refreshment center” is designed to attract immediate consumption. • PACKAGING Packaging continues to be an important part of Gatorade’s history. Gatorade continues to update its bottles for ease, convenience and looks. • ONLINE Gatorade maintains an active online presence. VML developed Mission Control in Gatorade’s headquarters in Chicago, Illinois. Mission Control monitors every online mention of Gatorade. At the same time, Community Managers respond to questions, comments and concerns from people on social media. • POSITIONING In 2009, Gatorade sales dropped sharply. PepsiCo CEO, Indra Nooyi, believed the company made the mistake of marketing Gatorade as a “social beverage” rather than a staple for athletes. As another top executive put it, “Gatorade’s not meant for the couch.” The recent Heritage campaign shifted the focus back to competitive athletes looking for hydration and fuel. 12 Sales Growth and Decline Gatorade sales began to decline in 2007 because of the oversaturated market and sports drink trend decline. In 2009, sales declined another 16 percent, and many believe it was because of the bottle label change. The label changed so much that consumers didn’t recognize the brand on grocery shelves. Also during 2009, Gatorade realized its consumer was shifting from intense athletes to couch potatoes who drank it for the “cool factor.” Its core consumer began to turn to other hydration products. However, in 2010, Gatorade sales volumes were up 15%. Beverage Digest publisher John Sicher said, “Gatorade is taking the brand back to its core, which is a hydration beverage for athletes, and that has begun to resonate, which is why Gatorade is back to double-digit growth.” 2010 also marks the beginning of Mission Control, when PepsiCo ‘08 ‘09 tried to breathe new life into Gatorade by using the Internet to reconnect with teen athletes who snubbed Gatorade when it became “uncool.” Gatorade’s social media infiltration proved successful and lead to the end of the three-year sales decline. With an estimated brand value of $2.5 billion, Gatorade dominates 71 percent of the sports-drink category. GLOBAL EXPANSION Gatorade is available in 80 countries, offering more than 30 flavors in the U.S. and more than 50 flavors internationally. Gatorade expanded to Japan in 1982, Canada in 1984, and Europe and South America in 1988. 13 PERCEPTUAL MAP RATIONALE X-axis: Variety We weighed several aspects of NCBs that motivate our consumer to purchase, one of which was flavor. We wanted to weigh Gatorade's diverse array of flavors against its competitors. However, it is important to note that variety isn't always synonymous with good. Our research has shown that Gatorade might have too many flavors for the consumer to comprehend. The king of all sports drinks #strawberry #gatorade @simgarcia1995 Y-axis: Mass appeal While Gatorade's defined target is narrow – the competitive athlete – the truth is that the product is enjoyed by a much larger community. We looked at key competitors of Gatorade and weighed if they appeal to a mass audience – like Gatorade – or to a much more niche audience. 14 PRODUCT ANALYSIS Gatorade is the most researched beverage on the market for athletes and active individuals with ongoing hydration research conducted by the Gatorade Sports Science Institute in Barrington, Illinois. It is the most scientifically researched and tested way to replace electrolytes lost in sweat. It hydrates better than water, which is why it’s trusted by some of the world’s best athletes. During strenuous physical activity, water is not sufficient in replenishing all of the body’s lost fluids. Drinking Gatorade is only necessary during and after vigorous activities such as long distance running, cycling and contact sports. It is not meant for consumption during non-physical activities and should not be used as the only or main fluid replacement through out the day. PRODUCT CURRENT ORIGINAL FLAVORS: Berry, Cool Blue, Fierce Grape, Fierce Melon, Fierce Strawberry, Fruit Punch, Orange, Lemonade, Lemon Lime, Lime Cucumber, Rain Berry, Rain Lime, Rain Strawberry Kiwi, Watermelon Citrus, Strawberry Watermelon, Tangerine, X-Factor Fruit Punch + Berry, Citrus Cooler, Mango Extremo CURRENT FROST FLAVORS: Glacier Cherry, Glacier Freeze, Riptide Rush, Orange Strawberry, Tropical Mango MOST POPULAR FLAVOR: Fruit Punch 15 BOTTLE EVOLUTION Gatorade designed its newest bottle in 2013 to be lighter, sleeker, easier to grip and featured a nodrip label. It contains fewer ounces, 28 instead of 32, as the bottle costs more to produce. Why is the no-drip label important? According to Dwayne Wade, Miami Heat All-Star, when athletes pull their Gatorade out of a cooler full of ice, there’s water dripping from the label and it makes a mess of their uniform. The new bottle claims to put an end to drips from the label. 