Capital Budgeting Decisions Tools

advertisement

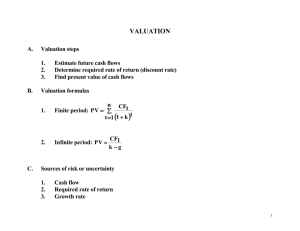

Management Accounting Capital Budgeting Decisions Tools In many businesses, growth is a major factor to business success. Substantial growth in sales may eventually means a need to expand plant capacity. In order to expand plant capacity, the company will have to invest considerably in more capital on a long term basis. A new assembly line or a chemical processing plant can cost millions or even hundreds of millions of dollars. An investment of large amounts of money on a long term basis should be founded on a thorough analysis of economic and financial conditions to determine that the prospects for success are favorable. The analysis should include computations that indicate the kind of return to expect. The project should return the invested capital in a reasonable length of time and also provide at a minimum the desired rate of return. The process of analyzing the future prospect of a project and using the appropriate tools to determine the rate of return is commonly called capital budgeting. Nature of Capital Budgeting Capital budgeting is a system of long term financial planning involving: 1. Identifying investment opportunities (long term projects) 2. Determining profitability of investment projects 3. Ranking projects in terms of profitability 4. Selecting projects | 217 218 | CHAPTER TWELVE • Capital Budgeting Decisions Tools Step 1 Identifying projects The object of capital budgeting is typically called a project. An investment project may be a: a. b. c. d. e. f. New plant or equipment Expansion of existing plant and equipment Investment in information technology equipment Purchase of an existing business Opening a new territory Development of a new product A potential project has the following characteristics that must be recognized: 1. An initial outlay of cash which is simply called the cost of the project. This cost is incurred in the time period that is commonly called period zero. 2. The project has a useful life which can be typically from five years or more to fifty years. 3. The project will generate in each period of its life starting with period 1 a net cash flow. 4. A desired rate of return for the project is set by management. 5. At the end of the life of the project, some residual value may exist. This residual value or salvage value must be estimated because it is equivalent to a net cash flow amount in the year in which the project ends. Step 2 Determining or measuring profitability The most critical step is to measure the potential profitability of the project. In general, two measures of future profitability are available: (1) accounting net income and (2) net cash flow. The process of determining profitability at a minimum involves the following steps: 1. Determine the cost of the project. 2. Determine the revenue expected in each period of the life of the project. 3. Determine the cash expenses for each year of the life of the project. 4. Determine the net cash flow for each period of the projects useful life (cash revenue less cash expenses). Step 3 Rank the projects in order of profitability. The term “profitability” is an ambiguous term and, consequently, has different meanings. For this reason different techniques of measuring profitability have been developed. The more important of these techniques include the following: a. Average rate or return method (accounting method) Management Accounting b. Payback method c. Time adjusted rate of return method (Internal rate of return) d. Net present value method The selection of a project should be taken very carefully. The project should fall within the experience and capabilities of management. New products are consequently being developed everyday. If a company is in the restaurant business, then it is highly unlikely management would want to expand into the electronics business. However, having a diversified business with different products or divisions can under the right circumstances be a good strategy. All projects involve risk and the risk potential in a given project should be evaluated. An important question is: if the project is undertaken, will failure of the project risk putting the company into bankruptcy? Evaluating the profitability of a project perhaps is the most important and difficult task. First of all, it is important to have an accurate estimate of the cost of the project. Under estimating the cost can cause the eventual actual rate of return to be far less than the desired rate of return. Secondly, the expected net cash flow for each period of the life of the project must be measured. It is normal to expect that the farther the estimates are made into the future, the less reliable the will be estimates. After the cost and future net cash flows have been determined, the next step is to actually compute the resulting rate of return. If the methods used are present value methods, then a discount rate must be determined. Theory holds that the discount rate should not be less than the company’s cost of capital. Because companies use a combination of different sources of capital such as both debt and equity and use both internal financing and eternal financing, the company’s cost of capital is usually an average. Computing cost of capital is a fairly complex subject and the techniques for doing so are beyond the scope of this book. When several investment opportunities are being evaluated and the source of funds to invest is limited, then a decision has to be made concerning which of the available projects are the most profitable and most affordable. Modern capital budgeting theory maintains that the tools used to evaluate projects should be present value based. The two tools have received the most attention