Mountain Man Brewing Company

advertisement

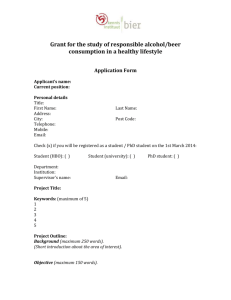

Mountain Man Brewing Company: Cultivating a New Generation of Loyalty By: Prianka Jhingan December 5, 2014 1 Without a change in strategy, Mountain Man Brewing Company will risk its existence in the market and operate in a loss of $1,096,973 by 2009. Mountain Man Lager Market Share Net Income $ 2006 2007 2008 2009 2010 1.36% 1.32% 1.28% 1.24% 1.20% 3,387,446.97 $ 2,010,049.67 $ 518,820.53 -$ 1,096,973.86 -$ 2,849,129.65 Mountain Man Consumption by Age 21-24 2% How this concerns Mountain Man 25-34 15% Increasing competition Competing against national major domestic brands, as MM lacks the financial and marketing resources to defend brand as aggressively. 35-44 19% 45-54 32% Increasing pressure from distributors Looking for high margins and MM is not as attractive and powerful as its competition, may risk being dropped if they do not meet demand requirements and contribute profitably. 55-64 19% 65+ 13% Changes in beer drinking preferences Premium segment of beer market is shrinking, light beer is increasing and currently accounts for 50.4% of the market. Loss of core customers The current core demographic is aging , resulting in less consumption and is unable to capture a younger consumer base. Consumption by Type of Beer Light Beer +4% Premium Beer Imported Beer (4%) Specialty Beer +9% (5%) MMBC’s core customers are aging and not consuming as much beer and are not being replaced. Mountain Man is currently viewed as an older man’s beer and is therefore not seeing its consumption in the younger demographic. Although light beer is growing, people who would consider drinking MM, would not consider drinking light beer. Specialty and craft beers – beers with bold flavour, similar to MM are growing (which further concerns MM’s recent decline) 2 Mountain Man should primarily focus on capturing individuals between the ages of 2535 who are not loyal to a particular brand. Consumer Segments Mountain Man’s Opportunity? Can this be a MM Drinker? Is aware of MM, but has not tried it due to its strong, blue collar perception Yes, the goal would be to create occasions for this individual to try MM and create a new perception Tried MM, but feels it is too strong or bitter No, will not convert into a MM drinker Has preference for light beer No, will not convert into a MM drinker Has never heard of MM Yes, introducing this segment to MM could allow MM to create a brand loyal MM drinker Drink other domestic premium beer or craft beers other than MM Age Domestic Light Beer Domestic Premium Beer Mountain Man Lager 25-34 20% 20% 15% 35-44 24% 23% 19% 45-54 22% 23% 32% The highest consumption of domestic premium beer is consumed by 25-34, there is an opportunity for MM to be in the consideration set and should be the aimed target for MM’s strategy. Yes, the distinctive qualities of MM could cause this segment to become a MM drinker Current Perceptions: Mountain Man is a beer that fathers/grandfathers drank and is now consumed by older blue collars Desired Perception: Mountain Man is a distinctively tasting beer which is consumed by those who appreciate quality, local authenticity, and are proud to identify themselves as hardworking individuals Factors that influence beer purchase decisions Is Mountain Man distinguishable on criteria the target segment values? Taste Yes Perceived Quality Yes Brand Image Yes Local authenticity Yes Tradition Yes 3 Mountain Man must increase its presence through channels that appeal to their target audience and consider extending their product offerings. Objective Broaden Target Audience New Product Extension Alternative Change packaging/label What we need to believe That the reason that the younger drinkers are not interested in MM is because they feel as though they do not fit with the current target audience, packaging can be more inclusive No Change size of offering A smaller can offering would be inviting enough those who currently do not feel as though they are “tough” enough to handle MM to feel they are able to No Light beer – to appeal to female/younger drinker trends Product offering will outweigh the investment costs Yes Dark beer – to shift perceptions that MM lager is too strong Current brand awareness will aid in capturing non-drinkers to become MM drinkers – current non-drinkers were not consuming MM solely because the product was not for them, but would be willing to switch if it did Flavoured beer – to keep original MM formula but offer a different product New Product Extension under new name Launch product extension without leveraging Mountain Man’s name That the new product would perform better in the market under a parent name. This extension not diminish the existing brand equity. Modify Current Lager Formula Reformulate the current MM lager The slightly higher-than-average alcohol and percentage of water content are hindering the younger generation to try MM beer based on the tough, working man perception Increase presence in on-site locations Do we believe it? Increase presence of MM in local bars with MM branded signage, coasters, glasses etc. to create an on-site buzz No No MM has not captured a younger audience because it is not as prominent as other brands in channels that they consume beer in Yes Leverage grassroot marketing, in smaller local bars, in order to let the product speak for itself, while staying true to core drinkers Increase presence in channels specifically appealing to younger audience Sponsorships in local events at College sport events, local bars and specialty events The presence of MM in local events will allow the younger drinkers to associate MM with more than just a drink for blue