Situation Analysis 905453507 984850369

advertisement

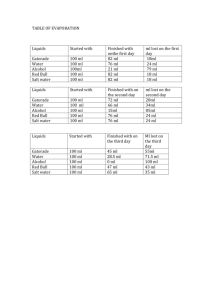

905453507, 984850369, 939256888, 993496495, 903239402, 976971344 Situation Analysis 905453507 984850369 939256888 993496495 903239402 976971344 1 905453507, 984850369, 939256888, 993496495, 903239402, 976971344 Table of Contents Executive Summary ………………………………………………………………………………………………....1 Company Analysis ………………………………………………………………………………………………..…2 History Synopsis ……………………………………………………………………………………….....2 Brief History of Parent Company ……………………………………………………………...…3 Core Values: What they stand for ………………………………………………………………...3 Gatorade’s Financial Outlook …………………………………………………………….…………4 Market standing, category share ……………………………………………………………….…4 Consumer Analysis ………………………………………………………………………………………………….….5 Product Analysis …………………………………………………………………………………………………..…….9 Competitive Analysis ………………………………………………………………………………………………..10 Primary Competitive Set ……………………………………………………………………………….10 Secondary Competitive Set ………………………………………………………………………..…11 Market Analysis ……………………………………………………………………………………………………..…13 Past and Present Communication (and Promotion) ………………………………………………..…14 Other Considerations ……………………………………………………………………………………………..…16 S.W.O.T. Analysis …………………………………………………………………………………………………..….18 1 905453507, 984850369, 939256888, 993496495, 903239402, 976971344 Executive Summary This executive summary is designed to provide an overview of the information contained in the situation analysis for Gatorade. Gatorade is a multi-national brand owned by the parent company, PepsiCo. As the leader of the sports beverage market, Gatorade captures 73.52 percent of the market share in its category (Marketshare Reporter1). In 2011, Gatorade underwent a brand repositioning during which it developed different lines of Gatorade products targeted at different types of athletes. These lines included the traditional G-series for athletes, the G-series Pro for extreme sports athletes and the G-series Fit for fitness athletes (Gatorade.com2). Gatorade’s primary competitors include Powerade and Vitamin water, while its main secondary competitor is Red Bull. This report will provide a more in-depth look at the history of the brand, its current market status, its competitors, and its target audience. In addition, the product line will be explored in depth and communications and promotions will be discussed. A SWOT analysis of the brand will conclude this report. 1 1 905453507, 984850369, 939256888, 993496495, 903239402, 976971344 Company Analysis In summer 1965, University of Florida’s assistant coach worked with a team of university physicians to determine why players were affected by heat and heat related illnesses. Players were losing fluids and electrolytes through sweat that were not being replaced. They also noted that players used large amounts of carbohydrates for energy that were not being replenished. They developed a new, precisely balanced carbohydrate-electrolyte beverage that adequately replaced those key components, and named it “Gatorade” after the Florida Gators, (Gatorade.com3). After Gatorade was introduced to the Gators football team, it became apparent that the players were able to outlast a number of heavily favored opponents in the extreme heat. The Gators were able to win the Orange Bowl for the first time in the school’s history. Today, Gatorade is found on the sidelines of 70 Division I colleges as the official sports drink, (Gatorade.com4). In 1983, the National Football League adopted Gatorade as its official sports drink, a title that remains today. Additionally, Gatorade is presently the official sports drink of the NBA, WNBA, MLB and MLS, (Pepsico.com5). In 1985, The Gatorade Sports Science Institute (GSSI) was developed and headquartered in Barrington, IL. GSSI is a research and educational institute designed to share information on and expand the knowledge of sports nutrition and exercise science. Staff members use current technology to study the effects of exercise and nutrition on the human body by working with scientists from around the world, (Gssiweb.com6). In 2011, to continue building on Gatorade’s success, the brand underwent a repositioning. The goal was to align themselves as a sports nutrition brand, rather than simply a hydration brand, (AdAge.com7). Timeline: 1983: NFL makes Gatorade its official drink. 1965: Gatorade is developed by Florida Gators assistant Head coach & scientists. 2001: PepsiCo acquires Gatorade. 1985: GSSI founded in Barrington, Illinois. 2010: G Series Launch 2011: Gatorade 2 a repositions itself as sports nutrition brand. 