in the capital budgeting literature are the following: 1. Net present value method 2. Time adjusted rate of return method. The Basic Present Value Equation The basic fundamentals of present value are explained in Appendix B. If you have forgotten the basic fundamentals of computing present value, it is recommended that you first read and study this appendix before proceeding further. In order to understand the basic principles of capital budgeting, a sound understanding of present value is required. When using present value methods, the net cash flows of the project is regarded as a series of future amounts. Because they are future amounts, the process of discounting these amounts is logical. The cost of the project is an outlay in period zero and, therefore, does not require any discounting, After the individual future net | 219 220 | CHAPTER TWELVE • Capital Budgeting Decisions Tools cash flows have been discounted and the sum of these amounts found, the comparison of the sum of the discounted amounts to the cost of the project is appropriate. The basic present value equation is as follows: FV2 FVN FV1 PV = ––––– + –––––– +… ––––––– 1 2 (1 + i) (1 + i) (1 + i)N Where: PV - present value FVi - future value at time period i. N - life of project i - interest rate (discount rate) Because we are now using present value fundamentals in the framework of capital budgeting, the equation will be revised as follows: NCF2 NCFN NCF1 PV = ––––––– + ––––––– + … –––––––– 1 2 (1 + R) (1 + R) (1 + R)N In principle, this equation is exactly the same. The net cash flows values of the project have been substituted for FV. Also, the desired rate of return for the project, R, is used as the discount rate. This equation can be used to compute the present value of net cash flows that are equal, unequal, or zero in some years. There are two methods of computing net cash flows. The first method which is the more logical method simply involves subtracting from cash revenues the cash expenses. NCF = CR - CE Where NCF - net cash flow CR - cash revenue CE - cash expenses The second method involves starting with net income and adding back depreciation. NCF = NI + D Where NI D - - net income depreciation Illustration of Computing Present Value From an accounting viewpoint, depreciation is a necessary expense in determining net income. In most business, it is the primary non cash expense. In the period in which depreciation is recorded, no cash outlay is involved. The cash outlay related to depreciation was incurred at the time the asset was purchased or at the time the debt incurred was paid. As used in capital budgeting the term net cash flow simply means cash revenue less cash expenses and starting with net income and adding back depreciation is simply a short cut method. Examples of computing present value using this basic equation will now be presented: Management Accounting Example 1 Equal periodic net cash flows where the desired rate of return is 10% and the life of the project is 4 years: 100 100 100 100 PV = –––––1 + –––––– + –––––– + ––––––– = $316.98 2 3 (1 +.1) (1 + .1) (1 +.1) (1 +.1)4 Example 2 One net cash flow amount at the end of 4 years where the desired rate of return is 10%: 0 0 0 100 PV = –––––– + –––––– + ––––––– + (1 +.1)1 (1 + .1)2 (1 +.1)3 –––––– = 1+.1)4 $68.30 In this example, it is easy to recognize that the present value of a zero amount is zero. Example 3 Unequal net cash flows where the desired rate of return is 10% and the life of the project is 4 years: PV = 100 200 300 400 –––––– + ––––––– + –––––– + –––––– 1 2 3 (1 +.1) (1 + .1) (1 +.1) (1 +.1)4 = $754.80 If net cash flows are equal, then the net cash flows may be treated as though they are an annuity and the use of present values of an annuity of $1 tables may be used to compute the answer. An annuity may be defined as a series of equal payments at equal intervals of time. As explained in chapter 8, Comprehensive Business Budgeting, the capital expenditures budget was one of the four elements of the final product of the total budget. The capital expenditures budget affects the following: Cash balance Amount of stock issued or debt incurred Interest expense, if debt financing is used The size of the plant and equipment accounts Future depreciation Net income In Figure 12.1 a diagram of capital budgeting as discussed above is illustrated. Net Present Value Method The net present value method is commonly used to evaluate capital budgeting projects. The steps involved in this method are the following: Step 1 Determine the net cash flows for each period (normally each year) of the life of the project. This step involves estimating both cash inflows and cash outflows. Net cash flow is simply Cash inflows less cash outflows. Step 2 Determine the cost of the project. The cost of the project might be a single contracted amount or the sum of many individual expenditures. | 221 222 | CHAPTER TWELVE • Capital Budgeting Decisions Tools A clear distinction should be made between cost expenditures made in period zero and expenditures that represent operating expenses during the life of the project. Step 3 Compute the present value of the project using the net cash flows as the future amounts. The discount rate is the desired minimum rate of return as determined by management. Step 4 Determine whether the project is acceptable. In the net present value method, the present value computed is compared to the cost of the project. If the present value exceeds the cost, then the project is acceptable. If the net present value is positive, then this means the rate of return of the project is greater than the discount rate. If the net present value in negative, then the rate of return of the project is less than the discount rate. The net present value