Exxon Mobil Corporation.

advertisement

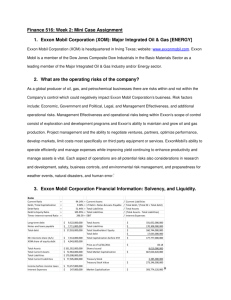

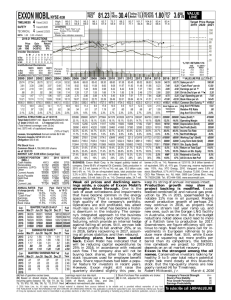

1 Exxon Mobil Corporation. Ticker: XOM Sector: Energy Oil & Gas Industry: RECOMMANDATION Recommendation: Hold Pricing HOLD Market Cap1 $315.95B Trading Vol. 25.15M Total Assets $291,068M Total Liabilities $150,896M Exxon Mobil Corporation is a conglomerate with well diversified business, both in segments and geography. It is an industry leader in almost every aspect of the energy and petrochemical business, operating facilities or market products in most of the world’s countries and explore for oil and natural gas on six continents. As the superior capital allocator and operator and few remaining firms with an AAA credit rating, Exxon Mobil showed the strong performance in the first two quarters of 2010. However, the higher correlation with current economic uncertainty may drag its future performance down. EPS(09) $3.98 POMPANY DESCRIPTION 2 11.85 Closing Price (09/24) $61.75 52-wk High $76.54 52-wk Low $55.94 Market Data Valuation P/E P/Sales 0.87 P/Books 2.23 P/EBITDA 6.34 P/CF 7.40 Div. Yield 2.80% Profitability & Effectiveness ROA(06/30) 9.60% ROE(06/30) 20.00% Profit Margin 31% Oper Margin 12.5% Net Margin 6.9% Analyst: Yuhui Qian Email: yqvcd@mail.missouri.edu 1 2 Exxon Mobil Corporation operates petroleum and petrochemical businesses on a worldwide basis. In late 1999, the FTC allowed Exxon and Mobil to reunite, creating Exxon Mobil Corp. The company’s operations include exploration and production of oil and gas, electric power generation, and coal and minerals operations. Exxon Mobil also manufactures and markets fuels, lubricants, and chemicals. Over the last 125 years ExxonMobil has evolved from a regional marketer of kerosene in the U.S. to the largest publicly traded petroleum and petrochemical enterprise in the world. Today they operate in most of the world's countries and are best known by familiar brand names: Exxon, Esso and Mobil. In 2009, it produced 2.4 million barrels of oil and 9.3 billion cubic feet of natural gas a day. At year-end 2009, reserves stood at 14.95 billion boe (plus 8.03 billion for equity companies), 62% of which are oil. The company is the Average of Bloomberg and Morningstar Bloomberg MU IFM- 09/27/2010 2 Exxon Mobil Corporation. world's largest refiner, with 37 refineries, and it is one of the world's largest manufacturers of commodity and specialty chemicals. BUSINESS SEGMENTS AND OPORATIONS Exxon Mobil’s revenues are generated from 3 distinct operational segments consisting of upstream operations, downstream operations, and chemical operations. ExxonMobil's businesses include oil and natural gas exploration and production (8% of 2009 sales; 81% of 2009 segment earnings); refining and marketing (83%; 8%); chemicals (9%; 11%); and other operations, such as electric power generation, coal and minerals. At year-end 2009, the company had an ownership interest in 37 refineries with 6.23 million barrels per day (b/d) of atmospheric distillation capacity (U.S. 32%, Europe 28%, Asia Pacific 27%, Canada 8%, and Middle East/Latin America/Other 5%). The following pages breakdown these operations further.3 Upstream Operations Upstream operations consist of exploration, development, produce and gas and power marketing. Earnings in this segment during 2009 totaled $17.1 billion with a return on average capital of 23 percent. Exxon produced liquids and natural gas for sale of 3.9 million oil-equivalent barrels per day. Exploration activities span the entire globe and include geographic locations such as Canada, U.S. Gulf of Mexico, Turkey, Vietnam, Norway, and many more. The company possesses massive resources, adding 2.9 billion oil-equivalent barrels to the resource base in 2009, bringing the total resource base to 23.3 billion oil-equivalent barrels. This equates to 16 years of reserves life at current production rates. Proved reserves make up 31 percent of this resource base. Downstream Operations Downstream operations consist of refining & supply, fuels marketing, and lubricants and specialties. Exxon’s refining and marketing business was severely affected by the recession reflected by lower product demand because of the economic downturn. Exxon is the largest global refiner, manufacturer of lube bases tocks, and supplier of petroleum products. Chemical Operations Exxon’s chemical operations capitalize on their core competencies and benefit from their integration across different sectors of Exxon’s operations. Selected investment strategies in advanced projects have led to industry leading performance. Earnings in this operational sector for 2009 totaled $2.3 billion and are complemented with returns on average capital employed of 14 percent. 