Filling Seats at a Theater: Estimating the Impact of Posted Prices

advertisement

Filling Seats at a Theater: Estimating the Impact of

Posted Prices and Dynamic Discounts

Necati Tereyağoğlu

Peter Fader

Senthil Veeraraghavan

{necati, faderp, senthilv}@wharton.upenn.edu,

The Wharton School, University of Pennsylvania,

Philadelphia, PA 19104

March 2012

Preliminary and Incomplete

Abstract

Applying revenue management techniques for the entertainment industries, such as theaters,

faces several specific challenges. Many theaters increase their audience and revenues through

promotional discounts and pricing strategies based on the quality of the seats. Due to the

varying quality of shows, and the high availability of seats, many customers purchase tickets or

postpone their purchases in anticipation of future promotion periods and discounts. In order to

respond to such purchasing habits, it is vital to understand the underlying process that governs

the timing of the customer’s purchases. To this end, we develop a competing proportional

hazard framework that models the dynamic effects of an organization’s show and time related

pricing decisions on the customer’s propensity to purchase a ticket for a variety of dates and

times during a specified timeframe. We test our model on data from a leading performing

arts organization located in the Northeast USA, covering theater ticket sales over two seasons.

We demonstrate the model’s descriptive capabilities by reviewing the effects of discounts, the

timing of the show, the base price of the ticket category, and multiple factors for the sales figures

for the fifty-three individual performances. Finally, we define dynamic pricing and discounting

strategies to increase the organization’s revenues. For instance, we provide and empirically test

our suggestions to identify attractive ticket price tiers for subscribers and occasional buyers over

time; and to develop discount decisions that increase the revenues from each performance.

1

1

Introduction

Pricing and Revenue Management of theater tickets is an emerging area of theoretical interest.

Unlike airline tickets, which are merely products that serve travelers between destinations, theaters

sell shows that have attributes of desired leisure and exciting experience. Such attributes make it

hard for the organization to extract the information about a customer’s perceived valuation of the

show. Therefore, not having this information, makes it hard to determine the customer’s likelihood

to attend the show. From the organization’s standpoint, the information about the timing of ticket

purchases plays a crucial role in the effective management decisions because it enables them to test

appropriate pricing and discounting strategies to improve revenues.

In general, the entertainment industry has been plagued with struggling revenues and losses.

Attendance has fallen due to the recent economic conditions, the increase in ticket prices, and the

change in customer interests towards the theater performances. This issue is further compounded

by the customer’s propensity to purchase a ticket for a show may change over time due to theater,

venue, concert and time related factors.

The objective of this paper is to analyze the impact of pricing and discounting strategies at a

theater on the timing of ticket purchases, using a data-driven probabilistic model. We analyze several factors using this model, including the following: (i) the purchasing intensity of the customer’s

demand for a ticket; (ii) the subscribers within several categories; and (iii) the occasional buyers

who compete to purchase a ticket for a specific show. We also determine the interdependence of

the customer’s category and the underlying behavior on their purchase intensities; as well as, the

influences that cause tickets purchases to change over time, such as the organization, concert, and

time related factors. We employ a proportional hazard framework to track the impact of these

factors on the hazard rate over time.

There is very little empirical research that has been done in the area; although, there is growing

attention for this type of research in the recent years. Probably, the most important research paper

on price discrimination, in this category of revenue management, is credited to Leslie (2004), who

studies price discrimination at a Broadway theater, where the ticket prices are based on the seat

quality (second degree price discrimination) and the discount prices are based on mail coupons

(third-degree) received by customers and redeemed at the time of ticket purchases. There has also

2

been considerable theoretical research in revenue management, beginning with the classical model

by Gallego & van Ryzin (1994). This model states that the organization makes pricing decisions

in response to the customer arrivals (the time of ticket purchases) over time. Nevertheless, to our

knowledge there have been no research papers that have empirically explored the pricing impacts

from the ticket standpoint.

Using a statistical model, we model the customer arrivals over time as impacted by pricing,

discounting and scheduling decisions of the organization. Using this model, we evaluate and implement pricing decisions that facilitate the organization’s management to make the best revenue

generating decisions based on the timing of customer purchases rather than focusing on the effect

of a single pricing policy for the whole population.

We develop and implement our model by using the individual level transaction data from a

renown Northeast orchestra in USA. We confirm that the theater organization sells more tickets to

subscribers at earlier periods in the show season; whereas, occasional buyers purchase their tickets

in later periods – closer to the performance date.

Thus, we find evidence that the general assumptions and pricing strategy from the airline

setting, where the pricing strategy postulates that selling to customers with lower valuations at

earlier periods; and then, start selling to customers with higher valuations (higher prices) in the

later periods does not hold true for the theater setting.

In fact, we find that cheap tier theater tickets are purchased later (closer to the show day)

than the expensive-tier tickets. We explore the varying effects of scheduling a promotion period,

i.e. subscription drive for the Last Week or Rush Week period on timing of purchases for different

ticket price tiers. Normally, we would expect delays in the ticket purchases in response to an

increase in the base ticket price. For instance, our research reveals that the expected time to sell a

ticket to both subscribers and occasional buyers increases by approximately more than one day, if

we increase the price of an expensive tier ticket by one dollar ($1). Similarly, we observe comparable

effects for the mid-expensive and cheap tier tickets. Finally, we discover that discount promotions

offered to the expensive and cheap tier tickets, make it more likely to sell tickets to both occasional

buyers and subscribers at earlier periods. For instance, a one percent (1%) increase in the discount

percent offered to customers, increases the expected time to sell a ticket to the occasional buyers

and subscribers by 0.13 and 0.19 weeks respectively.

3

Theaters are in need of a practical tool to predict the weekly sales for each and every performance. We verify the predictive capabilities of our model. It performed effectively in predicting

the sales for the 2009-2010 season. These accurate predictions led us to apply some counterfactual

analysis to our research to determine the possibility of the organization generating more revenue

with a simple pricing strategy, including discounts. These computations reveal that static pricing

together with linear discount strategies provide more revenues to the organization than the current

revenue management strategies.

The lay-out of our research paper is the following: First, we position our within the broad scope

of the extant literature in Section 2. Then, in Section 3, we describe the individual level transaction data gathered from an anonymous orchestra in USA. In addition, we explain our competing

proportional hazard model that delves into the underlying purchasing behavior of the subscribers

and occasional buyers in Section 4 and discuss our method of analysis in Section 5. In Section 6, we

provide some descriptive results about the impact of various factors on the customer’s intensity to

purchase a ticket. In section 7, we check the predictive capability of our model and illustrate some

counterfactuals. In section 8, we summarize our findings. Additionally, we share some of the best

practice learning and important conclusions for improvements in theater management. Finally, we

discuss our ideas for future research.

2

Literature Positioning

The customer’s demand for experiential products, in the entertainment industry, such as, theater

seats, music albums, and movies, is purely dependent on the organization’s efforts to respond to the

customer’s purchasing habits at that moment. This requires making the preferred product available

at the crucial time, with sufficient quality and at an affordable price. Otherwise, the customer may

lose interest and will not buy the product at that moment, nor will they purchase the product at

any time in the future.

From the organization’s perspective, lacking the proper tools to determine ways to satisfy

the customer’s desires and requirements creates significant roadblocks in their revenue generation

capability. So, there has been an emerging interest in theoretical literature to provide dynamic

pricing strategies, but it has been mostly restricted to airline settings.