16 NUTRITIONAL INFORMATION INGREDIENTS Water, Sugar, Dextrose, Citric Acid, Natural and artificial flavor, Salt, Sodium Citrate, Monopotassium, Phosphate, Gum Arabic, Glycerol ester of rosin, Sucrose Acetate, Isobutyrate, Yellow 5 * Ingredients shown for Original Lemon Lime flavor only SCIENCE BEHIND THE INGREDIENTS ELECTROLYTES When athletes sweat they lose electrolytes such as potassium, chloride and sodium. Electrolytes are lost through sweat and must be replaced to stay hydrated and keep their concentrations in bodies constant. Gatorade includes a carefully balanced mixture of these electrolytes to keep athletes hydrated. CARBOHYDRATES The carbohydrates in Gatorade include glucose, fructose and sucrose to provide energy to athletes. OSMOLALITY Osmolality is the measure of a substance’s electrolyte-water balance. The osmolality of Gatorade is a little higher than the osmolality of our blood. This is to make sure the body absorbs the Gatorade quickly during exercise to increase and maintain hydration. “More than 40 years of scientific research have gone into Gatorade to assure its formula is optimal. Nothing rehydrates, refuels or replenishes better.” GATORADE’S TRUTH BEHIND SUGAR Gatorade stands by the inclusion of sugar and dextrose in its sports fuel. Joe Grigsby, Director of Digital Marketing for Gatorade, explained the decision, “Gatorade is an athletic product, not a health product. While being an athlete includes a healthier lifestyle, it does require specific types of benefits.” Sugar is that benefit. Gatorade’s target consumer is not trying to cut down on sugar for health reasons, rather, they understand that sugar and dextrose are the very elements that fuel their performance. They are part of the essential competitive formula that needs to be replaced after an intense workout. Therefore, sugar itself is among the benefits--not drawbacks--that Gatorade offers. 17 PERFORMANCE CLAIMS Gatorade Thirst Quencher is scientifically formulated and athletically proven to replace fluids and provide energy to working muscles. By offering a scientifically validated blend of carbohydrates (6 percent carbohydrate blend; 14 grams per 8 oz) and key electrolytes (including the proper amounts of sodium at 110 mg per 8 oz), Gatorade stimulates fluid absorption, helps the body maintain fluid balance, provides fuel to working muscles and helps enhance athletic performance. INGREDIENT REMOVAL Responding to consumer concerns, PepsiCo announced the removal of brominated vegetable oil (BVO) from its citrus-flavored Gatorade in January of 2013. The U.S. Food and Drug Administration’s last review of BVO, conducted in the 1970s, called for more toxicological testing that was never performed. A petition on Change.org noted that BVO has been patented as a flame retardant and is banned in Japan and the European Union. For Gatorade, spokeswoman Molly Carter said BVO was used as an “emulsifier,” meaning it distributes flavoring easily so that it doesn’t collect at the surface. It was only used in select flavors, including Orange and Citrus Cooler. Carter said the removal was specifically a response to concerns expressed by Gatorade customers. BVO has been replaced with an ingredient called sucrose acetate isobutyrate. FAN ACTIVISM: Sarah Kavanagh is the 15-yearold who posted a petition on Change.org that prompted the removal BVO from Gatorade. NATURAL GATORADE DISCONTINUED Since consumer trends are leaning toward “natural” products, PepsiCo created Gatorade Naturals with claims that the drinks provided benefits of regular Gatorade while using ingredients like sea salt. The line had limited distribution in select Whole Foods and Kroger locations. Gatorade Naturals was discontinued in November of 2013 because the drinks did not resonate with Gatorade’s core consumer. Not only were consumers unwilling to go out of their way for the natural version of Gatorade, but athletes do not drink Gatorade for health reasons other than to fuel and rehydrate during and after intense competition. 18 CONSUMER ANALYSIS GATORADE’S TARGET Gatorade’s Heritage campaign’s current target audience is competitive athletes ages 13 to 17. These athletes don’t play sports for the fun – they play because the need for competition is embedded in their very DNA. Previous Gatorade studies assert that about 15 percent of the population fits this description. According to Mintel, professional athlete endorsements are very likely to sway this population. There are nearly 25 million teens in the United States. Of these, 77 percent say they drink sports drinks. Since there is already high penetration within this market, it can be assumed there is not much space for expansion by acquiring new users. Instead, increasing consumption frequency is likely a more effective strategy. While about a quarter of teens believe exercising is a chore, half say that they know they should exercise and play sports more than they currently do. And when they do exercise, they are mostly participating in activities for fun. Forty-six percent of teens say they will only participate in exercise if they think it is fun. All of these consumers are unlikely to be phased by the Heritage campaign’s current messaging, because it is targeted at not only teens who exercise, but those who need exercise and competition to keep themselves going. Despite this, 33 percent of teens say they do everything they can to keep themselves healthy. This includes competing in sports, exercising, and consuming healthy foods and drinks. When they are competing, an overwhelming majority – 67 percent – say they do it to be with their friends. According to Mintel research conducted in November 2013, half of teenage girls say they know they should be playing sports more than they currently do. Herein lies an opportunity for Gatorade. Teenage girls are the group most likely to believe that they will do everything they can to keep themselves healthy, which suggests that they are likely open to trying new products that will help them achieve these goals. The report says that these girls are likely to need some motivation to spur their participation, which Gatorade can provide. Overall sport drink consumption is about the same between boys and girls, with boys having a slightly higher consumption rate. For this reason, it’s important