Mountain Man Brewing Company Bringing the Brand to Light By

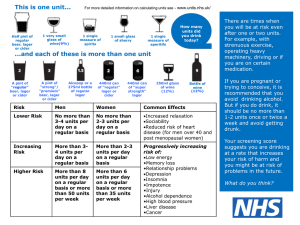

advertisement

Mountain Man Brewing Company Bringing the Brand to Light By Jonas Wera BMK710MS Brand Strategy I Prof. Bob Carroll December 5, 2014 Table of Contents Table of Contents Problem Statement Lack of Customer Inflow Forecasted Beer Consumption over 2005 - 2007 in East Central Region Shrinking Premium Beer Segment in ECR Customer Segments Competition Criteria/Alternatives Launch of Light is a bad Idea Short Term Solution to boost Sales Long Term Solution to boost Sales Appendices 1 2 3 4 5 6 7 8 9 10 11 12 - 20 1 The MMBC is confronted with a two percent drop in sales last year and is looking forward to decreases in sales of up to 12,7 percent by yearend 2007. Current customers are ageing and there is no new inflow of young customers The ECR (East and Central Region) beer market is declining and forecasted to decline in the near future Within the shrinking ECR beer market, the premium beer segment is shrinking Deep pocket players fight hard to maintain sales levels in premium market* Stringent regulations has led to a limit on advertising & promotion, making distributors selling beer at deep discounts. This has made the stores highly reluctant in offering a wide range of products (shelf space is distributors’ most important limitation) and made distributors focus on products that contribute a lot to the bottom line and have high selling rates. This tendency plays in the disadvantage of small and medium companies (like MMBC) Forecasted income statement for Mountain Man Lager if the MMBC does not take action: Mountain Man Lager Revenu TVC Gross Margin Fixed Cost Operating Margin 2005 $50.440.000,00 $34.803.600,00 $15.636.400,00 $10.995.920,00 $ 4.640.480,00 2006 $46.657.000,00 $32.193.330,00 $14.463.670,00 $10.995.920,00 $ 3.467.750,00 2007 $44.025.390,00 $30.377.519,10 $13.647.870,90 $10.995.920,00 $ 2.651.950,90 * In a shrinking market, market share has to grow in order to maintain sales levels 2 The biggest Threat for MMBC is a Lack of new Customer Inflow which leads to a shrinking Customer Base. Younger Drinkers (the new generation) prefer Light beer They are developing a bond with Light beer brands which will make them loyal to these brands when growing older (older people become brand loyal) MMBC’s current customer is 45+ and is expected to stay loyal to the brand. However, there will be natural outflow of customers (by death, health reasons etc.) The threat is that there is no new inflow of customers to replace the natural outflow of customers This will lead to decreasing sales year after year and finally turning the profits into a loss MMBC needs to address this issue by assuring a new inflow of customers *Sole brand loyalty rate (loyal customers who are not interested in experimenting with other brands) of 53% 3 The Beer Consumption in The East Central Region is forecasted to decline over the next two years. Beer Consumption in East Central Region over last five years and forecast for next two years (in barrels) 37.800.000 Historical Data Forecast 37.600.000 37.400.000 37.200.000 37.000.000 36.800.000 36.600.000 36.400.000 36.200.000 2000 2001 2002 2003 2004 2005 2006 2007 Factors negatively influencing beer consumption in East Central Region in next two years: Increasing competition from wine and spirits Increases in the federal excise tax (government is more and more discouraging alcohol via tax increases) Initiatives encouraging moderation Increasing health concerns Personal responsibility Increased regulation for alcoholic beverages advertising & promotion A new generation of new-drinkers will enter the market (people who turn 21 in the next two years) but this will largely be compensated by a natural outflow of drinkers (e.g.: death, health reasons, etc.). 4 The Premium Beer Segment is Shrinking in the Declining East Central Region Beer Market over the Period 2005 – 2007* Forecasted East Central Region Beer Consumption by Type & Origin, 2007 Light Beer Premium Beer (including MM Lager) Popular Imported Premium Superpremium (craft & high-end domestics) 7% 14% 9% 54% 16% East Central Region Beer Consumption (in barrels) by Type & Origin, 2005 Light Beer Premium Beer (including MM Lager) Popular 12% Imported Premium Superpremium (craft & high-end domestics) 6% 12% 50% 20% *See Appendix 1, page 12 for more information about the pie charts. 