4

This paper offers the management of an organization a probabilistic model for understanding

the underlying purchasing habits of different customer categories. It also provides a flexible and

practical tool to assist them to test alternative pricing and discounting strategies. This enables

the organization to more effectively respond to the varying purchasing habits of their current and

prospective customers over time.

Prior Empirical Research: There is very little empirical research that has been done in the

area of ticket pricing for performing arts organizations, in theater settings, such as symphonies and

orchestras. Tirole (1988) provides an extant description of price discrimination strategies, and the

practice of charging different prices to different types of customers. For a variety of markets under

the theoretical framework, along the same line, Rosen and Rosenfield (1997) explore ticket pricing

by focusing on the price discrimination of theater seats. Under empirical framework, Leslie (2004)

looks at Broadway ticket sales and explores the effects of i) price discrimination, where the practice

involves setting prices based on the seat quality (second degree price discrimination), ii) providing

discounts, in the form of mail coupons (third degree price discrimination) on the revenues of the

theater, and on the welfare of customers. Chu et. al. (2011) introduce a new type of bundle pricing

strategy which investigates whether using the same price for bundles of the same size provides

approximately the same revenues, as mixed bundling strategies generate.

In totality, these empirical findings provide a thorough analysis of common ticket pricing strategies that are non-changeable throughout the season, they lack the ability to provide information on

the underlying customer behavior in the market. In contrast, our model looks at the dynamic effect

of prices and discounts on customer purchase decisions. It provides an understanding of the timing

of a customer’s purchases allowing the organization to better respond to the changes that affect

the timing of the customer’s purchases based on organization, concert and time related factors.

Theoretical RM Research: As noted in Bitran and Caldentey (2003) and Elmaghraby and

Keskinocak (2003) there has been extensive theoretical research on dynamic pricing but very little

empirical research on such pricing issues. Gallego and van Ryzin (1994) introduced the canonical

dynamic pricing model for a single product case. A Poisson process with a stationary but price

dependent arrival rate predicts the arrival of customers in the setting. They show the asymptotic

optimality of a fixed price policy. There is an extension of this study where multiple products

are compared at the same time to provide a similar asymptotically optimal fixed pricing policies

5

(Gallego and van Ryzin 1997). These papers along with many other subsequent ones assume that

the customer’s decisions are influenced by a homogenous process in which the arrival rate is inversely

correlated to the price charged by the organizations. We refer the reader to Talluri and van Ryzin

(2004) for an extensive analysis of theory and practical issues in revenue management settings.

In many settings, we find that the timing of customer’s purchases may also be influenced by

other organization-related dynamic factors, such as the discounts offered in the previous periods,

or by concert and time related factors. Hence, these optimal pricing policies have some limitations

without a clear understanding of the customer’s responses. Recently, there has been some literature

on dynamic pricing strategies that depend not only on the inventory level and time, but also on

the information that the organization has at the individual level of each customer. Some of the

recent work examines the use of personalized pricing. Kuo, Ahn, and Aydin (2007) study the

impact of a customer’s ability to negotiate on the organization’s dynamic prices and revenues;

whereas, Netessine, Savin, & Xiao (2006), Aydin & Ziya (2007) investigate upselling and crossselling, when the price set for the ticket depends on the customer’s prior experience on what s/he

bought previously from the seller.

There has been a growing literature on exploring the impact of demand learning on dynamic

pricing strategies, when the organization does not know the specific characteristics of the market

that impacts the arrival process of customers; but, it has a prior belief about their characteristics.

Aviv and Pazgal (2005a) initiate the use of Bayesian learning within the dynamic pricing model of

Gallego and van Ryzin (1994) by assuming a Gamma distributed prior belief on the demand intensity that dictates the Poisson arrivals to create a new system. Popescu and Wu (2007) investigate

consumer reference effects when faced with dynamic pricing.

In general, optimal dynamic pricing policies are known to be hard to characterize. Farias

and van Roy’s (2010) decay-balancing heuristic provides a good numerical performance for the

Gamma distributed arrival rate model. Araman and Caldentey (2009) consider demand learning

in an infinite horizon setting. Similarly, the arrival process is parameterized by using an unknown

parameter with Bayesian updating and performed in a sequential testing process. Bertsimas and

Perakis (2006) consider a discrete-time model in which demand is formulated in a linear function of

price but with unknown coefficients, and white noise is added to provide little random shifts over

time.

6

Motivated by the stream, we model the customer arrivals as a Poisson process. Additionally,

we model the time related effects on non-stationarity of the Poisson arrival process. We use an

artifact as customer level data to understand the proportional and fixed effects of the organization,

concert and time related factors on the timing of customer’s purchases rather than imposing an

abstract mathematical structure on the demand learning. The dependency of the demand on the

initial prior belief makes it limited for predictive suggestions, unless the user of the tool makes sure

that the prior belief holds.

Our model provides the user the capability to track a ticket’s propensity to be sold throughout

the time horizon without setting prior beliefs on the customer’s demand intensities. In addition

to this framework, there has been a growing interest on understanding the demand using a nonparametric approach. For instance, Besbes and Zeevi (2009) explore the unobserved characteristic

of the customer’s demand by the set of all demand models that could potentially be factored into

the analysis. Nevertheless, in this paper, we employ a parametric model, mainly as a structural

evaluation.

Recent empirical research in marketing literature has studied a number of different probabilistic

models to explore the customer’s underlying purchasing behavior in different markets. One relevant

empirical research study that moves away from the organization’s perspective and starts the analysis

from the customer level is done by Moe and Fader (2009). Their research develops a Weibull model

that explores the timing of a customer’s purchase decisions within each price tier of a theater.

They measure the customers’ responsiveness to various dimensions of price through the use of

time-varying and price-related factors. Furthermore, they incorporate a measure of spot market

size. In contrast, our objective is to understand the underlying customer behavior in a market of

concert tickets and to provide dynamic discount strategies to increase the organization’s revenue

generation capability.

Unlike all these research studies that begin the process and build the model from the customer’s

perspective to try to perceive the customer’s purchasing behavior, we utilize the tickets for the

theater seats as our test subjects, and model their cause-specific sales.

In this paper, we analyze two different types of customers and their arrival process to purchase

tickets and the resultant impact of organization, concert and time related factors on the timing

of these purchases. We use a proportional hazard framework (Cox 1972) to explore the impact

7

of dynamic organization and time related factors on the exponentially distributed timing of these

purchases. Such duration models have not been widely used in operations management, except in

one empirical article by Terwiesch et. al. (2005) on supply chain management.

Our research analyzes the arrival streams of two different types of customers who compete with

each other for a ticket. Then, we explore the “intensity” of the streams and the observed factors in

the market that exert influence on them. We model the sales point of the ticket as the culmination

of a race between the two streams under the competing hazard framework (Prentice et. al. 1978

and Han & Hausman 1990).

3

Summary of the Data

This research is based on data collected during two seasons of ticket sales transactions at the

individual level for a reknown symphony orchestra in the Northeast region of the United States.

The orchestra management relies heavily on revenues from ticket sales from single ticket customers

and various categories of season ticket subscribers, as well as donors to sustain their long-term

future. The data was collected by our team from several departments and the employees working

at the ticket booths. Each recorded transaction in the data reflects not only the number of tickets

sold, their transaction price, but also the type of customer purchasing the ticket with the discount

used during the transaction.

There is very little doubt that the marginal cost of every ticket sold is insignificant. Thus,

the revenue management setting is appropriate. One of the goals of the management is revenue

maximization and the other is maximizing the total sales for all concerts - that is to say, filling all

the seats in the venue at each performance. The motivation is that there is a strongly perceived

positive effect of a crowded hall on the customer’s experience at the concert and their retention, as

an ongoing and repeat customer.