collar working men Increase the market size Expand out of East Central Region by considering the expansion outside of its current operations MM does not have the necessary production and distribution capabilities to support a national launch ($10-20M) No Lower price of MM Lower manufacturer price in order to appeal to distributors who can offer MM at the same price to retailers That the decrease in price will be significant enough to attract the attention of distributors. No Yes 4 An experiential marketing campaign will allow Mountain Man to reach younger audiences directly, cultivating a relationship similar to those of current core customers. Increase overall MM Profit Does not alienate core MM drinkers Makes MM more appealing to distributors Broadens the target audience Protects the brand reputation Launch of Light Beer No, the launch of Light beer shows a decrease in overall profitability of MM. No, MM light does not align with the values of current MM drinkers. It favours what mainstream brewery companies are doing, which does not respect what the core customer seeks to offer. No, the launch of light beer in a highly saturated market would make MM light less favourable in the distribution channel as its demand against major competitors would be lower. Yes, the introduction of MM light would extend its product offering to those who felt alienated by the higher-content level. No, for years MM has done business on the basis of its quality offering, which would not translate to its light beer offering. Experiential marketing campaign Yes, through broadened awareness, non current MM drinkers would switch to MM after trial and increased presence in desired channels. Yes, because sponsorships are in line with core values. N/A, this campaign does not affect distribution channels. Yes, this campaign is designed to be situated in events that pertain to younger audiences. Yes, this campaign would enhance brand reputation due to involvement and increased presence in the ECR community, furthering their local promise. Decrease selling price to appeal to distributors No, the decrease in price would not grow the overall profit, as this would not increase sales as drastically as would be needed. Yes, the core MM consumer would be unaffected by the implementation of a price reduction to distributors. Yes, however, with the high competition in the market, Mountain Man would still not be as desirable as its powerful major competitors. No, the target audience would not be broadened by the implementation of a price reduction to distributors. N/A, the price to distributors does not affect the end consumer. Promotional Advertising to brand loyalists Yes, by leveraging current consumers, the younger demographic is likely to , which would result in increased profit for MM with the desire to attract the next wave of loyal consumers. Yes, the advertising to current core consumers will further strengthen the relationship by cultivating an emotional connection with the next generation. N/A, this campaign does not affect distribution channels. Yes , the core purpose of this campaign is to directly target the older demographic to allow them to encourage the younger demographic in their social circle to try MM. Yes, this further establishes MM’s reputation as a local brewery, which strives to strengthen existing relationships through grassroot marketing. 5 Mountain Man should not expand into light beer because it cannot compete in an already saturated market and its NPV suggests that it will not yield a good investment. Before Launching Light Beer by 2010 After Launching Light Beer by 2010 NPV Before Investment Investment Costs Overall MM Net Income Overall MM Share -$2,849,129 1.30% -$4,442,394 NPV -$3, 441, 552 $750, 000 -$4, 191, 552 1.18% The launch of light beer impacts MM’s overall profitability negatively in the next 5 years. A negative NPV suggests that MM will not yield a return on their investment in light beer. Factors that hinder successful launch of light beer Shelf Space MM would not take away from facings of other light beers, suggesting that in order to gain shelf space, MM would be replacing its existing offering, which will not benefit the overall MM portfolio Promotion MM does not have the financial capabilities to compete with larger domestic light beers. Light has a lower contribution margin than its Lager, which would mean that volumes must be higher to match the same revenue as Lager. Popularity MM’s launch of a light beer would not convert non-existing MM drinkers to switch to MM, due to the increasing popularity of other light beers that have established themselves in the market already (Bud Light, Miller Lite) Distributors MM Light would not be able to guarantee turnover, making them less favourable than its Original Lager. Since distributors are becoming stricter with their requirements, MM Light would be a tough sell. 6 Mountain Man will need to focus its efforts towards on-premise channels in order to gain awareness and attract new audiences. Off-premise sales are dominated by MM core blue collar drinkers because they are more likely to purpose for the purpose of home/work consumption rather than consume on-premise where younger consumers tend to be Off-Premise Account for 70% of MM sales Convenience Stores Liquor Stores Consumption of Beer Restaurants On-Premise Target would be to increase brand awareness from 60% to 80% so that a younger audience would put MM in their consideration set when choosing their beer. Grocery Stores Bars Account for 30% of MM sales Sporting Events Desired demographic is more likely influenced by on the spot decisions, based on presence, availability, social influence With on-premise