Sustainable Growth

advertisement

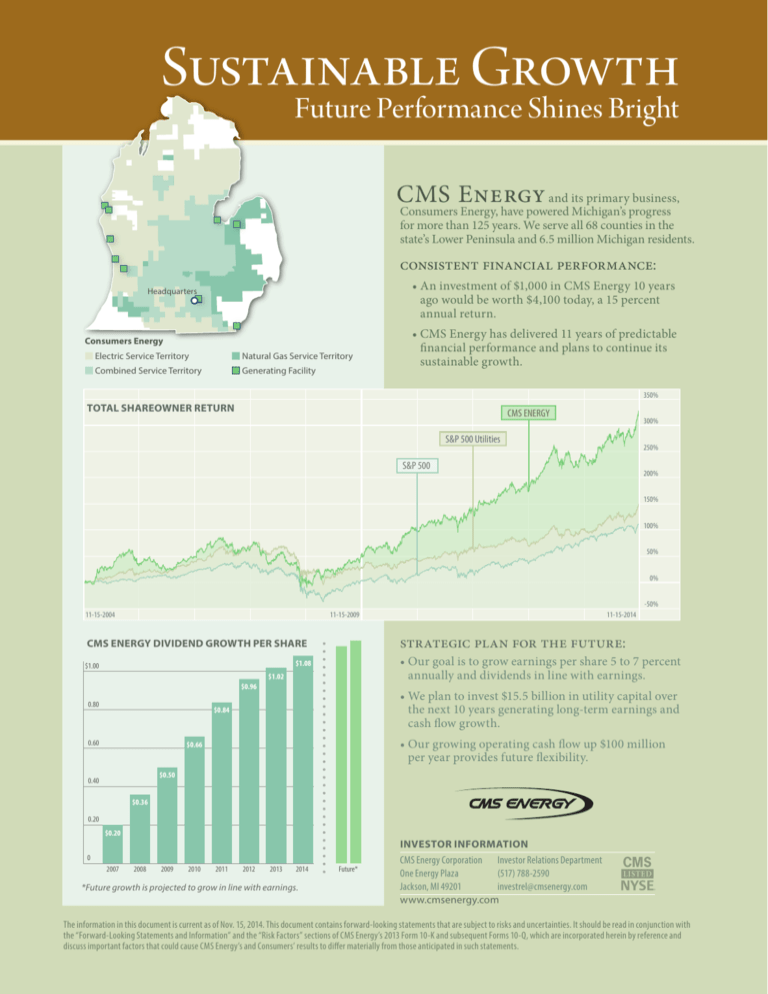

Sustainable Growth Future Performance Shines Bright CMS Energy and its primary business, Consumers Energy, have powered Michigan’s progress for more than 125 years. We serve all 68 counties in the state’s Lower Peninsula and 6.5 million Michigan residents. consistent financial performance: • An investment of $1,000 in CMS Energy 10 years ago would be worth $4,100 today, a 15 percent annual return. Headquarters Consumers Energy Electric Service Territory Natural Gas Service Territory Combined Service Territory Generating Facility • CMS Energy has delivered 11 years of predictable financial performance and plans to continue its sustainable growth. 350% TOTAL SHAREOWNER RETURN CMS ENERGY 300% S&P 500 Utilities 250% S&P 500 200% 150% 100% 50% 0% -50% 11-15-2004 11-15-2009 strategic plan for the future: CMS ENERGY DIVIDEND GROWTH PER SHARE • Our goal is to grow earnings per share 5 to 7 percent annually and dividends in line with earnings. $1.08 $1.00 $1.02 $0.96 0.80 • We plan to invest $15.5 billion in utility capital over the next 10 years generating long-term earnings and cash flow growth. $0.84 0.60 11-15-2014 • Our growing operating cash flow up $100 million per year provides future flexibility. $0.66 $0.50 0.40 $0.36 0.20 $0.20 0 2007 2008 2009 2010 2011 2012 2013 2014 *Future growth is projected to grow in line with earnings. Future* INVESTOR INFORMATION CMS Energy Corporation Investor Relations Department (517) 788-2590 One Energy Plaza investrel@cmsenergy.com Jackson, MI 49201 www.cmsenergy.com The information in this document is current as of Nov. 15, 2014. This document contains forward-looking statements that are subject to risks and uncertainties. It should be read in conjunction with the “Forward-Looking Statements and Information” and the “Risk Factors” sections of CMS Energy’s 2013 Form 10-K and subsequent Forms 10-Q, which are incorporated herein by reference and discuss important factors that could cause CMS Energy’s and Consumers’ results to differ materially from those anticipated in such statements. Organic Growth Sustainable Over the Long-Term capital investments: Cross Winds® Energy Park • Capital investments of $15.5 billion over the next 10 years supports earnings per share and rate base growth. #2 in renewables in the Great Lakes area • Over the next 10 years, CMS Energy plans to make investments in customer reliability, clean energy and smart grid technology. • CMS Energy has been the second largest investor in the state of Michigan over the last five years. total shareowner return: • Predictable and visible earnings growth of five to seven percent, with a 11-year track record that speaks for itself. Ludington Pumped Storage Facility #4 largest in the world • Eight years of dividend growth with plans to grow future dividends in line with earnings. • Over the last 10 years, CMS Energy has grown total shareowner return more than 300 percent, the best in the Electric Utility sector. CMS Energy is a sound, proven choice for investors. Southwest Michigan Natural Gas Pipeline #1 LDC in natural gas storage research coverage: • Argus Research Gary Hovis • Barclays Capital Daniel Ford • BMO Capital Markets Michael Worms • Credit Suisse Dan Eggers • Deutsche Bank Securities Jonathan Arnold • Evercore ISI Greg Gordon • Hilliard Lyons David Burks • KeyBanc Capital Markets Paul Ridzon • Ladenburg Thalmann Brian Russo • Macquarie Research Andrew Weisel • Morningstar Mark Barnett • RBC Capital Markets Shelby Tucker • RW Baird David Parker • SunTrust Ali Agha • UBS Julien Dumoulin-Smith •W ells Fargo Neil Kalton •W olfe Research Steven Fleishman www.cmsenergy.com