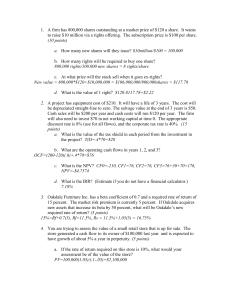

HBL NIFE Equity Share Offer: Rights Issue Details

advertisement