Externalities in Competitive Markets

advertisement

Chapter 21

Externalities in Competitive

Markets

At this point you may have gotten the impression that economists believe markets always and

unambiguously result in efficient outcomes — with total surplus maximized when markets operate

without interference from other institutions.1 If this were the case, there would be no efficiency

role for non-market institutions in society, and their only justification would lie in concerns about

the distribution of surplus — concerns about equity and fairness as these relate to the market

allocation of scarce resources. But, while such issues do play an important role in justifying nonmarket institutions (including government), we will in this and the coming chapters investigate

conditions under which non-market institutions are motivated by efficiency rather than equity

concerns. These conditions include all the possible violations of the assumptions underlying the

first welfare theorem (Chapter 15) – including the presence of market power and of asymmetric

information.

Before we get to asymmetric information and market power, however, we will first take a look

at yet a third set of conditions that lead to dead weight losses in the absence of other institutions

– even when markets are perfectly competitive. These conditions are called externalities, and they

arise whenever decisions of some parties in the market have a direct impact on others in ways that

are not captured by market prices. When a firm’s production process emits pollution into the air,

for instance, this pollution potentially has a direct impact on many. Put differently, the emission

of pollution imposes on society costs that are typically not priced by the market and thus are not

costs taken into account by producers unless some other institution imposes those costs on them.

When I decide to get in the car and enter a congested road, I am similarly contributing to the

overall congestion and thus am delaying others from getting to where they want to go, but I don’t

think about others when I make the decision of whether to get in the car. When I play loud music

on my patio at home, my neighbors get to “enjoy” the music as well. These are all examples of

externalities — of “external costs or benefits” that markets do not internalize because the market

participants do not have to pay for them.

1 This chapter builds once again on a basic understanding of the partial equilibrium model from Chapters 14 and

15. Section 21B.3 also builds on the discussion of exchange economies in Chapter 16 but can be skipped if you have

not yet read Chapter 16.

760

21A

Chapter 21. Externalities in Competitive Markets

The Problem of Externalities

The essential feature of an externality is then that either costs or benefits of production or consumption are directly imposed on non-market participants. Since non-market participants are neither

demanders nor suppliers of goods, neither market demand nor market supply curves are affected by

such externality costs or benefits. Thus, a competitive market composed of price-taking consumers

and producers continues to produce in equilibrium where demand intersects supply. However, while

the aggregate marginal willingness to pay curve still allows us to measure the benefits consumers

receive from participating in markets and the supply curve still allows us to measure costs incurred

by producers, there are now non-market participants that also incur benefits or costs. Thus, we

can no longer simply use consumer and producer surplus to measure the net-gains for society from

the existence of markets. Put differently, we have to include the externality costs and benefits that

a competitive market ignores in our calculation of overall surplus.

Before we get started, I should note that we will treat consumers and producers as strictly separate in their roles as consumers and producers from their roles as individuals who may incur some

damage or benefit from an externality. We generally lose nothing by making this assumption. Even

if, for instance, a producer whose production causes pollution incurs health problems from pollution, no individual producer will take those costs into account in her production choices because,

in competitive markets, each producer is so small relative to the market that her contribution to

overall pollution is negligible. Thus, we will simply treat all producers as considering only their

own production costs when making decisions, and then lump them in separately with all economic

agents who are hurt by the aggregate level of pollution produced by the industry. In other words,

we will treat producers as individuals who consider their own cost of production when making

supply decisions, and then we will treat the part of that producer that is hurt by the overall level

of pollution as a separate person.

21A.1

Production Externalities

Suppose, then, that we return to the example of an industry that produces “hero cards” but now

we assume that the least-cost production process for producers involves the emission of green-house

gases that contribute to environmental problems. Thus, in addition to the costs of production

that are faced by each of the producers of hero cards, costs of pollution are imposed on others in

society. We will then reconsider how many hero cards would be produced by a social planner who

knows all the relevant costs and benefits and who seeks to maximize social surplus — how much

production would take place if our omniscient and benevolent “Barney” from Chapter 15 would

allocate resources. In our Chapter 15 analysis that excluded production externalities like pollution,

it turned out that “Barney” could do no better than the competitive market. We will now see that

this is no longer true when externalities become part of the analysis.

21A.1.1

“Barney” versus the Market

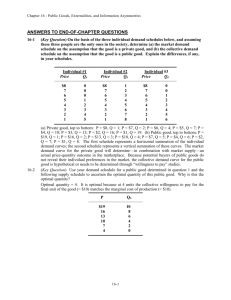

In Graph 21.1, we begin with the market demand and supply graph for hero cards in panel (a).

Whether there are production externalities or not, the market will then produce xM at price pM ,

with all consumers and all producers doing the best they can in equilibrium. Assuming tastes in

hero cards are quasilinear, consumers then get the shaded blue area in surplus while producers get

the shaded magenta area. If the production of hero cards produces pollution, however, each hero

21A. The Problem of Externalities

761

card that is produced imposes a pollution cost on society, a cost that is borne neither by those who

consume nor those who produce hero cards.

Graph 21.1: Maximizing Social Surplus in the Presence of a Negative Production Externality

Panel (b) of the graph then inserts a green curve labeled “SM C”. This curve represents the

social marginal cost of producing hero cards. It includes the producers’ marginal costs that are

captured in the market supply curve, but it also includes the additional cost of pollution that is

imposed on others. Thus, the social marginal cost curve must lie above the supply curve since it

includes costs in addition to those incurred by producers. It may be that the SM C curve is parallel

to the supply curve — implying a constant marginal cost of pollution for each hero card produced,

or that it diverges from the supply curve — implying that each additional hero card results in a

greater additional pollution cost than the last one. Regardless of how exactly it is related to supply,

however, it is this curve that accurately reflects the society-wide cost of production.

As a result, our omniscient and benevolent “Barney” would then decide to continue to produce so

long as the benefits from production as represented by the marginal willingness to pay of consumers

outweighs the overall cost of additional production for society. Put differently, Barney would

certainly produce the first hero card because there is some consumer to whom this card is worth

more than all the costs incurred by society as measured by SM C, and he would continue to produce

until the green SM C crosses the blue marginal benefit curve. He would not, however, produce any

more than that — because once SM C is higher than the marginal willingness to pay of consumers,

the society-wide cost of additional hero cards is larger than the benefit. Barney then would choose

to produce xB , resulting in an overall surplus for society represented by the shaded green area.

We can already see that the social planner who seeks to maximize overall surplus will therefore

choose less production than will occur in the market. This implies that the market will produce

an inefficiently high level of output in the absence of any non-market institutions that curtail

production. This is clarified even further in panel (c) where we have labeled some areas in the graph

that can now be used to calculate the dead weight loss society incurs under market production.

