Chapter 6. Short Term Credit Management

advertisement

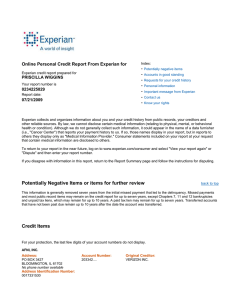

Chapter Objectives Chapter 6. Short Term Credit Management Major Topics Arranging and Using Credit Revolving Credit Installment Credit Obtaining Credit and Resolving Credit Problems To evaluate reasons for and against using credit and decide whether or not credit is appropriate for you. To be able to take the necessary steps to establish credit and develop a credit history. To identify what is meant by revolving credit and how it is used. To understand how to use credit cards properly and to know your legal rights as a borrower against credit mistakes. To learn how installment credit works. To compare the various sources of credit and to learn what to do if you experience credit problems. Reasons for Using Credit As a Shopping Convenience Especially good for record keeping, rebates, other benefits To Increase Total Consumption Actual borrowing As an Inflation Hedge Buy now to avoid higher future prices As a Source of Emergency Funds If you don’t have 3-6 months of liquid assets … Disadvantages of Using Credit How to Get Credit Consider what the lender looks for (3 C’s) Temptation to overspend All too common. Keep in mind credit needs to be repaid with interest! It’s not free money! Credit costs Some can be very high Less flexibility with future budgets When you borrow, you are borrowing against your future income. Character: previous obligations Capital: financial assets Capacity: future obligations Begin a credit record. Open savings and checking accounts. Open a retail charge account. Qualify for a small installment loan. Make sure your credit records follow you. Have a telephone installed. Review your credit report. Repair a bad credit record. Special Concerns for Spouses Establishing Credit Make sure your credit history is in your name. Don’t use a social title. ex., Mrs.Edward Hall Inform creditors that you wish to maintain your own credit history. Know the difference between a joint and individual credit account. Joint Credit Account: • Both spouses responsible for debt. • Divorced or separated spouses should cancel joint accounts. The Role of the Credit Bureau Does not decide who receives credit. Stores information on past use of credit Stores information on legal actions against you. Sells credit reports to lenders. Individual Credit Account • Only you are responsible for debt. • Account will appear only on you credit report. Contents of a Credit Report Credit Report The three largest credit bureaus Existing credit accounts Information on each credit account includes credit limit, loan amount and account balance who is responsible for paying the account Public record information bankruptcies, tax liens and monetary judgments Who has obtained a copy If You are Denied Credit Obtain a copy of your report. Correct any mistakes. Submit your own statement on disputed claims. Have adverse information that is old removed from report. Have those who received report notified of any incorrect entries. Equifax: http://www.equifax.com Trans Union: http://www.transunion.com Experian: http://www.experian.com Now consumers can obtain credit reports for free once a year. For more information about credit, visit Federal Trade Commission Website at http://www.ftc.gov/bcp/conline/edcams/credit/index.html For your free credit report, visit https://www.annualcreditreport.com/cra/index.jsp Credit report and credit score are used for many purposes (insurance, job, rental, etc.) these days. In addition, identity theft is becoming a major consumer fraud issue. You need to be diligent about checking your credit report. It is a good idea to obtain one credit report every four months, rotating among the three credit bureaus. Credit Accounts Revolving credit account An open-end account with an established line of credit and rules for minimum payments. Retail installment account An closed-end account that has a separate installment contract for each purchase Revolving Credit Account Credit limit determined by credit record and net worth. Partial payment must be made each month. Interest charged on unpaid balance. Account may never actually be paid off. Interest Computation Methods Previous balance method Rate applied to balance at end of previous month. Adjusted balance method Equal to the previous balance less any payments or returns made during the current billing cycle Average daily balance method (most common) including current purchases excluding current purchases Truth in Lending Act Annual percentage rate (APR) applied to balance. Method for calculating interest. Grace period, if any. Minimum monthly payment, and penalties for late payment. Permission to investigate credit history. Major Issuers of Credit Cards Bank Credit Cards Discover MasterCard Visa Travel & Entertainment Cards American Express Other Cards Two-cycle average daily balance method Eliminates a grace period in the previous month when you fail to completely pay off the balance in the present month. Can go back two periods to collect interest on unpaid balance. Credit Card Cost Comparison Annual membership fee Variable rate information Balance