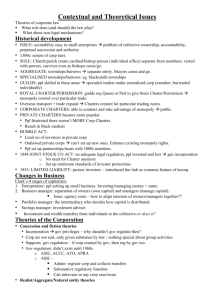

Portfolio. - Rochester Business Journal

MARKET WATCH

LOCAL STOCK PERFORMANCE

ADT Corp. (NY ADT)

AT&T Inc. (NY-T)

Arista Power Inc. (OTC-ASPW)

Bank of America Corp. (NY-BAC)

Bon-Ton Stores Inc. (NAS-BONT)

CVS Caremark Corp. (NY-CVS)

CLOSING

PRICE

11.04.13

43.18

36.45

0.37

14.04

11.63

61.98

CLOSING

PRICE

10.28.13

41.78

35.57

0.37

14.23

11.29

61.74

NET

CHANGE

IN

PERIOD

1.40

0.88

0.00

-0.19

0.34

0.24

PERCENT

CHANGE

IN

PERIOD

3.35

2.47

0.00

-1.34

3.01

0.39

Ciber Inc. (NY-CBR)

Citigroup Inc. (NY-C)

Constellation Brands Inc. Class A (NY-STZ)

Constellation Brands Inc. Class B (NY-STZB)

The Cooper Cos. Inc. (NY-COO)

Corning Inc. (NY-GLW)

Danaher Corp. (NY-DHR)

Document Security Systems Inc. (AMEX-DSS)

Dr Pepper Snapple Group Inc. (NY-DPS)

Earthlink (NAS-ELNK)

Eastman Kodak Co. (NYS-KODK)

3

EnPro Industries Inc. (NY-NPO)

Exelis (NY-XLS)

3.19

48.63

65.78

64.91

129.05

17.26

72.75

1.07

47.18

4.90

26.90

57.63

16.24

3.36

50.15

65.01

64.54

129.64

17.30

72.16

1.19

47.51

5.14

22.75

60.24

16.41

-0.17

-1.52

0.77

0.37

-0.59

-0.04

0.59

-0.12

-0.33

-0.24

4.15

-2.61

-0.17

-5.06

-3.03

1.18

0.57

-0.46

-0.23

0.82

-10.08

LOSS

-0.69

15.29

-4.67

18.24

LOSS

LOSS

-4.33

-1.04

LOSS

14.79

7.25

7.15

20.59

14.50

20.37

37.73

10.41

Exxon Mobil Corp. (NY-XOM)

Fairport Savings Bank (OTCBB-FSBC)

Financial Institutions Inc. (NAS-FISI)

First Niagara Financial Group Inc. (NAS-FNFG)

Frontier Communication Corp. (NY-FTR)

Gannett Co. Inc. (NY-GCI)

GateHouse Media Inc. (OTCBB-GHSE)

Genesee & Wyoming Inc. (NY-GWR)

Graham Corp. (AMEX-GHM)

HSBC Holdings PLC (NY-HBC)

Harris Corp. (NY-HRS)

Harris Interactive Inc. (NAS-HPOL)

Hewlett-Packard Co. (NY-HPQ)

Home Properties Inc. (NY-HME)

IBM Corp. (NY-IBM)

IEC Electronics Corp. (AMEX-IEC)

ITT Corp. (NY-ITT)

92.10

8.31

23.82

11.06

4.46

28.04

0.04

99.92

37.93

56.51

62.11

1.91

25.77

57.47

180.27

4.31

88.23

8.31

24.14

11.26

4.49

27.52

0.04

101.16

38.04

55.25

59.40

1.90

23.86

61.13

177.35

4.59

3.87

0.00

-0.32

-0.20

-0.03

0.52

0.00

-1.24

-0.11

1.26

2.71

0.01

1.91

-3.66

2.92

-0.28

4.39

0.00

-1.33

-1.78

-0.67

1.89

0.00

-1.23

-0.29

2.28

4.56

0.53

8.01

-5.99

1.65

-6.10

11.24

LOSS

13.89

15.00

43.60

12.99

LOSS

40.95

28.23

11.91

14.80

16.07

LOSS

30.04

12.49

23.55

J.C. Penney Co. Inc. (NY-JCP)

JPMorgan Chase & Co. (NY-JPM)

Johnson & Johnson (NY-JNJ)

Kohl's Corp. (NY-KSS)

Kraft Foods Group Inc. (NAS-KRFT)

Level 3 Communications Inc. (NAS-LVLT)