Area (a + b + c) is equal to the blue consumer surplus (assuming the uncompensated demand is

equal to marginal willingness to pay) in panel (a) while area (d + e + f ) is equal to the magenta

producer surplus from panel (a). Producers and consumers are, in their roles as producers and

762

Chapter 21. Externalities in Competitive Markets

consumers, unaffected by the pollution and therefore receive the same surplus as if there was no

pollution. However we also know that, in the presence of pollution, we have to take into account

the overall cost of the pollution that is produced when the market quantity xM is produced. That

area is the difference between the costs incurred by producers and the costs as represented in the

SM C curve — an area equal to (b + c + e + f + g). Thus, we have to subtract that from consumer

and producer surplus to get overall social surplus (a + d − g) under market production. Under

Barney’s benevolent dictatorship, on the other hand, society gets an overall surplus of (a + d) equal

to the green area in panel (b). The market therefore produces a deadweight loss equal to (g).

Exercise 21A.1 Suppose that the “pollution” emitted in the production of hero cards is of a kind that

has no harmful effects for humans but does have the benefit of killing the local mosquito population — i.e.

suppose the pollution is good rather than bad. Would the market produce more or less than Barney?

Exercise 21A.2 Would anything fundamental change in our analysis if we let go of our implicit assumption

that the aggregate demand curve is also equal to the aggregate marginal willingness to pay curve? (Your

answer should be no. Can you explain why?)

21A.1.2

Another Efficient Tax

Our analysis thus far tells us that competitive markets will produce too much in the presence

of negative pollution externalities. As a result, there exists the potential for government policy to

enhance efficiency — and thus reduce or eliminate the deadweight loss from market overproduction.

And we have already seen in Chapter 18 that taxation of goods is one policy tool that can reduce

market output. In the absence of externalities, this is inefficient because the market allocation

of resources was efficient to begin with. Now, however, this reduction of an otherwise inefficient

output level can reduce rather than increase deadweight loss.

Suppose, for instance, you knew both the market demand and supply curves as well as the

optimal production level xB that Barney would choose. This information is depicted in panel (a) of

Graph 21.2. Based on what we learned about taxes and tax incidence in Chapter 18, you can then

easily determine the tax rate t required to reduce market output from xM to xB by simply letting

t per unit be equal to the green vertical distance in the graph. As a result, buyers in the market

would face the higher price pB while sellers would receive the lower price pS with the difference

between the two prices representing the payment t per unit in taxes. A tax such as this that is

intended to reduce market output to its efficient quantity because of the presence of a negative

production externality is called a Pigouvian Tax.2

In panel (b) of the Graph we can then analyze more directly how this tax is efficient. In the

absence of the tax, the market produces output xM at price pM . You can check for yourself, in

a way exactly analogous to what we did in panel (c) of Graph 21.1, that the competitive market

on its own will produce overall surplus equal to (a + b + e + h − j), with the triangle j once

again representing dead weight loss. Under the tax t, however, consumer surplus (a) and producer

surplus (h + i) combine with a positive tax revenue (b + c + e + f ) and a social cost from pollution

(c + f + i) to produce an overall surplus (a + b + e + h). This is exactly equal to the green maximum

surplus achieved by benevolent Barney in Graph 21.1b — and eliminates the deadweight loss (j).

Put differently, the reason we found taxes to be inefficient in Chapter 19 was that they distorted

the price signal that coordinated efficient cooperation between producers and consumers – but, in

2 The tax is named after Arthur Cecil Pigou (1877-1959), a British economist and student of Alfred Marshall (who

succeeded Marshall as Professor of Political Economy at Cambridge University). Pigou developed the distinction

between private and social marginal cost in his most influential work entitled Wealth and Welfare.

21A. The Problem of Externalities

763

Graph 21.2: An Efficient Pigouvian Tax

the presence of externalities, the price signal is already distorted insofar as it does not efficiently

coordinate production and consumption. The tax then removes the distortion and causes the market

to “internalize the externality”.

In order for the government to be able to impose an efficient Pigouvian tax t, it must however

know the optimal quantity xB it wants the market to reach and it must know the difference between

the market demand and supply curve at that quantity. Put differently, the government must

know the marginal social damage caused by pollution at the optimum quantity. If it possesses this

information, the government can achieve the maximum social surplus by simply setting the per-unit

tax equal to this marginal social damage of pollution.

Exercise 21A.3 What if the government only knows the marginal social damage of pollution at the equilibrium output level xM and sets the tax rate equal to this quantity? Will this result in the optimal quantity

being produced? If not, how do the the SM C and the supply curve have to be related to one another in

order for this method of setting the tax to work?

It may in principle not look too difficult for the government to gather sufficient information

to implement a Pigouvian tax that causes markets to once again produce efficiently. However,

suppose that there are now many different industries, each causing pollution. In order to set optimal

Pigouvian taxes, the government now has to know this same information for each industry and set

the per unit tax in each industry, letting taxes vary across polluting industries as the marginal social

damage of pollution at the optimum is different everywhere. This would then result in a complex

system of different Pigouvian taxes across all polluting industries. As technology changes, these

rates would have to be continuously adjusted. And, perhaps worst of all, unless the government

adjusts Pigouvian taxes whenever firms find ways of reducing pollution on their own, individual

firms in each industry would gain no benefit from applying pollution-abating technologies in their

own firms — because they would still face the same taxes. Thus, while it may look easy in principle

to impose Pigouvian taxes, it is much more difficult to do so in practice and to simultaneously

encourage those industries for whom it is easy to reduce pollution to do so in ways other than

simply cutting production due to the tax.

It is for this reason that economists have largely turned away from recommending Pigouvian

taxes on output and have instead turned to alternatives that focus more directly on forcing pro-

764

Chapter 21. Externalities in Competitive Markets

ducers to confront the tradeoff between reducing pollution (through less production or through the

development of pollution abating technologies) or paying for its social costs. This shift in focus

has also been made possible by new technologies that allow governments to pinpoint who is producing pollution – and thus to require polluters to pay for pollution directly. This can be done

either through a pollution tax (as opposed to a Pigouvian tax on output), or through the design of

market-based environmental policy. We will discuss the latter first and then briefly compare it to

the former.

Exercise 21A.4 In Chapter 18, we discussed the efficiency losses from government mandated price ceilings

or price floors. Could either of these policies be efficiency enhancing in the presence of pollution externalities

(assuming the government has sufficient information to implement these policies)?

21A.1.3

Market-based Environmental Policy

The most common market-based environmental policy works as follows: The government determines

an overall level of pollution (of each kind) that it finds acceptable and then issues pieces of paper

that permit the owner to emit a certain quantity of different types of pollutants per week (or month

or year). These pieces of paper, known as pollution vouchers or tradable pollution permits, thus

represent the “right to pollute” by some amount. Then the government releases these rights —

either by auctioning them off or by simply giving them to different firms in different industries.

It turns out that it does not matter which precise way the government uses to distribute such

permits — the important feature for our analysis is that individuals who own such permits can

sell them to others if they so choose (and thus transfer the “right to pollute” to someone who is

willing to pay more than it is worth to the original owner). In essence, the policy therefore “caps”

the overall pollution level by fixing the number of pollution permits – and then allows “trade” in

permits to determine who uses them. For this reason, it has come to be known as a cap-and-trade

policy.