does not tell us what the true rate of return is unless the net present value is zero. In other words, if the present value is exactly equal to the cost of the project, then we know that the true rate of return is equal to the discount rate. Illustration - In order to illustrate the net present value method, let’s assume we have been provided the following information. Cost of project Life of project (years) Estimated net cash flow: Year 1 Year 2 Year 3 Year 4 Year 5 Desired rate of return Periods (Years) $250,000 5 $ 50,000 $100,000 $150,000 $ 75,000 $ 25,000 10% Net Cash Flow Present Values PV Factor Net Cash Flow 1 $ 50,000 .909090 $ 45,454.54 2 $ 100,000 .826446 $ 82,644.62 3 $ 150,000 .751314 $ 112,697.72 4 $ 75,000 .683013 $ 51,225.99 5 $ 25,000 .620921 $ 15,523.27 $ 307,546.14 Total present value The present value of each net cash flow is computed by multiplying the present value factor times each net cash flow amount. The present value of the project is, therefore, the sum of the individual present values. The present values could have been easily computed without the use of tables. For example, the present value of Management Accounting the net cash flow in year 2 ($100,000) could have been calculated as follows: $100,000 $100,000 PV = –––––––– = –––––––– = $82,644.62 ( 1.1)2 1.21 A simple four function calculator makes the computation of present value fairly easy. Is the project in the illustration above acceptable? The answer is yes as the following comparison shows. Present value of project $307,546.14 Cost of project 250,000.00 ––––––––––– Net present value $ 57,546.14 ––––––––––– The true rate of return of this project is greater than the discount rate because the net present value is positive. The main disadvantage of this method is that the true rate of return is not computed. This method only determines the present value of the project and indicates whether or not the project is acceptable. For this reason, many analysts prefer the time adjusted rate of return method. Time Adjusted Rate of Return Method The time adjusted rate of return method is a present value method that determines the true rate of return of a project. If the true rate of return is equal to or greater than the desired rate of return, then the project is acceptable. This method works Figure 12.1 • Outline of Capital Budgeting CAPITAL BUDGETING EVALUATION TECHNIQUES Accounting rate of return Payback period Timed adjusted rate of return Net present value TYPES OF PROJECTS New products Replacement of assets New plants and equipment Opening a new territory Purchase of an existing business CONCEPTS Cost of capital Depreciation Desire rate of return Net cash flows Present value Future value Discount rate EVALUATION OF INDIVIDUAL PROJECTS Quantity factors Cash inflows Cash outflows Useful life Present value Recoverable value Qualitative factors Management ability Management experience Economic enviroment Risk | 223 224 | CHAPTER TWELVE • Capital Budgeting Decisions Tools because the objective is to find the present value of the project that is exactly equal to the cost of the project. The cost of the project is considered to be the present value of the project. The problem is that this method has to be used on an iterative basis, that is a trial and error basis. In using this method, it makes no difference whether the net cash flows are equal or unequal in amounts. If they are equal, the process is a bit easier because a present value of $1 annuity table may be used. This method is also based on the same equation that was used in the net present value method, with the exception that cost now represents the present value of the project. In this method, we know at the start what the present value is. The problem is to find the rate that will generate this present value. Therefore, the goal is to solve for R. NCF2 NCFN NCF)1 Cost = ––––– + ––––– +… ––––– 1 (1+R) (1+R)2 (1+R)N Net Cash Flows Unequal - The procedure for finding R or the true rate of return is as follows: Step 1 Select any interest rate to begin the process. The only guideline is to select a rate you intuitively think might be close to the answer. Step 2 Using the selected rate in step 1, compute the present value of the project in the same manner used in the net present value method. Step 3 Compare the computed present value to the cost of the project. If the present value if greater than the cost, then the true rate is greater than the discount rate used. If the present value is less than cost, then the true rate is less than the rate used. Step 4 If the present value did not equal cost, then select a second rate. This rate should be greater or less than the rate first used according to the rules specified in step 3. A smaller rate will increase the present value while a greater rate will make the present value smaller. Step 5 Again, compare the resulting present value computed to cost. If the two amounts are not substantially close, then a third attempt should be made. The trial and error process should be repeated until there is no significant different between cost and the last present value amount computed. When the present value is equal or very close to cost, then the true rate of return has been found. Illustration-This method will now be illustrated using the same problem used for the net present value method. Cost of project Life of project (years) Estimated net cash flow: Year 1 Year 2 $250,000 5 $ 50,000 $100,000 Management Accounting Year 3 Year 4 Year 5 Desired rate of return $150,000 $ 75,000 $ 25,000 10% The first step is to compute present value using the first estimated rate. Since the desired rate of return is 10% this rate will be used. However, the use of the desired rate of return is an arbitrary decision. Any rate, however, may