Morningstar Corporate Credit Rating

Starbucks Corporation SBUX (NAS)

|

A-

Business Risk

Cash Flow Cushion™

Solvency Score

Distance To Default

Economic Moat™

Industry Group

Sector

Good

Fair

Good

Very Good

Wide

Restaurants

Cons Svcs

Product innovation and cost-containment efforts should help

Starbucks fend off mounting competitive pressures.

Morningstar Credit Committee

Credit Perspective

credit@morningstar.com

Committee members voting on rating do

not own securities issued by the company.

Credit Analysis as of 18 May 2010

Business Analysis as of 18 May 2010

Estimates as of 26 Jul 2010

Currency amounts expressed with “$” are in

U.S. dollars (USD) unless otherwise denoted.

Contents

Summary

1

Credit Analysis

2

Business Analysis

4

Outstanding Issues

6

Analyst Notes

7

Methodology

10

13 Aug 2010

We have very few concerns about Starbucks' credit risk due

to the company's solid financial position and expectations

of strong earnings performance, coupled with moderate

credit metrics and a wide economic moat. Despite immense

cyclical and competitive pressures over the past few years,

Starbucks remains the dominant player in specialty coffee.

Quick-service restaurant chains represent credible threats,

but with a wide economic moat based on meaningful scale

advantages and a brand that commands premium pricing,

Starbucks will maintain its leading position, in our view.

Starbucks generates consistent, healthy free cash flows and

has no meaningful debt maturities until 2017. Credit metrics

are good, with debt/capital of 0.15 and debt/EBITDA 0.41

(lease-adjusted debt/EBITDAR is 3.0). Starbucks' Cash Flow

Cushion (cash on the balance sheet and future cash flow

divided by debt and debt-like obligations) is about 2 times.

Free cash flow has averaged about 5% of revenue the past

three years (including $943 million in fiscal 2009),

suggesting that Starbucks should have little trouble

supporting debt or future lease obligations. Even with a

target dividend payout range of 35%-40% of net income,

we believe Starbucks' cash available to debt service will

continue to be strong.