Pollution vouchers have value to producers because they permit producers to emit pollution in

their production process. At the same time, whenever a producer chooses to use such a voucher,

she incurs an economic (or opportunity) cost — because she could have chosen to sell (or rent) the

voucher to someone else instead. Each producer therefore has to weigh the costs and benefits of

using a pollution voucher — and each producer knows that she will have to use fewer vouchers the

less she produces and the more she takes advantage of pollution-abating technologies. Since some

production processes lend themselves to pollution-abating technologies more easily than others,

firms in some industries will have a greater demand for such vouchers than firms in other industries.

As a result, by introducing pollution vouchers into an economy (and prohibiting the emission of

pollution when firms do not own such vouchers), the government has created a new market — the

market for pollution vouchers.

Exercise 21A.5 Explain how firms face a cost for pollution regardless of whether the government gives

them tradable pollution vouchers or whether firms have to purchase these.

This market is depicted in Graph 21.3 where pollution vouchers appear on the horizontal axis

and the price per voucher appears on the vertical. By introducing only a limited quantity of such

vouchers, the government has set a perfectly inelastic supply at precisely that quantity which results

in the level of overall pollution across all industries. Firms that emit pollution in their production

processes are the demanders of such vouchers, with demand depending on how much pollution is

involved in producing different types of goods and how easy it is for firms to find ways of reducing

21A. The Problem of Externalities

765

the pollution emitted in production. Put differently, those firms that find it difficult to reduce their

pollution will be willing to pay more for the right to pollute than those who can easily put a filter

on their smokestacks. In equilibrium, pollution vouchers will then sell at price p∗ .

Graph 21.3: A Market for Pollution Vouchers

Assuming the government can monitor polluting industries effectively (which is becoming increasingly easy as pollution monitors are widely distributed by the Environmental Protection

Agency across different regions and as satellite technology is becoming increasingly effective at

detecting pollution emissions from very precise locations), a system of pollution vouchers then

achieves the following: First, it imposes a cost on polluters by requiring that they purchase sufficient pollution rights for the pollution they emit. This, then, causes an upward shift in firm M C

curves as pollution vouchers become an input into the production process, and with it a shift in the

market supply curve in polluting industries. Such a shift will result in less production of output

in such polluting industries. Second, the system introduces an incentive for firms to search for

(and invest in) pollution-abating technologies. So long as it costs less to reduce pollution from my

firm than the pollution vouchers would cost me, I now have an incentive to reduce my pollution

emissions. Third, the system creates an incentive for new firms to arise and to independently invest

in research and development of pollution-abating technologies because the system has increased the

demand for such technologies in light of the fact that polluters would otherwise have to pay for

vouchers in order to produce.

As a result, the system achieves an overall reduction in pollution at the least social cost and

without the government adjusting any policy to changing conditions. The government does not have

to be in the business of picking which industry reduces which type of pollution by how much, and

it does not have to adjust those policies as pollution-abating technologies (that are more applicable

to some industries than to others) are produced. All the government has to do is to set an overall

pollution target and print a corresponding quantity of pollution vouchers. The newly created

pollution voucher market then rations who gets the vouchers and who does not get them — with

those for whom reductions in pollution are most costly choosing to use vouchers and others choosing

to reduce pollution cheaply. Put differently, pollution vouchers are government interventions that

harness the power of a newly created market to generate the information required to reduce pollution

at the lowest possible cost without any further government interference.

Exercise 21A.6 If the government, after creating the pollution voucher market, decides to tax the sale of

pollution vouchers, will there be any further reduction in pollution? (Hint: The answer is no.)

766

Chapter 21. Externalities in Competitive Markets

And there is one final check on the system: While we have said thus far that polluters are the

ones who will form the demand curve in the pollution voucher market, it is in principle possible

to allow anyone at all to participate in that market. If, for instance, a group of deeply concerned

citizens feels that the government is permitting too much pollution to be emitted into the air, they

could pool resources and purchase some quantity of the vouchers — thus increasing the price (and

raising the cost to polluting) while lowering the supply (if they simply store away the pollution

vouchers). As we will see in a later chapter on public goods, such groups face a difficult free rider

problem that they need to overcome, but if they can, they are able to impact the overall level of

pollution without lobbying the government.

One last clarifying caveat, however: While pollution vouchers offer a mechanism to reduce

pollution to a target level in the least costly way, there is nothing in a pollution voucher system

that guarantees we will have set the socially optimal target for pollution to begin with. If the

political process that determines this target is efficient, then the target will be set optimally. But

otherwise, the target might be too high or too low – all that the cap-and-trade system does for us

is to get us to the target in the least costly way.

21A.1.4

Pollution Taxes, Pigouvian Taxes and Cap-and-Trade

While the idea of taxing output in polluting industries – as originally proposed by Pigou – has lost

considerable favor among economists, the very technology that allows the establishment of markets

in tradable pollution permits now enables governments to tax pollution (rather than output) directly.

One suspects that, had Pigou thought it possible to detect pollution where it is emitted, he would

most likely have favored taxing pollution rather than output as well. Taxing pollution directly has

the same advantages over Pigouvian taxes that we have pointed out for cap-and-trade systems,

and a per-unit-of-pollution tax is in fact equivalent to establishing tradable pollution permits if the

tax rate is set at the same level as the price-per-unit-of-pollution that emerges in cap-and-trade

systems. Both systems provide incentives for firms to invest in pollution abating technologies;

neither requires governments to adjust industry tax rates as circumstances change (as it the case

under Pigouvian taxes on output); overall pollution is reduced in the least cost ways as firms for

whom it is easy to reduce pollution will do so rather than incur the cost of pollution (by either

paying a pollution tax or using pollution vouchers); and neither system automatically results in

full efficiency unless the government has lots of information on what the efficient tax rate or the

efficient number of pollution permits is.

Exercise 21A.7 In one of the 2008 Presidential Primary debates, one candidate advocated the cap-andtrade system over a carbon tax on the grounds that the carbon tax would be partially passed onto consumers

in the form of higher prices. Another candidate who also supported the cap-and-trade system corrected this

assertion – suggesting that, to whatever extent a carbon tax would be passed onto consumers, the same is

true of costs (of tradable permits) under the cap-and trade system. Who was right?3

While pollution taxes and cap-and-trade systems are therefore quite similar, environmental

policy makers nevertheless debate their relative merits. Some consider it important to set precise

target levels for pollution – with cap-and-trade systems allowing an easy way of establishing such

targets while then letting the market for tradable permits determine the per-unit-of-pollution price

required to implement the target. Others believe it is more important to specify the per-unitof-pollution cost directly through a tax in order to allow firms to plan accordingly – leaving the

3 The exchange took place in the January 5, 2008 Democratic Presidential Primary Debate held at St. Anselm

College. The first candidate was New Mexico Governor Bill Richardson; the second was then-Senator Barak Obama.

21A. The Problem of Externalities

767

level of pollution reduction that result to arise from firm responses to the tax. Again, if the perunit-of-pollution tax is set at the same rate as the per-unit-of-pollution price that emerges under

a particular “cap” in a cap-and-trade system, the two policies have identical effects – but one gets

there by being precise about the target pollution level up front while the other gets there by being

precise about the per-unit-pollution cost up front.

