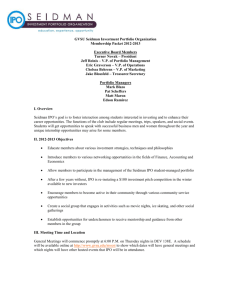

Pre-Market Trading and IPO Pricing

advertisement