5 The Two Customer Segments of our Primary Interest are Younger Drinkers and Rough Men. Younger Drinkers 21-27 year old First-time drinker Not loyal to beer brand Are open for new tastes; want to experiment 4 million growth by 2010 (based on demographics data) Willing and able to spend a lot of money on beer Buys predominantly offpremise Rough Men 45+ year old men Blue collar Middle to low income Buys predominantly (60%) off-premise Loyal to beer brand Has an emotional connection with beer brand (which makes them price insensitive) Heavy consumers of beer Preference for flavorful, bittertasting beers Fancy Old 45+ year old men and women White collar Middle to high disposable income Loyal to beer brand Price insensitive for beer Buys predominantly onpremise Non-involved Drinkers Men and women above 27 years of age Have drinking experience Not loyal to specific brand Poor knowledge about the beer market Price sensitive for beer Looking for low price rather than quality Experienced women above 27 years of age Loyal to specific beer brand Have an emotional connection with beer brand (which makes them price insensitive Heavy consumers of beer The typical customer for Mountain Man Lager is the “Rough Man”. There is tremendous potential in the “Younger Drinkers” segment as these customers are not yet loyal to a specific brand and are willing to experiment. 6 We Are Competing For the Same Customer (Rough Men) as Other 2nd Tier Premium & Popular Brewers, Imported Beer Brands and Regional Craft Brewers. Major Domestic* Customer Segment Younger Drinkers as primary target audience Experienced Women Not-involved Drinkers Other 2nd Tier Premium & Popular Brewers Rough Men Experienced Women Craft/Specialty Beers Fancy Old Rough Men (especially for Regional Craft Brewers) Experienced Women Imports Fancy Old Rough Men Experienced Women Distribution Technique Sold via distributors and retailers Sold via distributors and retailers Predominantly sold onpremise Sold via distributors and retailers Price Average Premium Above Premium Above Premium MMBC is not in competition with the major domestic brands, also known as the deep pocket players. Competition is most severe from other 2nd tier premium & popular brewers (e.g.: Pabst Brewing Company and Genessee) followed by competition from Regional Craft Brewers and to a lesser extent from Imports. The competition with Regional Craft Brewers is limited given the difference in distribution (on- versus off-premise). *Major Domestic is a collection of Anheuser-Busch, Miller and Coors’ beer brands. 7 Launching Second Version, expand Market Span and increase Price Will Turn The Declining Sales into Boosting Sales. Launch of Mountain Man Light in ECR Launch second version of Lager under young image** Extent onpremise selling In line with current target audience (Rough Men) No. The target audience for light is Younger Drinkers. Damages the brand image of Lager* Increases bargaining power over distributors Differentiates us from competitors (weakens competition) Will lead to new inflow of customers Yes. The Yes. An increase in product No. By launching Yes. A big chunk of scope and total brand sales will leverage MM’s bargaining power. Yes. Target Yes/No. The “rough audience buys 40% of beer onpremise but we currently only have 30% onpremise sales. men image” will be damaged when sold in fancy restaurants/bars. Carefully choose appropriate locations. No. Makes Lager even more exclusive and strengthens the image of “the real thing”. MM Light, we will enter the area of the large domestic players (A-B, Miller & Coors). Yes. There currently is no heavy, dark beer specifically targeted at Young Drinkers. Yes. We are currently at industry average in terms of on-premise sales; increasing our onpremise presence can set us apart from competition. No. This will increase competition with specialty beer brands and imported beers. Younger Drinkers will start drinking our brand. Younger Drinkers. introduction of MM Light will soften the “rough men image” MM Lager currently has. Yes. “mine workers image” of Lager will be softened. No. Targets scope and total brand sales will leverage MM’s bargaining power. No. No influence as we sell directly to on-premise locations or sell to them via non-shelf holding intermediaries. audience is price insensitive and very brand loyal. Yes. An increased price Yes. A new inflow from Younger Drinkers (no drastic inflow as they prefer Light over Dark) No. We will only sell to existing customers as there is no incentive for non-consumers to start consuming when offered on-premise. 