A second issue that is raised in policy debates regarding cap-and-trade versus pollution taxes

relates to politics and implementation. Some fear that a nation-wide – or even world-wide – cap-andtrade system would involve excessive government bureaucracy to administer the various markets for

different types of pollution vouchers while others argue that administering pollution taxes would

involve similar issues. In practice, however, there appears to be one important political reason for

environmental policy makers to favor the cap-and-trade system: It has a built in mechanism for

overcoming concentrated opposition from industries that are particularly affected. Such industries

would face increased marginal costs under both the pollution tax and the cap-and-trade system, but

pollution vouchers could be given away for free to some industries in order to “buy” their political

support. In essence, this involves a transfer of wealth (in the form of pollution vouchers that can be

traded) without a change in the increased opportunity cost of emitting pollution. Under pollution

taxes, one could similarly “buy off” industry opposition through transfers of taxpayer money, but

this appears to be politically more controversial.

Exercise 21A.8 Suppose that advocates of pollution taxes proposed a reduction in such taxes for key industries that would otherwise be opposed to the policy. How is this different than giving pollution vouchers

away for free to such key industries in a cap-and-trade system?

Finally, to the extent to which the pollution problem to be addressed is global (as in the case of

greenhouse gases) rather than local (as in the case of acid rain), policy makers may favor the capand-trade system as it permits the establishment of global markets in tradable pollution permits

to achieve global reductions in pollution while allowing an initial establishment of country-specific

“caps” through negotiated international agreements. Such a system does not enshrine countryspecific caps because permits could be traded across national boundaries, but – much as support

form particular industries can be gained by giving some pollution permits away – international

support for such agreements could be facilitated by initially allocating relatively more pollution

permits to some countries rather than other countries.

Exercise 21A.9 Less developed countries often point out that countries like the U.S. did not have to

confront the fact that they caused a great deal of pollution during their periods of development – and thus

suggest that developed countries should disproportionately incur the cost of reducing world-wide pollution

now. Can you suggest a way for this to be incorporated into a global cap-and-trade system?

21A.2

Consumption Externalities

We have thus far considered only externalities generated in the production of goods and, with the

exception of the externality considered in within-chapter-exercise 21A.1, we have limited ourselves

to externalities that have negative impacts on others — or what we have referred to as negative

externalities. Externalities can, however, arise in production and consumption, and they can be

positive or negative. We will now illustrate the impact of an externality on the consumer side, and,

to differentiate it further from what we have done so far, we will consider a positive rather than a

negative externality.

768

Chapter 21. Externalities in Competitive Markets

Suppose, for instance, that production of hero cards entails no pollution whatsoever but, whenever a consumer purchases hero cards for children, the world becomes a better place. In particular,

suppose that for each child that is exposed to hero cards, future crime falls and good citizens emerge.

This may sound silly because of the context of the example, but such arguments are often made

in markets like children’s programming on television or markets involving the arts. The essential

nature of the argument is always the same: In addition to the private benefits that consumers

obtain directly from consumption, others in society benefit indirectly in ways that are not priced

by the market.

21A.2.1

Positive Externalities from Consumption

Graph 21.4 then presents a series of graphs for positive externalities that is exactly analogous to

the series of graphs in Graph 21.1 for negative externalities. Panel (a) simply illustrates consumer

and producer surplus along market supply and demand curves (once again under the assumption

that demand can be interpreted as marginal willingness to pay). Panel (b) introduces a new curve

called ”SM B” or social marginal benefit. This curve includes all the benefits society gains from

each unit of consumption. It therefore includes all the private benefits that consumers get (and

that are measured by the demand curve), plus it includes additional social benefits that are gained

by others. As in the case of SM C and supply, SM B and demand can be related to each other in a

variety of ways, but under positive externalities SM B must certainly lie above demand (or private

marginal willingness to may).

Graph 21.4: Underproduction in the Presence of a Positive Externality

Our benevolent social planner would then use this SM B to measure the marginal benefit of

each hero card that is produced (while measuring the marginal cost along the supply curve in the

absence of negative externalities.) He would therefore choose the production level xB in panel (b)

of the graph, giving the shaded green area as overall social surplus. Thus, the market produces an

inefficiently low quantity of a good that exhibits a positive consumption externality. We can derive

the exact deadweight loss from the areas labeled in panel (c) of Graph 21.4. At the competitive

market equilibrium, consumer surplus is simply area (a) (equivalent to the blue area in panel (a))

and producer surplus is area (b) (equivalent to the magenta area in panel (a)). Since the market

21A. The Problem of Externalities

769

produces an output level xM , the additional social benefit from the externality is given by area (c).

Thus, the market achieves an overall social gain equal to area (a + b + c). Our social planner, on

the other hand, achieves that plus area (d) — implying that society incurs a deadweight loss of (d)

in the absence of non-market institutions that induce additional production.

21A.2.2

Pigouvian Subsidies

One non-market institution that we already know from our previous work can raise the level of

output in the market is a government subsidy. Suppose that the government knows it wants to raise

output in the hero card market to xB above the market quantity xM . In panel (a) of Graph 21.5,

this implies that the government can accomplish its goal by imposing a subsidy s equal to the green

vertical distance, thus lowering the price for buyers to pB and raising the price for sellers to pS .

Our discussion of the economic incidence of a subsidy in Chapter 18 treats this in more detail and

illustrates that the degree to which prices faced by buyers and sellers change depends on the relative

price elasticities of market demand and supply curves. When such a subsidy is used to “internalize

a positive externality”, it is known as a Pigouvian subsidy. As in the case of a Pigouvian tax, it

can restore efficiency by removing the externality-induced distortion in market prices.

Graph 21.5: An Efficient Pigouvian Subsidy

Suppose again (for simplicity) that tastes for hero cards are quasilinear and that we can therefore

treat the market demand curve as the aggregate marginal willingness to pay curve for consumers.

In panel (b) of the graph we can then calculate the areas that make up total surplus before and after

the subsidy. Before the subsidy, consumer and producer surplus simply sum to (a + b + c + d) and

non-market participants gain additional surplus of (e + f ). Thus, total surplus under pure market

allocations is (a+b+c+d+e+f ). Under the subsidy, consumer surplus is (a+b+c+g +k), producer

surplus is (b+c+d+f +i) and surplus for non-market participants is (e+f +h+i+j). From the sum

of these areas we then need to subtract the cost of the subsidy, which is (b + c + f + g + i + j + k) —

giving us a total surplus of (a + b + c + d + e + f + h + i). Thus, total surplus under the subsidy

is now equal to the green area in Graph 21.4b which we concluded was the maximum social gain

possible, with the subsidy having eliminated the deadweight loss (h + i) that occurred under a pure

market allocation.

Exercise 21A.10 Suppose that, instead of generating positive consumption externalities, hero cards actually

770

Chapter 21. Externalities in Competitive Markets

divert the attention of children from studying and thus impose negative consumption externalities. Can you

see how such externalities can be modeled exactly like negative production externalities?

