MDL-830 - National Association of Insurance Commissioners

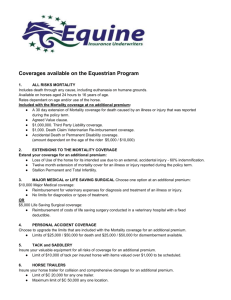

advertisement