3 XOM 10-K 2009. MU IFM- 09/27/2010 3 Exxon Mobil Corporation. MU IFM- 09/27/2010 4 Exxon Mobil Corporation. 2009 Earnings by Segments 2009 Earnings by Regions Chemical 11% United States 17% Downstre am 8% Upstream 81% Non-U.S. 83% Figure 1 Figure 2 MANAGEMENT Rex Tillerson is chairman and CEO of Exxon, a role he assumed in 2006. Previously, he served as president after spending his career with Exxon, beginning in 1975 as a production engineer. Tillerson is likely to continue a disciplined capital allocation strategy and deliver the high returns that his predecessor did. Total compensation for Tillerson was only $27 million in 2009, which is reasonable, considering the size of the company and his peers' compensation. Exxon has a typical compensation structure consisting of a salary, cash bonus, and equity awards. Performance is not evaluated by typical quantitative measures but by the executives' performance relative to achievement of the company's long-term goals. Exxon gets credit for delaying 50% of bonus payment until later periods' earnings targets are met, and requiring longer vesting periods for equity awards. Low executive equity ownership relative to total shares outstanding is understandable, considering the size and history of the company. Shareholder return is a focus of management. Over the past five years, Exxon paid $39 billion in dividends and repurchased $135 billion worth of stock, reducing shares outstanding by 23%.4 Table 1 4 Morningstar MU IFM- 09/27/2010 5 Exxon Mobil Corporation. PERFORMANCE As the table below shows, upstream earnings for 2009 were $17,107 million, down $18,295 million from 2008, including the absence of an after−tax special gain in 2008 of $1,620 million from the sale of a natural gas transportation business in Germany. Lower crude oil and natural gas realizations reduced earnings $15.2 billion. Downstream earnings were $1,781 million, down $6.4 billion from 2008. Weaker margins reduced earnings $5.1 billion. Lower divestment activity reduced earnings about $1.0 billion. Volumes decreased earnings approximately $300 million. Petroleum product sales of 6,428 kbd decreased 333 kbd, mainly reflecting asset divestments and lower demand. Earnings declined $648 million versus 2008 to a total of $2,309 million. Weaker margins reduced earnings by $340 million, mostly in commodities. Lower volumes decreased earnings $190 million. All other items, including unfavorable foreign exchange impacts, reduced earnings $115 million. Prime product sales of 24,825 kt (thousands of metric tons) decreased 157 kt from 2008. Prime product sales are total chemical product sales, including ExxonMobil’s share of equity−company volumes and finished−product transfers to the downstream business. U.S. Chemical earnings of $769 million increased $45 million. Non−U.S. Chemical earnings were $1,540 million, down $693 million. Table 2 2009 Financial Performance by Segments5 Table 2 5 XOM,2010 10-K. MU IFM- 09/27/2010 6 Exxon Mobil Corporation. 6 Figure 3 All IN MILLIONS 3-Year Functional Earnings 40,000 35,000 30,000 25,000 20,000 15,000 10,000 5,000 0 -5,000 Upstream Downstream Chemical Corporate and financing 2009 17,107 1,781 2,309 -1,917 2008 35,402 8,151 2,957 -1,290 2007 26,497 9,573 4,563 -23 Figure 4 6 XOM 2009 Annual Report MU IFM- 09/27/2010 7 Exxon Mobil Corporation. ALL IN MILLIONS 3-Year Earnings by Regions 40,000 35,000 30,000 25,000 20,000 15,000 10,000 5,000 0 2009 2008 2007 United States 3,509 8,616 10,171 Non-U.S. 17,688 37,894 30,462 Figure 5 7 Table 3 ExxonMobil reported an 85% rise in second-quarter earnings compared with the same period a year ago, thanks to higher crude-oil price realizations, improved refining