905453507, 984850369, 939256888, 993496495, 903239402, 976971344 Gatorade is a subsidiary of ultimate parent PepsiCo and immediate parent The Quaker Oats Company. The brand generates more than $1 billion in sales for PepsiCo each year, (Hoovers Report8). PepsiCo is a global company that is second in market share behind The CocaCola Company at 10.1 percent (IBIS Industry Report9). PepsiCo acquired Tropicana in 1998 before merging with The Quaker Oats Company in 2001, which is how PepsiCo gained control of Gatorade, (IBIS Industry Report10). The Gatorade beverages are available in some 80 countries worldwide, and it is the official sports drink of numerous athletic groups and general sporting events, (PepsiCo.com11). PepsiCo absorbed Gatorade in 2001 by purchasing immediate parent company The Quaker Oats Company for USD $13 billion, (Hoovers Report12). Gatorade was then placed as a part of PepsiCo Americas Beverages (PAB), which is one of Pepsi’s largest business segments, generating 35% of sales in 2010, (Hoover’s Report13). Core Values- What They Stand For The core function of the brand, and GSSI, is to continue to search for and study new and innovative ways to help athletes improve performance by facilitating proper hydration and nutrition. Gatorade and GSSI strive to advance their collective mission of enabling athletes to perform at their peak, (Gatorade.com14). Additionally, Gatorade strives to help the environment by using a proprietary air-rinse technology to clean newly manufactured bottles with air instead of water. This technology is helping save almost 150 million gallons of water per year. They also instituted comprehensive “water mapping” at manufacturing facilities and are increasing awareness of water conservation with associates, (PepsiCo.com15). Outside of these goals, Gatorade is dedicated to the promotion of sports participation, and the powering of athletic performance by supporting local and national programs, (Gatorade.com16). Further, Gatorade strives for and believes in gender equality both on and off the athletic playing field. Ten of the key leaders of PepsiCo are women with work roles in communications, sales, finance, and research & development (AdAge.com17). 3 905453507, 984850369, 939256888, 993496495, 903239402, 976971344 As well as Gatorade’s view that women leaders at Gatorade are strong competitors, dedicated to sports, business minded, and there is also a strong emphasis on health and healthy lifestyles for all employees. Meetings have been known to begin with sharing fitness goals, announcing personal progress and successes, (AdAge.com18). Gatorade’s Financial Outlook In 2008, the Gatorade brand was valued at approximately $3 billion US, (AdAge.com19). In 2011, PepsiCo Americas Beverages had net revenue of $22.4 billion US, which accounted for 34 percent of PepsiCo’s total revenue that fiscal year, (PepsiCo Annual Report20). Gatorade’s estimated sales were $125.10 million US, (Hoovers Report21). As of 2011, Gatorade led the sports beverage category increasing 9 percent by volume, (BeverageWorld.com22). Market Share A study of sales in supermarkets, drug stores and mass merchandisers, which is primarily where Gatorade products are sold, for 12 weeks ending September 5, 2010 showed that Gatorade captures a total of 73.52 percent of the market share, (Marketshare Reporter23). From Table 1.0 , it can be noted that Gatorade holds eight out of the eleven spots for brands. Most importantly, Gatorade captures the first two places and its largest competitor, Powerade, holds only 21.47 percent total, (Marketshare Reporter24). 25 Table 1.0 “Top Sports Drink Brands, ” (Source: Market Share Reporter ) 4 905453507, 984850369, 939256888, 993496495, 903239402, 976971344 Company Analysis Insights Gatorade created the sports drink industry as it was the first player on the scene, this allowed time for the product to become comfortable and perhaps complacent with its positioning. Over the course of Gatorade’s history, the brand has traditionally enjoyed a high market share, which is primarily due to the fact that for a number of years, it was the only sports beverage. Looking forward, Gatorade may struggle to retain or grow its market share as new competitors enter the landscape. Further, the brand’s strong core values align well to the repositioning that occurred in 2011, and may help to ensure the brand remains relevant for its target consumers. Finally, as the brand’s portfolio of beverages diversified (which is seemingly in conjunction with the acquisition by PepsiCo) it will be imperative for the brand to maintain a strong link to its core function- hydrating athletes- and resist the urge to become everything to everyone. Consumer Analysis: Gender: Males are 29 percent more likely than the average consumer to drink Gatorade, while women are 27 percent less likely than the average consumer. Based on these indexes, Gatorade should take a defensive approach by focusing on targeting a male audience. 