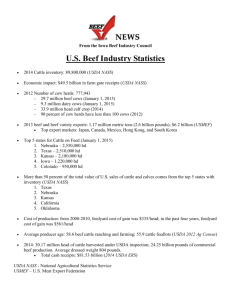

A Value Chain Analysis of the U.S. Beef and Dairy Industries

advertisement