Mise en page 1 - Financière agache

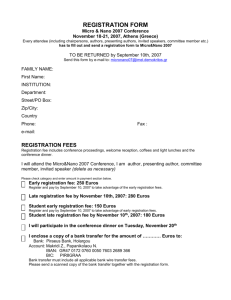

advertisement