Our data covers ticket sales for two years. It includes a total of fifty-three performances during

the 2008-2009 season; and fifty-four performances during the 2009-2010 season. Each season has

about twenty-one weeks of concerts or performances. Multiple concerts of the same repertoire are

performed each week on different days and times. The concerts are generally scheduled on Fridays

and Saturdays; and occasionally on Thursdays and Sundays. Therefore, there are a total of fifty-

8

three performances in the twenty-one weeks which is considered a full season. In each of the 21

weeks, a different artist musician presents a distinct repertoire, with most of the shows conducted

by the orchestra conductor.

The theater venue has a maximum seating capacity of 2,674 seats. Our data covers 9,833

distinct customers – a few special customers, many regulars, and various categories of subscribers.

The concerts are very rarely sold out. Thus, seating capacity is not an issue. For example, in the

2008-2009 season, the average sales was 1,661 per concert (with a standard deviation of 457) which

is about 62% of the capacity of the venue. During the season of fifty-three concerts, only eight

shows had sales in excess of 80% of the venue capacity.

The venue is divided into three tiers of seating, which are typically sold in eight different zones

(1, 2, 3, etc.) which are situated in various locations in the venue. Although there could be

individual seat differences, the prices of these seats are determined by the seat quality that is

associated with the zone – in other words, the acoustic experience and the visual line of sight to

the stage. There is a significant price difference between the zones.

It should be noted that independent of the ex ante expectations of the quality of the show, the

advertised ticket prices, depend only on the day of the concert, and the zone location of the ticket.

For instance, on Fridays, the high priced zones are sold at an advertised ticket price of $78.50 and

the lowest priced zone ticket is about $19.50. The list of advertised ticket prices for all shows are

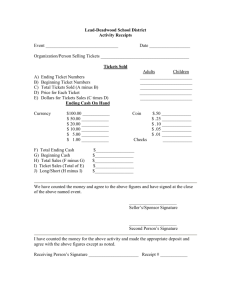

shown in Table 1.

Typically, ticket sales begin several weeks in advance of the first concert of the season. In our

data, the ticket sales begin as early as thirty-nine weeks prior to the first concert week. Thus, our

data covers sales over sixty weeks for the full season.

Nevertheless, there is a variety of discount options and programs available to the customers

throughout the concert season. The mean price of the ticket sold is $28.63, and the standard

deviation is $16.08. The average Gini coefficient for 0.216 (and the standard deviation is 0.031).

This indicates that the expected absolute difference between the prices of any two tickets chosen

at random is about 42% of the mean price.

There are a variety of customer categories in the data. There are subscribers who subscribe to

all twenty-one shows, fourteen-show subscribers, and seven-show subscribers. Subscribers commit

to purchase different pre-set quantities of tickets. It is only a commitment - though they pay for

9

Tier

1

2

3

4

5

6

7

8

Day of the Show

Thurs

Fri/Sat

Sun

Thurs

Fri/Sat

Sun

Thurs

Fri/Sat

Sun

Thurs

Fri/Sat

Sun

Thurs

Fri/Sat

Sun

Thurs

Fri/Sat

Sun

Thurs

Fri/Sat

Sun

Thurs

Fri/Sat

Sun

2008-2009

41.50

78.50

71.50

34.50

63.50

53.50

29.50

52.50

47.50

26.50

49.50

45.50

24.50

47.50

41.50

19.00

40.00

32.50

15.00

26.50

23.50

12.00

19.50

17.00

2009-2010

43.50

82.50

75.00

36.50

67.00

56.00

29.50

52.50

48.50

28.00

52.00

47.50

24.50

47.50

41.50

19.00

40.00

32.50

15.00

26.50

23.50

12.00

19.50

17.00

Table 1: The list of base prices throughout the 2008-2009 and 2009-2010 seasons.

the tickets at the time they make the commitment to attend a specific number of shows, they are

free to select the content throughout the season and may infrequently incur additional charges for

the changes. The subscribers, regardless of the number of shows that they committed to attend,

are all grouped together and labeled for the research purposes as “subscribers”. It is useful to

think of subscribers as customers who buy “flexible” bundles of shows, rather than a specific set of

seven shows. It is important to understand that the reason that subscribers do not buy tickets for

specific shows when they make their ticket purchase commitment is they are rarely penalized for

missing shows. The other main category of customers is “occasional buyers”, who may buy tickets

to multiple shows; however, they purchase their tickets to each of them, individually. In our data

set, occasional buyers typically buy tickets for about two shows.

Typically, we observe that shows where the subscribers swap their tickets are rarely sold out.

Occasionally, if the specific zone for their subscription ticket is sold out for their desired show, they

10

are offered tickets from other comparable zones. Also, subscribers are allowed to add shows to their

bundle packages at the same base ticket price or at the price of an ongoing discount.

Our data exposes the fact that there is always some form of a ticket discount in the market

offered every week. Typically, we see a significant gap between the advertised price and the average

sales price, for any zone, in any given week. As one might expect, the effect of discounts are

pervasive, – in fact, they instill a hidden message to the customer that causes a delay in the

purchase to a later time closer to the show date to take advantage of the lower priced tickets.

3.1

Some Other Notes

Income is an important dimension to understand the customer heterogeneity. However, it is hard

to obtain individual income level data, for this customer population. We examine the following

facts to determine the percentage of subscribers at each concert who are locales: 1) the location of

the orchestra, 2) the relevance of the fact that the average attendance for each concert is small, and

3) the importance of fact that the majority of the ticket customers for each concert are subscribers.

Therefore, we conclude that a significant fraction of the attendees are locals (rather than tourists).

Nevertheless, we use zip code location data for customers, whenever it was available. The customers

are dispersed over three major zip codes, which did not differ much in income levels to affect our

main findings.

3.2

Research Description

The orchestra’s management has two interdependent concerns. They are to improve revenues and

to increase the fill rate in the concert venue. Their current operational practice is to attempt to

influence the occupancy rate by deeply discounting ticket price. They hope this will lift sales.

However, this only causes several important problems.

For instance, on most days, concerts are not sold out. This is visible to customers who frequently

attend the concerts. Secondly, even when most of the capacity is sold, the management observes

that many tickets are often sold in the last weeks prior to the concert. If the seats remain unsold

until the last few weeks, then management decides to deeply discount tickets, which establishes in

a vicious cycle because customers then postpone their purchases to receive the deep discounts in

these weeks.

11

Thus, fortified with better sales information, the question becomes can last minute discounting

generate increased sales in the last periods without deep discounting. We also seek to determine

the amount that the discounting policy varies among the different seating zones and the customer

categories.

Most of the operations and revenue management literature assumes that a customer arrives in

a period, observes the available choices of the organization or theater, and decides whether or not

to buy one of the products based on the prices then leaves the process. However, in our setting, we

only observe those customers who purchased a ticket. We neither observe the underlying tradeoff

made by the customers upon selecting their seats nor their decisions not to purchase tickets for

the show. Hence, we model the propensity of a ticket being sold at a particular point in time and

the ways it differs based on the organization’s pricing and discounting actions, as they change over

time so we can gain greater understanding and efficacy.

For a couple of reasons, we do not model the customer’s choices between different ticket categories. First, based on the data, we find that there is very little substitution of tickets. The seats

in each zone are rarely sold out. Thus, we find very few occasional customers who substitute their

tickets from one zone to another. Second, we pool the data across the zones; and, simultaneously,

we conduct an analysis with the separate zones. This helps us identify the customer’s demand

across comparable zones.