21A.2.3

Charitable Giving, Government Policy and Civil Society

In the case of a negative production externality of pollution, we illustrated next how government

could, instead of attempting to calculate all the “right” Pigouvian taxes each year, create a new

market of pollution vouchers that can efficiently reduce pollution to some level set by the government. In the case of positive consumption externalities, I can’t offer a similar market-based

policy that is currently under discussion, but we should note that the market outcome we have

predicted in the model may not necessarily be the actual outcome if markets operate within the

context of non-governmental and non-market institutions that we referred to in Chapter 1 as civil

society. The word “civil society” does not have a clear definition and is often used to mean many

different things. In this text, I will refer to an institution as a “civil society” institution whenever

it is not clearly set up by the government nor does it operate strictly on the self-interested motives

that generate explicit prices in markets. Civil society institutions are then the sets of interactions

among individuals that occur outside the context of government and outside the context of explicit

market prices. Such institutions tend to arise as individuals try to use persuasion rather than the

political process to address issues of concern that are not addressed in the market. The existence of

positive consumption externalities offers an example — because, as we have seen, it is a case when

the market in the absence of non-market institutions produces too little of goods that are valued

in society beyond their simple consumption value.

As you are no doubt aware, many organizations spend substantial energy in attempts to make

people aware of many social concerns in an attempt to persuade them to voluntarily contribute

money or time to organized efforts aimed at addressing such concerns. In the case of television

programming for children, for instance, we have all seen appeals on television for private donations

to increase funding for such programs. Such efforts to appeal for charitable donations run into

difficulties involving “free riding” that we will address more explicitly in Chapter 27 and thus offer

no guarantee of achieving a fully efficient outcome, but they appear to play an important role in

many circumstances where positive externalities would make markets by themselves produce too

little.

At this point, we will simply leave the issue with the observation that all three types of institutions that we have discussed — government, markets and civil society, face obstacles in achieving

efficient outcomes. Markets, as we have seen, will tend to underproduce in the presence of positive externalities and overproduce in the presence of negative externalities; governments may face

difficulties in ascertaining the information necessary for implementing optimal outcomes through

taxes, subsidies (or other means), especially as circumstances within societies change, and they face

political hurdles that we will treat more explicitly in Chapter 28. And civil society efforts that

rely on strictly voluntary engagement of non-market participants face difficulties in engaging those

non-market participants fully as each will tend to rely on others to address the problem. Yet each

appears to play a role in the real world.

Finally, just as the case of pollution vouchers represents an effort by government to engage

market forces in finding efficient solutions to excessive pollution, government policies are often

aimed at engaging civil society institutions more. The most obvious example of this can be found in

the U.S. income tax code that offers tax deductions to individuals who voluntarily give to charitable

causes — thus subsidizing such causes without the government making the explicit decision of which

21A. The Problem of Externalities

771

charities will end up engaging non-market participants. Thus, when the government faces too many

hurdles in designing explicit subsidies for each industry that generates positive externalities, it can

offer such general subsidies aimed at reducing the hurdles faced by civil society organizations in

finding non-market, non-governmental solutions.

Exercise 21A.11 In what sense does the tax-deducibility of charitable contributions represent another way

of subsidizing charities?

Exercise 21A.12 In a progressive income tax system (with marginal tax rates increasing as income rises),

are charities valued by high income people implicitly favored over charities valued by low income people?

Would the same be true if everyone could take a tax credit equal to some fraction k of their charitable

contributions?

Exercise 21A.13 We did not explicitly discuss a role for civil society institutions in correcting market

failures due to negative externalities. Can you think of any examples of such efforts in the real world?

21A.3

Externalities: Market Failure or Failure of Markets to Exist?

Thus far, we have seen that markets by themselves will produce inefficient quantities of goods

that exhibit positive or negative consumption and production externalities. In the absence of

government intervention, civil society efforts may contribute to greater efficiency. Alternatively,

government policies can be designed to change market output directly (as in the case of Pigouvian

taxes and subsidies) or to indirectly harness the advantages of market forces (as in the case of capand-trade policies) or civil society institutions (as in the case of the tax deductibility of charitable

contributions) to increase efficiency and lower deadweight losses. After we have explored more

fully (in the upcoming chapters) the many hurdles faced by markets, governments and civil society

institutions in implementing optimal outcomes for society, we will return in the last part of the

book to a general model of how we can ascertain the appropriate balance of markets, government

and civil society depending on the particulars of the social problem that is to be solved.

In the meantime, however, we can see yet another efficiency-enhancing policy tool the government has at its disposal by exploring a little more deeply the fundamental problem created by the

presence of externalities. We have seen that markets by themselves will tend to “fail” in the presence of externalities — and this has often led economists to refer to externalities as one (of several)

potential market failures. In this section, we will see how this market failure arises because of the

fact that, whenever there is an externality generated in competitive markets, we can trace the over

or under production that arises from this externality to the lack of a market or the non-existence of

a market somewhere else.

21A.3.1

Pollution and Missing Markets

Consider again the case of a market in which pollution is a by-product of production. The fundamental reason that a market will overproduce in this case (relative to the efficient quantity) is that

producers are not forced to face the full costs they impose on societies when making production

decisions. In particular, if the pollution that is generated is air pollution, the producer escapes

paying for the input “clean air” that is used in the production process unless some mechanism (like

Pigouvian taxes, pollution taxes or pollution vouchers) is implemented. Were there a market for

each of the inputs used in production — including the input “clean air”, the producers would have

to fully pay for all the costs they impose. Air pollution therefore arises as a problem that keeps

markets from producing efficiently because one of the inputs into production is not bought and sold.

772

Chapter 21. Externalities in Competitive Markets

I know that this sounds rather silly — how could there possibly be a “market for clean air” when

no one owns the air and therefore no one can sell clean air to firms that use it in the production

process. It sounds silly because it is silly. Nevertheless, if we can suspend disbelief for a moment, we

can see the conceptual point that the externality is a problem precisely because we have not found a

way to create a market in clean air. If there was such a market, and if all air was owned by different

people, then each user of clean air would have to pay for it as it is being used. Consumers of clean air

— including producers who use clean air as an input — would have to pay for clean air just as firms

have to pay for labor and capital. Such a market for clean air would therefore result in a market

price which would, in the absence of any other externalities, result in maximum social surplus in the

clean air market. As producers contemplate production that involves pollution, they would then

face a price for clean air — shifting their marginal cost curves up and thus shifting market supply

up to be equal to the social marginal cost (SM C) of production rather then the marginal private

cost that excludes the social cost of pollution. This would then result in the efficient quantity of the

pollution-generating output, with social surplus once again maximized purely by market forces.4

In an abstract conceptual sense, the market failure generated by the presence of externalities

can then be traced to the failure of a market to exist. Does recognizing this get us any closer to

solving the problem? In the case of pollution, it is that recognition that has led economists to come

up with the proposal for creating markets in pollution vouchers. Pollution voucher markets are not

the same as markets in clean air, but they represent an attempt to resolve a problem created by

the non-existence of a market (for clean air) through the creation of a different type of market that

can help. Recognizing the market failure generated by externalities as a failure of a market to exist

can therefore create the opportunity for innovative government interventions that may, at least in

some cases, work better than other government solutions we might otherwise implement.

