2011 Summary Annual Report

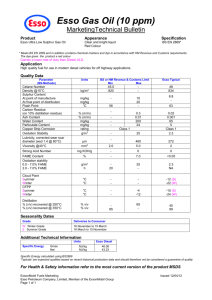

advertisement