5 1 4 No. A price increase 3 offers us the possibility to will not attract new offer a slightly larger customers. margin to the distributors, making them willing to carry our product(s). Geographical Yes. Target the No. The same Yes. The geographical Yes/No. Will not Yes. People from new 2 expansion (e.g.: Rough Men in brand image will be extension will make it more directly influence our geographical areas will to Missouri) the new created in the new difficult for distributors not competitive position. start drinking MM geographic area. geographic area. to carry our brand. Lager. *Mountain Man Lager’s image is about how the brand is perceived by customers; the focus is on its’ history, authenticity and status-giving aspects. **Next to the current Lager, also sell the same liquid under other packaging and advertising, tailored around the Younger Drinkers segments. Increase the price of Lager to Specialty Beer Brand prices Yes. Target Yes. An increase in product Ranking (1 is best) 8 Launch of Mountain Man Light in the East Central Region will negatively impact the MMBC in the long Term. Next to the criteria outlined on page 8, a more extended list of (dis)advantages makes the absurdity of launching even more clear. Advantages Helps to gain presence in on-premise locations Extents the customer base by attracting the Younger Drinkers No initial investment in plant/equipment necessary thanks to excess capacity Has a net present value of $95.579 over the next two years (See Appendix 4). Note that this number does not take into account major brand damage costs in more than two years and does not take into account investment costs which are likely in the future. Disadvantages Brand image will be damaged Increased competition from deep pocket players (large domestic beer brands) and regional breweries Cannibalization of MM Lager due to distributors who will substitute Lager for Light Increased inventory, SG&A, packaging costs No experience with product launches High advertising costs Deep pocket players are constantly launching new products So far, no single small or medium company has been able to successfully introduce a new product 9 Increasing Sales in the Short Term: The MMBC should geographically expand its’ brand presence and increase the price to $100 per barrel. Based on the alternatives table on page 8, we have the following promising alternatives: Increase the price of Lager to specialty beer brand prices, geographically extent the brand and launch a second version of the brand. It is advisable to do the geographical expansion together with the price increase to boost sales in the short term. The launch of a second version lager is necessary to guarantee long term sales growth. Geographical Expansion Expansion to Missouri Missouri is relatively close to our production plant in West Virginia (low transport costs) Drinking habits and patterns are comparable to the those in the ECR Missouri also has a coal mine industry which makes the “coal mine workers image” of our brand very livable Set up a marketing campaign to raise brand awareness ($1,000,000) Build contacts with local distributors ($200,000) This expansion will be profitable if we sell at least 39,900 barrels a year in this new market when keeping the price at the same level. (See Appendix 2 and 3) MMBC is expected to exceed this 39,900 barrel/year target (See Appendix 3). Price Increase Lager currently priced at $2,25 for 12 ounce at bar, $4,99 for a 6-pack at convenience store. Taking into account the distribution margins, this leads to an average price per barrel of $97,00 (See Appendix 2). An increase of 3,09% in price gives an average price per barrel of $100,00, leading to 36.287 barrels to be break-even (See Appendix 2). An increase of 6,19% in price gives an average price per barrel of $103,00, leading to 33.269 barrels to be break-even (See Appendix 2). A 3,09% increase in price will not lead to drastic customer switching, given the loyalty and price insensitivity of our customers. 