A key objective is to identify ways we can effectively use the collected information, such as the

ticket purchase timing and the causes for that purchase. This information may reveal the likelihood

of a ticket sale change due to the organization’s actions as the concert date approaches.

Extant arrival models, in the literature, assume that i) the time when a customer arrives to

purchase a ticket is governed by a single stochastic process, and ii) the process is governed by a

constant rate λ. The former assumption may hold for the cases when one and only one customer

category can be affiliated with the purchase of tickets, which is hardly the case in our setting; and

more accurate in other settings. Unobserved variations among purchases made by different customer

categories may be absorbed into the population-level mixing distribution, and such heterogeneous

models may be used here to assess the ticket purchase time. Regardless if a ticket purchase is

influenced by the organizations’s actions or not, our objective is to understand the proportion of

tickets purchased by a particular customer category – not just the time of the purchase, but how

12

those proportions evolve as the concert date approaches.

This makes competing hazards by different customer categories for a ticket an acceptable way

of thinking for our objectives. Different categories of customers may have different propensities

to purchase a ticket. Our objective is to understand how those propensities change due to the

organization’s varying pricing and discounting actions over time.

Implications from the results of this study highlight different seat allocation mechanisms to

cover the gap between ticket sale propensities to customer valuations that are dictated by not only

customer oriented reasons but also by organization oriented actions. There may be many ways

for an organization to increase the likelihood of a ticket sale at a given time. An organization

that has the capability of estimating the changes in probabilities for a specific ticket sale within

a customer category for a given timeframe can benefit the management to decide when to apply

attractive pricing and promotion strategies and to which category of existing customers. Thus,

having a powerful tool gives management the knowledge to create attractive pricing and promotion

strategies to increase ticket sales completed by different customer categories.

4

4.1

Model Description

Customer Arrival

We are analyzing an orchestra (organization) which sells tickets for shows at a venue, which has

capacity of K seats that are allocated to j = 1, ..., J zones. The organization sells tickets for N shows

or performances in a season. The organization sells the tickets at the base price for the zone and/or

at a discounted price. There are different types of discounts available to the customers. There are

discounts for customers who buy tickets for a single show occasionally (“occasional buyers”); and,

those customers who buy tickets for multiple shows in advance (“subscribers”). Furthermore, if the

customer buys tickets for multiple shows in advance, s/he is allowed to inform the theater of his

selection for the specific shows s/he desires to attend at any point in time before the show dates.

Hence, even though customers may pay for multiple show tickets in advance; the actual timing of

the purchase of tickets for a particular show is the moment when the customer informs the theater

about his show selection. This type of timing of the ticket purchase process is no different from the

timing of the purchase by a customer who buys one ticket for a single show periodically. Hence, we

13

define the customer arrivals in this context of the timing of ticket purchases.

We define the customer arrivals in the context of the timing of a ticket purchase by taking the

ticket perspective. Let T ∈ (0, ∞) be the time to sell a ticket for a particular concert. Let f (t) be

the probability density function of selling a ticket for a seat at time t and F (t) = P (T < t) be the

cumulative distribution function of selling a ticket until time t. Then, the survival function, the

probability for a seat to remain empty until time t would be S(t) = 1−F (t). The survival probability

specifies the unconditional probability that the sale of a ticket for a seat has not happened by time

t. The hazard rate λ(t), on the other hand, is defined by means of a conditional probability. We

look at those tickets that have not been sold by time t and consider the probability of there being a

ticket sale in the small time interval [t, t + dt]. Then, this probability would be equivalent to λ(t)dt.

Mathematically, the hazard rate is defined as a limit in the following way,

P r(t ≤ T < t + h|T ≥ t)

h→0

h

1 S(t) − S(t + h)

= lim

h→0 h

S(t)

λ(t) =

lim

0

(t)

In that case, the instantaneous hazard rate of selling a ticket would be λ(t) = − SS(t)

assuming that

T is absolutely continuous. This leads to another mathematical connection by integration, using

S(0) = 1,

ˆ

S(t) = exp −

!

t

λ(s)ds

(1)

0

Hence, for this setting it is useful to think of λ(t) as the hazard of the ticket survival, i.e., arrivals

create sales. We need to model λ(t) to explore the relation between observed covariates and the

purchase timing decisions of customers using the Equation (1).

We use the time-dependent Exponential distribution as the statistical demand model for modeling customer arrivals over a finite time horizon. Thus, our approach thus includes the stationary

demand models considered in the classical revenue management literature, such as Poisson arrivals in Gallego & van Ryzin (1994), or Farias and van Roy (2010). Exponential distribution is

characterized by the scale parameter λ. A single scale factor makes the exponential distribution

flexible enough to cover stationary arrivals that may increase or decrease monotonically over time.

However, it is not flexible enough to cover the non-stationary arrivals seen in our data.

14

1000

Weekly Sales for All Zones

600

400

0

200

Seat Sales

800

OccasionalBuyers

Subscribers

0

10

20

30

40

50

60

Weeks

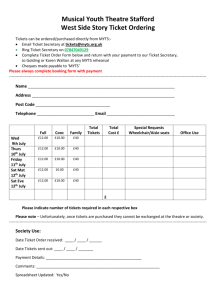

Figure 1: Total weekly sales to subscribers and occasional buyers over time for the 11th concert.

In Figure 1, we graph the total sales of both subscribers and occasional buyers over time until

the show week for the eleventh concert. For subscribers, the sales pattern starts with a peak; and

then, monotonically decreases. Then, around the end of the horizon, it starts to increase again. In

contrast, for the occasional buyers, we see a monotone increasing pattern for their ticket sales; but

then, we see a couple of perturbations in sales until the end of the horizon when, there is a sudden

peak at the very end.

Such preliminary observations suggest that the exponential distribution by itself may be insufficient to explain the underlying customer behavior in the data. Though the baseline stationary

exponential distribution may not be useful, the non-stationarity of the arrivals may still be explained by the impact of the organization and time related factors on the baseline distribution.

Mathematically, non-stationarity can be accounted by the impact of the organization and time

related factors on the baseline likelihood of selling a ticket when it has not been sold until that

point in time. The baseline hazard rate for an exponentially distributed arrivals (purchase timing)

is known to be h0 (t; λ) = λ.

Our approach of exploring the impact of organization and time related factors on exponentially

distributed arrivals begins with the proportional hazards model (Cox 1972) which has not been

widely used in operations management. Although the semiparametric specification of the model

15

makes it a good choice, it is also setup for use with continuous time durations (see Han & Hausman

(1990) for other reasons). Recall that we use an exponential parametrization for the baseline hazard.

We choose exponential parametrization because i) the duration data is discrete, and ii) differences

between customer categories are well defined in the data, so it is more plausible to measure the

impact of different categories on the timing of purchases with parametrization. Keifer’s (1988)

survey provides examples of the use of parameterized baseline hazard models in econometrics with

similar motives, as in our research.

We assume an exponential functional form for the effects of the covariates, for the organization

and time related factors, and the hazard rate of the purchase timing. We consider the known fixed

covariates, Xf , and the dynamic covariates, Xd (t), and formulate their effects on the purchase

timing by using the parameter vectors βf and βd , respectively. Hence, the proportional hazard rate

of the purchase timing for a particular customer type can be written as

Λ (t; λ, βf , βd , Xf , Xd (t)) = h0 (t; λ)exp Xf0 βf + Xd0 (t)βd = λexp Xf0 βf + Xd0 (t)βd

(2)

The customers are classified into two categories, subscribers and occasional buyers. Each of

them has a different arrival rate distribution. Subscribers commit to buy tickets for multiple

shows in advance. Furthermore, subscribers are permitted to inform the theater of their final show

selection at any point prior to the show dates. Hence, the actual timing of the ticket purchases for

a particular show is the date when the subscriber informs the theater of this final decision and is

not tabulated in our calculations until this time. Occasional buyers purchase tickets for a single

show, periodically.