that Gatorade’s campaign doesn’t segment itself to just one gender. KEY TAKEAWAYS - Consumption is about the same between genders - An overwhelming majority of teens prefer to exercise and train in groups - Teens already have high penetration in the sports drink industry - Teens are participating in sports for fun What all us runners dream of, a fridge full of #gatorade @run_motivated 19 CONSUMER PROFILE Gatorade’s current definition of “competitive athlete” is missing the mark. Rather than out of an innate need to compete, research shows that today’s teenage athlete participates in team sports for fun. We have named them Communal Competitors to more effectively define the teenage athlete’s lifestyle and values. THE COMMUNAL COMPETITOR WHY THE COMMUNAL COMPETITOR? Communal Competitors love to play sports, work hard and compete. Team sports like basketball, football, baseball and soccer appeal to them for several reasons, but one trumps them all: they get to hang out with their friends. If they aren’t on the field with their friends, they’re on their phones texting their friends. They know their health is important and want to improve it, but these aren’t things that keep them up at night. WHO ARE THEY? They are competitive, maturing and active. But more than anything, they are social. Not only are they social on the field, they are social in all things that they do, and they use social media to share their experiences. WHAT DO THEY DO? Communal Competitors live on a routine. They wake up early in the morning, squeeze in an episode of “Teen Wolf” over a bowl of Cheerios and then rush to catch the bus to school. During the day, they’re sitting in class or catching up with their friends during passing period or lunch. And when the final bell of the day rings, they rush home so they can eat in a quick dinner before they go to practice. After practice, they head home to finish up their homework and, if they’re lucky, play some video games or watch TV before they go to sleep – only to wake up the next morning and do it all over again. WHAT OTHER PRODUCTS DO THEY USE? Since they might not have a job yet (only about 13 percent do), the Communal Competitors’ parents do a lot of the buying. The spending occurs when they’re with their friends instead of their family. When they do spend their hard earned allowances, they’re spending it at places like malls and movie theaters. 20 WHAT MOTIVATES ATHLETES TO USE GATORADE? FLAVOR, PRICE, BRAND AND SIZE There’s nothing special about me, I just work extremely hard. Anything can happen. #gatorade @JohnnyBones USAGE Are Communal Competitors the primary consumer? Yes. Although they don’t always make the purchases themselves, they are the highest consumers of sports drinks. Seventy-seven percent of teens say they drink sports drinks (the next highest is men between 18-24). There is extremely high brand awareness among Communal Competitors, and often Gatorade is at the top of their consideration set. When and how often do they drink Gatorade? Communal Competitors will drink Gatorade whenever they have practice and it’s in the fridge. If they’re going to practice and Gatorade is available, they’ll likely choose it over water. ATTITUDES & MOTIVATIONS What attributes and benefits do they look for in the brand? The consumer looks for electrolytes and other ingredient buzzwords they know will power their intense workout. The target also wants to feel included in the Gatorade brand image. Seeing their less-traditional sport acknowledged in Gatorade’s advertising will have a powerful and lasting effect on their loyalty to the brand. Athletes like swimmers, cheerleaders and lacrosse players will be affected by the Gatorade message just as profoundly as football and basketball players. What do consumers expect from Gatorade? Communal Consumers expect Gatorade to be affordable and available. It’s typically the first brand people think of when they think of sports drinks, so it can often be seen on the sidelines of their athletic competitions. #gatorade 21 COMPETITOR ANALYSIS DIRECT COMPETITORS POWERADE Powerade is a direct substitute for Gatorade and therefore one of its biggest competitors. The Coca-Cola Company’s share of the sports drink market is 22.7 percent, second in size only to PepsiCo. Powerade might see its share rise since they are the official sports drink chosen by FIFA for the 2016 world cup in Brazil. PROPEL Propel is PepsiCo’s take on “flavored hydration.” Propel is marketed toward the fitness crowd instead of the intense athletes that Gatorade targets. However, with the health trend being to avoid sugar, some of Gatorade’s consumers might start looking at Propel as another option to hydrate during competition. VITAMIN WATER Vitamin Water is a brand with a drink for every occasion. Its drinks have names such as revive, glow, energy, focus and defense. It is not going after the intense athletes like Gatorade, but instead focuses on the moderately active twentysomething female. This product could be seen as more nutritionally rich than Gatorade may become a bigger threat in the future. Manufacturer: Coca-Cola Number of Flavors: 8 Vitamins: B3, B6 and B12 Protein: 0g Sugar: 21g Calories: 80 per serving Tagline: Power Through Position: Sports drink Manufacturer: PepsiCo Number of Flavors: 9 Vitamins: C and E Protein: 0g Sugar: 0g Calories: 0 per serving Tagline: The Workout Water Manufacturer: Glaceau Number of Flavors: 10 Vitamins: Depends on the flavor (usually A, B or C) Protein: 0g Sugar: 31-32g Calories: 120 per serving Tagline: Make Boring Brilliant Position: Nutritional water 22 MUSCLE MILK Manufacturer: Muscle Milk Number of Flavors: 6 Vitamins: 20 essential vitamins and minerals Protein: 18-34g Sugar: 2g Calories: 170-340 Tagline: Give Me Strength Position: Protein nutrition shake BOTTLED WATER Manufacturer: many brands Number of Flavors: 1 Vitamins: none Protein: 0g Sugar: 0g Calories: 0 per serving While Muscle Milk is not in the “sports drink” category, it still poses a threat due to its market reach. It is positioned as a drink that should be consumed before, during and after a workout, much like Gatorade. It also uses football players as endorsers and targets intense athletes. Muscle Milk is beating Gatorade in sales in multiple major cities including Dallas, Denver, Miami, Orlando, Phoenix, San Diego and San Francisco. With recent health trends moving toward sugarfree and calorie-free options, water is now seen as the obvious alternative to indulgent beverages. Water has the added benefit of consumers perceiving it to be the “ultimate hydrator.” It is also readily available. INDIRECT COMPETITORS THE PRICE CONCIOUS Private label brands hold less than one percent of the sports drink market share. An example is WalMart’s Great Value Sports drink. Since it is seen as “off-brand” it is targeted more towards the price conscious consumers. It could catch the Gatorade and Powerade potential users that see the value in sports drinks but also want to see value reflected in price. 23 THE DEVIL’S NECTAR POWERADE® is the sports drink that helps underdog athletes power through adversity. Powerade was introduced as a sports drink by The Coca-Cola Company in 1988. The Coca-Cola Company states that Powerade is formulated with ION4 to help replenish four electrolytes lost in sweat. The brand positions itself as the sports drink that helps underdog athletes power through adversity, targeting the audience they call “Young Lions:” males with an athletic mindset who are goal-oriented. The market share battle between Gatorade and Powerade has been referred to as the “biggest rivalry in sports,” and rightly so. The rivalry between the two beverages originates in a battle to sign Michael Jordan as an endorser in 1991. Coca-Cola wanted to build rapport for its soon to be released sports drink, Powerade, but Gatorade landed the deal. This win by PepsiCo would prove to be instrumental in the brands dominance. At the time, most Americans had no clue what a sports drink was, but with Michael Jordan touting its benefits the consumer base began to skyrocket. The company still considers its prime competitor to be Gatorade. The two companies have grappled over the benefit crossover offered by both products that often results in ambiguous lines in advertising. A potential competitive advantage that Powerade holds over Gatorade is its wide variety of “Zero” products, which have zero calories and sugar. Coca-Cola describes Powerade Zero as “the greattasting electrolyte-enhanced sports drink formulated with vitamins B3, B6 and B12 to help the body metabolize energy from food.” With the attempt to launch a “natural” version of Gatorade failing in the past year, this calorie free Powerade option is a potential threat for Gatorade. Both companies are increasing social media use and online presence to build brand equity with young consumers. However, Powerade recently introduced an incentive-based program: Powerade Rewards, part of My Coke Rewards. The program rewards consumers with points every time they drink Powerade or another participating product. Participants can then redeem their points for rewards, instant wins or an entry into a sweepstakes. 24 THE EXTREME Red Bull is leading the energy drink market. It targets Fall down 7 athletes like Gatorade but times, stand up 8. focuses on extreme sports like #WinFromWithin snowboarding, kayaking, surfing and dirt bike racing. It focuses on @iRepTeamHEAT individual sports while Gatorade focuses on team sports. The intense athletes that Gatorade targets are likely to be turned off by the unhealthy image that energy drinks portray. THE ALL-NATURAL Although Gatorade and Powerade have a hold on 99 percent of the market share for sports drinks, products like AriZona Sports aims to court consumers with an allnatural offering. This drink has no preservatives, color, or artificial flavor added. It is marketed toward less intense athletes. Mintel’s consumer survey reveals that 50 percent of respondents who drink or purchase sports drinks are motivated by all-natural ingredients. THE TREND Coconut water has been a major trend recently and is being used as a substitute for sports drinks. It is seen as a healthier option that will not cause spikes in blood sugar. A 2012 study in the Journal of the International Society of Sports Nutrition found that coconut water is as effective at rehydrating athletes as a bottle of water. THE ORIGINALS Juice is the least threatening of Gatorades competitors. However, it is still a part of the NCB category. The market is actually shifting away from juice as consumers see it to be high in sugar and calories. Thirty-seven percent of consumers say they prefer to drink water and 17 percent of consumers say they prefer flavored beverages, which include flavored water and sports drinks. 