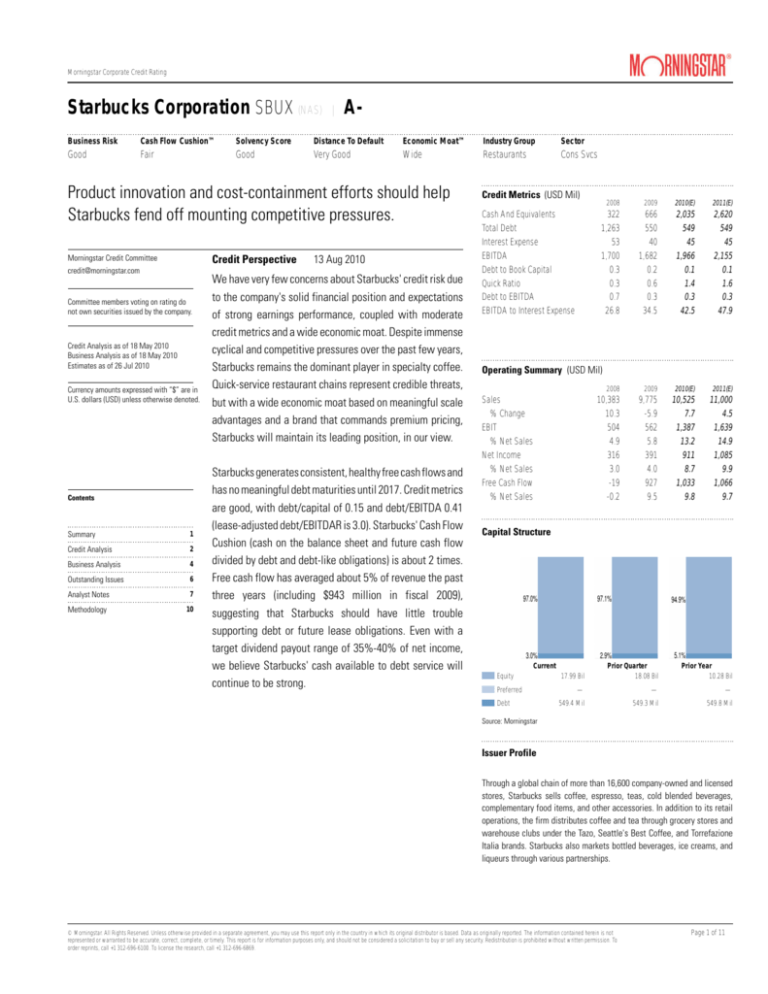

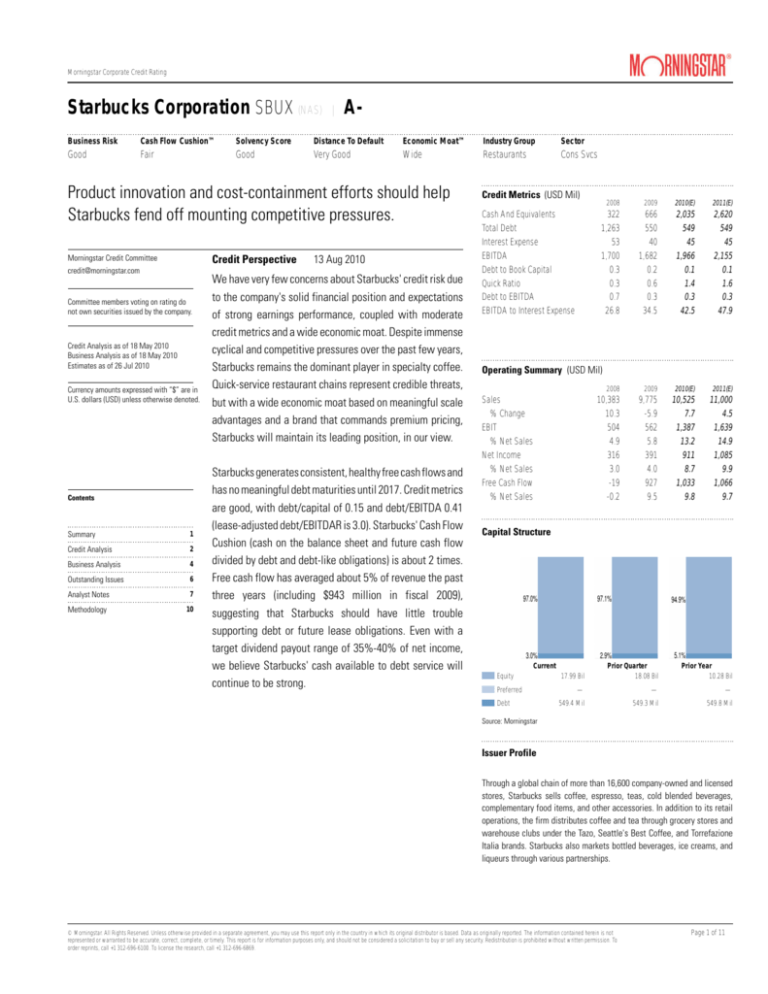

Credit Metrics (USD Mil)

Cash And Equivalents

Total Debt

Interest Expense

EBITDA

Debt to Book Capital

Quick Ratio

Debt to EBITDA

EBITDA to Interest Expense

2008

2009

2010(E)

2011(E)

322

1,263

53

1,700

0.3

0.3

0.7

26.8

666

550

40

1,682

0.2

0.6

0.3

34.5

2,035

549

45

1,966

0.1

1.4

0.3

42.5

2,620

549

45

2,155

0.1

1.6

0.3

47.9

Operating Summary (USD Mil)

Sales

% Change

EBIT

% Net Sales

Net Income

% Net Sales

Free Cash Flow

% Net Sales

2008

2009

2010(E)

2011(E)

10,383

10.3

504

4.9

316

3.0

-19

-0.2

9,775

-5.9

562

5.8

391

4.0

927

9.5

10,525

7.7

1,387

13.2

911

8.7

1,033

9.8

11,000

4.5

1,639

14.9

1,085

9.9

1,066

9.7

Capital Structure

Current

Equity

Preferred

Debt

17.99 Bil

Prior Quarter

18.08 Bil

Prior Year

10.28 Bil

—

—

—

549.4 Mil

549.3 Mil

549.8 Mil

Source: Morningstar

Issuer Profile

Through a global chain of more than 16,600 company-owned and licensed

stores, Starbucks sells coffee, espresso, teas, cold blended beverages,

complementary food items, and other accessories. In addition to its retail

operations, the firm distributes coffee and tea through grocery stores and

warehouse clubs under the Tazo, Seattle's Best Coffee, and Torrefazione

Italia brands. Starbucks also markets bottled beverages, ice creams, and

liqueurs through various partnerships.

© Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not

represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To

order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

Page 1 of 11

Morningstar Corporate Credit Rating

Starbucks Corporation SBUX (NAS)

|

A-

Business Risk

Cash Flow Cushion™

Solvency Score

Distance To Default

Economic Moat™

Industry Group

Sector

Good

Fair

Good

Very Good

Wide

Restaurants

Cons Svcs

Credit Analysis

Five Year Adjusted Cash Flow Forecast (USD Mil)

Financial Health

2010(E)

2011(E)

2012(E)

2013(E)

2014(E)

Cash and Equivalents (beginning of period)

Adjusted Free Cash Flow

Total Cash Available before Debt Service

666

1,678

2,344

2,035

1,755

3,790

2,620

1,817

4,436

3,048

1,980

5,028

3,562

2,059

5,621

Principal Payments

Interest Payments

Other Cash Obligations and Commitments

Total Cash Obligations and Commitments

0

-45

-796

-841

0

-45

-840

-885

0

-48

-890

-938

0

-50

-928

-978

0

-53

-967

-1,019

Cumulative Annual Cash Flow Cushion

With a consistent record of positive free cash flow, no

meaningful debt maturities until 2017, and leverageable

assets on the balance sheet, Starbucks appears to be in

sound financial health. Debt/capital is 0.15 (0.67 including

operating leases), EBITDA covers interest expense by 34

times, and the Cash Flow Cushion (cash on the balance sheet

and future cash flow divided by debt and debtlike

obligations) is about 2 times. We give Starbucks an issuer

credit rating of A-.

Cash Flow Cushion

Possible Liquidity Need

Capital Structure

Adjusted Cash Flow Summary

% of

USD Millions Commitments

Beginning Cash Balance

Sum of 5-Year Adjusted Free Cash Flow

Sum of Cash and 5-Year Cash Generation

Revolver Availability

Asset Adjusted Borrowings (Repayment)

Sum of Cash, 5-Year Cash Generation, Revolver and Adjustments

Sum of 5-Year Cash Commitments

666

9,289

9,955

14.3

199.3

213.5

986

0

21.2

0.0

10,941

-4,662

234.7

—

Credit Rating Pillars Peer Group Comparison

Business Risk

Cash Flow Cushion

Solvency Score

Distance to Default

Credit Rating

SBUX

Sector

Universe

4

5

3

1

A-

4.6

6.3

5.8

4.1

BBB-

4.5

5.7

4.8

3.9

BBB+

Starbucks' capital structure is relatively straightforward and

likely to be sustained. The only long-term debt on the

balance sheet is $550 million in 6.25% senior notes due

2017, and the firm has almost $1 billion in borrowing

capacity under its revolving credit facility and commercial

paper program. Debt/capital and total debt/EBITDA have

averaged 0.28 and 0.70 during the past three years,

respectively, though we expect these metrics to remain

much closer to current levels of 0.15 and 0.41 going forward.

Free cash flow has averaged about 5% of revenue the past

three years (including $943 million in fiscal 2009),

suggesting that Starbucks should have little trouble

supporting debt or future lease obligations. In addition, the

firm had $2.5 billion in net property, plant, and equipment

as of December 2009, which should provide an asset base

to secure debt if necessary. Even with a target dividend

payout range of 35%-40% of net income, we find few

reasons to believe that Starbucks will be forced to access

capital markets on unfavorable terms over the next several

years, especially given our A- issuer credit rating for the

company.

