abbreviations - Bank Indonesia

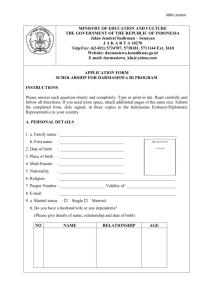

advertisement