Figure 1 shows that there is a significant difference between the sales patterns of subscribers

and occasional buyers. To account for the impact of the difference between these two customers

and the timing of their purchases, we define λs and λo as the baseline arrival rate for subscribers

and occasional buyers, respectively. Recall that the arrival rate is the equivalent to the hazard rate

for the exponentially distributed arrivals (timing of customer purchases). Hence, subscriber’s and

occasional buyer’s baseline hazard rates are hs0 (t; λs ) = λs and ho0 (t; λo ) = λo . Both customers have

the same fixed covariates, Xf but they may have different dynamic covariates over time. We define

the dynamic covariates for subscribers and occasional buyers as Xd,s (t) and Xd,o (t). Also, each

16

category may respond to the impact of covariates differently. We define the parameters for fixed

and dynamic covariates as β s = {βfs , βds } for subscribers and β o = {βfo , βdo } for occasional buyers.

Using the Equation (2), we calculate the proportional hazard rates of subscribers and occasional

buyers respectively as

(3)

(4)

0

Λs (t; λs , β s , Xf , Xd,s (t)) = λs exp Xf0 βfs + Xd,s

(t)βds

0

Λo (t; λo , β o , Xf , Xd,o (t)) = λo exp Xf0 βfo + Xd,o

(t)βdo

We explore the impact of the following organization, concert and time related fixed and dynamic

factors on the timing of purchases:

Theater or organization related factors:

1. Base Prices: The organization determines different base prices for each tier of tickets which

is computed by the zone setting. Occasional buyers purchase tickets at this listed price. In

addition, the organization provides different types of subscription packages at even lower

base prices. In our analysis, we use the advertised base price, as the base price for occasional

buyers. We use the advertised prices of the subscription packages as the base prices for the

subscribers. We expect that the probability of selling a ticket to both customer categories

should decrease in response to base price increases. We use the natural logarithm of the base

prices as the covariate in the estimation, i.e., log(P rice).

2. Discounts: The management provides many discounts to the general public, defined as

the market; but we do not document the organization’s direct involvement in offering these

discounts. There are other discounts available in the market and customers use them if the

discount applies to their situation. This provides a helpful method to record the impact of

the discounts on the timing of purchases, without the direct involvement of the organization.

We explore the impact of the weekly average discounts (AvgDiscount) received by occasional

buyers and subscribers on the timing of their purchases. We expect the probability of selling

a ticket to mid-expensive and cheap zone customers to be higher as the average discount

available in the market increases.

Concert related factor:

17

1. Concert Day: The shows are scheduled on Thursday, Friday, Saturday or Sunday. We

observe that Friday and Saturday shows have the highest demand of all the show days. The

demand for the shows on Sunday has the second level of desirability; and, the shows on

Thursday are the least desirable with the lowest level of demand. We expect the concert day

to play a huge role on the purchase timing for different ticket tiers. For Friday and Saturday

shows, customers may schedule and purchase their tickets in advance to ensure they secure

a good seat for the show. For Thursday and Sunday shows, customers may not be able to

plan in advance; and thus, purchase their tickets when they know their schedule is open; so,

they make a last minute decision to attend the show. We use Thursday (Thurs), Friday (Fri),

Saturday (Sat), and Sunday (Sun) covariates to account for these effects on the timing of

the ticket purchases. The estimates reveal the impact of the show day on the probability of

selling a ticket at any point in time prior to the concert day.

Time Related Factors:

1. Promotion periods for subscribers: In our preliminary analysis, we see big spikes in

the subscription sales starting around the seventh week and ending around the thirteenth

week for almost all shows. The organization starts the telephone marketing campaign of the

subscription packages approximately the seventh week. We believe that this period has a

significant impact on the probability of selling a ticket to subscribers. We explore the impact

by putting an additional indicator variable (P romo) which becomes 1 if the purchase is made

between the seventh and thirteenth weeks; otherwise, the value is 0.

2. Last 10 weeks before the shows: We usually observe a significant increase in the sales for

both subscribers and occasional buyers beginning ten weeks prior to the performance week.

To reflect this information and maintain accuracy, we add an additional indicator variable

(LastW eeks) to account for this unusual activity.

3. Performance week: The same as the sales graph in Figure 1, all concerts have a large sales

spike in the performance week. Occasional buyer sales constitute a large part of this spike.

To account for the impact of the last-minute sales of the last week on the timing of purchases,

we added one more indicator variable (Rush) to the model.

18

We identify these factors as fixed or dynamic. Among the effects we consider listed above,

we identify the concert day and the base price for the ticket tiers as the fixed effects, i.e., Xf =

(T hurs, Sat, Sun, log(P rice))0 . Other effects change over time, so the hazard rates for the subscribers and occasional buyers may change over time, due to the time dependent effects of these factors. We consider these time dependent factors as dynamic effects, i.e., Xd = (AvgDiscount, LastW eeks, Rush)0 .

In addition to the factors already considered in this research, we formulate the effect of the

Promotion weeks on the hazard rate of subscribers by using another approach. Reportedly, the

majority of the purchases between week seven and thirteen are driven by the organization’s marketing staff calls to previous subscribers. The callers strongly encourage these subscribers to renew

their subscriptions and offer them incentives to return as customers. For this reason, we consider

this stream of subscriber arrivals from prior years that exists only between week seven and week

thirteen, as separate from the existing streams of occasional buyers and subscribers of the current

year.

Mathematically, by the rule of total probability, we consider this impact of the subscriber arrivals

from the prior years (P romo) as an incremental effect on the overall hazard rate of subscribers.

Thus, the proportional hazard rate of subscribers defined in Equation 3 can be rewritten as

0

Λs (t; λs , β s , Xf , Xd,s (t)) = βP romo 1{7≤t≤13} + λs exp Xf0 βfs + Xd,s

(t)βds

(5)

To model the ticket sales, we consider the competing hazard framework, under which the different

streams of customers race against each other for the same tickets. In the medical fields, the standard

analysis involves modeling the cause-specific hazard functions of different failure types, such as

different types of disease or death, under a proportional hazards assumption (Prentice et al. 1978).

In labor economics, Han & Hausman (1990) use the framework to study the unemployment rate

and its causes. Similarly, we perceive the tickets as our test subjects and model their cause-specific

sales. Remember that subscribers and occasional buyers are coming from two different pools with

non-stationary rates. Each ticket is available to both categories of customers. In this case, if one

pool sends a customer earlier than the other pool, the seat is given to the earliest arrival. We

employ this framework for every seat in the theater.

We built our model on a reversed timing scale. Let D stand for the performance week of a

19

concert throughout the season. For each individual concert, we start the horizon at D weeks prior

to the performance week; and, calculate in reverse chronological order to the performance day,

labeled Week One. This structure provides us a way to interpret the impact of covariates on the

timing of purchases, in terms of the remaining weeks prior to the show.

We calculate the probability of a ticket sale for a specific customer type at time t in terms of the

survival probability of tickets. First, we determine the proportional survival functions of subscribers

and occasional buyers using the relationship we define in Equation (1). The data of concert and

organization related dynamic vectors is calculated weekly. To use these discrete covariates in our

continuous time framework, we discretize the integration over time where needed below.