Source: Morningstar Estimates

Note: Scoring is on a scale 1-10, 1 being Best, 10 being Worst

Enterprise Risk

Starbucks faces increased competition on several fronts,

including an influx of specialty coffee programs at

quick-service and fast-casual restaurant chains. Given its

© Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not

represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To

order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

Page 2 of 11

Morningstar Corporate Credit Rating

Starbucks Corporation SBUX (NAS)

|

A-

Business Risk

Cash Flow Cushion™

Solvency Score

Distance To Default

Economic Moat™

Industry Group

Sector

Good

Fair

Good

Very Good

Wide

Restaurants

Cons Svcs

Credit Analysis

position as a more affluent consumer brand, lingering

discretionary spending headwinds could damp top-line

results. Coffee commodity costs can affect profitability, as

well as labor and occupancy cost inflation. Starbucks also

faces heightened economic, legal, and political risk

associated with its international expansion efforts.

© Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not

represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To

order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

Page 3 of 11

Morningstar Corporate Credit Rating

Starbucks Corporation SBUX (NAS)

|

A-

Business Risk

Cash Flow Cushion™

Solvency Score

Distance To Default

Economic Moat™

Industry Group

Sector

Good

Fair

Good

Very Good

Wide

Restaurants

Cons Svcs

Business Analysis

Thesis

Despite immense cyclical and competitive pressures over

the past few years, Starbucks remains the dominant player

in specialty coffee. We doubt the firm can return to its lofty

historical top-line growth rates around 20%, but product

innovations, new food-service and licensing partnerships,

and international expansion should enable it to sustain a

solid, albeit more modest, long-term growth trajectory.

Quick-service restaurant chains represent credible threats,

but with a wide economic moat based on meaningful scale

advantages and a brand that commands premium pricing,

we expect Starbucks will maintain its leading position in

specialty coffee.

With more than 11,000 company-owned and licensed

locations in the U.S. representing $7.1 billion in revenue

during fiscal 2009, Starbucks maintains a sizable lead over

its direct domestic rivals, including Dunkin' Donuts, Caribou

Coffee CBOU, and Peet's Coffee PEET. The firm is often

granted exclusive leases to prominent locations rife with

consumer traffic, making it extremely difficult for these

rivals to compete effectively. Moreover, with cafelike

environments and a brand that invokes a high-quality

customer experience, Starbucks enjoys pricing power

advantages over these specialty coffee peers, in our view.

Quick-service and fast-casual restaurant chains represent

an emergent source of competition, however. McDonald's

MCD, which generated about $1.5 billion in coffee sales

through its 14,000 domestic units in 2009 and has rolled out

its McCafe program to several thousand international

locations, could develop into Starbucks' most formidable

competitor over a longer horizon. However, we believe there

is room for both firms to succeed in the large and

still-growing specialty coffee category. McDonald's has

undertaken a substantial reimaging program featuring

interior and exterior upgrades and plans to offer free

wireless Internet to its customers, but we still believe

Starbucks' upscale environments provide enough

differentiation to attract a premium audience. Moreover,

the introduction of Seattle's Best Coffee at more than 30,000

quick-service restaurant locations should allow Starbucks

to capitalize on the increasing popularity of specialty coffee

in the quick-service restaurant channel.

Although domestic opportunities are intriguing, international

markets will be the firm's primary growth vehicle. As one

of the most widely recognized brands in the world, Starbucks

is among the few retail concepts to be successfully

replicated across the globe. As such, we believe the firm

could match or even exceed its domestic store potential in

overseas markets. The chain has more than 5,500 units in

about 50 countries, including some well-established cafe

cultures such as France and Austria. Emerging market

prospects are also intriguing, including growth

opportunities in markets such as China (which already has

more than 700 units) and India.

Product innovation remains a hallmark of Starbucks'

success. A revamped food program has been additive to the

top line over the past several years, and we believe there

are opportunities to expand this program past the breakfast

and lunch dayparts. Smoothies and tea products have added

diversity to Starbucks' menu, allowing the firm to broaden

its target audience. Finally, early results from VIA,

Starbucks' entrant in the $21 billion global instant coffee

market, have been impressive. With its 37,000 current

points of distribution and significant opportunities to tap

underpenetrated overseas markets, we view VIA as a

potential multi-billion-dollar revenue stream over time.