M&T Bank Corp. (NY-MTB)

Macy's Inc. (NY-M)

Manning & Napier (NY-MN)

Metlife Inc. (NY-MET)

Monro Muffler Brake Inc. (NAS-MNRO)

NaturalNano Inc. (OTCBB-NNAN)

Newell Rubbermaid Inc. (NY-NWL)

Parker Hannifin Corp. (NY-PH)

Paychex Inc. (NAS-PAYX)

Performance Technologies Inc. (NAS-PTIX)

40.82

8.36

52.04

93.03

58.47

54.58

30.21

111.64

46.49

17.16

48.07

49.12

0.00

29.88

116.31

42.00

37.71

7.39

52.68

92.39

55.76

55.51

26.63

112.04

45.44

18.61

48.59

45.86

0.00

29.69

116.47

43.27

3.11

0.97

-0.64

0.64

2.71

-0.93

3.58

-0.40

1.05

-1.45

-0.52

3.26

0.00

0.19

-0.16

-1.27

8.25

13.13

-1.21

0.69

4.86

-1.68

13.44

-0.36

2.31

-7.79

-1.07

7.11

0.00

0.64

-0.14

-2.94

7.56

LOSS

8.15

21.21

13.68

17.53

LOSS

11.73

13.47

3.45

80.35

34.22

LOSS

22.16

18.58

26.52

SPX Corp. (NY-SPW)

Sears Holding Corp. (NAS-SHLD)

Seneca Foods Corp. Class A (NAS-SENEA)

Seneca Foods Corp. Class B (NAS-SENEB)

Stantec Inc. (NY-STN)

Staples Inc. (NAS-SPLS)

Stewart Information Services Corp. (NY-STC)

Synnex Corp. (NY-SNX)

Target Corp. (NY-TGT)

Thermo Fisher Scientific Inc. (NY-TMO)

Thomson Reuters Corp. (NY-TRI)

Time Warner Cable Inc. (NY-TWC)

Tompkins Financial Corp. (AMEX-TMP)

Torvec Inc. (OTCQB-TOVC)

Transcat Inc. (NAS-TRNS)

Ultralife Corp. (NAS-ULBI)

3.25

93.63

60.86

29.51

29.55

62.79

16.18

31.19

61.45

65.22

98.05

37.90

123.15

48.35

0.30

2.76

86.15

55.56

29.94

29.75

53.93

16.07

31.44

61.67

64.88

97.87

35.73

118.72

51.50

0.33

0.49

7.48

5.30

-0.43

-0.20

8.86

0.11

-0.25

-0.22

0.34

0.18

2.17

4.43

-3.15

-0.03

17.75

8.68

9.54

-1.44

-0.67

16.43

0.68

-0.80

-0.36

0.52

0.18

6.07

3.73

-6.12

-9.09

LOSS

LOSS

LOSS

11.99

12.01

23.29

LOSS

5.62

15.03

15.71

27.31

32.54

18.95

18.47

LOSS

8.08

3.70

8.80

4.35

-0.72

-0.65

-8.18

-14.94

15.10

36.94

United Technologies Corp. (NY-UTX)

Valeant Pharmaceuticals International Inc. (NY-VRX)

Verizon Communications Inc. (NY-VZ)

VirtualScopics Inc. (NAS-VSCP)

107.98

110.33

51.08

3.90

105.99

110.42

50.57

4.35

1.99

-0.09

0.51

-0.45

1.88

-0.08

17.74

LOSS

1.01

10.71

-10.34

LOSS

Vuzix (OTCBB-VUZI)

Windstream Holdings Inc. (NAS:WIN)

4.55

8.54

4.55

8.59

0.00

-0.05

0.00

-0.58

LOSS

33.67

Wal-Mart Stores Inc. (NY-WMT)

Xerox Corp. (NY-XRX)

77.33

10.19

77.14

9.77

0.19

0.42

0.25

4.30

14.44

10.49

1 Earnings per share are for the company's most recent four quarters.

2 Annual dividend rates are annual disbursements based on the last monthly, quarterly, semiannual or annual declaration.

3 Kodak canceled all shares of its common stock when it emerged from bankruptcy on Sept. 3, 2013. New shares of Kodak stock (EKOD) started trading