ˆ

s

s

s

!

D−t

s

S (t; λ , β , Xf , Xd,s (t)) = exp −

s

s

Λ (v; λ , β , Xf , Xd,s (v))dv

0

ˆ

ˆ

D−t

= exp −βP romo

1{7≤v≤13} dv − λ

s

0

= exp −βP romo

!

0

exp(Xd,s

(v)βds )dv

0

D−t

X

1{7≤v≤13} − λ

s

exp(Xf0 βfs )

v=0

D−t

X

!

0

exp(Xd,s

(v)βds )

v=0

ˆ

o

D−t

exp(Xf0 βfs )

!

D−t

o

o

S (t; λo , β , Xf , Xd,o (t)) = exp −

o

ˆ

D−t

Λ (v; λ , β , Xf , Xd,o (v))dv

0

= exp −λ

o

o

exp(Xf0 βfo )

!

0

exp(Xd,o

(v)βdo )dv

0

= exp −λ

o

exp(Xf0 βfo )

D−t

X

!

0

exp(Xd,o

(v)βdo )

v=0

We index all shows by i where i ∈ {1, . . . , N } is increasing in the performance week Di . Thus, the

season concludes on week DN ; and, there is a possibility that there are multiple shows scheduled

in the same week. In this case, they are indexed in increasing order chronologically. We group

together the zones, as follows: the expensive zones (1 and 2), mid-price zones (3, 4, 5), and cheap

zones (6, 7, 8). They are segregated together according to similar aspects of price and the quality

of the seats. We concluded that itemizing separate estimations for all of the zones may create

overestimation bias and decrease the predictive power of the model; plus, it would simultaneously

generate an increased number of parameters to estimate1 . In the end, we index all three tiers by j

1

Separate estimation of the zones in expensive, mid-expensive and cheap tiers provides very similar estimates.

20

where j ∈ {1, 2, 3} is increasing in the order of decreasing value of the tiers.

Now, we compute the likelihood of a ticket sale at time t to customer type k ∈ {s, o}. Superscripts (s) and (o) represent the subscribers and occasional buyers. The probability of a ticket being

purchased by customer type k would mean that the ticket was not purchased by any types until

t + 1 weeks prior to the performance week; and then, it is purchased by a type k customer during

the week which is t weeks prior to the performance week. A ticket that has not been purchased

until the performance week, would mean that it survived all purchases over Di weeks. Let the

indicator variable dit takes on the values dit = 1, if the time period t = 1, and dit = 0 otherwise.

Thus, the likelihood of a ticket from tier j of concert i being purchased by customer type k at time

t is

Lij (t, k|θjs , θjo , X s (t), X o (t))

=

Y l

k

k

k

k

k

k

S

t

+

1;

θ

,

X

(t)

−

S

t;

θ

,

X

(t)

S t + 1; θjl , X k (t)

j

j

if dit = 0

Y

S l 1; θjl , X k (t)

if dit = 1

l{s,o}

l{s,o}

(6)

n

where θjk = λkj , βjk

5

o

and X k (t) = {Xf , Xd,k (t)} for all customer types k {s, o}.

Analysis

We only use the data from the ticket purchase transactions of the twenty-one shows of 2008-2009

season for each price tier in estimating our models. From the total of 54,945 transactions observed

in this data, 7313 transactions of complementary or large group ticket sales were deleted. These

transactions are out of the scope of this research.

We selected each transaction that refers to single or multiple ticket purchases from one of

twenty-one weeks. Multiple shows of the repertoire are performed in each performance week which

yields a total of fifty-three performances. We code each performance labeling them with the values

{1, 2, 3, ..., 53}, in chronological order. We use this unique identifier code for each performance to

identify the performance day (Thurs, Fri, Sat, Sun).

Each transaction reflects the performance day and the date the tickets for the seats were pur-

21

chased. We use this information to identify the week the performance takes place (ConcertWeek);

and, the week the tickets are purchased during 2008-2009 season. This information for the transaction week is used to set the indicator variables that may impact the results of the calculations for

the ticket purchase transaction. These variables are (i) was it performed between week seven and

eleven (P romo); and/or, (ii) was it performed during the last ten weeks prior to the performance

week (LastW eeks); and/or, (iii) was the transaction performed in the last week (Rush). We asses

the customer category, subscriber or occasional buyers, and the type of ticket price tier selected for

this transaction. In addition, we know the quantity of tickets (seats) sold in this transaction. Finally, we calculate the number of tickets purchased by each customer category for each performance

week throughout the 2008-2009 season during all performances at all ticket price tiers.

We have the capability to extract from the data the pricing and discounting information from

each transaction. We know the ticket price tier selected by each customer and the customer’s

category. This information is sufficient to locate the base ticket price of his/her transaction and

identify if the customer is a subscriber or an occasional buyer. We take the log of the base price

before putting into the estimation to smooth the nonlinearity problem which usually affects the

estimation results (log(Price)). We find the transaction price for each transaction. We calculate

the discount percentage by comparing the transaction price to the base price of the purchase for

each customer, if applicable. Then, within a chosen purchase week’s information, we aggregate all

discounts used in a particular week for each concert and take their average to calculate the average

discount used in each week for each customer type throughout the 2008-2009 season (AvgDiscount).

We estimated the parameters for each ticket tier j using (6) as the likelihood of a ticket sale at

each time period t. Let the continuous variable nst and not stand for the number of tickets sold to

subscribers and occasional buyers during week t, respectively. Then, the log likelihood function is

Lj (θjs , θjo ; ns , no , X s (t), X o (t))

=

Ti N X

X

nst logLij (t, s|θis , θjo , X s (t), X o (t)) + not logLij (t, o|θjs , θjo , X s (t), X o (t))

i=1 t=1

We use the “maxLik” package of R to estimate the parameters by maximum likelihood estimation.

The maximum likelihood estimation for all tiers converged to the unique optimal maximum.

22

6

Results

Table 2 summarizes the estimates that we obtain from the maximum likelihood estimation. Although the coefficients provide information about the direction of the impact of the factor at time

t on the survival probability of a ticket t weeks before the show, quantifying the effect on the

probability of selling a ticket t weeks prior to the show from the estimates is very hard due to the

non-linearity in our model. We explore the direction of the impact and quantify this impact with

one unit of increase on that covariate where applicable below.

Covariates

λ̂

Thurs

Sat

Sun

AvgDiscount

log(Price)

LastWeeks

Promo

Rush

Subscriber

Expensive

Mid

Cheap

0.0041

0.0011 0.0017

0.0033

0.0727 0.0817

0.05045

0.0046 0.0767

0.05201

0.0822 0.0677

-0.0411

0.0113 -0.0235

0.05868

0.0427 0.0865

1.62128

2.4250 2.0341

0.03921

0.0280 0.0065

0.03277

0.0780 0.0476

Occasional Customers

Expensive

Mid

Cheap

0.0004

0.0001 0.0002

0.0849

0.0846 0.0457

0.0931

0.0735 0.0929

0.0265

0.0518 0.0288

0.0531

0.0167 0.0296

0.0356

0.0701 0.0347

2.3257

2.6000 3.5800

0.1904

2.6000 1.4210

Table 2: The estimates obtained from in sample maximum likelihood estimation

Arrival Rates: The preliminary analysis shows that subscribers start purchasing their tickets

many more weeks in advance of the show day relative to occasional buyers. Thus, the sales pattern

for subscribers shows an initial large volume of purchases in the early periods, which then declines

in the middle periods; but, it finally increases again in the last few days of the period.