25 Table 2.0 “Gender Index” (Simmons OneView ) Age: The below indexes show that the primary target consumer is of 25-34 years and the secondary target is in the 18-24 years bracket. Based on this information, the primary target should be 25-34 and the secondary should be 18-24 as individuals in the 25-34-age bracket are 57 percent more likely to drink Gatorade, compared to those in the 18-24 age bracket who are 5 905453507, 984850369, 939256888, 993496495, 903239402, 976971344 48 percent more likely to consume Gatorade as well. If the budget allows, these two brackets could be combined, as the difference in the index figures is less than ten points. 26 Table 3.0 “Age Index” (Simmons OneView ) Race: The last row of this chart, the “YES” row, is the Hispanic/Latino race, and is further explained in the attached appendix. From this information, the conclusion could be drawn that Gatorade’s highest consumers are of Hispanic/ Latino origin because that are 50 percent more likely than the average consumer to purchase Gatorade products. The secondary consumers of Gatorade define themselves as “SOME OTHER RACE,” as they are 48 percent more likely than the average consumer to purchase Gatorade products. 27 Table 4.0 “Race Index” (Simmons OneView ) 6 905453507, 984850369, 939256888, 993496495, 903239402, 976971344 Region: Based on the following table of indexes for the four census regions: the Northeast, the Midwest, the South, and the West, consumers in the West are 12 percent more likely to drink Gatorade than the average consumer. According to the numbers and a defensive strategy, Gatorade should focus its advertising in the markets where they are already doing well, which would be the West as a primary target and the South as a secondary target. 28 Table 5.0 “Region Index” (Simmons OneView ) Exercise Level: Gatorade is considered a sports drink, however, based on the lifestyle statements relating to exercising from Simmons OneView, the indexes of consumers who say that they exercise regularly or know they should exercise more are relatively average. Gatorade should focus on a primary target of those who exercise. 29 Table 6.0 “Exercise Index” (Simmons OneView ) 7 905453507, 984850369, 939256888, 993496495, 903239402, 976971344 TGI Socioeconomic Level: The information below provides us with an understanding of Gatorade’s consumers according to their socioeconomic status. This is based on their income, education and occupation with respect to the geographic cost of living: Level 1 represents the top 10 percent of consumers, in the U.S that is estimated to be 8.8 percent of the total population, (tgi-insights.com30). 31 Table 7.0 “TGI Socioeconomic Level” (Simmons OneView ) Insights Gatorade should mainly focus on targeting males between the ages of 25 to 34. They should take defensive approach to advertising, focusing on the West and secondly, the South census regions. Although Gatorade is a sports drink, it is available for all consumers and is consumed even by those who do not exercise regularly. Thus, Gatorade should primarily target athletes and secondarily target non-athletes. Further, Gatorade’s campaign strategy should be sure to be relatable to those individuals who have a greater level of freedom in their budgets, as these 8 905453507, 984850369, 939256888, 993496495, 903239402, 976971344 products are 5 percent more likely to be consumed by those who have a TGI level of 1, thus falling into the top 10 percent of consumers. Product Analysis The Gatorade brand sells a line of sports drinks targeted toward athletes of all levels and strives to promote overall sports nutrition. They are formulated to hydrate by restoring electrolytes, carbohydrates, and proteins. Gatorade is a product that is quickly consumed and therefore has a short purchase cycle. Their products are primarily found in supermarkets and convenience store retailers, and have a variety of 40 flavors. The number of flavors for a particular product line depends. However, the most popular flavors among consumers continue to be Lemon Lime and Fruit Punch, (Gatorade.com32). More than 30 professional athletes, ranging from NFL players to Olympic champions, endorse the Gatorade Brand, (Gatorade.com33). Gatorade’s products are easily recognized by the signature logo, bold “G” in front of an orange lightning bolt on the packaging. Gatorade recently re-branded to consist of multiple sets of sports drink lines called “series”, all of which contain prime, perform and recover products, (Gatorade.com34). G series Products Pouch Prime Energy Chews Gatorade Thirst Quencher G2 Perform Gatorade Thirst Quencher powder G2 Powder Better State Recover Rebuild Protein Shake Size 4 fl. Oz 30 g 32 oz 32 oz 18.4 oz 0.4 oz 16.9 fl oz. 11.16 fl oz Approximate price/ unit Additional Information $1.99 $2.25 Original Gatorade Low Calorie $6.69 $2.63 Post -game protein G Series Fit Prime Energy Bites Perform Workout Hydration Recover Protein and Carb