P/E

RATIO

23.70

26.86

LOSS

18.31

724.97

18.37

EARNINGS

PER SHARE 1

1.82

1.35

-0.29

0.77

0.02

3.37

-0.18

4.77

-0.67

-1.42

0.25

0.54

0.10

6.09

-0.32

1.16

6.50

2.62

-0.07

-0.31

5.55

4.09

4.15

3.59

6.26

1.58

-0.57

-1.35

0.59

1.44

-0.01

1.35

-1.48

9.52

3.45

4.97

-13.77

2.46

2.46

2.81

6.39

4.39

4.27

3.11

14.44

0.18

5.40

-7.32

4.20

0.12

-1.62

1.91

-0.76

2.44

1.34

4.75

1.53

1.56

8.19

-0.08

1.71

0.74

-0.25

3.09

-2.38

-2.41

3.30

9.08

9.08

6.27

1.19

3.57

0.10

2.16

5.35

0.97

over the counter on Sept. 23. On Nov. 1, the stock began trading on the New York Stock Exchange under the ticker symbol KODK

ANNUAL

DIVIDEND

RATE 2

0.50

1.90

NONE

0.04

0.20

0.90

NONE

52 - WEEK

HIGH LOW

50.37

38.09

39.00

32.71

1.26

0.25

15.03

8.92

22.68

9.82

62.36

44.33

4.99

2.70

0.40

0.80

1.52

2.64

0.58

2.80

3.80

NONE

27.78

11.35

67.79

56.24

215.90 178.71

7.27

2.92

41.62

20.41

24.57

6.27

56.93

38.83

94.42

67.80

1.40

2.00

58.93

41.35

58.76

43.25

NONE 30.77

17.95

1.00

119.54

95.68

0.20

50.77

36.30

NONE 20.45

11.89

1.10

0.44

51.65

51.12

30.55

30.72

NONE

0.60

1.80

1.40

0.00

0.00

30.44

19.93

117.94

77.34

43.62

30.55

NONE

1.00

3.97

0.73

93.86

60.61

NONE 68.77

38.40

NONE 36.33

26.62

NONE 37.86

27.10

0.63

63.48

34.13

0.48

0.10

17.30

34.39

10.94

19.88

NONE 64.50

30.70

1.72

73.50

58.01

0.60

98.52

59.61

0.04

53.56

34.04

NONE 65.98

28.37

NONE 65.39

28.71

0.06

135.41

88.80

0.40

0.10

18.07

10.71

74.25

50.63

NONE

1.52

3.64

0.88

50.37

42.10

0.20

7.07

4.70

NONE 30.00

19.25

NONE 61.24

35.43

NONE 16.77

10.08

2.52

NONE

95.49

9.50

84.70

6.40

0.72

0.56

1.00

0.16

24.27

17.61

11.28

7.08

4.94

3.71

28.09

16.35

NONE 0.12

0.02

NONE 101.95

66.66

0.12

38.96

16.45

NONE 58.71

47.21

1.48

NONE

62.81

2.19

41.08

1.09

2.06

NONE

NONE

1.00

1.88

0.23

1.12

2.60

1.60

NONE

38.28

26.71

128.17

84.57

52.00

36.85

0.85

0.30

NONE

NONE

9.06

4.65

4.97

2.54

2.14

112.46

74.44

NONE 115.40

52.50

54.31

8.00

9.55

11.15

40.51

3.80

0.03

10.00

7.50

79.96

67.37

6.10

PAGE 23

NOVEMBER 8, 2013

ROCHESTER BUSINESS JOURNAL

PORTFOLIO

A weekly report compiled from the proxy statement and annual report of a publicly held

company with local headquarters or a company with a major division in the area

NASDAQ — KRFT

Kraft Foods Group Inc. of Northfield, Ill., manufactures and markets packaged food products, including refrigerated meals, refreshment beverages and coffee, cheese and other grocery products. Prior to Oct. 1, 2012, the company was a wholly owned subsidiary of

Mondelez International. On that date, Mondelez spun off Kraft Foods Group, its North American grocery business, to shareholders and undertook a series of transactions to separate net assets and entities. As a result, Mondelez now holds the global snacks business. Kraft

Foods Group now holds the North American grocery business and operates as an independent, publicly traded company.

