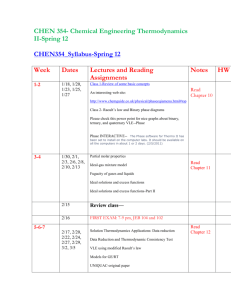

Modern Economic Theory and Development

advertisement