Economic Moat

Nonexistent switching costs, intense industry competition,

and low barriers to entry make it extremely difficult for

retailers to establish an economic moat. However, we

believe Starbucks has developed a wide economic moat,

© Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not

represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To

order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

Page 4 of 11

Morningstar Corporate Credit Rating

Starbucks Corporation SBUX (NAS)

|

A-

Business Risk

Cash Flow Cushion™

Solvency Score

Distance To Default

Economic Moat™

Industry Group

Sector

Good

Fair

Good

Very Good

Wide

Restaurants

Cons Svcs

Business Analysis

the result of both structural and intangible competitive

advantages. Starbucks has considerable influence over

arabica coffee bean suppliers, ensuring access to raw

materials at predictable, competitive prices. The company

is often granted exclusive lease terms for stores situated in

prominent locations rife with consumer traffic, making it

extremely difficult for competitors to develop necessary

scale advantages. With upscale cafelike environments and

one of the most widely recognized brands in the world,

Starbucks is among the few retail concepts to be

successfully replicated across the globe. As a result of these

competitive advantages, we believe the firm enjoys price

leadership advantages that allow it to generate excess

economic returns.

Moat Trend

The compelling economics behind a specialty coffee

program have attracted a number of substitutes in recent

years, most notably McDonald's McCafe menu. Though we

doubt that most quick-service restaurant chains are willing

or able to compete with Starbucks' in-store customer

experience, increased competition could erode Starbucks'

price leadership; this results in our negative moat trend

rating. That said, we believe the firm has taken prudent

steps to neutralize these competitive threats, including

partnerships to offer its Seattle's Best Coffee brand at more

than 9,000 Subway and 7,250 Burger King locations by the

end of 2010. If Starbucks is successful in its endeavors with

quick-service restaurant partnerships, we believe the moat

trend could stabilize.

© Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not

represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To

order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

Page 5 of 11

Morningstar Corporate Credit Rating

Starbucks Corporation SBUX (NAS)

|

A-

Business Risk

Cash Flow Cushion™

Solvency Score

Distance To Default

Economic Moat™

Industry Group

Sector

Good

Fair

Good

Very Good

Wide

Restaurants

Cons Svcs

Outstanding Issues

Outstanding Issue By Maturity Date and Yield

Issue Information

Name

Starbucks 6.25%

Currency

USD

Maturity

Date

15 Aug 2017

Coupon

(%)

6.25

Price

114.926

Yield

(%)

3.78

Callable

Yes

Convertible

No

Modified

Duration

5.7

Source: IDC and Finra

A maximum of 33 issues is displayed.

© Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not

represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To

order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

Page 6 of 11

Morningstar Corporate Credit Rating

Starbucks Corporation SBUX (NAS)

|

A-

Business Risk

Cash Flow Cushion™

Solvency Score

Distance To Default

Economic Moat™

Industry Group

Sector

Good

Fair

Good

Very Good

Wide

Restaurants

Cons Svcs

Recent Notes from our Credit and Equity Analysts

Is Starbucks’ 2011 Outlook Achievable? 22 Jul 2010

We're keeping our fair value estimate for Starbucks SBUX

intact, as the company turned in another solid quarter and

provided an initial outlook for 2011 that was consistent with

our expectations. We remain impressed by the continued

success of growth initiatives such as VIA instant coffee and

Seattle's Best Coffee and also by efforts to breathe life into

existing products. The rollout of the customizable

Frappuccino platform contributed roughly 2% of the 9% total

increase in comparable-store sales for the third quarter and

helped to drive positive sales growth of bottled Frappuccino

products sold in other retail outlets. In our view, a 6% jump

in customer traffic and increased usage of the My Starbucks

Rewards card (which has attracted more than 1 million

members in its first six months) validates our thoughts about

the relevancy of the Starbucks brand and recent in-store

enhancements. Despite lapping more difficult comparisons

versus the year-ago period and increased marketing

investments to support consumer product segment growth

platforms, Starbucks still delivered 270 basis points of

operating margin improvement to 13.3% (excluding

restructuring costs), suggesting the aggressive expense-reduction

measures and operating efficiencies put in place the past

few years can have a lasting impact on Starbucks' cost

structure. The company remains on track to meet our

full-year targets of high-single-digit top-line growth and

operating margins of around 13%.