be used. First Attempt- Discount rate is 10% Present Value Year Net cash flow Factor Net cash flow Year 1 $ 50,000 .909090 $ 45,454.54 Year 2 $ 100,000 .826446 $ 82,644.62 Year 3 $ 150,000 .751314 $ 112,697.72 Year 4 $ 75,000 .683013 $ 51,225.99 Year 5 $ 25,000 .620921 $ 15,523.27 Present Value $ 307,546.14 Cost $ 250,000.00 –––––––––– $ 57,545.14 The present value exceeds the cost by $57,545.14.This excess of present value over cost means the true rate of return is greater than 10%. A second attempt to find the true rate should be made now. This time the selected rate used will be 15%. Second Attempt- Discount rate is 15% Present Value Year Net cash flow Factor Net cash flow Year 1 $ 50,000 .869565 $ 43,478 Year 2 $ 100,000 .075614 $ 75,614 Year 3 $ 150,000 .657516 $ 98,627 Year 4 $ 75,000 .571753 $ 42,881 Year 5 $ 25,000 .497176 $ 12,294 $ 272,894.00 Present Value Cost $ 250,000.00 –––––––––– $ 22,894.00 In this second trial, our computations come up with an answer greater than cost. So we now know that the true rate of return is greater than 15%, however, we still do not know the true rate of return. Consequently, a third trial is required, and this time the discount rate used will be 20%. | 225 226 | CHAPTER TWELVE • Capital Budgeting Decisions Tools Third Attempt- Discount rate is 20% Present Value Year Net cash flow Factor Net cash flow Year 1 $50,000 .833333 $ 41,666.00 Year 2 $100,000 .694444 $ 69,444.00 Year 3 $150,000 .578704 $ 86,805,00 Year 4 $75,000 .482253 $ 36,169.00 Year 5 $25,000 .401877 $ 10,047.00 Present Value Cost $ 244,131.00 $ 250,000.00 –––––––––––– ($ 5,869.00) The true rate of rate is a bit less than 20%. If more accuracy is desired than another trial would be necessary. All we can say after three trials is that the true rate of return is between 15% and 20%. The true rate is actually between 19% and 20%. The internal rate of return method as this method is often called is based on a critical assumption. The true rate is earned only if the periodic net cash flows are reinvested as a rate equal to the true rate. For example, assume that the net cash flows are reinvested at 10% Net cash flow FA at end of 5th year $ 73,205 Year 1 $ 50,000 (1.1)4 x $ 50,000 $133,100 Year 2 $ 100,000 (1.1)3 x $100,000 2 $181,500 Year 3 $ 150,000 (1.1) x $150,000 $ 82,500 Year 4 $ 75,000 (1.1)1 x $ 75,000 Year 5 $ 25,000 $ 25,000 $ 25,000 –––––––– Sum of Future amount at the end of 5 years $495,305 Given that our original investment was $250,000 and given that the true rate of return is approximately 19%, we would expect the future amount of our investment at the end of 5 years to be $595,588 ( $250,000 x (1.19)5. However, the future amount turns out to be only $495,305 when the net cash flows are reinvested at an interest rate of 10%. However, this method does allow us to correctly rank projects in the order of profitability, if more than one project is being evaluated with the internal rate of return method. For the purpose of ranking projects, the issue of re-investing can be ignored. Accounting Rate of Return Method The accounting rate of return method or the average rate of return method, as it is sometimes called, is strictly an accounting method and based on net income. This method does not involve computing present value. The method is base on: Management Accounting 1 Average book value 2. Average net income The method does not take into account the time value of net cash flows and by computing average net income treats the project as having the same net cash flow each year, even when, in fact, this is not the case. The AROR method is based on this simple equation: Average net income AROR = –––––––––––––––– Average investment Average net income may be defined as the total income over the life of the project divided by the life of the project. Total net income ANI = –––––––––––––––– Life of project Average investment (book value) may be computed: Cost of Project AI = ––––––––––––– 2 Illustration of Average Rate of Return Method - In order to illustrate this, method the following information is assumed: Cost of project $80,000 Life of project (years) 5 Net cash flows of project: Year 1 $10,000 Year 2 $20,000 Year 3 $30,000 Year 4 $40,000 Year 5 $50,000 Total net income is the sum of the net cash flows less the cost of the project. Therefore, average net income per year is: (10,000 + 20,000 + 30,000 + 40,000 + 50,000) - 80,000) 70,000 ANI = –––––––––––––––––––––––––––––––––––––––––––– = –––––– = 5 5 AI = $80,000 ––––––– 2 AROR = = $14,000 –––––––– $40,000 $14,000 $40,000 = 35% If more than one project is under evaluation, then the most profitable project is the one with the greater rate of return. The major weaknesses of this method are the following: | 227 228 | CHAPTER TWELVE • Capital Budgeting Decisions Tools 1. The AROR method does not take into account the time value of money. Consequently, the project that appears to have the greatest rate of return may not actually be the most profitable in the long run. 2. Using average net income as the measure of profitability ignores the fact that two projects may have unequal net cash flows in a totally different pattern. These points may be illustrated as follows: Project A Cost Life of project (years) Net cash flow: Year 1 Year 2 Year 3 Year 4 Year 5 ANI = AROR = Project B $50,000 5 $ 5,000 $10,000 $15,000 $20,000 $25,000 $ 5,000 20% Cost Life of project (years) Net cash flow: Year 1 Year 2 Year 3 Year 4 Year 5 ANI = AROR% = $50,000 5 $25,000 $20,000 $15,000 $10,000 $ 5,000 $ 5,000 20% In the above example, both projects have the same average net income and same AROR. However, the projects are quite different. In project A, the net cash flow increases each year and in project B, the projects decrease each year. If we compute the