Kraft Foods Group manages and reports results in five segments: beverages, cheese, refrigerated meals, grocery, and international and food service. Two of the company s brands Kraft cheeses, dinners and dressings and Oscar Mayer meats generate annual revenues exceeding $1 billion each. Kraft Foods products are generally sold to supermarket chains, wholesalers, supercenters, club stores, mass merchandisers, distributors, convenience stores, drug stores, value stores and other retail food outlets in the United States and

Canada. One customer, Wal-Mart Stores Inc., accounted for approximately 25 percent of the company s combined net revenues in 2012. Among the company s significant assets are a portfolio of trademarks including Baker s, Cheez Whiz, Cool Whip, Cracker Barrel, Crystal

Light, Jell-O, Kool-Aid, Kraft, Lunchables, MiO, Miracle Whip, Oscar Mayer, Planters, Shake

N Bake, Stove Top and Velveeta. The company owns 37 manufacturing and processing facilities in the United States and three in Canada, and it has 23,000 employees. Approximately 445 people are employed at its plant in Avon, Livingston County, which manufactures Cool Whip toppings and Oscar Mayer Lunchables.

The company reported revenue of $18.4 billion during fiscal 2012 down 1.7 percent from 2011. Net income was $1.6 billion, a 7.5 percent decrease from the prior year, while net income per share declined 25 cents to $2.75. Net cash flow provided by operating activities was $3 billion; net cash used in investing activities was $422 million; and net cash provided used in financing activities was $1.4 billion.

The company s fiscal year ended on Dec. 29.

Common shares outstanding on Nov. 4 ........................................................... 595,562,000

Price per share of common stock on Nov. 4 ............................................................ $54.58

Total market value on Nov. 4 ...................................................................... $32,505,773,960

Controlled by all directors and officers as a group ............................................. 1,407,885

(0.2 percent)

Performance Record

(Dollars in millions except per-share data)

2012 2011 2010 2009 2008

Revenues

Net

Net income per share

Dividends per share

$18,339 $18,655 $17,797 $17,278 $17,708

1,642 1,775 1,890 1,896 1,406

2.75

0.50

3.00

NA

3.20

NA

3.21

NA

2.38

NA assets

Long-term

23,329 21,539 21,598 22,189 22,052

227

Operating cash flow (loss) 3,035

Investing cash flow (loss) (422)

Financing cash flow (loss) (1,358)

2,664

(401)

(2,265)

828

3,250

(4,078)

3,017

NA

NA

2,920

NA

NA

Directors

Number of common shares

1

John Cahill, 55, executive chairman ............................................................................ 226,866

W. Anthony Vernon, 57, CEO ...................................................................................... 212,476

John Pope, 63, chairman, PFI Group LLC ..................................................................... 12,861

Myra Hart, 72 .................................................................................................................... 8,024

Mackey McDonald, 66, senior adviser, Crestview Partners ............................................. 3,849

Peter Henry, 43, dean, Leonard N. Stern School of Business,

New York University .................................................................................................. 2,352

L. Kevin Cox, 49, chief human resources officer, American Express Co. ...................... 1,993

Terry Lundgren, 60, president and CEO, Macy s Inc. ..................................................... 1,099

Executive Compensation

Officer 2012 cash compensation

2

Irene Rosenfeld, former chairman and CEO ........................................................ $26,931,705

Timothy McLevish, executive vice president and chief financial officer .................. 11,369,522

W. Anthony Vernon, CEO ....................................................................................... 10,449,718

John T. Cahill, executive chairman ........................................................................... 6,532,553

Sanjay Khosla, former executive vice president and president, developing markets .................................................................... 5,939,990

David Brearton, former executive vice president and chief financial officer ............. 4,762,340

Georges El-Zoghbi, executive vice president and president, cheese and dairy and exports......................................................................................................... 4,121,397

Sam Rovit, executive vice president, strategy ........................................................... 3,382,500

Above executive officers as a group................................................................ $73,489,725

Footnotes:

1

Includes shares that are beneficially owned, shares of restricted stock, shares held in trust, shares held by family members, shares of deferred stock and shares that may be acquired through the exercise of stock options

2

Includes salary, bonuses, value of stock and option awards, non-equity incentive plan compensation, annual incentive awards, long-term incentive plan awards, change in pension value, value realized from stock options exercised and all other compensation

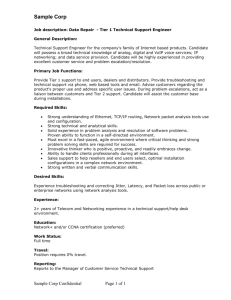

Stock Performance

Cumulative Total Return for Kraft Foods Group

Common Stock (versus S&P 500 and Peer Group)

$110

$100

$90

9/17/2012 9/28/2012 12/28/2012

Kraft Foods Group

Researched by Andrew Green

S&P 500 Peer Group

© 2013 Rochester Business Journal