Conversely, the occasional buyers start purchasing their tickets much later in the period (that

is closer to the performance day) than the subscribers. Therefore, their sales pattern reveals a

steadily increasing trend until the end of the period (the performance week).

Based on the preliminary observations, we expect to get a higher hazard rate for subscribers

compared to the occasional buyers. To account for the early sales from subscribers, we expect a

larger scale factor to keep the mass of the early periods for the subscribers; and, adjust a smaller

scale factor to push the mass to late periods for occasional buyers. The estimates for the baseline

hazard rates (λ̂s , λ̂o ) for all ticket price tiers are aligned with our expectations. The baseline hazard

23

rate for subscribers is higher than the baseline hazard rate for occasional buyers for all ticket price

tiers.

Daily effects: We use the Friday show sales as the baseline to evaluate the impact of the

performance day on sales for all the other show days. The estimates for each ticket price tier are

positive. This result suggests an accumulation of sales at the earlier periods compared to Friday

shows keeping all other factors constant. The estimates suggest higher number of sales arrivals for

all the performances on the show days excluding Friday.

LastWeeks: The preliminary observations of the sales suggest an increasing trend for both

subscribers and occasional buyers beginning ten weeks prior to the show. We find that our model

takes into account this increasing trend with positive estimates. The preliminary analysis suggests

an increasing trend with more mass on the occasional buyer purchases compared to the subscriber

purchases during the last ten prior to the show. The estimates in the calculations confirm this difference between the subscribers and occasional buyers. For each ticket price tier, the (LastW eeks)

estimate for subscribers is lower than the (LastW eeks) estimate of occasional buyers.

Promo: As stated earlier in this paper, we learned from the organization’s management that

this promotional activity is a result of the marketing campaigns to boost subscriptions. Hence, our

model accounts for this effect with the (P romo) factor; and, it modifies the baseline hazard rate

during these weeks by increasing it with the exponential of the estimates.

RushWeek: It is normal for any customer category to make last-minute purchase decisions to

attending a specific show. Our preliminary observations of the sales graphs suggest there exists a

jump within the last week prior to a show. In addition to the LastWeeks effect in that period, we

also observe that the occasional buyer purchases hit the highest values, especially during the last

period. The numbers are even higher than the subscriber purchases. Therefore, we expect the sales

for occasional buyers to represent the majority of the last period transactions. Our model confirms

our expectations. We observe positive estimates for each ticket price tier and customer category.

This suggests an adjustment of the baseline hazard rate for each customer category during this

period. Also, for each tier, the estimates for occasional buyers are much higher than the estimates

for subscribers. Hence, the hazard for the occasional buyers are increased by a higher factor

compared to the hazard for the occasional buyers during the last week prior to the performance.

Price: For each ticket price tier and customer category, the base price of each zone is estimated

24

to have a positive effect on the hazard rate of sales. An increase in the base ticket price for each

tier of any performance causes an increase in the baseline hazard rate of the total sales for both

customer categories.

Also, in a counterfactual analysis, we check the impact of an one dollar increase in the base price

of any tier on the expected remaining time to sell a ticket. For instance, if we increase the base price

of an expensive tier ticket by $1.00, the expected remaining time to sell a ticket to a subscriber

increases by 0.28 weeks. Similarly, subscribers and occasional buyers of the mid-expensive tier,

purchase the tickets on the average 0.11 and 0.18 weeks earlier with the increase of $1.00. For

the cheap tiers, the expected remaining time to sell a ticket to subscribers changes to 0.44 weeks

earlier. Whereas, the occasional buyers will purchase their tickets on the average 0.03 weeks later.

Discounts: For each ticket price tier, we find that the impact of the average discount on the

hazard rate of occasional buyers is positive. An increase in average discount available for the period

increases the baseline hazard rate of the occasional buyer sales. Comparatively, the positive impact

is maintained for the hazard rate of subscribers for the mid-expensive tier tickets. The hazard rate

of ticket sales to subscribers decreases in response to the increase in the availability of the average

discount for the expensive and cheap tier tickets.

We do some counterfactual analysis to calculate the impact of one unit of increase in the average

discount available for all weeks on the expected remaining time to sell a seat. A seat is sold to a

subscriber 0.21 weeks later and occasional buyers purchase a seat on the average 0.09 weeks earlier.

For the mid-expensive zone, the expected remaining time to sell a seat to subscribers and occasional

buyers increases by 0.03 and 0.04 weeks respectively. For the cheap tier, the expected remaining

time to sell a seat to subscribers decreases by 0.13 weeks on the average. The expected remaining

time to sell a seat to occasional buyers increases by 0.04 weeks.

7

7.1

Counterfactuals

Prediction

Predictive capabilities of a model in a revenue management setting plays a critical role in determining the recommended strategies. In this section, we examine the forecasting capabilities of our

model to test a couple of pricing strategies in the next subsection. Then, we check the predictive

25

capability of the model with the sample forecast of cumulative sales of one performance in the

2009-2010 season.

We commence our forecasting methodology by using the transaction level data of 2009-2010

season as the out-of-sample data. The organization has been using the same allocation and pricing

strategy for all the performances. The only difference from the prior year is the small increases in

the base prices of the different tiers and subscription packages. Observing minor changes in the

setting makes it appropriate for checking the predictive capabilities of our model.

The out-of-sample data provides the necessary inputs for the prediction. This covers the average

weekly discounts and the base ticket prices of all the tiers for both customer categories. We use

this information together with the estimates from the previous section to calculate the weekly

proportional hazard rates of subscribers (Λs (t)) and occasional buyers (Λo (t)) across all tiers by

using Equations 3 and 4, respectively. In the next step, we calculate the expected number of

arrivals from each customer stream (Salesk (t)) by using the weekly proportional hazard rates and

the number of tickets left (N (t)) for every week, i.e.,

Salesk (t) = N (t)Λk (t)

where N (t) = N (t + 1) − Saless (t + 1) − Saleso (t + 1) for t ≤ T − 1 and N (T ) is the seat capacity

of the studied tier.

We use this framework to predict the expected weekly sales of the expensive tier. Recall that

we group the zones under three different tiers. We use the prediction framework to predict the

expected number of ticket sales in each week for both ticket zones. We add up the weekly sales

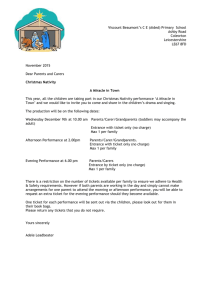

across the zones within a tier; and compare them to the actual number of ticket sales in 20092010 period. As an example, Figure 2 compares the actual number of ticket sales for the Friday

performance of the fifth show to the predicted number of weekly sales for the expensive tier.

The predicted curve effectively tracks the actual number of sales with MASE = 5.46 for occasional customers and with MASE = 1.81 for subscribers. The predicted curve is the expected

number of ticket sales for every period of that show. When we look at the prediction curves of all

performances, we discovered that the curves track the actual number of sales for occasional customers and subscribers with an average MASE as 5.17 and 1.83, respectively, as well as highlight

26

Figure 2: Weekly actual and predicted sales of occasional buyers and subscribers for Friday performance of the fifth show in 2009-2010.

the small variations. These small variations are mainly the result of the comparison of the expected

number of sales to the actual number of ticket sales in a period. The expected sales prediction

aligns well with the actual data; so, we can use the estimates to do some counterfactual analysis of

some of the discounting strategies.

