Syllabus - BYU Independent Study!

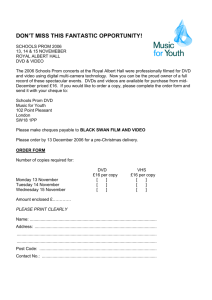

advertisement

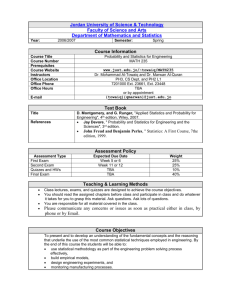

(../Media/Images/WelcomeObj.jpg) Syllabus Quick Links Course Materials Assignments Exams Grading Course Duration BYU Course Outcomes 1. Construct and use internal accounting tools such as cost-volume-profit analysis, budgets, product cost reports, and nonroutine decision analyses to understand how to make better business management decisions. 2. Construct and interpret a balance sheet and income statement understanding its usefulness in business and investment decision making. 3. Comfortably use accounting terms and concepts in business-related discussions. 4. Intelligently converse about the following areas: a. b. c. d. e. f. g. h. i. The role of accounting in international business The role of information systems in financial reporting Fraud and how to prevent fraud The theory and practice of income taxes Investing in stocks Career planning and spiritual decision making Managerial accounting as a competitive tool Personal budgeting and financial planning Write a brief, focused memo demonstrating basic understanding of background business reading material. j. Use computer-aided learning tools and online learning resources. k. Manage workload in a self-paced learning environment. Prerequisite No prerequisites Course Materials Intro to Accounting - The Language of Business DVD and Access code (Required) Accounting 200 Learning Resources Packet (Optional) Learning Resources (DVD, Learning Resource Packet, and Optional Text) All of the material that you will be held accountable for on quizzes and exams for this course is contained in the Intro to Accounting - The Language of Business DVD and Access code. The primary lesson materials for the course are provided through the DVD Introduction to Accounting: The Language of Business. Each DVD lesson presentation features a comprehensive audio/video lecture by the DVD author (Professor Norm Nemrow) with synchronized graphic displays, sample problems, homework problems and solution explanations. The homework problems included in the DVD are not turned in or graded in this course. They are provided solely for the purpose of assisting in the learning process. The topics covered in these DVD lessons are reflected in the lessons in this course. The following Accounting 200 Learning Resources are included in and can be printed directly from the Introduction to Accounting: The Language of Business DVD set or they can be optionally purchased in packet form through the online Bookstore: DVD Lesson Notes, Homework Problems and Solutions (The Notes, Problems and Solutions are organized lesson by lesson with the Notes for each lesson provided first, followed by the Problems and Solutions for that lesson) Financial Practice Set Problem and Solution Exam Topic Sheets (notes topics to be included on exams) Sample Exam Problems/Solutions Most students choose to purchase the packet from the Bookstore to avoid the hassle of printing it themselves. It is an invaluable learning tool for the course. The Introduction to Accounting: The Language of Business DVD contains 15 lessons, which teach you the fundamental concepts of accounting. In addition, you will be required to view eight supplemental lectures. These supplemental lectures feature several guest lecturers who speak on topics that are designed to enhance student appreciation of the relevance of accounting in today’s dynamic business world (see course lessons). Before viewing these lectures, students will read a number of current event articles provided in the course lessons. The material covered in these readings and the lectures will be covered in the lesson quizzes/assignments, but will not be covered in the exams. Effectively Using the Introduction to Accounting: The Language of Business DVD Set Students suggest that the DVD Lessons are most effectively used by first printing or purchasing a copy of the Lesson Notes discussed above as part of the Accounting 200 Learning Resources and then utilizing those notes for additional note-taking while viewing the DVD Lessons. A student can pause the DVD Lessons at any time to make any notations they feel will help them in future study and reviews. In addition, the DVD Lesson explanations can be viewed as many times as necessary to reinforce the learning of difficult concepts. Additional DVD navigational tools allow students to personalize their learning experience. These are the same DVDs that are used for this course on campus at BYU-Provo and over 90% of students say the DVD are a more effective learning tool than the more traditional textbook/classroom lecture learning approach. Although the homework problems in each DVD Lesson will not be submitted or graded, a student’s ultimate success on quizzes and exams will be directly correlated to their ability to understand and do the homework problems on their own. Because homework solutions and explanations are provided, many students will be tempted to simply refer to the solutions rather than hammering out a problem on their own. This will be a serious mistake. The best learning takes place when students work through problems on their own before resorting to a provided solution. You must be able to understand and do these homework problems on your own without assistance to do well on the quizzes and exams. Students who understand and can do the homework problems and the sample exam problems included in the Accounting 200 Learning Resources should do well on the course quizzes and exams. (Back to top) Assignments Summary: 15 computer-graded assignments, may be resubmitted once for a fee. Speedback Lesson Quizzes/Assignments A Speedback quiz will be given at the end of each of the 15 lessons. All quizzes will be taken online and will be in true/false and multiple choice format. The quizzes are open note and open DVD meaning students may use any of the learning materials available to them when taking the quiz. Because quiz results can be printed out for future study and these quizzes can be retaken for a fee, there is no reason why a student should not ultimately get 100% of the points associated with these quizzes for grading purposes. The quizzes cover designated material from the Introduction to Accounting: The Language of Business DVD lessons, the Accounting 200 Lecture Series and other readings provided in the course lessons. The quizzes do not comprehensively cover all of the materials in the Introduction to Accounting: The Language of Business DVD lessons and therefore cannot be relied upon for complete exam coverage. A non-programmable calculator may be used on quizzes. In addition to the 15 Speedback lesson quizzes there is also a short financial statement review