present value of both projects using a 10% discount rate we learn the following: Present value of project A: $52,969.93 Present value of project B $60,460.65 Project B is the better project when present value is computed because it has the greater present value. Also project B is the better project in terms of the true rate of return. True Rate of Return Project A 12.0% Project B 20.0% Clearly when timing and the pattern of net cash flow are considered, it is clear that the AROR method can be very misleading. Payback Method One of the basic concerns of investors in a project is the return of the capital invested in the project. If a project, even if profitable eventually, requires a long period of time for the capital invested to be recovered, then investors are inclined to not invest. They will seek out projects with a much shorter payback period even though the other projects do not initially promise to be as profitable. A payback period of ten years is considered too long. A payback period of three years is often considered ideal. Management Accounting The payback method is not a present value method nor a method that requires that accounting net income be computed. The payback period is that period of time it takes to recover the cost of the project. After the cost of the project has been recovered, any net cash flow from then is considered as profit. Payback has been reached when the accumulated net cash flows from the project equals the cost of the project. The basic payback period formula is as follows: Cost of project Payback period = ––––––––––––––––– Average net cash flow The steps involved in using the payback method are as follows: Step 1 The cost of the project and the net cash flow of the project for each year of its life must be determined. Step 2 The next step is to compute the average net cash flow. Step 3 Now that the cost and the average net cash flow is known, the payback period can be computed. Illustration of Using the Payback Method-This method will now be illustrated using the same data as used for the net present value method and the time adjusted rate of return method. Cost of project Life of project Estimated net cash flow: Year 1 Year 2 Year 3 Year 4 Year 5 Desired rate of return $250,000 5 years $ 50,000 $100,000 $150,000 $ 75,000 $ 25,000 10% The average net cash flow may be computed as follows: ANCF = ($50,000 + $100,000 + $150,000 +$75,000 +$25,000) / 5 = (400,000 / 5) = $80,000 $250,000 Payback period = –––––––– $80,000 = 3.125 Years In addition to not being a present value method, the method just illustrated also ignores the pattern of net cash flows. This use of average net cash flow has the same weakness as the use of average accounting net income. Unless the cash flows are uniform from year to year, a more refined procedure for computing the payback period is to not use average net cash flows but to accumulate the net cash flows until the sum of the net cash flows equal the cost of the project. The use of a work sheet is helpful when using this method: | 229 230 | CHAPTER TWELVE • Capital Budgeting Decisions Tools Computation of Payback Period Year Net Cash Flow Cumulative Net Cash Flow 1 $ 50,000 $ 50,000 2 $100,000 $150,000 3 $150,000 $300,000 Using this approach, it is clear that the payback period is more than 2 years and less than three years. The fractional part of year 3 can be computed as follows: Cash needed in the third year to reach payback period - $100,000 The payback period then is: $100,000 2 + : ––––––– = $150,000 2 .67 years. Another weakness of the payback method is that the method does not measure profitability. Two projects can have the same payback period, but one can be completely superior to the other. Project C Cost of project Life of project (years) Net cash flow per year Project D $8,000 4 $2,000 Payback period (years) 4 Cost of Project Life of project (years) Net cash flow per year Payback period (years) $8,000 8 $2,000 4 At the end of 4 years, project C has recovered the capital invested. However, the project has also reached the end of its life. Project C is obviously not profitable. Project D which also has a payback period of 4 years. However, Project D continues to generate income in years 5 through 8. Net Cash Flow After Taxes (NCFat) In this chapter to this point, it was not specified whether net cash flow was before or after taxes. When the objective is to use net cash flow after tax in computing present value, some additional fundamentals must be considered and understood. In the simplest terms possible, net cash flow after tax is: NCFat = NCFbt - T Where: T - tax expense Basically, net cash flow after tax is net cash flow before tax less the tax liability. When net cash flow before tax is used, obviously taxable income is not a factor to be considered. However, when the goal is to use net cash flow after tax, then Management Accounting various provisions of the tax law become important. Important factors that must be considered in determining taxable income include the following: 1. Depreciation and the selection of a depreciation method 2. Disallowed expenditures 3. Tax credits 4. Rules regarding capitalization and recording of expenses 5. Capital gains In order to compute net cash flow after tax, it is necessary to compute the effect of a tax rate on net cash flow. The most obvious way is to compute taxable income and then compute the amount of tax. Then the tax determined must be subtracted from net cash flow before taxes. While tax laws can be exceedingly complex, the goal in capital budgeting is not necessarily to be 100% accurate in computing the tax, but to derive a tax amount that is basically in the ball park. Some simplified methods have been developed to allow the analyst to quickly determine the amount