margins, and strong chemical results. Earnings also benefited from an 8.4% increase in total production from the year-ago quarter. Production gains came primarily from the continued ramp-up of ExxonMobil's liquefied natural gas facilities in Qatar and increased European demand. As a result, natural gas volume grew 24.7% from the year-ago period. However, oil volume fell almost 1% as natural field declines offset higher volume in Qatar and Kazakhstan. Through the first half of the year, production volume increased 6.4% from the year-ago period, led by gains in natural gas volume of 19.2%. Benefiting from higher price realizations as well as increased production volume, second-quarter upstream earnings rose 40% from the second quarter of 2009. The chemical and downstream segments also showed significant improvement during the quarter. Chemical segment earnings surged 273% from the quarter a year ago, thanks to improved margins and higher volume as a result of stronger global demand. The downstream segment also posted an impressive turnaround during the quarter. Improved global refining margins resulted in a 138% increase in earnings compared with the same quarter a year earlier, despite lower volume due to continued weak demand. The U.S. downstream segment marked a significant reversal by posting earnings of $440 million after posting losses for the past four quarters.8 7 8 ExxonMobil Annual Report 2009 Morningstar MU IFM- 09/27/2010 8 Exxon Mobil Corporation. 9 Table 4 Figure 6 Morningstar Investment Style The following chart shows the stocks comparison compared to the S&P 500 and other main competitors.10 Chart 1 So far in the YTD, XOM price has been down by 10%, chart 1 shows a weaker trend compare to 9 10 S&P Estimates Yahoo! Finance. MU IFM- 09/27/2010 9 Exxon Mobil Corporation. most of Exxon’s peers in the industry, expect BP oil due to the oil spill in the Gulf of Mexico. However, as Table 5 and 6 below shows, Exxon Mobil’s fundamental condition is still strong, compare to most of its direct competitors, as Sales and Income are significantly higher than peers. ROA and Asset turnover is above the industry average and market level; whereas P/E ratio is lower than the industry and market, showing positive signs for Exxon Mobil. Table 5 Comparison to Peers11 XOM Industry S&P 500 ROA % 9.60 9.30 8.50 ROE % 20.00 20.00 22.20 Net Margin % 6.90 8.70 12.70 Asset Turnover 1.40 1.10 0.80 P/E 11.80 12.80 15.10 Forward P/E 9.30 - 13.50 P/B 2.20 1.80 2.00 P/CF 7.40 7.00 7.00 P/S 0.80 0.80 1.20 Fwd Div Yld % 2.86 - 2.01 Table 6 Comparison to Industry and Market12 REASONS TO BE BULLISH ON XOM Financial Health As one of the few remaining firms with an AAA credit rating13, ExxonMobil’s financial health is beyond reproach. Cash flow from operations remains sufficient to finance capital expenditures while increasing dividend payments and buying back stock. More important, the large cash position and access to cheap debt give the company resources to make opportune acquisitions. 11 12 13 Morningstar Estimates Morningstar Stock Analysis Report Morningstar Credit Rating MU IFM- 09/27/2010 10 Exxon Mobil Corporation. Table 3 Financial Health14 Well Diversification As we described earlier in the report, Exxon Mobil is a conglomerate with well diversified business, both in segments and geography. It is an industry leader in almost every aspect of the energy and petrochemical business, operating facilities or market products in most of the world’s countries and explore for oil and natural gas on six continents. More than 80% of its earnings are generated from non-U.S. markets. With high-performing operations and global integration, Exxon is one of the best-positioned firms to weather a drop in commodity prices15. The diversity of its operations and a vast geographic footprint offer protection against regional economic weakness. REASONS TO BE BEARISH ON XOM Economic Uncertainty The demand for energy and petrochemicals correlates closely with general economic growth rates. The occurrence of recessions or other periods of low or negative economic growth will typically have a direct adverse impact on results. Other factors that affect general economic conditions in the world or in a major region, such