Smoothie 11.75 g 16 fl oz 11.16 fl oz $2.89 $1.79 $3.97 G Series Pro Prime Carb Energy Chews 38 g $2.18 9 905453507, 984850369, 939256888, 993496495, 903239402, 976971344 Pre-Game Fuel Endurance Formula Perform Endurance Formula Powder Gatorlytes Recover Post-Game Recovery 4 fl oz 24 fl oz 32 oz 0.10 oz 16.9 fl oz $2.29 $2.29 $28.99 $14.99 $4.27 Powder to prevent muscle cramps G Natural Perform Thirst Quencher 16.9 fl oz Made from natural sugars and ingredients G2 Thirst Quencher 16.9 fl oz Low calories and made from natural sugars and ingredients Note 1: The North American brands include; G Series, G Series Pro, G Series Fit and G Natural. In addition to these, there are international Gatorade brands as well, which include Gatorade G and G2. Note 2: Propel Zero is another Gatorade product, but is a separate brand under the Gatorade umbrella. This product comes in liquid and powder form and is designed with the same concepts of providing hydration, vitamins, 35 and antioxidants to consumers, (PepsiCo.com/Gatorade ). Insights Gatorade made the right strategic move in re-branding their image from Gatorade to G Series. A concern for Gatorade is the complexity of Gatorade’s four main product lines. While it is important for an athlete to hydrate and nourish before, during, and after a workout, the multiple seemingly similar G Series lines that use the same prime, performance, recovery stages can cause confusion for the average consumer. Gatorade may want to consolidate some of these lines in order to focus their efforts on the strongest products. Competitive Analysis Gatorade’s primary competitive set consists of all sports drinks. The company’s secondary competitors are other non-alcoholic beverages such as water, coconut water, energy drinks, soft drinks and juices. As Gatorade is a beverage that is available at places where these other drinks are, they are secondary competitors to Gatorade. Primary Competition According to the Mintel Oxygen database, Gatorade and Powerade together make up 99 percent of the sports drink market, making Powerade Gatorade’s only in-market competitor. Private-label sports drinks present no competition to Gatorade, the leading brand, as they represent 0.6 percent of the market (Mintel36). The Coca Cola Company created Powerade in 10 905453507, 984850369, 939256888, 993496495, 903239402, 976971344 1988 as competition to Gatorade. In the 1990’s, Powerade gained enough recognition as a sports drink to be named the official sports drink of the Olympic Games (Livestrong.com37). Powerade controls 21.47% of the market share in supermarkets, drug stores, and mass merchandisers, (Marketshare Reporter38). In the sports drink category market, Powerade has a 27.5% market share, compared to Gatorade’s 71.2% category market share. Powerade spent roughly $24 million US on advertising in measured media in 2011, which was a $10 million increase in spending from 2009, (AdAge.com39). Powerade launched its “Game Science” campaign that was inspired by incorporating physical and mental decision-making science during games (Ad Age.com40). Powerade positions their PoweradeION4 line as the “complete” sports drink, similar to what Gatorade has done by creating their updated drink and product lines. Relative strengths and weaknesses for Powerade include the fact that men and women do not favor either Gatorade or Powerade. Consumers aged 18-24 are 114 percent more likely to choose Powerade over the average consumer. Within the same age group, consumers who are slightly older, age 25 to 34, are 10 percent more likely to choose Gatorade than the average consumer (Table 8.0, Simmon’s OneView41). Consumers who chose Powerade more often than Gatorade were Black or African American, of some other race, or of a race that is not black or white (Table 9.0, Simmon’s OneView42). Additionally, consumers who say that they are brace, courageous, daring, and adventuresome are 12 percent more likely to drink Gatorade then the average consumer. Those who say that they are awkward, absent minded, forgetful, and careless are 16 percent more likely to choose Powerade than the average consumer (Table 10.0, Simmon’s OneView43). Men are 29 percent more likely to consume either of the sports drinks than the average consumer (Table 11.0, Simmon’s OneView44). Both Powerade and Gatorade are selling higher than average in the South and West regions of the United States. However, neither brand is doing significantly better than the other in these regions (Table 12.0, Simmon’s OneView45). Secondary Competition Energy drinks and enhanced waters have been creating some competition for sports drinks since 2007. For example, Glaceau’s VitaminWater or SoBe LifeWater are on the market 11 905453507, 984850369, 939256888, 993496495, 903239402, 976971344 as sports drink alternatives. Energy drinks such as Red Bull also offer