of tax. The basic difference in many cases between net cash flow before taxes and taxable income is deprecation. For this reason, the effect of depreciation on net cash flow must be considered. Depreciation - Depreciation is a recognized expense in accounting theory and must be taken into account when computing net income. However, students learn from the study of accounting that depreciation is not an expense that involves an outlay of cash in the period in which it is recorded. The outlay of cash occurs at the time the depreciable asset is purchased or the incurred liability is paid. In capital budgeting, the cost of the depreciable asset is strictly the cost of the project at time period zero. Depreciation in each year of the life of the project is a non cash expense. It is simply an amortized historical cost. In addition, depreciation has no effect on net cash flow before tax regardless of the amount of depreciation. However, depreciation has a profound impact on net cash flow after taxes. The greater the depreciation charge for tax purposes, the larger is net cash flow after taxes. Depreciation is always an allowable deduction in computing taxable income. The relationship between net cash flow before taxes and taxable income can be stated mathematically as follows: TI = NCFbt - D. Where: TI - Taxable income NCFbt - Net cash flow before tax D - Depreciation The tax would then be: T = R (TI) Where: R - Tax rate In other words, the tax is simply the rate times taxable income. Also, this equation assumes that depreciation is the only major non cash item. | 231 232 | CHAPTER TWELVE • Capital Budgeting Decisions Tools The tax treatment of depreciation can have a profound effect on the pattern of net cash flows after tax. If the net cash flows before tax are uniform, then it is possible on an after tax basis for net cash flows to be non uniform. Any change in the pattern of cash flows can have a significant impact on present value. The tax laws allow for the taxpayer to select different deprecation methods. For tax purposes, accelerated depreciation methods are very popular with business owners. Business owners in general prefer to pay less taxes in the early years and postpone a greater tax liability to later years. Illustration- To see how uniform cash flows can become nonuniform consider the following illustration: Cost of Project $12,000 Life of project 4 years Net cash flow (before tax) $8,000 Discount rate 10% In case A, straight line depreciation will be used. In case B, the sum of the year’s depreciation method will be used. When case B is examined carefully, we see that the net cash flow after tax pattern is, first of all, nonuniform and secondly, is decreasing each year. The accelerated deprecation method has caused net cash flow to be the greatest in the first year and, thereafter, progressively less each year. In each period, depreciation, taxable income, tax, and net cash flow is different. ‘However, it is extremely important to notice in terms of totals the following: A. Taxable income is the same, regardless of the method of depreciation B. Total depreciation is the same C. Total net cash flow after tax is the same D. Total tax is the same. In the long term, the use of accelerated depreciation does not decrease the total amount of tax owed and paid. The question then becomes: what is the advantage of accelerated depreciation? The answer is that is can increase the present value of a project: For example, present value in case A is: $6,000 PV = –––––– + (1.1)1 $6,000 –––––– + (1.1)2 $6,000 –––––– + (1.1)3 Case A Straight line Depreciation $19,019.19 Case B Sum of the years= Digits Depreciation NCFbt Depreciation. Taxable Income Tax NCFat 1 $ 8,000 $ 3,000 $ 5,000 $2,000 $ 6,000 2 $ 8,000 $ 3,000 $ 5,000 $2,000 3 $ 8,000 $ 3,000 $ 5,000 4 $ 8,000 $ 3,000 Totals $32,000 $12,000 Years $6,000 –––––– = (1.1)4 NCFbt Depreciation. Taxable Income Tax NCFat 1 $ 8,000 $ 4,800 $ 3,200 $1,280 $ 6,720 $ 6,000 2 $ 8,000 $ 3,600 $ 4,400 $1,760 $ 6,340 $2,000 $ 6,000 3 $ 8,000 $ 2,400 $ 5,600 $2,240 $ 5,760 $ 5,000 $2,000 $ 6,000 4 $ 8,000 $ 1,200 $ 6,800 $2,720 $ 5,280 $20,000 $8,000 $24,000 Totals $32,000 $12,000 $20,000 $8,000 $24,000 Years Management Accounting In case B, the present value of the project is: $6,720 $6,340 PV = –––––– + ––––––– + (1.1)1 (1.1)2 $5,760 5,280 ––––––– + –––––– = 3 (1.1) (1.1)4 $19,282.64 Net-of-Tax Approach Another approach to computing net cash flow after tax is to use the net-of-tax approach. In most businesses, if not all, profitable businesses have to pay income tax. In the long term, a tax liability is inescapable. If the tax rate is 40%, and the business’s sales is $100,000, then the amount of sales net-of-tax is $60,000. Forty per cent has to be used to pay the tax on the revenue and, therefore, only 60% remains. If expenses are $60,000, then net-of-tax the expense is $36,000. Of the total expenditure of $60,000 , 40% or $24,000 is an offset to the $40,000 tax on the revenue. Therefore, the net liability would be ($40,000-24,000) = $16,000. The same answer could have been derived by multiplying 40% x $40,000 ( $100,000 $60,000). Rather than compute the tax effect by first computing taxable income and then computing the total tax, net cash flow after tax can be computed on a net-of tax basis by applying the net-of-tax idea to each individual item that affects net cash flow. This idea can be seen mathematically as follows The amount of tax equals the rate times taxable income and taxable income equals revenue less expenses. Let Revenue = S and expenses = E1 + E2 + E3. Then the tax would be R( S - E1 - E2 - E3) = R(S) - R(E1) - R(E2) - R(E3) We see here mathematically that the tax rate can also be logically applied to each separate tax item. Assuming the