as changes in population growth rates or periods of civil unrest, also impact the demand for energy and petrochemicals. Economic conditions that impair the functioning of financial markets and institutions also pose risks to Exxon Mobil. The US economy was more sluggish in the second quarter than was initially projected. The original report for the second quarter estimated the annualized growth rate to be 2.4 percent, but the rate was adjusted to 1.6 percent. While the growth rate was less than was initially expected, the GDP did increase more than the 1.3 percent that polled economists were predicting. The 1.6 percent growth rate follows a stronger first quarter where growth was 3.7 percent.16 As the economy continues its 14 15 Morningstar Estimates Morningstar stock Report 16 Tom Barkley and Darrell Hughes, “GDP Growth Revised Downward.” 27 Aug 2010, Wall Street Journal. 28 Aug 2010 <http://online.wsj.com/article/>. SB10001424052748704147804575455270227305744.html?mod=djemalertNEWS>. MU IFM- 09/27/2010 11 Exxon Mobil Corporation. slow recovery, the chances of a recurring recession increase. The threat of a double-dip recession negatively impacted Exxon’s expected profitability and future growth. Government and Political Factors ExxonMobil’s results can be adversely affected by political or regulatory developments affecting operations. As nations become more protective of their natural resources, the company will find it increasingly difficult to increase production and book reserves. For a company with global operations, geopolitical risk is always an issue.17 Recent events in Russia, Nigeria, and Venezuela underscore the risk associated with doing business in those countries. These risks will only become greater as Exxon expands its global production portfolio through partnerships with NOCs. Access limitations A number of countries limit access to their oil and gas resources, or may place resources off-limits from development altogether. Restrictions on foreign investment in the oil and gas sector tend to increase in times of high commodity prices, when national governments may have less need for outside sources of private capital. Many countries also restrict the import or export of certain products based on point of origin. Restrictions on doing business As a U.S. company, Exxon Mobil is subject to laws prohibiting U.S. companies from doing business in certain countries, or restricting the kind of business that may be conducted. Such restrictions may provide a competitive advantage to their non-U.S. competitors unless their own home countries impose comparable restrictions. Regulatory and litigation risk Even in countries with well-developed legal systems where Exxon Mobil does business, they are exposed to changes in law that could adversely affect results, such as, increases in taxes or government royalty rates, price controls, changes in environmental regulations or other laws that increase cost of compliance. Another concern is the adoption of regulations mandating the use of alternative fuels or uncompetitive fuels. VALUATION I used the Two-Stage Discounted Free Cash Flow Model to find the intrinsic value of Exxon Mobil Corporation. I calculated the discount rate of 8.98% by using WACC which considers both the cost of equity and cost of debt. I used CAPM to determine the cost of equity, shows as follow: Cost of Equity = 3.74%+0.845*(10.59%-3.74%) = 9.49% 17 Morningstar Report MU IFM- 09/27/2010 12 Exxon Mobil Corporation. I adopted the cost of debt and weight of equity and debt from Bloomberg. Beta was found in Bloomberg as the 10-year adjusted Beta. The risk free rate of 3.74 percent is the mean annual interest rate of US treasury bills going back to 192818, while the market return rate of 10.59 percent is the average growth rate of the S&P 500 index since 1871.19 While these numbers may fluctuate in the short-term, S&P 500 and Treasury bill rates are currently depressed, these averages will likely be maintained in the long-run. Net Income and Depreciation and Depletion values were taken from the 2009 10-K report. For the 10-year Average Increase in Working Capital, I firstly calculated every-year working capital by subtracting current liabilities from current