Though early, we believe management has set realistic

expectations for 2011. Our mid-single-digit top-line growth

forecast is in line with management's, driven by

low-single-digit unit growth, mid-single-digit comparable-store

sales growth, and increased contribution from the global

consumer product group. Although tougher comparisons

and a still uncertain economic environment will probably

put 2011 comparable-store sales growth modestly below

2010 levels, we remain confident in this target as a result

of higher-ticket product platforms and other initiatives to

drive traffic. In our view, management's outlook for 50-100

basis points of operating margin expansion in 2011 (implying

midteen operating margins) appears slightly conservative,

even after taking into account higher coffee commodity

costs in the early part of the year and increased advertising

costs to support new product platforms. We remain

optimistic about Starbucks' margin expansion opportunities

in 2011 because of increased sales penetration from

profit-accretive businesses such as food service and product

licensing as well as positive leverage stemming from

cost-cutting efforts over the past few years. As such, we

would not be surprised if Starbucks came in at the high end

(or a few pennies ahead) of next year's earnings target of

$1.36-$1.41 per share.

Strong 2Q for Starbucks 22 Apr 2010

We plan to modestly raise our fair value estimate for

Starbucks SBUX after second-quarter results that reinforced

our belief that cost reductions and other operating

efficiencies put in place in the past few years will have a

lasting impact on the firm's domestic operations.

Furthermore, we have greater confidence that many of these

efforts can be replicated in international markets, driving

meaningful margin expansion over the long haul. On the

basis of the success of two of Starbucks' recent growth

initiatives--the rollout of VIA instant coffee in additional

foreign markets and new partnerships for the firm’s Seattle's

Best Coffee brand--we also plan to raise our long-term

growth assumptions for the consumer product segment.

Although we recognize the potential threat that McDonald's

MCD and other industry players represent, we continue to

believe the global specialty coffee market is large enough

to accommodate several major participants.

Given the substantial headwinds facing Starbucks during

the past two years, the firm's rapid turnaround has been

nothing short of remarkable. Comparable-store sales grew

7% for the quarter, fueled by a 3% increase in customer

© Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not

represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To

order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

Page 7 of 11

Morningstar Corporate Credit Rating

Starbucks Corporation SBUX (NAS)

|

A-

Business Risk

Cash Flow Cushion™

Solvency Score

Distance To Default

Economic Moat™

Industry Group

Sector

Good

Fair

Good

Very Good

Wide

Restaurants

Cons Svcs

Recent Notes from our Credit and Equity Analysts

traffic and a 4% gain in the average ticket. We find both

components of comparable-store sales growth to be

significant; the increase in traffic for the first time in 13

quarters in the United States suggests improved consumer

discretionary spending patterns, while the average ticket

growth implies that recent pricing modifications and new

product innovations (including food offerings and VIA) are

having a meaningful impact. When combined with last

year's store closings, head count reductions, lease

renegotiations, and store-level waste-management efforts,

the strong second-quarter top-line results were enough to

drive the highest second-quarter operating margins in the

firm's history (13.4%). We believe this quarter will probably

represent the high-water mark for 2010, as the firm plans

to ramp up marketing efforts in the back half of the fiscal

year to support new in-store initiatives and the launch of

VIA in broader consumer product channels.

Starbucks Announces Initial Cash Dividend 24 Mar 2010

We are not changing our fair value estimate for Starbucks

SBUX following the announcement that the board has

authorized the firm's first-ever cash dividend. The firm will

pay its initial quarterly dividend of $0.10 per share on April

23, representing a dividend yield of about 1.6% at the

current stock price. The firm said it is initially targeting a

dividend payout ratio of 35%-40% of net income, though

future dividend payouts will be subject to board approval.

Starbucks also announced that its board has authorized the

repurchase of 15 million shares, on top of the 6.3 million

shares that remain available for repurchase under previous

programs.

Our model projects that Starbucks will generate around $1

billion in annual free cash flow the next few years, or around

9% of revenue. As such, we are confident that Starbucks

will be able to fund its growth initiatives, even with these

shareholder-enhancing activities. Since we do not expect

the firm to return to lofty double-digit revenue growth in the

foreseeable future, we believe this is the appropriate time

to put a dividend program in place.

