ANNUAL REPORT 2014

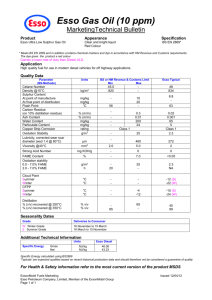

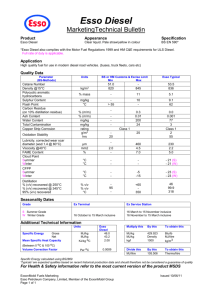

advertisement