assets. Then I calculated the change in working capital from previous year to later year. Finally, I calculated the average change in working capital which is $107.33million. For the 10-year Average Capital Expenditure, I adopted every-year Capital Expenditure from XOM’s annual reports, and then averaged them to get the value of $14,121.40million. In the first stage, I used 5% growth rate which was estimated for 2010, 2011 and 2012 fiscal years. Then I conservatively decreased the growth rate to 4% for the later years. In the second stage, we used 3.41% which is average percent change from preceding period in Real Gross Domestic Product since 1930, as the growth rate of perpetuity. I find the intrinsic value of Exxon Mobil Corp. is $68.99 per share, which is higher than the current price of $61.75. Table N. DCF Sensitivity Analysis Discount Rate 7% 8% 8.98% 10% 11% 93.47 73.52 60.99 51.89 45.39 16000 99.71 78.42 65.06 55.34 48.41 16968 105.74 83.16 68.99 58.69 51.34 18000 112.17 88.22 73.19 62.26 54.46 19000 118.4 93.12 77.25 65.72 57.49 FCF (All In Millions) 15000 18 19 http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html http://www.moneychimp.com/features/market_cagr.htm MU IFM- 09/27/2010 13 Exxon Mobil Corporation. CONCLUSION ExxonMobil sets itself apart among the other super majors as a superior capital allocator and operator. With a majority of the world's remaining resources in government hands, opportunities for the company to grow its large production base are limited. After the financial crisis in 2008, Exxon Mobil Corporation showed a strong recovery in the first 2 quarters of 2010. Through a relentless pursuit of efficiency, technology, development, and operational improvement, it consistently delivers higher returns on capital relative to peers. However, the performance of Exxon Mobil is highly correlative with global economic condition. The increasing probability of “double-dip” recession after the second quarter negatively affects the expected profitability of Exxon Mobil. MU IFM- 09/27/2010 14 Exxon Mobil Corporation. Appendix A MU IFM- 09/27/2010 15 Exxon Mobil Corporation. MU IFM- 09/27/2010 16 Exxon Mobil Corporation. MU IFM- 09/27/2010 17 Exxon Mobil Corporation. Appendix B Two-Stage Discounted Free Cash Flow Valuation Model assuming discount rate (k) of Free Cash Flow in 2009: Net Income Average Increase in Working Capital (subtract) Depreciation and Depletion (add) Amortization (add) Average Capital Expenditures (subtract) Free Cash Flow (Owner Earnings) FIRST STAGE Prior Year Free Cash Flow First Stage Growth Rate (add) Free Cash Flow Discounted Value per annum $ $ $ $ $ $ Year: 2010 $ 16,968.3 5.0% $ 17,816.7 $17,816.7 Sum of present value of owner earnings SECOND STAGE Residual Value $147,979.1 8.98% (In millions) 19,280.00 (107.33) 11,917.00 (14,121.40) 16,968.27 2011 $17,816.7 5.0% $18,707.5 $17,166.5 $ 25,848.7 3.41% Free Cash Flow in year 11 Capitalization rate (k-g) Value at end of year 10 $ 26,730.1 5.57% 480,170.33 Present Value of Residual Intrinsic Value of Company Shares outstanding assuming dilution Intrinsic Value per share Current Price 2013 $19,642.9 4.0% $20,428.6 $15,784.7 <----- This number represents the sum of long) Free Cash Flow in year 10 Second Stage Growth Rate (g) (add) $ 2012 $18,707.5 5.0% $19,642.9 $16,540.1 2014 $ 20,428.6 4.0% $ 21,245.7 $15,063.8 2015 $ 21,245.7 4.0% $ 22,095.6 $14,375.9 2016 $ 22,095.6 4.0% $ 22,979.4 $13,719.4 2017 $22,979.4 4.0% $23,898.6 $13,092.8 2018 $ 23,898.6 4.0% $ 24,854.5 $12,494.9 2019 $ 24,854.5 4.0% $ 25,848.7 $11,924.3 present values of the free cash flow that we expect in the first stage (which in this case is ten years $203,261.27 $351,240.36 5091 $68.99 $61.75 11.73% MU IFM- 09/27/2010 18 Exxon Mobil Corporation. (ALL IN MILLIONS) Working Capital Change In WC Average Change In WC 2009 3,174 (19,992) 107 2008 23,166 (4,485) 2007 27,651 691 2006 26,960 (75) 2005 27,035 9,639 2004 17,396 9,822 2003 7,574 2,458 2002 5,116 (451) 2001 5,567 3,359 2000 2,208 CapEx Average CapEx 22491 14121.4 19318 15387 15462 13839 11986 12859 11437 9989 8446 Data above is according to Annual Reports 1999-2009 which are directly downloaded from Exxon Mobil Corporation's website. MU IFM- 09/27/2010