25 PAST MARKETING EFFORTS ADVERTISING SPENDING PepsiCo invested an additional $500 million to its existing $600 million advertising budget in 2012. PepsiCo plans to focus its advertising efforts in North America, and allocate $100 million to implementing and creating in-store display racks. PepsiCo does not disclose specific percentages regarding how much of the advertising goes to specific brands. However, PepsiCo plans to focus the investment on Pepsi, Gatorade, Tropicana, Mountain Dew, Sierra Mist and Lipton. In the past three years, The Coca-Cola Company spent close to $3 billion on advertising while PepsiCo has spent less than $2 billion. ENDORSEMENTS Gatorade has relied heavily on athlete endorsements to build brand equity. Its target market looks up to professional athletes, and Gatorade chooses its endorsers carefully. This strategy began with the historic adoption of Michael Jordan as its first and most famous spokesperson. The tradition has gone on to include numerous great athletes representing various sports. NOTEABLE ADVERTISING CAMPAIGNS Gatorade has taken several approaches with their advertising efforts to reach multiple target audiences. Gatorade transitions from targeting the everyday consumer to the intense athlete. The following are a few of their most notable campaigns. 26 GATORADE IS THIRST AID BE LIKE MIKE Gatorade launched a campaign saying, “Gatorade is thirst aid for that deep-down body thirst.” This campaign helped to drive sales to nearly $900 million by the end of the decade. The campaign ran from 1984 until 1990. The campaign was instrumental in debuting the relatively new product. The campaign showed people doing every-day activities like mowing the lawn benefiting from Gatorade. The TV spots ended with “That’s why the pro’s drink it,” to emphasize the celebrity use. In 1990, Quaker signed a 10-year $13.5 million contract to make Michael Jordan the exclusive Gatorade celebrity spokesperson. AdAge called the TV spot “the most iconic sports commercial of all time.” This campaign was monumental in positioning Gatorade as the leading sports drink. At the time, consumers had no idea what the innovative sports drink concoction was; but if Michael Jordan was drinking it, so would they. IS IT IN YOU? Gatorade’s “Is it in you?” campaign was successful because viewers felt the message spoke directly to them. By capitalizing on famous sports players and having a constant presence on sidelines, Gatorade has become synonymous with sports, victories and hard work. The “Is it in you?” campaign challenged the viewer to go out and perform their best. 27 BECOME Probably one of the coolest things I’ve ever done #Gatorade #WinFromWithin @howe_you_doin The Become Campaign was targeted toward mothers of young athletes. The campaign highlighted the vital role moms play in athletes’ performance. The campaign gave advice to mothers on how to keep their athletes healthy. Ads emphasized facts like, “70% of athletes show up to athletic events dehydrated” and encouraged parents to buy Gatorade for their children. HERITAGE Gatorade’s Heritage program gave rise to the Win From Within hashtag. The program aims to both celebrate the epic history of Gatorade and help high school competitive athletes understand and demonstrate what it means to Win From Within. Typically only elite athletes have been on the iconic packaging. However, the Heritage Campaign encourages athletes from all sports and competitive levels to put their own Win From Within moments on a digital Gatorade bottle and share it across social media. This audience engagement created a two-way conversation that has proven successful. The campaign has surpassed all benchmarks established to measure success. The “win from within” tagline focuses on the idea that what athletes put into their bodies is just as important as what they put on them. The first advertisement in the campaign launched at the January 2, 2012 Fiesta Bowl, and compared high school and professional athletes and focused on the idea that “…nothing you put on is enough.” 28 BRAND EQUITY & POSITIONING BRAND POSITIONING STATEMENT “To the team player who gives it their all, Gatorade is the fuel that will make sure you feel just as good off the field as you do on it.” RATIONALE PepsiCo created Gatorade for athletes. It is crafted with a blend of ingredients with one goal: to refuel athletes – and that is what it is known for. Gatorade enjoys an overwhelming hold on the sports drink market – more than 70 percent. Athletes associate the brand Gatorade with performance. Gatorade offers a variety of flavors for athletes to experiment with, encouraging them to find their favorite. Although concerns over the drinks’ sugar content exist, Gatorade provides electrolytes and other nutrients essential to athletes' recovery. COMPETITOR POSITIONING Powerade, conversely, focuses on the underdog. Which is fitting, as it sees a much smaller influence on the sports drink category. Powerade wants to help athletes through adversity. BRAND EQUITY THROUGH PARTNERSHIP Global Director of Sports Marketing Jeff Kearney said, “We’re a brand that was built on knowing and fulfilling athlete needs. And one of the most important things we can do for our brand equity is to ensure we’re staying true to our audience. It goes back to the cliché: You have to build your brand GATORADE PLAYER OF THE YEAR The Gatorade Player of the Year award: It was established in 1985 to recognize and celebrate the nation’s most outstanding high school talents for their athletic achievement, academic excellence and exemplary character. Now in its third decade, the Gatorade Player of the Year award has become one of the most prestigious accolades in high school sports. GATORADE CARES Gatorade uses a proprietary air-rinse technology to clean newly manufactured bottles with air instead of water in all manufacturing plants. This technology is helping Gatorade save almost 150 million gallons of water per year. The company also institutes comprehensive "water mapping" at manufacturing facilities to increase awareness of water conservation with associates. 