21A.3.2

The Tragedy of the Commons

This insight then points toward a huge role that governments more generally have to play in

order for markets to function efficiently. Throughout our treatment of the efficiency of markets in

Chapters 15, 16 and 17, for instance, we made the implicit assumption that markets for all sorts of

inputs such as labor and capital actually exist. Presuming that such markets exists presumes that

individuals own resources that they can trade — and this presumes that there is some mechanism in

place that protects the property rights of owners of resources. Firms cannot just take my leisure and

use it for labor inputs — they are required to persuade me to sell my leisure to them by offering

me a wage that I consider sufficient. Similarly, they cannot just take my savings or retirement

account and use the money to buy labor, land and equipment — they have to pay for using my

financial capital by paying me interest. All this requires a well-established system of legally enforced

property rights, and such a system has in practice typically required government protection and a

well-functioning court system to enforce property rights.5

Externalities, as we have seen, arise when such property rights have not been established. Pollution is a problem because there does not exist a system of property rights to clean air that forces

4 It is noteworthy that it does not actually matter who owns the right to clean air — whether individuals or firms

own this right, a market that prices the use of clean air in production would form. If the polluter herself owns the

right to the air, she is still facing the cost of polluting because her opportunity cost of using the clean air in her own

production is to sell the clean air to someone else in the market. We will say more on this later on.

5 Most of us, including me, take for granted that such protection of property rights must be provided by government.

And it usually is. But there are contrarian voices among some economists and philosophers that maintain government

is not necessary for protection of private property to emerge. We will say a bit more about this in Chapter 30.

21A. The Problem of Externalities

773

firms to pay for using clean air as an input into production. In effect, without some other institution

in place, firms are simply able to take clean air for free as they produce goods — something we

do not permit for inputs like labor and capital. Were they to similarly be able to take my leisure

and capital — were there no legal system of property rights in those input markets, we would have

even worse externality issues to deal with. Whenever a resource is not clearly owned by someone, it

therefore becomes possible for economic agents to take those resources without incurring a cost —

even though this imposes costs on society. It is then a logical consequence that, if it is feasible for

the government to establish a system of property rights in resources that are not currently owned

by anyone, such government interference can create additional markets that reduce the problem of

externalities by forcing market participants to face the true social cost of what they are doing.

For this reason, economists have come to refer to externality problems that arise from the nonexistence of markets as the “Tragedy of the Commons” — the “tragedy” of social losses that emerges

when property is “commonly” rather than privately owned. We could say, for instance, that clean

air is owned by everyone, but that simply means it is owned by no one in particular. Parents know

this tragedy well. When we give toys to our children as common property to be shared without

any guidance or rules, our children tend to fight like cats and dogs as they try to get those toys for

themselves. Most parents therefore quickly learn that conflict is reduced if clear ownership of toys

is established, with each child knowing (to the extent that children fully internalize this) that they

have to get permission from the other child when seeking to use that child’s toys. When parents

realize this, they act as economists who understand the tragedy of the commons.

More generally, much human suffering in the world can be directly traced to societies not heeding

the lessons of the Tragedy of the Commons. Entire societies have been set up in attempts to abolish

private property and replace the mechanism of markets with some alternative mechanism. It takes

only a quick glance at 20th century history, for instance, to see how much societies that have

protected private property and (thus established markets) have economically thrived while societies

that have attempted to do the opposite have failed. A full understanding of externalities suggests

that such societies failed because they created huge externalities by eliminating markets without

finding an alternative government or civil society mechanism to generate social surplus. In short,

by not supporting markets, they have created large “tragedies of the commons.”

Exercise 21A.14 Large portions of the world’s forests are publicly owned – and not protected from exploitation. Identify the tragedy of the commons – and the externalities associated with it – that this creates.

Exercise 21A.15 Why do you think there is a problem of over-fishing in the world’s oceans?

21A.3.3

Congestion on Roads

We do not, however, have to dig into historical examples of non-market based societies or reach for

the pie in the sky of “markets in clean air” to see the relevance of an understanding of the Tragedy of

the Commons in thinking about solutions to externality problems. Economists who have estimated

the social cost of externalities in the U.S., for instance, have found that the social cost of time

wasted on congested roads rivals the social cost of environmental damage from pollution. Think

of your own experiences being stuck in traffic — it is mind-numbing to be stuck in traffic even for

short periods of time because the opportunity cost of our time is large. In some of our larger cities,

commuters routinely spend significant amounts of time in precisely such a position.

The problem of congested roads is an example of a Tragedy of the Commons. Roads, by and

large, are commonly or publicly owned — which is to say that they are not owned by anyone. As

you and I get on the road, we may think about the cost of taking the drive into the city — the

774

Chapter 21. Externalities in Competitive Markets

cost of our time, the gasoline we use and the depreciation of our car. We do not, however, think

about the cost we are imposing on everyone else that is also taking a trip. Put differently, there

is a negative externality each of us imposes on everyone else who is on the road at the same time

as we add to the congestion of the road. In the absence of a mechanism that makes us face this

social cost of our private actions, we therefore will tend to take too many trips – and we will be on

the road at the “wrong” times. You may say that surely my own contribution to the congestion of

the roads is minor, but all of us together are causing the congestion problem that wastes billions

of dollars worth of time each week on the congested roads of larger cities. If my entry onto the

road causes thousands of others to take even one more second to get to where they are going, I am

imposing quite a social cost on others without paying any attention to it.

Exercise 21A.16 Can you think of an other costs that we do not think about as we decide to get onto

public roads?

Solutions for this particular Tragedy of the Commons are still evolving, and changes in technology are playing a large part in shaping these solutions just as new technologies that permit

detection of pollution have shaped new environmental policies (such as pollution taxes and capand-trade systems). The difficulty in finding a way for individuals to internalize the social cost

they are imposing on others on the road lies in the difficulty of establishing a market that will price

that social cost. In the past, economists have often proposed somewhat blunt policies falling into

two general categories: First, we can impose a tax on gasoline that will raise the cost of driving

and therefore reduce the amount of driving individuals will undertake; and second, when there are

sufficiently many individuals in sufficiently dense geographic areas, governments can design public

transportation systems like subways that are expensive to build but that, once built, can offer

attractive alternative means of transportations within cities.

The building of public transportation may alleviate congestion, but it does not in itself address

the Tragedy of the Commons that remains on public roads — and it may create a different Tragedy

of the Commons if public transportation is priced in such a way as to cause congestion in buses,

subways and so forth. Nevertheless, it has represented an important element of addressing crowding

on roads in some urban areas. Taxation of gasoline is appealing in that it does raise the cost

of driving and bring it more into line with the social cost of individual decisions during peak

traffic hours, but it also raises the cost of driving during non-peak hours when congestion is not a

problem — thus creating deadweight losses during those hours just as it reduces deadweight losses

during peak hours.

Exercise 21A.17 Are there other externality-based reasons to tax gasoline?