New Credit Rating: Starbucks 09 Feb 2010

Morningstar is initiating credit coverage of Starbucks SBUX

with an issuer rating of A-. We have very few concerns about

the firm's credit risk. Starbucks carries only $550 million in

total debt obligations--equal to less than a third of operating

income, excluding depreciation and amortization--versus

about $1.4 billion in cash on its balance sheet. In addition,

the entirely of its debt load is in the form of notes that don't

mature until 2017. Operating leases are a bit more of a

concern, but we don't believe the firm will have any trouble

meeting these obligations. We forecast lease payments of

$773 million in fiscal 2010, growing to about $1 billion

annually over the next decade. Starbucks has been active

in renegotiating leases with landlords over the past year,

and our operating lease estimates may prove somewhat on

the high side. However, as there is no way to accurately

verify the impact of these lease negotiations, we prefer to

have more-stringent numbers included in our Cash Flow

Cushion calculations. Capitalizing lease expenses, we place

Starbucks' total debt load at a bit over $6 billion, bringing

leverage net of cash to 3.3 times operating income,

excluding depreciation and amortization.

While leverage in on the high side, Starbucks has a long

history of using leases wisely. Although the firm closed 800

underperforming locations in the United States because of

mounting economic challenges, stores are typically situated

in prominent locations rife with consumer traffic. In our

view, Starbucks' prime locations make it extremely difficult

for rivals to succeed. As a result of its competitive position,

the firm has generated strong, consistent free cash flows,

averaging 5% of revenue during the past five years. We

believe Starbucks is navigating the current economic

environment well and is poised to deliver modest long-term

growth in the U.S. International expansion should provide

© Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not

represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To

order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

Page 8 of 11

Morningstar Corporate Credit Rating

Starbucks Corporation SBUX (NAS)

|

A-

Business Risk

Cash Flow Cushion™

Solvency Score

Distance To Default

Economic Moat™

Industry Group

Sector

Good

Fair

Good

Very Good

Wide

Restaurants

Cons Svcs

Recent Notes from our Credit and Equity Analysts

incremental growth as well. We expect the firm will

generate enough cash to cover its obligations, including

operating lease payments, 1.9 times over during the next

five years.

On the surface, our view of Starbucks could support a slightly

higher credit rating. However, 46% of the firm's 16,600

global stores were operated by licensees as of September

2009. Although we generally consider Starbucks' licensees

to be high quality, we acknowledge there are credit risks

involved with individual licensees. If Starbucks runs into a

rough patch, it has $2.5 billion in net property, plant, and

equipment that should provide an asset base to secure debt

if necessary.

© Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not

represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To

order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

Page 9 of 11

Morningstar Corporate Credit Rating

Morningstar’s Approach to Rating Corporate Credit

3 Offers a proprietary

measure of the credit quality of companies on our

coverage list.

3 Encapsulates our in-depth

modeling and quantitative

work in one letter grade.

3 Allows investors to rank

companies by each of

the four underlying components of our credit

ratings, including both

analyst-driven and

quantitative measures.

Purpose

Methodology

The Morningstar Corporate Credit Rating measures the

ability of a firm to satisfy its debt and debt-like obligations.

The higher the rating, the less likely we think the company

is to default on these obligations.

We feel it’s important to perform credit analysis through

different lenses—qualitative and quantitative, as well as

fundamental and market-driven. We therefore evaluate

each company in four broad categories.

The Morningstar Corporate Credit Rating builds on the

modeling expertise of our securities research team. For

each company, we publish:

Business Risk

Business Risk captures the fundamental uncertainty around

a firm’s business operations and the cash flow generated

by those operations. Key components of the Business Risk

rating include the Morningstar Economic Moat™ Rating

and the Morningstar Uncertainty Rating.

3 Five years of detailed pro-forma financial statements

3 Annual estimates of free cash flow

3 Provides access to all

the underlying forecasts

that go into the rating,

available through our institutional service.

3 Annual forecasts of return on invested capital

3 Scenario analyses, including upside and downside cases

3 Forecasts of leverage, coverage, and liquidity ratios

for five years

3 Estimates of off balance sheet liabilities

These forecasts are key inputs into the Morningstar

Corporate Credit Rating and are available to subscribers

at select.morningstar.com.