10 Increasing Sales in the Long Term: The MMBC should launch Second Version of Lager Under Young Drinker Image in order to drive Customer Inflow. The biggest threat to the MMBC is a declining customer base New inflow of customers is necessary to guarantee sustainability in the long term The Younger Drinker segment is the new generation with a large CLV* and as such, deserves special attention The Younger Drinkers are not a big fan of heavy, dark beer so we don’t expect a large amount of them to start drinking Lager However, every Younger Drinker that starts drinking Lager is a highly profitable one in terms of CLV Over two years, this will result in a NPV of $15.760 (See Appendix 5). Although this is a small NPV, it is nevertheless important to launch this second version of Lager in order to guarantee customer inflow. This customer inflow will later (more than two years in the future) generate high income streams. *CLV stands for Customer Lifetime Value; a cumulative number reflecting all future value streams of a certain customer with the company. 11 Appendix 1: Forecasted East Central Region Beer Consumption (in barrels) by Type & Origin, 2007. Light Beer +4% (54%)* New generation drinkers (21 years old) predominantly drink light beer. Light beer will get a new inflow of consumers over the next two years and the people who are currently drinking light beer will mostly stay loyal to light, even when growing older (as they have developed a psychological bond with their light brand). This stretches the light customer base and drives up the market share. Premium Beer –4% (16%) A small inflow of new customers is expected, however, the increased presence and competition from light beers will derive part of the new generation drinkers towards light. Besides, there is an outflow of old customers (for health reasons, death, etc.). Popular -3% (9%) The negative tendency of the last years is expected to level out. Imported Premium +2% Imported premium brands are not that popular in the ECR as in the rest of The States but they (14%) are gaining attention. Superpremium (craft and This industry is gaining more and more attention in the ECR, however, the limited size of the high-end domestics) +1% companies will be a problem as the distributors are becoming more and more discriminative (7%) about which brands to carry (distributors have limited shelf space and are confronted with decreasing margins on beer products). Although the margins on superpremium beer are generally higher, the rotation (number of items sold over a certain time span) is lower which makes distributors reluctant to carry them. *The first percentage indicates the increase/decrease in volume market share and the percentage between brackets indicates the forecasted volume market share in 2007. 12 Appendix 2: Minimum Number of Barrels MMBC Need to Sell in order to be Profitable in the Missouri Market. Quantity (in barrels) 39.907 Price $ 97,00 UVC $ 66,93 Revenu $ 3.870.979,00 TVC $ 2.670.975,51 Gross Margin $ 1.200.003,49 Fixed Cost $ 1.200.000,00 Operating Margin $ Quantity (in barrels) 3,49 The average price of $97,00/barrel for Lager is obtained by the following calculation: Net revenues of Mountain Man in 2005/Number of barrels sold in 2005 =$50.440.000/520.000 barrels =$97,00/barrel 36.287 Price $ 100,00 UVC $ 66,93 Revenu $ 3.628.700,00 TVC $ 2.428.688,91 Gross Margin $ 1.200.011,09 Fixed Cost $ 1.200.000,00 Operating Margin $ Quantity The Unit Variable Cost of $66,93/barrel for Lager is obtained by the following calculation: Cost of goods sold in 2005/Number of barrels sold in 2005 =$34.803.600/520.000 barrels =$66,93/barrel 11,09 33.269 Price $ 103,00 UVC $ 66,93 Revenu $ 3.426.707,00 TVC $ 2.226.694,17 Gross Margin $ 1.200.012,83 Fixed Cost $ 1.200.000,00 Operating Margin $ The Fixed costs are the sum of the $1.000.000 advertising costs and the $200.000 contact set-up costs. No initial investment in plant/equipment is necessary as we are currently dealing with excess capacity. 