computation method Late payment fee Copy charge Required Information on Revolving Charge Account Annual percentage rate Grace period Cash advance fee Over-the-limit penalty Replacement fee Fees for optional services Department store chains Major gasoline retailers Credit Card Benefit Comparison Credit limit Disability insurance Accident insurance Rental car collision insurance Warranty protection Merchandise loss protection Credit life Rebates & discounts Frequent flyer miles Credit card registry Purchase price protection Payback Period $3,000 Credit Balance @ 19% APR Monthly Payment $60 75 100 125 Months Total Interest 100 64 42 31 $2,991 1,790 1,102 804 Correcting Credit Mistakes Notify the creditor in writing within 60 days after bill was mailed. Pay parts of the bill that are not in dispute. Creditor will notify you within 30 days of its decision. If no error is found, you must pay or you will be reported as delinquent. If you still challenge in writing the creditor must report that information. Provide credit bureau with your explanation of the dispute. Debit Cards Bank deposit is immediately reduced You do not have the protections afforded credit card purchases Lost or stolen credit cards are covered by the Electronic Funds Transfer Act you can lose up to $500 if you fail to notify issuer within two days after learning of theft if you wait 60 days your losses may be unlimited Protect Against Credit Card Fraud Record card numbers, expiration dates and phone number for card company. Destroy old bills, receipts and credit cards. Check sales receipt and compare with credit card statement. Be careful giving out your card number. Report lost and stolen cards immediately. Other Credit Terms Chargeback a disputed amount charged back to the merchant by the credit card company. Credit blocking a reduced credit limit based upon an expected purchase Installment Credit Repay the debt by A series of uniform payments called installments Elements of a retail installment contract Promissory note Security agreement Methods for Charging Interest Simple Interest Method percentage rate applied to outstanding loan balance Discount Method interest deducted from credit extended you Add-on Method interest added to amount borrowed at beginning of loan Discount Method Need $1,000 Borrow $1,136.36 at 12% simple interest 1000/(1-12%)=1136.36 Monthly payment: 1136.36/12=$94.72 Annual Percentage Rate (APR) Same as annual simple interest. Takes into consideration fees and methods of computation In the previous example: Simple interest: APR=12% Discount: APR=24.28% Add-on: APR=21.46% In credit shopping, compare APRs!!! Figure. A 12-month installment loan with annual simple interest of 12 percent Monthly Outstanding Balance Monthly Payment Finance Loan Charge Repayment 1 $1,000.00 $88.85 $10.00 2 921.15 88.85 9.21 .... ... ... ... $78.85 79.85 ... 11 175.07 88.85 1.75 12 87.97 88.85 0.88 87.97 $1,066.19 $66.19 $1,000 Total 87.10 Add-on Method Need $1,000 Total payments= $1,120 for 12% simple interest 1000*(1+12%)=1,120 Monthly payment: 1120/12=$93.33 Sources of Credit Banking Institutions Overdraft protections Unsecured personal loans Home equity line of credit Consumer Finance Companies Specialized loans (GM cars) Other Life insurance policies Margin accounts on stocks and bonds Pawnbroker A Credit Management Strategy Use the grace period. Avoid expensive credit on revolving charge accounts. Take a broad view of credit sources. Carefully consider the use of variable rate loans. If You have Personal Debt Problems – Credit Counseling National Foundation of Credit Counseling http://www.nfcc.org The only Utah location is in St. George • Credit Counseling of Utah, 163 West 1600 South #2 Saint George, UT 84770 (800) 451-4505 Utah State University Family Life Center: Housing and Financial Counseling http://www.usu.edu/fchd/hfc.cfm Last Resort - Bankruptcy What a counselor will do: Develop a budget and a repayment plan to repay debt Negotiate a more reasonable repayment plan with the lenders Bankruptcy statistics American Bankruptcy Institution: http://www.abiworld.org/ Straight Bankruptcy (Chapter 7) Primary form of bankruptcy. Discharges all debts and provides a fresh start. Homeowner’s equity and some personal assets may be partially protected. Cannot file again for 6 years. Record remains on credit report for 10 years. Utah’s Bankruptcy Situation Wage Earner Plan (Chapter 13) Repayment schedule established by court. Debtor may retain property. Lenders receive partial or total repayment over 3-5 year period. Remains on credit report for 7 years. Assignment for Chapter 6 If you have never obtained a copy of your credit report, you should try to get a copy. For a free copy go to https://www.annualcreditreport.com/cra/i ndex.jsp Take a close look at the credit cards you have. What’s the interest rate? What is the balance computation method? What’s the grace period? Compare your credit cards using the list of costs and benefits National Rank is #1 in 2003 and previous years – 1 in 36.5 households filed for bankruptcy in 2003: http://www.abiworld.org/statcharts/Hou seRank.htm Utah-specific laws: http://www.utahbankruptcylaw.com/