competition since they compete for a similar target audience; young and Hispanic men (Mintel46). Market share information about these companies is not applicable to compare with Gatorade because they belong to different market categories. Red Bull energy drink is a secondary competitor as it’s positioned as a way to boost energy. Whereas Gatorade focuses on increasing macronutrients such as carbohydrates and protein and micronutrients such as sodium and restore electrolytes, Red Bull relies caffeine, sugars, and vitamins to “increase performance, increase concentration and reaction speed, improve vigilance, stimulate metabolism and improve energy and well-being” (RedBull47). Weaknesses of Redbull include that it has potentially harmful ingredients such as the artificial sweetener Aspartame (Redbull48). Although Red Bull is not a sports drink, it targets the athletic type. Red Bull positions itself to target this type of consumer similar to Gatorade by sponsoring teams and athletes. For example, on Red Bull’s webpage, they feature certain local and famous athletes and provide bios (Redbull49). Looking at Glaceau’s VitaminWater, a strength over Gatorade is that VitaminWater targets women more effectively, while Gatorade and sports specific drinks target men more, (Mintel50). VitaminWater positions itself similarly to Gatorade, however, by having a full line of different flavors that represent a certain type of value or nutrient need a consumer may be looking for. Similar flavors to Gatorade would be “Energy” or “Revive.” Another strength is that enhanced waters such as VitaminWater can be lower in calories than a typical sports drink. Gatorade and Powerade have both responded to this by coming out with lower calorie options for their drinks that will still rehydrate and restore their consumer (Mintel51). Red Bull and VitaminWater are sold at the same retailers as Gatorade. Enhanced waters and energy drinks have become more popular over the last few years. “Water beverages fortified with vitamins, minerals, and herbal supplements have increasingly taken a bite out of sports drink sales. Glaceau’s VitaminWater, and more recently VitaminWater Zero, offer flavored water with functional benefits and compete for sales when it comes to casual athletes and among non-athletes (Mintel52)”. The increasing popularity of these types of drinks has put them in the position to be secondary competitors for Gatorade. 12 905453507, 984850369, 939256888, 993496495, 903239402, 976971344 Insights Gatorade and Powerade dominate the sports drink market, making up over 99% of the market together (Mintel53). However, Gatorade is still beating out Powerade by having over double the market share that Powerade has. The companies’ competitive strategies follow similar lines focusing on the development new products, targeting athletes, and positioning themselves as an aid to athletes and sports teams. When it comes to the sports drinks market, Gatorade is still the strongest competitor. Of concern to Gatorade is the development of enhanced waters and energy drinks. Though the product offering is slightly different, they have similar target markets and all provide hydration, which qualifies them as competition. Market Analysis Gatorade products are sold nationally within the United States as well as internationally. In 2009, within the sports-drinks market Gatorade held 77 percent of the market share with primary competitor Powerade capturing 22 percent, (Crain’s Chicago Business54). There is concern that Gatorade is losing its ability to hold onto market share as it has lost 8 percent of volume to competitors, (AdAge.com55). Within the United States, Gatorade brand has more popularity among consumers living in the South and West regions of the United States. The population of the Western Region of the United States is approximately 73 million, (US Census Bureau56) and people living in this region are 10 percent more likely than average to consume Gatorade, (Table 13.0, Simmons OneView57). The total population of the Southern Region is approximately 116 million, (US Census Bureau) People living in the South are 7 percent more likely than average to consume Gatorade, (Table 13.0, Simmons One View58). Looking at Gatorade’s primary competitor, Powerade, consumers are 10 percent more likely to purchase this beverage in the South, and 20 percent more likely to purchase this beverage if they live in the West, (Table 14.0, Simmons One View59). Insights 13 905453507, 984850369, 939256888, 993496495, 903239402, 976971344 Based on the figures discussed above, Gatorade should adopt a defensive strategy in order to preserve and maintain its popularity in the South and West regions of the United States. However, Gatorade must be careful not to generate identical campaigns as the values and ideals of consumers in the South and West