locations, there is more opportunity to be influential to the younger 7 audience in channels that involve direct advertising and recommendations. The marketing campaign must initiate a relationship among younger audiences through event sponsorship and sampling, in order for Mountain Man to be more appealing. How the young audience is consuming their beer? What does the marketing campaign need to do? At the Bar Increase the exposure of MM by increasing presence in bars through signage, merchandise and special events At a sporting event Encourage sampling at local sponsored sporting events to gain the attention of younger audiences and eliminate perception of ‘older man’s beer’ At local concerts Encourage sampling at beer tents with emphasis on local and quality, pass out free merchandise (branded glasses, t-shirts, history) At home Encourage current older demographic to pass on beer to the next generation through advertising directly pertaining to current loyal MM drinkers Why this will work Currently, the younger audience, although aware of MM does not view it as a beer in their consideration set. This is partly due to the fact that MM has not built a relationship with a younger demographic. The experiential marketing will allow a younger demographic to get closer to the brand and try it firsthand. This is MM’s opportunity to emphasize its history and local heritage which is valued by the younger demographic but has not been the focus of current advertising strategies. With an 11% higher brand loyalty rate than competitive products (at 53%), MM’s has a loyal consumer base to direct its marketing, younger consumers are likely to be influenced with their beer choices based on parental influences 8 Experiential marketing will lead to an increase in revenue and will yield a positive NPV over a 5 year period. How the young audience is consuming their beer? Cost Allocation NPV Before Investment $17,568,752 Experiential Investment $2,250,000 NPV $15,318, 572 Experiential marketing will be viewed as an upfront investment, aimed at aggressively increasing presence. Consistent increases in advertising expenses in the future years will ensure that the ongoing presence is maintained. Merchandise spending, equip bars with free glasses, coasters, banners, bottle openers - $50,000 On-site parties and contests hosted by MM- $100,000 At the Bar On-site complimentary tastings - $100,000 Dedicated sales team to handle in-bar promotions - $50,000 x 10 people = $500,000 Giveaways, sampling – $150,000 Beer information tent – $200,000 At a sporting event Sponsorship of event and teams (logos on jerseys and team equipment) – $500,000 Tailgate (Pre-game party) for local college teams and minor leagues – $100,000 At local concerts Mountain Man Lager Overall Post Marketing Initiative 2006 Total Quantity Revenue COGS Gross Margin Fixed Costs Net Income 2007 623,546 2009 2010 716,546 774,023 859,940 $60,483,922 $ 66,240,826 $69,505,027 $75,080,296 $ 83,414,209 $41,733,906 $ 45,706,170 $47,958,468 $ 51,805,404 $ 57,555,804 $18,750,016 $ 20,534,656 $21,546,558 $23,274,891 $ 25,858,404 $12,755,512 $ 14,476,563 $16,303,719 $18,247,591 $ 20,319,850 $5,994,504 $5,242,838 $5,027,300 $ 5,538,554 Major sponsor for concerts supporting local talent in each state – $500, 000 Increase trial rates and social responsibility through community involvement will attribute to MM’s presence in influential channels that will attract younger non MM drinkers to taste Mountain man beer, whether for the first time or to gain appreciation for local, reputable quality 682,895 2008 $ 6,058,092 In comparison to the current forecasted income statement where MM experiences a loss, this marketing campaign allows MM is to experience increasing revenue. 9 Direct advertising that appeals to core customers in the older consumer base will increase the likelihood of shifting in demographics, leading to an increase in market share. How to target current drinkers? Packaging Design – further reinforce the message Print – aimed at targeting off-premise locations, major channels of core customers Radio aimed at targeting blue collar audiences Advertising Breakdown $50,000 (redesign and printing) $2000/full page ad x 15 appearances = $30,000 x 7 states Yearly expenditure: $210,000 Daily Radio Spots= $1500/ day = $7500/work week Yearly expenditure: $390,000 Channels Limited Edition packaging to encourage sharing an integral part of their lives with family and friends Trade magazines, specialty outdoorsy magazines, Cottage Life Communication Message To encourage the younger drinkers to try MM through parental influenced at home Transcend loyalty from current MM drinkers who consider Mountain Man to be more than just a beer – a meaningful generational tradition “Official Beer of the Eastern Region” – from your father and now to your children. Popular country stations, talk radio, other local stations We’ve gained your trust for generations, now its your turn to share quality beer with your son and show him what MM is all about 2006 2007 2008 2009 2010 Current 1.36% 1.32% 1.28% 1.24% 1.20% Market Share Market Share after broadening target 1.40% 1.66% 1.80% 1.87% 2.00% through aggressive advertising MM can expect a steady increase that is due to an influx of advertising and social recommendations from existing loyal consumers. Unaided awareness will increase and the newly reached audience will be more likely to choose MM over other domestic beers. Target: Total core consumer demographic make up for 32% of current revenue, which amounts to 166,400 barrels If direct advertising to these consumers is able to convert 5% of their children, MM can expect an increase of 8,320 barrels or $807,040 annually 10