29 COMMUNICATION STRATEGY ONLINE PRESENCE Gatorade maintains an active online presence on social media sites including Twitter, YouTube, Instagram and Facebook. Gatorade has several Twitter profiles for countries including, Venezuela, Mexico, UK, and Brazil to appeal to different audiences. Gatorade maintains an active Instagram account by posting pictures daily. Pictures range from advertisements with famous athletes to pictures of everyday people pushing themselves physically and enjoying Gatorade. It also uses Instagram and Twitter to further any existing advertising campaigns by incorporating the use of hashtags. Gatorade also posts pictures of events it sponsors such as the Super Bowl. The brand harnesses its international awareness by showcasing region-specific athletes on specific international Instagram and Twitter accounts. Gatorade utilizes the Mission Control center developed by VML to track and monitor every mention of Gatorade online. The Mission Control Center is monitored by VML employees that respond to questions, concerns, or comments brought about by consumers on any social media platform. Gatorade also has an interactive website where consumers can learn more about how Gatorade affects athletes’ bodies. The site allows viewers to click on different parts of the body, such as the heart or muscles, and see how Gatorade aids hydration during physical activity. TELEVISION 2.5 hours of football this morning... electrolytes and I reconnect this afternoon... soccer tonight #Gatorade @MatherPE Gatorade is the official sports drink of the NFL, MLB, NBA, WNBA, NHL, US Soccer Federation and many other sports. It also sponsors college and high school athletic teams. TV shows Gatorade jugs, cups and water bottles on the sideline of almost every professional game. Gatorade typically runs advertisements during Super Bowls and during major games. These commercials often feature famous athletes consuming the product during physical activity. The commercials are meant to be inspiring to the audience. Gatorade is often depicted as the competitive edge athletes need to beat their opponents. 30 PRINT Gatorade produces region-specific print advertisements that feature famous athletes from particular regions with hopes that Gatorade will gain top-of-mind awareness with athletes from those areas. Many print advertisements include athletes pushing themselves to the extreme while working out or playing a sport. The athlete is not always drinking Gatorade, in fact most of the time the Gatorade logo is simply in the corner of the advertisement with its tagline. More recently, its print advertisements have included hashtags to incorporate social media such as #WinFromWithin. POINT OF PURCHASE & PACKAGING Research has shown that consumers prefer Gatorade to be cold upon consumption. Gatorade capitalizes on this by having in-store displays at the beginning of checkout lines and at the end of grocery store isles. Consumers’ attention is also drawn to elaborate in-store displays. Gatorade ties in its sponsorship to the NFL and other organizations by using creative in-store displays. Famous athletes who sponsor Gatorade often grace the famous bottle itself, and the packaging often ties into the current advertising campaign. OUT-OF-HOME Gatorade produces billboards that tie in with its print adverting. One of its most famous billboard campaigns has a simple background of one of its classic flavors and the iconic “G” logo in the center. Gatorade has also produced billboards with the famous athletes it sponsors in moments of victory on the field or on the court with the Gatorade logo in the corner. These advertisements are unique because they rarely feature a headline or body copy. The picture often speaks for itself. CAUSES & PARTNERSHIPS As stated previously, Gatorade is the official sports drink of the NFL, MLB, NBA, WNBA, NHL, AVP and the US Soccer Federation in addition to high school and college sports teams. Gatorade distributes its products to all of the teams it sponsors as well as other products such as coolers, towels and water bottles. Gatorade also partnered with Action Against Hunger to create the “G Movement,” a campaign that challenged athletes to raise awareness and funds to end global hunger. Gatorade’s sponsorship included training grants for athletes, the production of promotional videos and a $100,000 contribution. Gatorade also sponsors athletes to educate others on the importance of sports nutrition. For example, Gatorade sponsors Cam Newton and works with him in the Gatorade Sports Science Institute to identify ways he can improve his on-field performance through proper sports fueling and training. 