In recent years, however, it has become possible to price driving on congested roads more directly

through tolls. Before the advent of electronic equipment that has made this easier, such tolls have

involved toll booths which themselves can contribute to congestion around the booths as traffic

slows down even as it keeps individuals off the roads. As technology improves, however, we are

beginning to see increasingly efficient mechanisms for tolls to be imposed, mechanisms that do not

require individuals to stop, reach into their wallets and pay a toll-booth attendant. As a result, we

are seeing cities increasingly use electronic tolls that can vary with the time of day that individuals

choose to use roads. User fees in the form of tolls then represent an attempt to make individuals

face the social cost of driving during peak hours. At least in principle, such technology also permits

the more direct establishment of markets in roads — markets in which road networks are privately

owned and the use of the road is priced within markets. As technology and our understanding of the

21A. The Problem of Externalities

775

underlying causes of externalities on roads is changing, we therefore see the emergence of new ways

for government policy to interact with markets to reduce the social costs of an important externality.

If such topics are of interest to you, you might consider taking an urban or transportation economics

course at some point.

Exercise 21A.18 Some have argued against using tolls to address the congestion externality on the grounds

that wealthier individuals will have no problem paying such tolls while the poor will. Is this a valid argument

against the efficiency of using tolls?

21A.4

Smaller Externalities, the Courts and the Coase Theorem

We have thus far focused primarily on externalities that affect many individuals – such as pollution

and congestion. But many of the externalities that we are most aware of in our daily lives are much

less grand – the loud music in the dorm-room next to yours, the odor from the student who insists

on sitting next to you in class but who also insists on showering infrequently, the insensitivity of

the person on the bus who appears to be talking loudly to himself but is actually speaking on his

well-hidden cell-phone, or that baby that just stopped screaming only to have switched from an

externality that affects the auditory nerve to one that affects our sense of smell. These are all

negative externalities – but we could think of positive ones as well. When I smile in the hallway at

work, a few people a day might derive direct benefits from my cheerful disposition, or when I open

the door for a student carrying heavy books (such as the one you are reading – sorry, I don’t know

how to be brief!), that student’s life might be just a bit better today – even more so if I happen at

the moment to be offering a rousing rendition of “O Sole Mio” . If you think about it, externalities

are everywhere that people operate within close proximity to one another – in the workplace, in

restaurants, in neighborhoods. And sometimes these externalities cause us to take each other to

court.

21A.4.1

The Case of the Shadow on your Swimming Pool

Consider, for instance, the following example: You and I live next to each other in peace and

harmony. Suddenly I win some money in the lottery and decide that I want to add to my house.

So I draw up some plans to add an additional floor to my existing house. Normally you would

not care about this, but it turns out that the additional floor will cast a long shadow onto your

property – and in particular the area of your property that currently contains a beautiful (and

sunny) swimming pool. You get very upset that your swimming pool will suddenly be in the shade

all the time, and so you go to court and ask the judge to stop my building plans. Your legitimate

argument is that I am imposing a negative externality that I am not taking into account. “He must

be stopped,” you insist to the judge.

The judge sees your point but he wants to be careful and is trying to figure out whether it would

or would not be efficient to build the addition to my house despite the adverse effect this will have

on you. Maybe I get a lot more enjoyment from the addition than you lose from the shade on your

swimming pool, or maybe it’s the other way around. Maybe it would cost you very little to move

to a different house and have someone that does not care about the shade on the swimming pool

move into your house (thereby eliminating the very externality we are worried about). Or maybe

it would be easy for me to find a bigger house elsewhere and relatively costless for me to move. It’s

hard to tell without the judge figuring out a lot of details about the case. And, one might argue,

that there isn’t an easy way to judge this on a basis other than efficiency. After all, we both are

776

Chapter 21. Externalities in Competitive Markets

equally to blame for the existence of the externality – it would not exist if I were not trying to build

an addition, but it also would not exist if you were not so insistent on having the sun shining on

your silly pool!

21A.4.2

The Coase Theorem

Ronald Coase, an economist at the University of Chicago, came along and had a neat insight that

might, under certain conditions, make the judge’s life a lot easier.6 He thought that the reason you

are taking me to court is that we are confused about who has what “property rights” – and this

ambiguity is making it difficult for us to come up with the optimal solution to our problem on our

own. Suppose, for instance, you knew the judge would rule that I had the right to build regardless

of the damage this does to you. You might then invite me for coffee and ask if there isn’t a way

you could convince me to not build my addition. If the damage that is done to you is greater than

the pleasure I get from my addition – i.e. if it would be efficient for me not to build the addition –

you would in fact be willing to pay me an amount that will make me stop the addition. Perhaps

I would find another way to add to my house, or perhaps I would move with the money you gave

me to make me stop. If, on the other hand, your pain from the addition is less (in dollar terms)

than my pleasure – i.e. if it is efficient for me to go ahead with the addition – you would discover

over coffee that you aren’t willing to pay me enough to stop the addition. Perhaps you will just

stay and suffer in a shaded pool, or perhaps you’ll move elsewhere. But notice that, once you know

that I have every right to build the addition, you have an incentive to figure out whether you can

pay me to stop – and once you figure this out, you will insure that the efficient outcome happens.

The same is true in the case where I know that you have the “property right” – that is, that

you have a right to block my addition. In that case, I have an incentive to have you over for coffee

to my house to see if I could persuade you to let me go ahead. If the addition means more to me

than the pain it causes you, then you will be willing to accept a payment that I am willing to pay

in order to get you to drop your objections. If, on the other hand, my gain from the addition is less

than your pain, then I won’t be willing to pay you enough to get you to stop your objections. Thus,

if the initial “property right” rests with you, then I am the one who has an incentive to figure out

whether my gain is greater than your pain – and in the process get us to do what is efficient. Note

that neither one of us actually cares about efficiency – but, once we know who has what rights, our

private incentives make it in our interest to find the efficient outcome.

Exercise 21A.19 True or False: While it might not matter for efficiency which way the judge rules, you

and I nevertheless care about the outcome of his ruling.

To the extent to which we find this reasoning persuasive, Coase has just gotten the judge who

cares only about efficiency off the hook: No matter what the judge decides, you and I will arrive

at the efficient outcome – the most important thing is that he needs to define the property rights so

that we can have coffee and know what we are negotiating about. I know this problem well in my

house where I am frequently called upon to be the judge that adjudicates cases of property rights

disputes involving my two eight year old daughters. Knowing about Coase, I don’t even listen to

6 Ronald Coase (1910-), who won the 1991 Nobel Prize in part for his contribution to this area, has the rare quality

of being both an economist and a person so averse to math that it has been said of him (which is probably not true)

that he will not number the pages of his manuscripts. The article in which he put forth the Coase Theorem – “The

Problem of Social Cost,” The Journal of Law and Economics 3 (1960), 1-44 – is therefore quite readable by those

with math phobias – and incidentally is one of the most cited articles in all of economics.

21A. The Problem of Externalities

777

their arguments. I just flip a coin to decide who gets the property rights this time and then send

them off to negotiate with each other.7

21A.4.3

Bargaining, Transactions Costs and the Coase Theorem

The Coase Theorem then says it is essential that property rights be clearly defined in cases when

there are negative externalities but it is not necessarily essential how those rights are defined.

