Rules for Computing Income Rules for Computing Income

advertisement

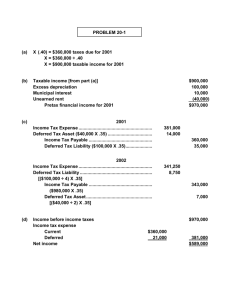

Rules for Computing Income The rules for computing income for financial statement purposes do not correspond to the rules for computing income for taxation purposes. Rules for Computing Income Book Income Ô GAAP 1 Rules for Computing Income Book Income Ô Taxable Income Ô GAAP IRS Rules for Computing Income Book Income Ô Taxable Income Ô GAAP IRS The differences between the two may be temporary differences or permanent differences Temporary Differences ¦Temporary differences that will cause taxable income to be higher than book income in future periods give rise to a deferred tax liability. ¦Temporary differences that will cause taxable income to be lower than book income in future periods give rise to a a deferred tax asset. 2 Temporary Differences ¦Future taxable amounts. • Revenue accrued before taxed. • Expenses deducted before accrued. ¦Future deductible amounts. • Revenues taxed before accrued. • Expenses accrued before deducted. Permanent Differences Because permanent differences between book income and taxable income do not reverse and are not offset by corresponding differences in subsequent periods, they do not give rise to deferred tax assets or deferred tax liabilities. Liability Approach ¦Deferred income tax liabilities ¦Deferred income tax assets 3 Accounting for Income Tax Procedures ¦Calculate the future taxable amounts and/or future deductible amounts. ¦Calculate deferred tax liability ¦Calculate deferred tax asset ¦Calculate the valuation allowance ¦Prepare the proper journal entry The journal entry accomplishes three things: ¦Records income taxes payable or income tax refund receivable. ¦Increases or decreases deferred tax liability, deferred tax asset, and/or valuation allowance to amounts at balance sheet date. ¦Records income provision for income taxes as a “plug” figure. Change in Enacted Tax Rate ¦A change in effective tax rates is reflected in the financial statements of the year of enactment. ¦This is accomplished by applying the new rate to cumulative temporary differences. 4 Valuation Allowance ¦ The FASB requires that firms with deferred income tax assets assess the likelihood that these assets may not be fully realized in future periods. ¦ If it is more likely than not (>50%) that some portion of the benefit will not be realized in its entirety, a deferred tax asset valuation allowance is required. ¦ The valuation allowance should be sufficient to reduce the deferred tax asset to the amount that is more likely than not to be realized. Net Operating Losses ¦ Companies that experience operating losses for tax purposes may elect one of two options • Both carryback and carryforward • Only carryforward ¦ Most firms will elect the first option ¦ The carryback period is two years and the carryforward period is twenty years Footnote Disclosures ¦Footnotes disclose the portion of the provision for income taxes that is currently payable and that which is deferred. ¦Footnotes provide a reconciliation between the provision for income taxes and income taxes determined by applying the federal statutory rate to income before income taxes. 5 Tax Policy Decisions The divergence between the statutory rate and the effective tax rate arises from two types of tax policy decisions • The tax jurisdiction in which the firm chooses to operate • Special characteristics of the income tax law Analytical Insights ¦Increases in balances of deferred tax liabilities may signal a decrease in earnings quality. ¦Decreases in balances of deferred tax assets may signal a decrease in earnings quality. Interfirm Comparability The deferred tax portion of the income tax footnote can be used to undo differences in financial reporting choices across firms. 6 Earnings Conservatism Ratio Pre-tax book income EC = Taxable income per tax return Earnings Conservatism Ratio ¦EC ratios close to one indicate relatively conservative financial reporting. The lower the ratio, the more conservative the reporting. ¦Increases in EC ratios from year to year suggest adoption of more aggressive reporting practices. Earnings Conservatism Ratio ¦ EC ratio comparisons for a single company over time can be misleading if the tax law has changed over the period of comparison ¦ Comparisons across companies should be made cautiously ¦ LIFO layer liquidations are not captured by the EC ratio 7 8