31 MISSION CONTROL Gatorade has one of the newest and most cutting edge marketing tools available today. Behind the scenes, Gatorade’s marketers are quite literally at the center of the social media world. The company, along with VML, created the Gatorade Mission Control Center inside its Chicago headquarters. It has six large monitors and several dashboards with visual data that allow employees to see real-time social media trends related to the brand. This gigantic “super computer” uses a special IBM server that handles any mention of Gatorade globally across almost all social media including Twitter, Facebook and blogs. It can even track words that relate to Gatorade such as athlete, training, sport and nutrition. This incredible tool is one of a kind and gives Gatorade the upper hand at being able to stay “in the moment.” The goal of the project, says Senior Marketing Director, Consumer & Shopper Engagement Carle Hassan, is to “take the largest sports brand in the world and turn it into largest participatory brand in the world.” To that end, the company is not only monitoring its brand on social media, but giving its fans increased access to Gatorade’s athletes and scientists. “These people are leading something that has never been done at PepsiCo before. It is an interaction and engagement with consumers that this company has never before invested in.” - William Morris, Director of Mission Control 32 Mission Control not only monitors chatter nationally-it monitors global conversation about Gatorade. The software provides an analysis of the general mood surrounding the brand all around the world. Gatorade employees all around the world can access Mission Control using a server that VML developed. Community Managers don’t have to be at Mission Control to benefit from the massive amounts of data analysis. The programs run continuously on flat screen TVs in the Mission Control center. Employees can stop by and monitor chatter whenever they please. 33 SWOT ANALYSIS #Gatorade <3 @CaandeDecima 34 STRENGTHS Gatorade is a historic and strong brand with recognition all over the globe. Paired with the Gatorade Sports Science Institute, the brand has consistently proven their dedication to front-line sports research and making sure their product is delivering on athlete’s needs. The strong findings about Gatorade are top-of-mind for athletes who know that drinking Gatorade will fuel their bodies far better than water or other competitors could. Gatorade’s strong partnerships with professional athletic organizations around the world reinforce this image in the consumer’s mind. And the Gatorade consumer is a unique one- dedicated to their bodies and the brand, they consider their athletic success a partnership with Gatorade, and share this bond openly on social media. They are brand loyal. WEAKNESSES Gatorade is a strong sports drink brand; however, they cater to a very limited target audience. Gatorade knows who they want their consumer to be, but this idealized image is rarely aligned with reality. Furthermore, isolating certain sports markets by not including them in Gatorade’s positioning may drive down sales. This narrow focus on only a few sports may be hurting the brand. Additionally, the frequent addition of new and limited release flavors may annoy or confuse the consumer. By focusing on cranking out constant new flavors, Gatorade may be ignoring need for other kinds of product innovation. However, the introduction of energy bars and Gatorade chews are beginning to tap into this market. OPPORTUNITIES Emerging international markets are offering huge opportunities for all kinds of products, especially the widely varied NCB category. Gatorade has begun to pursue these opportunities, and does an excellent job reaching out to each international market it conquers. Additionally, nutrition trends across the nation are beginning to reflect consumers’ growing health concerns and desire to limit sugar intake. Expanding into different drink types, including a sugar free option, could present a large opportunity for sales. Embracing this health trend could result in gaining more of the market share. Finally, another effective approach to increasing market share is to continue to build strong partnerships with the schools and universities that are so closely bound to competitors’ athletic journeys. This is a great opportunity to increase touch points with the consumer. THREATS This same health trend also presents a threat if Gatorade fails to respond. Competitors like Powerade are already offering a sugar free option that may appeal to these health-conscious consumers. Additionally, the target market of 18-24 year old males is becoming increasingly interested in the energy drink segment of the market. Gatorade should address the health benefits of consuming an electrolyte-based drink for energy rather than artificial stimulants. Water is also always a strong competitor. It is readily available almost everywhere, and poses a threat by being cheaper (often free). The perception that water is the most hydrating substance, as well as being calorie and sugar free, can paint the picture that it is the best choice for athletes; Gatorade needs to combat that conviction. Overall, the strongest threat is the increasingly saturated nature of the NCB category. Gatorade must continue to be a standout product to maintain the company’s market share. 35 CONCLUSION As the Situation Analysis team for Gatorade Heritage, we have presented valuable information for the NCB industry, the sports drink category and Gatorade as a brand. We have provided an indepth appraisal of sports drink consumers and have determined the segment of athletes that offers the greatest financial opportunity for Gatorade. Here, we present our recommendations for further research and strategy that teams 2, 3 and 4 can utilize for our final proposal for Gatorade. BROADEN THE TARGET AUDIENCE • Gatorade currently focuses on ball-and-stick sports and the “competitive athlete.” While it is focusing on the correct age range, 13 to 17, it is limiting the brand’s opportunities. • The definition of the competitive athlete alienates social athletes who are less intense but still play for more than just recreation. These Communal Competitors still value the Gatorade