This should have a familiar ring – we just emphasized in the previous section that the absence of

“markets” for the externality is the real underlying problem with externalities. Coase’s argument

is similar, except that he does not insist that we have to have a competitive “market” in the

externality – all we need to do is establish who has what rights and then let people solve the

problem on their own by bargaining with one another. In our example of me building an addition

to my house that will then cast a shadow on your swimming pool, there is no hope of establishing

a real (competitive) market, but we can clarify property rights sufficiently to give us an incentive

to figure out how to solve the externality problem.

Coase was not, however, naive, and he recognized that there might be barriers that keep people

from getting together to bargain their way out of an externality problem once property rights are

fully defined. These barriers are called transactions costs, and if they are sufficiently high, you and

I might never have that coffee to talk about how to proceed. If we just can’t stand each other’s

presence in the same room, then there is a transactions cost to getting together – and when this is

the case, the judge’s decision suddenly matters a great deal more. If the efficient outcome is for me

to build my addition and the judge rules in your favor, these transactions costs would keep me from

getting together with you to offer you the payment necessary to let me proceed. Similarly, if the

efficient outcome is for me to not build the addition and the judge rules in my favor, transactions

costs again keep us from getting together in order for you to offer me the payment necessary not

to build. Thus, in the presence of sufficiently high transactions costs, the judge needs to figure out

what the efficient outcome is and then rule accordingly so that it is not necessary for us to get

together to solve the problem through side payments among each other. The full Coase Theorem

can then be stated as follows: In the presence of sufficiently low transactions costs, the efficient

outcome will arise in the presence of externalities so long as property rights are sufficiently clear.

We can then see that the Coase Theorem offers us a decentralized way out of externality problems so long as transactions costs are low, and transactions costs will tend to be lower the fewer

individuals are affected by an externality. If it’s just you and me arguing about whether I should or

should not build an addition that only affects the two of us, we might think that transactions costs

are in fact sufficiently low and we will bargain our way to a solution if the assignment of property

rights requires such bargaining. For this reason, we might not worry about all the every-day externalities that affect only small numbers of people – chances are probably better that individuals

themselves will figure out the efficient outcome than that a government with limited information

can dictate the efficient outcome. Put differently, as long as people in “small externality settings”

have reasonable expectations about how the law will treat externality issues if such issues were to

be adjudicated in a court room, such problems are best handled in the “civil society” in which

people interact voluntarily outside the usual price-governed market setting.

Exercise 21A.20 Use the Coase Theorem to explain why the government probably does not need to get

involved in the externality that arises when I play my radio sufficiently loud that my neighbors are adversely

affected, but it probably does need to get involved in addressing pollution that causes global warming.

7 My

wife thinks that makes me a bad parent. Weird.

778

21A.4.4

Chapter 21. Externalities in Competitive Markets

Bees and Honey: The Role of Markets and Civil Society

The Coase Theorem applies to all types of externalities – positive or negative. So far, we have

been sticking with the example of the negative externality of the shadow cast on your pool by

the addition to my house. A classic example of positive externalities involves bee keepers and

apple orchard owners. It turns out, however, that – although the example was originally given as

motivation for Pigouvian subsidies, this is a case were Coase’s insights – as well as our more general

insights on markets and property rights – have held true in the real world, and there appears to be

no need for further Pigouvian interventions.8

Externalities in the case of bees and apple orchards abound. In order for apple trees to produce

fruit, bees need to travel from tree to tree to carry pollen from “male” to “female” trees. And in

order for bees to produce honey, they need some blossoms to visit. (You probably remember all this

from the “birds and the bees” talk that I recently had to have with my children.) Bee keepers that

let their bees roam therefore impose a positive externality on apple orchard growers (who benefit

from the cross-polination services), and apple orchard growers bestow a positive externality on bee

keepers (by providing them with the means for apple honey production). Even if we can figure out

a way for markets to solve this problem in general, there is the second problem: bees have a way

of not staying on the precise properties on which they were released. So if one orchard owner hires

cross-polination services (or invests in his own bees), the bees will cross into neighboring orchards

and provide services there – while also contributing to honey production.

In the absence of markets that can price all these externalities, our theory predicts that there

would be too few bees on apple orchards – resulting in too little cross-polination and too little

honey. As it turns out, however, none of this is a surprise to bee keepers and orchard growers.

Fairly sophisticated markets for bee-keepers to release their bees on orchards have emerged “spontaneously” – markets that established “themselves” in an environment where government’s only

role has been to guarantees the integrity of contracts and thus the property rights that are defined

in those contracts. The flowers on apple trees, it turns out, do not produce much honey — causing

the externality to go almost entirely from bee keepers to apple orchard growers. (The “apple honey”

that you can find on your supermarket shelves has precious little honey produced from apple trees

– it’s mainly the product of wild flowers that grow in the area of the orchards.) Clover, on the other

hand, produces tons of honey. Thus, growers of clover produce a net-positive externality for bee

keepers. While apple growers pay bee keepers to release their bees on the orchard, bee keepers pay

clover growers for permitting them to release their bees on the clover farms. This is an example of

competitive markets resolving an externality problem when property rights are well established.

Exercise 21A.21 In what sense do you think the relevant property rights in this case are in fact well

established?

This does not, however, resolve the more “local” externalities between orchard owners. If one

owner hires bee-services, those same bees cross over into other orchards – benefitting those growers

(while also benefitting the bee-keepers). Another economist has looked at this closely, and he

identifies a social custom that has emerged within the civil society – that is to say, outside the realm

8 This externality between bee keepers and orchard growers was pointed out by the economist James Meade (190795) who argued in 1952 that Pigouvian subsidies were needed to remedy the problem. Meade shared the Nobel Prize

in 1977 for contributions to the theory of international trade – which only goes to prove that even Nobel Laureates

can get it wrong (as Meade did in the case of subsidies in the bee keeping business.) To his credit, Meade wrote

eight years before Coase published his insights that came to be known as the Coase Theorem.

21B. The Mathematics of Externalities

779

of explicit market-based transactions and outside the realm of government intervention.9 This has

been dubbed the “custom of the orchards” – and it takes the form of an implicit understanding

among orchard owners in the same area that each owner will employ the same number of bee

hives per acre as the other owners in the area. While the Coase Theorem literally interpreted

suggests that individuals will resolve these “local” externalities through bargaining, this illustrates

another possible way for the theorem to unfold: Sometimes it is easier to converge on some local

understanding of appropriate behavior that can be sustained among small groups within the civil

society – rather than negotiate all the time about how many bee hives everyone is going to hire

this time around. (In part B of exercise 24.17, we investigate a game theoretic explanation for the

“custom of the orchards”).)

21B

The Mathematics of Externalities

We will begin our mathematical exploration of externalities in competitive markets (as in Section

A) with the motivating example of a polluting industry in partial equilibrium. Using linear supply

and demand curves, we can demonstrate how to calculate the optimal Pigouvian tax. Furthermore,

we will explore how the establishment of pollution permit markets can in principle achieve the

same efficiency gains as an optimally set Pigouvian tax and that, in fact, there exists a cap-andtrade policy that is equivalent to any Pivouvian tax policy in the absence of pollution abating