are not identical. Past & Present Communications According to the media mix that looked at Gatorade’s advertising in the time period of January 1, 2010 to July 31, 2012, Gatorade has spent roughly $20.2 million in total on advertising, (AdSpender60). Gatorade focused their efforts on the ready-to-serve (RTS) beverage spending $19.5 million of the total budget, (AdSpender61). Outside of traditional advertising, Gatorade has an active Facebook presence, with 5.2 million likes, (Facebook.com62), as well as an active Twitter presence, with 113,733 followers, (Twitter.com63). On these networks, they post a variety of health-related tips, promotions related to their product lines and inspirational photos. In the past, Gatorade’s advertising started as word-of-mouth. From here, the Superbowl tradition of dumping a cooler of Gatorade on the winning coach started in 1987, (EHow.com64) and started targeting the youth athlete market, (Twoop65). As the brand began to grow, the type of communications offered began to change. 1991, “Be Like Mike” Campaign The 1991“Be Like Mike” campaign, was the most successful campaign in the brand’s history, and the first link between a celebrity endorser and Gatorade (Ehow66). Other celebrity sports endorsers for Gatorade include Mia Hamm, Landon Donovan, Ryan Lochte, Kerri Walsh, Chaz Ortiz, and Tiger Woods, (Gatorade.com67). Gatorade did; however, drop their endorsement deal with Tiger Woods in 2010 shortly after his public scandal, (Adage.com68). Fast forwarding to almost present day, Gatorade’s campaigns continued to focus on product lines. 2010, “Gatorade has Evolved” focusing on the launch of the G Series In 2010, Gatorade launched the “Gatorade has Evolved” campaign focusing on the product launch of the G series. This was launched during the NBA playoffs and has a catchy 14 905453507, 984850369, 939256888, 993496495, 903239402, 976971344 jingle that gets stuck in your head, (Adweek.com69). To launch the campaign, Gatorade used two 60 second spots. The second 60 second spot focused on the “Before, During, and After”. Those two spots were followed by three 15 second spots that focused on each of the three products separately, (AdAge.com70). This campaign continued into 2011, with a wildly successful 60-second anthem ad called “The Inside Edge” where an athlete is shown consuming the G series products properly against a backdrop of James Brown’s hit song “Super Bad”, (Adweek.com71). Current (2012) campaign, “Win From Within”, and Gatorade develops the “G-Force” The 2012 campaign that Gatorade is running has the tag-line “Win From Within” and focuses on the idea that what athletes put into their bodies is just as important as what they put on them, (AdAge.com72). The first ad launched Jan. 2 at the Fiesta Bowl, and had high school athletes juxtaposed with professional athletes and focused on the idea that “...nothing you put on is enough,” (AdAge.com73). Another of the current ad slots for this campaign is set during the 2012 Summer Olympics and features Usain Bolt preparing to run his race after taking a Gatorade Chew, (AdAge.com74). To enhance the brand’s presence in the marketplace, Gatorade took a leaf out of Red Bull’s playbook and developed the “G-Force”, which is a dedicated sales and marketing team that visits retailers and champions the product line locally, (AdAge.com75). This team is primarily composed of former college athletes. The “G-Force” is remarkably similar in scope and design to the Red Bull “Wings” team that travels across the nation to bring Red Bull products to college towns and other metropolitan areas using young, college-aged individuals. Insights Gatorade’s previous campaigns have focused heavily on the product lines on offer and have seen heavy use of celebrity sports endorsers. This is in contrast to the present campaign that Gatorade is running which lines up with the brand reposition that Gatorade underwent in 2011, and focuses on the Gatorade experience. Of major concern for Gatorade’s communication efforts is inconsistency in the key messages that Gatorade is sharing with consumers. This is exacerbated by the variety of campaigns, and sub campaigns that have been used. Thus, Gatorade’s brand messages could be 15 905453507, 984850369, 939256888, 993496495, 903239402, 976971344 getting lost or confused in consumers minds making it more difficult for the brand to grow its market share and may see the brand experiencing a loss of current consumers. Other Considerations Social: As there has been a perceived increase in pace of life, research has indicated that consumers rely more on bottled water and functional drinks as a source of sustenance and health.