12,83 13 Appendix 3: MMBC will easily realize the 39.000 barrels/year Target in the Missouri Market. Last year (2005), we sold 520.000 barrels We were (and currently are) serving seven different states When comparing the number of inhabitants of each state with the number of barrels sold in that particular state, we observe an extraordinarily high correlation. State Inhabitant Ranking (1 is most inhabitants, 7 is least inhabitants)* Illinois 1 Indiana 4 Kentucky 6 Michigan 3 Ohio 2 West Virginia 7 Wisconsin 5 *Data from The United States Government Consumption Ranking (1 is most barrels/year, 7 is least barrels/year) 1 5 6 3 2 7 4 This observation is in line with the expectations (as the demographics are comparable over the states). The new market (Missouri) also has comparable demographics and ranks around Indiana when it comes to number of inhabitants. So we expect similar sales volumes for Missouri as for Indiana. 10,75% (3.998.855 barrels / 37.191.077 barrels) of the barrels consumed in the ECR are consumed in Indiana. Assuming similar market shares across the seven states, we sell 55.911 (10,75% of 520.000) barrels in Indiana. This gives us a rough indication of 55.911 barrels that we will sell in Missouri. The start-up phase in Missouri may lead to slightly decreased sales compared to Indiana but 55.911 is still way above the target of 39.907 barrels. 14 Appendix 4: Net Present Value (NPV) Calculation for Launch of Mountain Man Light over the next two Years. Notice that this NPV calculation only covers a two year situation. Damage to the Lager brand is likely to cause severe negative effects on the income stream after this two-year period. In case the MMBC does not launch Light and does not change anything to the current strategy (the base case), the following brand matrix is expected for the next two years. Volume Market shares Mountain Man Lager Mountain Man Youth Major Domestic Other 2nd tier Premium & Popular Brewers Craft/Specialty Brewers Imports Total 2005 1,40% 0,00% 74,00% 11,10% 1,50% 12,00% 100,00% 2006 1,30% 0,00% 75,30% 9,00% 1,40% 13,00% 100,00% 2007 1,23% 0,00% 76,50% 6,97% 1,30% 14,00% 100,00% Mountain Man Lager is forecasted to lose market share mainly due to natural outflow of customers in combination with a lack of customer inflow. Also the decreasing margins which has led to more discriminating distributors is not playing in our advantage. Major Domestic consists of deep pocket players A-B, Miller & Coors who are gaining market share in an attempt to keep their sales on the same level in the shrinking market. They predominantly do this buy regularly launching new products and spending lots of money on advertising and promotion. Besides, they have considerably more power over distributors then other players. Other 2nd tier Premium & Popular Brewers are losing shares because of their limited power over distributors (distributors are becoming more and more reluctant to carry their products). Craft/Specialty Brewers are losing share due to a lack of bargaining power over distributors. Imports are decreasing as a consequence of the new trends in the ECR where imports are becoming more and more popular and evolving to levels comparable to other states. 15 Net Present Value (NPV) Calculation for Launch of Mountain Man Light over the next two Years - Ctd. Historical and Forecasted Income Statements for the Period 2005 – 2007 in Base Case (no Launch). Mountain Man Lager Market Share Quantity Price UVC $ $ Revenu TVC Gross Margin Fixed Cost Operating Margin $ 50.440.000,00 $ 34.803.600,00 $ 15.636.400,00 $ 10.995.920,00 $ 4.640.480,00 2005 1,40% 520.000 97,00 $ 66,93 $ 2006 1,30% 481.000 97,00 $ 66,93 $ $ 46.657.000,00 $ 32.193.330,00 $ 14.463.670,00 $ 10.995.920,00 $ 3.467.750,00 2007 1,23% 453.870 97,00 66,93 $ 44.025.390,00 $ 30.377.519,10 $ 13.647.870,90 $ 10.995.920,00 $ 2.651.950,90 A severe drop in operating margin is observed over the period 2005 – 2007 in case the MMBC continues business as usual. 16 Net Present Value (NPV) Calculation for Launch of Mountain Man Light over the next two Years - Ctd. Brand Share Matrix in Case of Innovation (Launch of Light): Volume Market shares Mountain Man Lager Mountain Man Light Major Domestic Other 2nd tier Premium & Popular Brewers Craft/Specialty Brewers Imports Total 2005 1,40% 0,00% 74,00% 11,10% 1,50% 12,00% 100,00% 2006 1,25% 0,20% 75,22% 8,96% 1,37% 13,00% 100,00% 2007 1,17% 0,23% 76,41% 6,92% 1,27% 14,00% 100,00% The introduction of Light will lead to cannibalization with Lager. This cannibalization is NOT due to customers who switch from Lager to Light but is caused by distributors who only want to carry one of our brands or will devote the same shelf space that now needs to be shared with two brands instead of one. Market share will be taken from Major Domestic (A-B, Miller & Coors) as we fight for the same customer, i.e.: the Younger Drinkers. Market share will also be taken from Other 2nd tier Premium brands and Craft/Specialty brewers. 