tax rate is 40% and if we let S = $10,000 and E1, E1, and E3 be $1,000, $2,000, and $3,000 respectively, then we have the following: T = .4($10,000) - .4($1,000) - .4($2,000) - .4($3,000) = $4,000 - $400 - $800 - $1,200 = $1,600 The same answer results if we use a more traditional approach T = ($10,000 - $6,000).4 = $1,600. It is clear that, if we choose to do so, that we can apply the tax rate to each individual item that makes up taxable income. The same amount of tax will result. Under some circumstances, the analyst may find this method easier to use, even it is conceptually more difficult to understand. Mathematically, the net of tax approach can be presented as follows; NCFat = S(1 - R) - E(1 - R) + R(D) Where: S E D T R - - - - - Revenue (sales) Cash expenses Depreciation Amount of tax Income tax rate | 233 234 | CHAPTER TWELVE • Capital Budgeting Decisions Tools The derivation of this equation is shown in the Appendix to this chapter. It is interesting to note that the term R(D) reveals that as the depreciation expense in any time period is increased the net cash flow after tax increases. The net-of-tax approach can be illustrated as follows: Illustration of Net-of-tax Method - The same example used previously (case A) will be used again, except that the amount of cash revenue and cash expenses will be separately listed rather than shown as a net. Cost of Project Life of project Cash revenue (before tax) Cash expenses (before tax) Discount rate $12,000 4 years $12,000 $ 4,000 10% NCF after tax for Years Item Amount per year (before taxes) Net-of-tax NCF percentage 1 Cash revenue 12,000 .6 Cash expenses - 4,000 .6 - 2,400 7,200 2 3 7,200 -2,400 4 7,200 7,200 -2,400 -2,400 Depreciation: Year 1 3,000 .4 Year 2 3,000 .4 Year 3 3,000 .4 Year 4 3,000 .4 1,200 1,200 1,200 1,200 6,000 Total NCFat Present value 5,454.54 Sum of present value of net cash flows Cost of project Net present value 6,000 4,958.67 6,000 4,507.88 6,000 4,098.08 $19,019.19 $12,000.00 ––––––––– $ 7,019.19 Since the net cash flows after tax remains the same, then the present value remains the same at $19,019.16. The net-of-tax method does not give a different answer. It is simply a different approach to determining tax and net cash flow after taxes. Management Accounting Summary Capital budgeting involves a body of literature that has grown and developed in the last fifty years. In finance, a significant body of literature has developed which dwells heavily on using present value concepts to make capital budgeting decisions and to measure the value of a firm. To understand this body of theory, a good knowledge of the following terms is necessary. 1. Simple interest 9. Depreciation and net cash flow 2. Compound interest 10. Minimum desired rate of return 3. Principal 11. Internal rate of return 4. Future amount 12. Discounting 5. Present value 13. Discounted cash flow 6. Annuity 14. Cost of capital 7. Present value of a future amount 15. Net present value 8. Net cash flow Appendix: Derivation of the Net-of-Tax approach to computing net cash flow after taxes: The computation of tax can be done in two different ways: 1. It can be computed on taxable income which is in simple terms: taxable income = S - E - D Tax = R(S - E - D) Where : S - Sales E - Cash expenses D - Depreciation R - tax rate 2. It can be computed where the tax rate is applied individually to each revenue and to each expense: Tax = R(S) - R(E) - R(D) Based on this approach NCFat is : NCFat = S(1- R) - E(1 - R) + RD Why is this true?: We can demonstrate this mathematically as follows: NCFat = (S - E) - (R (S - E - D)) NCFat = (S - E) - (RS - RE - RD) NCFat = S - E - RS + RE + RD NCFat = S - RS - E + RE + RD NCFat = S(1- R) - E(1 - R) + RD So we have two basic equations for net cash flow after taxes: | 235 236 | CHAPTER TWELVE • Capital Budgeting Decisions Tools (1) NCFat = (S - E) - (R (S - E - D)) This equation determines net cash flow after taxes by applying the tax rate to taxable income and then subtracting the tax from net cash flow before tax. (2) NCFat = S(1- R) - E(1 - R) + RD This method applies the tax rate to revenue, cash expenses and depreciation separately. Illustration: Sales Cash expenses Depreciation Tax rate = $100 = $ 70 = $ 20 = .4 Applying the rate to taxable income: (1) NCFat = (S - E) - (R (S - E - D)) NCFat = (100 - 70) - (.4 (100 - 70 - 20) NFCat = (30) - .4 (10) NCFat = 30 - 4 = 26 Applying the rate to each element of net income separately: (2) NCFat = S(1- R) - E(1 - R) + RD NCFat = 100 (1 - .4) - 70 (1-.4) + .4(20) NCFat = 100 (.6) - 70 (.6) + 8 NCFat = 60 - 42 + 8 NCFat = 26 Q. 12.1 Define capital budgeting. Q. 12.2 What steps are involved in the capita budgeting process? Q. 12.3 What tools may be used to evaluate capital budgeting projects? Q. 12.4 Explain the importance of net cash flow in capital budgeting. Q. 12.5 What is the basic present value equation used in capital budgeting? Q. 12.6 In the accounting rate of return method (average rate of return), what is used as the measure of profitability? Q. 12.7 Explain how net cash flow may be easily converted to net income? Q. 12.8 Explain how the average book value of a project may be computed? Q. 12.9 Define what is meant by the payback period? Q. 12.10 What are the major weaknesses of the payback method? Management Accounting Q. 12.11 What is the major disadvantage of the net present value method? Q. 12.12 When using the net present value method, how does one know whether the true rate of return is greater or less than the discount rate? Q. 12.13 When using the time adjusted rate of return method, how does one know when the true rate of return has been found? Q.12.14 What factors must be considered that otherwise may be ignored when the objective is to discount net cash flow