message and seek the same hydration benefits. • Gatorade should include sports such as soccer, lacrosse, swimming, cheerleading, field hockey, competitive dance, rugby, and more. • The brand can incorporate this new message in all communications to reach the Communal Competitor. FIGHT THE GOOD FIGHT • The current health trend, that sugars are always bad is taking a toll on the perception of Gatorade. • Gatorade needs to educate its audience with spots like the Cam Newton “The Science of G” interactive experience on the Gatorade website to show consumers how athletes’ bodies need and use glucose during strenuous physical activity. HERITAGE NEEDS TO FOCUS ON THE HERITAGE • Gatorade is not just a sports drink, it’s a fuel. It was developed to be a fuel, and having the younger generation understand that is critical. Stick to the story of Gatorade’s history-- it’s exciting enough and doesn’t need extra hype. • Gatorade as a company is so consumed with its own history, that it forgets their target is far removed from the age group that knows the story. Consumers need to hear it again (even if that bores corporate). • #WinFromWithin needs to relate back to the roots of Gatorade, when the sports fuel began to fuel the Gators from within their bodies. • Unite the message, while avoiding “matching luggage.” The digital experience doesn’t need to be the same as TV, but they need to connect. If Gatorade can properly reach Communal Competitors, the audience will respond with loyalty to the Gatorade brand message, which will lead to higher sales. 36 37 SOURCES http://mashable.com/2010/06/15/gatorade-social-media-mission-control/ www.gatorade.com www.facebook.com/gatorade www.twitter.com Instagram http://www.huffingtonpost.com/2013/01/25/gatorade-brominated-vegetable-oil_n_2551533.html http://academic.mintel.com.proxy.mul.missouri.edu/sinatra/oxygen_academic/display/id=652413?highlight#hit1 https://www.beveragemarketing.com/dilworthcsdgrowth.html http://academic.mintel.com.proxy.mul.missouri.edu/sinatra/oxygen_academic/display/id=546337?highlight#hit1 http://espn.go.com/blog/playbook/dollars/post/_/id/3102/gatorade-releases-new-bottle-wade-speaks http://www.oregonlive.com/food/2014/01/natural_gatorade_is_discontinu.html http://www.athletepromotions.com/gatorade-endorsements.php http://academic.mintel.com.proxy.mul.missouri.edu/sinatra/oxygen_academic/display/highlight&id=150399/display/ id=637356 http://www.fitday.com/fitness-articles/fitness/exercises/drinking-gatorade-vs-drinking-water-during-sports-games.html#b http://academic.mintel.com.proxy.mul.missouri.edu/sinatra/oxygen_academic/display/id=606233?highlight#hit1 http://academic.mintel.com.proxy.mul.missouri.edu/display/590696/ http://academic.mintel.com.proxy.mul.missouri.edu/display/637836/ http://academic.mintel.com.proxy.mul.missouri.edu/display/637813/ http://www.referenceforbusiness.com/history2/29/The-Gatorade-Company.html http://www.forbes.com/sites/darrenheitner/2014/01/28/gatorades-impact-on-the-super-bowl-goes-beyond-a-fun-prop-bet/ http://www.research.ufl.edu/publications/explore/v08n1/gatorade.html http://www.nationallacrosseclassic.com/gatorade/ http://www.hollydell.com/poweradechallenge.htm http://www.gssiweb.org/ http://www.referenceforbusiness.com/history2/29/The-Gatorade-Company.html#ixzz2srUzpyYZ http://academic.mintel.com/display/692540/?highlight#hit1 http://academic.mintel.com/display/590137/# http://academic.mintel.com/display/679959/ http://www.caryinstitute.org/sites/default/files/public/downloads/lesson-plans/The_Gatorade_Company_Fact_Sheet.pdf http://www.forbes.com/sites/darrenheitner/2014/01/28/gatorades-impact-on-the-super-bowl-goes-beyond-a-fun-prop-bet/ http://dinersjournal.blogs.nytimes.com/2013/01/25/gatorade-listens-to-a-teen-and-changes-its-formula/ http://www.us.powerade.com http://www.propelzero.com/products.html http://www.drinkarizona.com/index_national.html#product_azsports_fruitpunch http://www.vitaminwater.com/vitaminwater_2013_NutritionFacts.pdf http://www.walmart.com/ip/Great-Value-Lemon-Lime-Sports-Drink-32-oz/21274650 http://www.musclemilk.com/products/ready-drink/genuine/ http://academic.mintel.com.proxy.mul.missouri.edu/display/636987 http://academic.mintel.com.proxy.mul.missouri.edu/display/636988 http://abbottnutrition.com/brands/products/ensure-high-protein-shake http://store.vitacoco.com/v/images/NutInfo/188.pdf http://vitacoco.com/our-products/ http://www.redbull.com/us/en/browse-all-athletes http://academic.mintel.com.proxy.mul.missouri.edu/display/674451/ http://www.walgreens.com/store/c/gatorade/ID=307978-brand http://www.walmart.com/search/search-ng.do?search_query=gatorade+&ic=16_0&Find=Find&search_constraint=0 http://www.womansday.com/food-recipes/5-recent-beverage-brand-overhauls-72781 http://articles.latimes.com/2011/jan/01/business/la-fi-gatorade-20110101 http://online.wsj.com/news/articles/SB10001424052748703466704575489673244784924 http://www.forbes.com/pictures/mlm45jemm/5-gatorade/ http://www.businessweek.com/the_thread/brandnewday/archives/2009/04/gatorade_sales.html http://www.pepsico.com/Download/Gatorade_Company_Fact_Sheet.pdf https://www.vml.com/news-and-trends/articles/gatorade-immortalizes-all-athletes-winfromwithin http://www.pepsico.eu/brands/gatorade-brands.html http://www.forbes.com/sites/darrenheitner/2014/01/28/gatorades-impact-on-the-super-bowl-goes-beyond-a-fun-prop-bet/ http://www.floridamemory.com/photographiccollection/photo_exhibits/football/football4.php http://www.gatortailgating.com/news/archives-gators-win-biggest-game-history-against-bama-1963-260412 38 #WinFromWithin 39