7.2

Performance of The Monotonic Linear Discounting Policy

In this section, we use our model to test a discounting strategy to gauge its performance compared

to the current ones. In 2009-2010, the revenue from each tier of the venue varies between every

show. Specifically, we focus on the Friday shows of the performances to compare a discounting

strategy to the current discounting policy of the organization. Table-3 provides information on

how much the organization generated from each tier of the venue during 2009-2010.

Tiers

Revenue ($)

1

194607.3

2

174748.2

3

182016.1

4

118032.9

5

168246.6

6

68338.6

7

74410.9

8

46406.4

Table 3: The revenues generated by the organization during 2009-2010 for each tier.

An extensive price variation within each tier is one source of the problem of the low revenue

27

generation capability of the organization. Recall that in section 6, the estimates for the impact

of the average discount used per week suggest that the discounts act as a discouraging signal for

subscribers to attend the show by providing negative estimates. At the same time, the estimates

for the occasional buyers suggest that more discount used in a week implies more occasional buyers

buying tickets for the show. Such opposite effects of discounts for subscribers and occasional

buyers show that providing discounts to the whole market without considering different types

of customers’ responses to discounts may decrease the revenue for the organization as in this

setting with subscribers. Hence, the organization may increase the revenue generation capability

by eliminating the discounts for the subscribers.

At the same time, excessive use of discounts for some occasional buyers suggests another source

of revenue loss. For instance, number of tickets sold to the occasional buyers increase during the

last 10 weeks before the show. This result holds even if the average discount used in any one of

those weeks is high or low. If an occasional buyer wants to see the show and if she has a tendency

to buy the tickets for the show during the last 10 weeks at the same time, then providing discounts

for an already attending customer may be excessive and may lead to additional losses. On the other

hand, if we eliminate the discounts fully for the whole selling horizon, then we may lose the discount

responsive occasional buyers and would decrease the selling rates to occasional buyers significantly

for the whole selling horizon. We explore the tradeoff between high volume of sales with discounts

and higher margins without discounts and study how this tradeoff changes over time due to the

change in selling rates to different types of customers.

We test a linear monotonic discounting policy to see how the revenue changes with respect to

the current state of the organization. Firstly, we eliminate the discounts for both customer types,

so that the tickets for all tiers in the venue are sold at the base prices set for 2009-2010. Then, we

start the selling horizon with x% discount on occasional buyer purchases and decrease the discount

every week by the same amount until the discount hits zero during the last week before the show.

Table 4 summarizes the revenues obtained when we start discounts at the corresponding value

under the Discount heading for every tier.

In Table 4, the revenue from each tier does not increase monotonically with discounts. The

revenue increases until a certain threshold of initial discount and decreases afterwards. The result

confirms the fact that some discount may compensate the loss from the margins with more oc28

Discount (%)

0

5

15

25

35

40

50

65

75

Zone 1

158.67

159.17

160.32

161.62

162.94

163.52

164.18

161.81

155.09

Zone 2

171.01

171.56

172.79

174.21

175.65

176.28

177.01

174.54

167.39

Revenues (×103 )

Zone 3 Zone 4 Zone 5 Zone 6

104.67

58.70

176.86

43.82

104.70

58.72

176.92

43.94

104.75

58.75

177.04

44.20

104.79

58.77

177.07

44.46

104.80

58.78

177.09

44.71

104.80

58.78

177.09

44.82

104.77

58.76

177.04

45.02

104.64

58.69

176.82

45.15

104.49

58.60

176.56

45.04

Zone 7

47.08

47.22

47.49

47.78

48.06

48.19

48.41

48.56

48.45

Zone 8

24.49

24.56

24.71

24.86

25.01

25.07

25.19

25.27

25.22

Table 4: The predicted revenue from each tier for every corresponding starting discount on occasional buyer purchases.

casional buyers buying the tickets for the show. However, excessive discounting may not attract

sufficient number of occasional buyers to compensate the loss from margins. Also, we find that the

revenue is concave in the discounts provided to the occasional buyers for each tier. For instance,

the most expensive tier’s revenue increases until the initial discount hits a value between 50% and

55% and then starts to decrease. Table 5 highlights the discount interval that contains the optimal

discount for each zone.

Tiers

Optimal Disc.(%)

1

50-55

2

50-55

3

35-40

4

35-40

5

35-40

6

65-70

7

65-70

8

65-70

Table 5: The interval of initial discounts that contains the optimal starting discount for each zone.

The comparison of the actual revenues in Table 3 with the predicted revenues in Table 4 confirms

that a discounting policy can be formulated to perform better than the current revenue for the

organization. The predicted revenues for the zones 2 and 5 at the maximal discounting policy are

some values in (176864.3,177015.0) and (177086.3,177090.8), respectively. Note that these revenues

are approximately $2000 and $9000 higher than the actual revenues obtained from zones 2 and 5

in Table 3. Although, our monotonic linear discounting policy in time is simple, the policy could

improve the organization’s revenues for some zones. Our simple and easy-to-implement discounting

policy can be used to improve the revenues for some zones though it could be made more sales

responsive over time to further increase the revenues for other zones too.

29

8

Conclusion

Having better, more accurate and dynamic information on the timing of ticket purchases plays a

critical role in the survival and potential growth of symphony orchestras. The capability to extract

information about changes in all the factors that affect ticket purchases and the chance to sell a

ticket to different customer categories would highly benefit management. They also need to be able

to test appropriate pricing and discounting strategies to improve their revenues.

The empirical research in the area of ticket pricing for performing arts organization, in theater

settings, such as symphonies and orchestras is very little. Leslie (2004) looks at Broadway ticket

sales and explores the effects of price discrimination and mail coupon provision for discounts on

the revenues of the theater, and on the welfare of customers. These empirical findings provide

a thorough analysis of common ticket pricing strategies that are non-changeable throughout the

season and the underlying customer behavior has not been considered at all. Our paper takes a

different approach. Just as price discriminations may be used as a tool to increase the revenues,

we show how discounts with static base pricing policy may also be used to influence demand and

the timing of customer’s purchases, by application of an appropriate demand model that better

responds to the changes that may affect the timing of the customer’s purchases, especially when

different customer categories have different purchase behaviors.

We initiate a new approach of demand anticipation for theater tickets. We provide a data

driven probabilistic model to test the impact of pricing and discounting and other concert related

factors on the timing of the ticket purchases. We employ a duration model under the proportional

hazard framework and explore how customers’ purchase intensities change over time in response to

organization related factors, such as the discounts, and other concert and time related factors. The

model takes into consideration the different customer categories, such as subscribers and occasional

buyers, as well as tracks the differences in their purchase timing decisions.

We show through our duration model that the existence of discount responsive customers does

not guarantee high volume of sales or high revenues with discounts in action. In fact, if the discount

responsive customers, i.e., occasional buyers in our case, have a tendency to purchase their tickets

in later periods, providing discounts would not be effective to attract more of these customers at

earlier periods and may even lead to lower margins for the later periods by providing excessive

30

discounts. We confirm that a subscriber’s timing of purchase still occurs at earlier periods even if

the subscriber is flexible in choosing the content of his package throughout the season. Using the

information on a customer’s timing of purchases, we consider when and how much the organization

should provide discounts to different customer categories and how it is dependent on organization

and concert related factors.

As opposed to the airline settings, we find that the cheap tier tickets are purchased later in

the season than the expensive tier tickets. Normally, we would expect delays in ticket purchases in

response to an increase in the base price; however, the expected remaining time to sell a ticket to