after taxes? Exercise 12.1 • Compound Interest Principal Interest rate Future years Problem A $10,000 8% 4 Problem B $50,000 10% 6 Problem C $5,000 6% 8 Problem D $100,000 20% 5 Required: Compute the future amount at the end of the stated number of years. Exercise 12.2 • Present Value Problem A Problem B Problem C Problem D Future Amount Desired rate Future years $5,000 8% 10 $8,000 10% 12 $20,000 12% 10 $1,000,000 15% 40 Required: Compute the present value of each problem. Exercise 12.3 • Present Value of an Annuity Annual Payment Desired rate No. of payments Problem A $5,000 8% 10 Problem B $8,000 10% 12 Problem C $20,000 12% 10 Problem D $1,000,000 15% 40 Problem C $8,000 $2,000 $1,000 Problem D $15,000 $10,000 $ 3,000 Required: Compute the present value of each annuity. Exercise 12.4 • Net Cash Flow Cash revenue Cash expenses Depreciation Problem A $1,000 $ 600 $ 200 Problem B $2,000 $1,200 $ 500 Required: Compute the net cash flow in each problem. | 237 238 | CHAPTER TWELVE • Capital Budgeting Decisions Tools Exercise 12.5 • Net Present Value Method (Uniform net cash flows) You have been provided the following information: Cost of project $15,000 Useful life (years) 5 Annual net cash flow $ 4,000 Desired rate of return 10% Required: 1. Based on the above information compute the present value of the project. 2. Is the true rate of return greater than or less than the discount rate? Exercise 12.6 • Net Present Value Method (Uniform net cash flows) You have been provided the following information: Cost of project $20,000 Useful life (years) 8 Annual net cash flow $ 4,000 Desired rate of return 12% Required: 1. Based on the above information compute the present value of the project. 2. Is the true rate of return greater than or less than the discount rate? Exercise 12.7 • Net Present Value Method (Nonuniform net Cash Flows) You have been provided the following information: Problem A Problem B Problem C Cost of project $15,000 Useful life 5 Discount rate 12% Net cash flow: Year 1 $2,000 Year 2 $3,000 Year 3 $4,000 Year 4 $5,000 Year 5 $8,000 Year 6 Year 7 Year 8 $18,000 8 8% $40,000 4 10% $1,000 $ 6,000 $3,000 $ 8,000 $5,000 $10,000 $7,000 $20,000 $3,000 $2,000 $1,500 $1,000 Problem D $10,000 6 6% $5,000 $4,000 $3,000 $2,000 $1,000 $ 500 Required: 1. Based on the above information compute the present value of the project. 2. Is the true rate of return greater than or less than the discount rate? Management Accounting Exercise 12.8 • Time Adjusted Rate of Return Method (Uniform Net Cash Flows) Problem A Problem B Problem C Problem D Cost of Project $15,000 $50,000 $20,000 $100,000 Useful life (years) 5 15 8 10 Net cash flows (annual) $5,000 $6,000 $4,000 $15,000 Required: For each problem, compute the project’s internal rate of return. Exercise 12.9 Time Adjusted Rate of Return Method (Nonuniform Net Cash Flows) You have been provided the following information: Problem A Problem B Problem C Cost of project $15,000 $18,000 $40,000 Useful life 5 8 4 Net cash flow: Year 1 $2,000 $1,000 $ 6,000 Year 2 $3,000 $3,000 $ 8,000 Year 3 $4,000 $5,000 $10,000 Year 4 $5,000 $7,000 $20,000 Year 5 $8,000 $3,000 $ 1,000 Year 6 $2,000 $ 500 Year 7 $1,500 Year 8 $1,000 Problem D $10,000 6 $5,000 $4,000 $3,000 $2,000 Required: Based on the above information compute the true rate of return of each product. Exercise 12.10 • Average Rate of Return Method Problem A Cost of Project Useful life (Years) Depreciation per year Net Cash Flow Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Problem B Problem C Problem D $75,000 5 $15,000 $60,000 6 $10,000 $125,000 5 $25,000 $10,000 $18,000 $10,000 $20,000 $10,000 $25,000 $10,000 $30,000 ––– $25,000 ––– $15,000 $15,000 $15,000 $20,000 $50,000 $60,000 $30,000 $35,000 $40,000 $45,000 $50,000 ––– $30,000 4 $ 7,500 Required: For each problem, compute the average rate of return. | 239 240 | CHAPTER TWELVE • Capital Budgeting Decisions Tools Exercise 12.11 Payback Method (Uniform Cash Flow) Problem A Problem B Cost of Project $30,000 $75,000 Useful life (Years) 4 5 Depreciation per year $7,500 $15,000 Net income per year: Year 1 $10,000 $20,000 Year 2 $10,000 $20,000 Year 3 $10,000 $20,000 Year 4 $10,000 $20,000 Year 5 $15,000 $15,000 Year 6 Problem C Problem D $60,000 6 $10,000 $125,000 5 $25,000 $15,000 $15,000 $15,000 $15,000 $30,000 $15,000 $30,000 $30,000 $30,000 $30,000 Required: For each problem, compute the payback period. Exercise 12.13 • Payback Method (Nonuniform Cash Flow) Problem A Cost of Project $30,000 Useful life (Years) 4 Depreciation per year $7,500 Net income per year: Year 1 $10,000 Year 2 $12,000 Year 3 $14,000 Year 4 $16,000 Year 5 ––– Year 6 Problem B Problem C Problem D $75,000 5 $15,000 $60,000 6 $10,000 $125,000 5 $25,000 $20,000 $22,000 $24,000 $26,000 $28,000 ––– $15,000 $14,000 $13,000 $12,000 $11,000 $10,000 $32,000 $34,000 $36,000 $38,000 $40,000 ––– Required: For each problem, compute the payback period using the cumulative cash flow method. Management Accounting Exercise 12.14 • Net Cash Flow After Taxes Case 1 Item Income Statement Approach Sales $12,000 Cash expenses $ 7,000 Depreciation $ 2,000 Total expenses $ 9,000 Net income (BT) $ 3,000 Case 2 Net- of- Tax Approach Income Statement Approach Net-of-tax Approach Case 3 Income Statement Approach Net-of-tax Approach Tax Net cash flow (BT) $ 5,000 Net cash flow (AT) $ 3,800 Assume that the tax rates are as follows: Tax rate Case 1 Case 2 Case 3 40% 30% 20% Required: Compute the net cash flow after tax in each case using the net-of-tax method. In case 1 the net cash flow after tax has already been computed in the traditional manner. Enter the income statement data in case 1 also in the appropriate columns for cases 2 and 3. | 241 242 | CHAPTER TWELVE • Capital Budgeting Decisions Tools