Cash Flow Cushion ™

Morningstar’s proprietary Cash Flow Cushion™ ratio is a

fundamental indicator of a firm’s future financial health

The measure reveals how many times a company’s internal

cash generation plus total excess liquid cash will cover

its debt-like contractual commitments over the next

five years. The Cash Flow Cushion acts as a predictor of

financial distress, bringing to light potential refinancing,

operational, and liquidity risks inherent to the firm.

Morningstar Research Methodology for Determining Corporate Credit Ratings

BB

Competitive

Analysis

Cash-Flow

Forecasts

Scenario

Analysis

Quantitative

Checks

Rating

Committee

C

AAA

A

CC

Analyst conducts

company and

industry research:

Management interviews

Conference calls

Trade show visits

Competitor, supplier,

distributor, and

customer interviews

• Assign Economic

Moat™ Rating

•

•

•

•

Analyst considers

company financial

statements

and competitive

dynamics to

forecast future

free cash

flows to the firm.

Analyst derives

estimate of CashFlow Cushion™.

Analysts run bull

and bear cases

through the model

to derive alternate

estimates of

enterprise value.

Based on competitive analysis,

cash-flow forecasts, and

scenario analysis,

the analyst

assigns

Business Risk.

We gauge a firm’s

health using

quantitative tools

supported by our

own backtesting

and academic

research.

Senior personnel

review each

company to

determine the

appropriate final

credit rating.

• Review modeling

• Morningstar

Solvency Score™

• Distance to Default

assumptions

BBB

CCC

B

D

AA

AAA

AA

A

BBB

Extremely Low Default Risk

Very Low Default Risk

Low Default Risk

Moderate Default Risk

BB

B

CCC

CC

Above Average Default Risk

High Default Risk

Currently Very High Default Risk

Currently Extreme Default Risk

• Approve

company-specific

adjustments

C

D

Imminent Payment Default

Payment Default

©2010 Morningstar. All Rights Reserved. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

© Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not

Redistribution is prohibited without written permission. For licensing or permission to use this information, call +1 312-696-6869.

represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To

order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

of 8

PagePage

10 of7 11

Morningstar Corporate Credit Rating

Morningstar’s Approach to Rating Corporate Credit

The advantage of the Cash Flow Cushion ratio relative to

other fundamental indicators of credit health is that the

measure focuses on the future cash-generating

performance of the firm derived from Morningstar’s

proprietary discounted cash flow model. By making

standardized adjustments for certain expenses to reflect

their debt-like characteristics, we can compare future

projected free cash flows with debt-like cash commitments

coming due in any particular year. The forward-looking

nature of this metric allows us to anticipate changes in a

firm’s financial health and pinpoint periods where cash

shortfalls are likely to occur.

Morningstar Solvency Score™

The Morningstar Solvency Score™ is a quantitative score

derived from both historical and forecasted financial ratios.

It includes ratios that focus on liquidity (a company’s

ability to meet short term cash outflows), profitability

(a company’s ability to generate profit per unit of input),

capital structure (how does the company finance its

operations), and interest coverage (how much of profit is

used up by interest payments).

Overall Credit Rating

The four component ratings roll up into a single preliminary credit rating. To determine the final credit rating,

a credit committee of at least five senior research personnel reviews each preliminary rating.

We review credit ratings on a regular basis and as events

warrant. Any change in rating must be approved by the

Credit Rating Committee.

Investor Access

Morningstar Corporate Credit Ratings are available on

Morningstar.com. Our credit research, including detailed

cash-flow models that contain all of the components of the

Morningstar Corporate Credit Rating, is available to

subscribers at select.morningstar.com.

Distance to Default

The Distance to Default rating is a quantitative, marketbased measure of a company’s current financial health.

(Distance to Default serves as the basis for Morningstar’s

Financial Health Grade.) The underlying model treats

the equity of a firm as a call option on that firm’s assets.

Based on estimates of asset volatility and the BlackScholes option-pricing model, we can estimate the

likelihood that the value of the company’s assets falls

below the value of its liabilities, implying likely default.

For each of these four categories, we assign a score, which

we then translate into a descriptive rating along the scale

of Very Good / Good / Fair / Poor / Very Poor.

©2010 Morningstar. All Rights Reserved. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

© Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not

Redistribution is prohibited without written permission. For licensing or permission to use this information, call +1 312-696-6869.

represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To

order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

of 8

PagePage

11 of8 11