17 Net Present Value (NPV) Calculation for Launch of Mountain Man Light over the next two Years - Ctd. Historical and Forecasted Income Statements for the Period 2005 – 2007 in Innovation Case (Launch). Mountain Man Light Market Share Quantity Price UVC Revenu TVC Gross Margin Fixed Cost Operating Margin Mountain Man Total Market Share Quantity Price UVC Revenu TVC Gross Margin Fixed Cost Operating Margin 2005 2006 $ $ 0,00% 0 97,00 $ 71,62 $ $ $ $ - $ 2005 1,40% 520.000 $50.440.000,00 $34.803.600,00 $15.636.400,00 $10.995.920,00 $ 4.640.480,00 2007 0,20% 74.000 97,00 $ 71,62 $ $ 7.178.000,00 $ 5.299.880,00 $ 1.878.120,00 $ 900.000,00 $ 978.120,00 2006 1,45% 536.500 $52.040.500,00 $36.255.005,00 $15.785.495,00 $11.895.920,00 $ 3.889.575,00 $ $ $ $ $ 0,23% 84.870 97,00 71,62 8.232.390,00 6.078.389,40 2.154.000,60 900.000,00 1.254.000,60 2007 1,40% 516.600 Mountain Man Lager Market Share Quantity Price UVC $ $ Revenu TVC Gross Margin Fixed Cost Operating Margin $ 50.440.000,00 $ 34.803.600,00 $ 15.636.400,00 $ 10.995.920,00 $ 4.640.480,00 2005 2006 1,40% 520.000 97,00 $ 66,93 $ 2007 1,25% 462.500 97,00 $ 66,93 $ $ 44.862.500,00 $ 30.955.125,00 $ 13.907.375,00 $ 10.995.920,00 $ 2.911.455,00 1,17% 431.730 97,00 66,93 $ 41.877.810,00 $ 28.895.688,90 $ 12.982.121,10 $ 10.995.920,00 $ 1.986.201,10 The fixed costs of Light ($900.000) are incremental SG&A costs associated with Light. In order to obtain the NPV, an investment cost of $750.000 is taken into account (advertising campaign to get product launched). $50.110.200,00 $34.974.078,30 $15.136.121,70 $11.895.920,00 $ 3.240.201,70 The differences between the Innovation and the Base situation gives us a NPV for the launch of Light of $95.579. 18 Appendix 5: NPV Calculation for Launch of Mountain Man Youth. Brand share matrix for the period 2005 - 2007 if we launch Mountain Man Youth Volume Market shares Mountain Man Lager Mountain Man Youth Major Domestic Other 2nd tier Premium & Popular Brewers Craft/Specialty Brewers Imports Total 2005 1,40% 0,00% 74,00% 11,10% 1,50% 12,00% 100,00% 2006 1,28% 0,15% 75,22% 8,98% 1,37% 13,00% 100,00% 2007 1,20% 0,20% 76,39% 6,94% 1,27% 14,00% 100,00% Mountain Man Youth will predominantly steal market share from Major Domestic brands (A-B, Miller & Coors) Cannibalization with Lager will only occur to a very limited extent as the target market is totally different (Younger Drinkers versus Rough Men) 19 NPV Calculation for Launch of Mountain Man Youth - Ctd. Income Statements for the period 2005 – 2007 when we launch Mountain Man Youth. Mountain Man Lager Market Share Quantity Price UVC $ $ Revenu TVC Gross Margin Fixed Cost Operating Margin $50.440.000,00 $ 34.803.600,00 $ 15.636.400,00 $ 10.995.920,00 $ 4.640.480,00 $ 45.939.200,00 $ 31.698.048,00 $ 14.241.152,00 $ 10.995.920,00 $ 3.245.232,00 $ 42.951.600,00 $ 29.636.604,00 $ 13.314.996,00 $ 10.995.920,00 $ 2.319.076,00 2005 2006 2007 Mountain Man Total Market Share Quantity Price UVC Revenu TVC Gross Margin Fixed Cost Operating Margin 2005 2006 1,40% 520.000 97,00 $ 66,93 $ 1,40% 520.000 $50.440.000,00 $34.803.600,00 $15.636.400,00 $10.995.920,00 $ 4.640.480,00 2007 1,28% 473.600 97,00 $ 66,93 $ 1,43% 529.100 $51.322.700,00 $35.672.958,00 $15.649.742,00 $11.895.920,00 $ 3.753.822,00 1,20% 442.800 97,00 66,93 1,40% 516.600 Mountain Man Youth Market Share Quantity Price UVC Revenu TVC Gross Margin Fixed Cost Operating Margin 2005 2006 $ $ 0,00% 0 97,00 $ 71,62 $ $ $ $ - $ - 2007 0,15% 55.500 97,00 $ 71,62 $ $ 5.383.500,00 $ 3.974.910,00 $ 1.408.590,00 $ 900.000,00 $ 508.590,00 0,20% 73.800 97,00 71,62 $ 7.158.600,00 $ 5.285.556,00 $ 1.873.044,00 $ 900.000,00 $ 973.044,00 The fixed costs of Youth ($900.000) are incremental SG&A costs associated with Youth. In order to obtain the NPV, an investment cost of $750.000 is taken into account (advertising campaign to get product launched). $50.110.200,00 $34.922.160,00 $15.188.040,00 $11.895.920,00 $ 3.292.120,00 The differences between the Innovation and the Base situation gives us a NPV for the launch of Youth of $15.760. 20