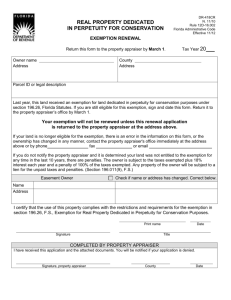

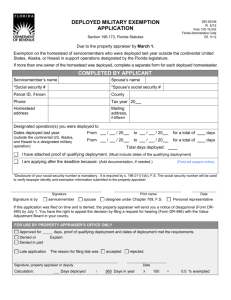

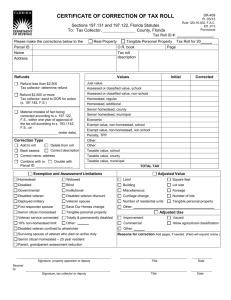

Property Tax Rules - Florida Department of Revenue

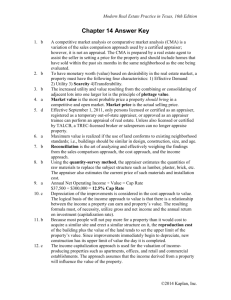

advertisement