(IBIS Industry Report78) Historical: In 1997, Gatorade launched an NBA ad featuring a 103 degree fever-ridden Michael Jordan using Gatorade to help him recover. The Public Health Advocacy strongly encouraged the FTC to pull the advertisement believing the ad promoted dangerous playing conditions for teen athletes. PepsiCo had no comment, and the PHA suggested that the FTC release a corrective advertisement stating the dangers of physical activity when ill and how Gatorade is not an aid for ailing athletes (Huffington Post76). Legal: Gatorade has clashed with other industry power player, Powerade in the courtroom. Most recently in 2009, Gatorade sued PowerAde over false advertising claims stating that the ION4 product has deceived consumers. Issues arose when Powerade claimed that the beverage was superior due to the two added electrolytes; calcium and magnesium. The advertising claim was “Don’t settle for an incomplete sports drink”, (Adweek.com77). Going forward, this could lead to increased scrutiny by the Federal Trade Commission, FDA and American Beverage. Economic: as the sports and energy drinks market becomes saturated with products it can be difficult for the two major players, TCCC and PepsiCo, to continue to grow and capture market share. Price Competition is high: Due to major players seeking market share there is an increase in price competition. To some extent brand loyalty will undermine this, however, price discounts and promotions encourage sales, (IBIS Industry Report78). Entry of New Products into the Marketplace: the entry of new products, such as coconut water products positioned as an after-sport recovery drink, could threaten Gatorade’s existing recover line. Specifically, coconut water products contain the same isotonic properties 16 905453507, 984850369, 939256888, 993496495, 903239402, 976971344 of a sports drink, but may appeal to consumers of the G natural line, who are more concerned with the health properties of the products they consume (Bevindustry.com79). High Cost of Advertising: this industry is a major user of advertising; and as this expense increases the volume and value should increase to meet rising demand. If the cost of advertising increases, then operators must scale back or see a fall in their profitability, (IBIS Industry Report80). Price of Sugar: this industry is a heavy consumer of locally purchased sugar. Most manufacturers have long-term supply contracts, and with a rise in the price of sugar, the operation costs will increase meaning higher product prices for the consumer or a fall in profit margins for the company, (IBIS Industry Report81). Insights High costs due to the rising cost of sugar, and the high cost of advertising for this industry are reflected in the company’s product pricing, which could lead to Gatorade being less competitive as compared to new products entering the sports/functional beverage market that rely less on traditional advertising efforts. An external factor working in Gatorade’s favor is the concern for the environment, which could offer them a way to maintain a connection with consumers who are increasingly concerned with the “greenness” of beverage companies. Another concern for Gatorade are the legal implications of making health claims, due to the recent issues with Powerade’s false advertising the sports/functional beverage industry may face greater regulation and oversight from food and health bodies, which could lead to delays in product development as there additional barriers in place for new products entering the market. 17 905453507, 984850369, 939256888, 993496495, 903239402, 976971344 SWOT Analysis: Strengths• Strong market share; Gatorade is one of the top two for functional sports beverages. • Strong relationships with a variety of key athletes across numerous sports disciplines. • Over 40 years of science that can back up the scientific claims made. • Gatorade’s Sports Science Institute puts the company at an advantage over competitors in that it is a leader and innovator in sports science and nutrition research. Weaknesses• Due to the sheer number of product lines, Gatorade is at risk for losing control over the key messages that they put out to the consumer. • Gatorade only sees 0.4 percent growth from new consumers which could cause their market to stagnate and cause problems retaining market share. • Weaker product lines pull down overall revenue and inhibit possible growth in stronger lines. • Large geographic market areas (i.e. North East) where sports drinks are struggling to capture consumers. Opportunities• Gatorade could eliminate weaker product lines and invest in lines with larger market share, giving Gatorade the potential to increase revenue. • Develop a more specialized campaign to target consumers in the South and West. Threats• Powerade due to its similar influence and growing market share. • Increasing price of sugar could influence Gatorade’s ability to remain price competitive as compared to other functional beverages with lower sugar contents. 18