assignment you will do in conjunction with Lesson 2. (Back to top) Exams Summary: 3 proctored computer-graded exams, may retake once for a fee, must pass the final in order to pass the course. Exams and Keys to Successful Performance Three non-comprehensive exams will be given throughout the course as noted below. Exams Covers Questions Exam 1 Lessons 1-4 & Practice Set concepts 33 multiple choice Exam 2 Lessons 5 - 10 40 multiple choice Final Lessons 11 - 15 10 True/False and 43 multiple Exam: choice These exams are closed book/DVD and closed note exams. They are proctored exams and only a calculator and blank scratch paper can be used during the exam. Bringing Accounting 200-related material into the Testing Center stored in your calculator constitutes cheating. Taking information related to this exam out of the Testing Center stored in your calculator also constitutes cheating A maximum of 4 hours are allowed for the completion of each exam. The final exam must be passed with a minimum 50% score to pass the course. Each exam may be retaken once for a fee. In order to perform well on exams, a student must not only have a solid understanding of the course material but must also be able to apply that understanding to actual problems. The best evidence of a student’s adequate preparation for the exams is their ability to do the DVD lesson homework problems on their own without assistance. Students must understand how to do the problems and the reasoning behind the solutions. If students are having difficulty understanding the homework problems they should consider reviewing the DVD Lesson problem and solution explanations a number of times. They may also need to re-review the actual lecture materials. A basic overall review of the course materials may also be helpful exam preparation and can be facilitated by simply reviewing the DVD Lesson Notes. Included in the Accounting 200 Learning Resources are three sample exams with solutions provided at the end of each exam. These sample exams provide students with an opportunity to experience typical exam questions in a multiple-choice format. These sample exams are not intended to provide complete coverage of topics, but can be a valuable tool in exam preparation. If a student takes the sample exam and does poorly it probably means there is need for additional study of the lesson examples and homework problems. Also available through the Accounting 200 Learning Resources are Exam Topic Sheets, which simply highlight the topics to be covered in each exam. (Back to top) Grading Assignment/Exam % of Total Grade Exam #1 23 Exam #2 27 Final Exam (non-comprehensive) 34 Speedback Lesson Quizzes 15 Financial Statement Review Assignment 1 Total 100 Grade Scale A 100-92 A- 91-89 B+ 88-86 B B- 80-77 C+ 76-74 C 73-69 C- 68-64 D+ 63-60 D 59-55 D- E 49-0 54-50 85-81 There are NO make-up, or grade improvement projects and there is no curving in this course. These are the final grade breakdowns...period. (Back to top) Course Duration You have 1 year to complete this course. You may purchase a 3-month extension if you need more than a year to complete the course. What should I think if I struggle in this course? To be honest, experience has shown that some students seem to have a natural talent or gift in accounting and perform well on the multiple-choice exams with what seems to be relatively little effort. Other students struggle but can master the course material with considerable study, review and practice in doing the homework and sample exam problems. Finally, for some students, the analytical thinking process associated with accounting is a skill that they seem to have been born without and regardless of the time and effort put into the course it just doesn’t come. Even though these students understandably become frustrated, they should not become too discouraged. A lack of talent in accounting is not the end of the world. It probably just means that you have a personality and will end up hiring an accountant rather than doing it yourself. Do the best you can. Learn as much as you can about business and do not become too concerned about your ultimate grade. Remember, your grade in Accounting 200 has no significance in the eternities! Some students express concern that they do not perform well on multiplechoice exams. The nature of business and accounting information makes examination through multiple-choice exams a logical testing vehicle rather than essay or other means. Experience has shown that the multiple-choice exams for accounting do provide a fair reflection of comprehension and ability in the subject. It is true that many students may understand basic business and accounting concepts but have trouble when detailed information is provided and has to be organized, analyzed and used to produce a problem solution. Unfortunately, that is the nature of accounting and business information and an exam that eliminates those characteristics is not a fair reflection of the course content. Finally, if you are one of those students with your heart set on a degree in business but cannot seem to overcome an accounting stumbling block, be comforted in the fact that most people who are hired in and become successful in business do not have an undergraduate degree in business. Businesses are interested in people who are personable, can get along and work well with others and can learn on the job. Your college degree is not the most significant factor in determining your ultimate success in business. Hardware and Software Information for Running the DVDs Hardware and Software Requirements (version 2.0) Hardware: Pentium II 300 or greater Multimedia PC 64Mb of RAM CD-ROM drive Speakers or headphones Necessary Software: Microsoft Windows 98, 2000, NT 4 SP6a, ME, XP or higher (version 2.0 will not work on Windows 95) Microsoft .NET Framework 1.1 or greater Microsoft Windows Media Player 6.4 or higher (we recommend version 9.0+ for greater functionality) Macromedia Flash 6.0 or higher Adobe Acrobat 5.0 or higher Internet Explorer 5.01 or higher Software Installation Version 2.0 has an automatic diagnostic and install feature for the necessary software. Please insert the DVD and click on version 2.0. Follow the directions and install the necessary software. If you encounter problems, please consult the technical support by clicking on the blue technical support button on the start up screen. You may need to perform a manual installation of certain items. Consult the technical support for directions to accomplish this task. Macintosh Support To use the accounting software on a Mac, you must purchase an access code online and use the online software. To purchase the software go to: www.businesslearningsoftware.com/ code (http://www.businesslearningsoftwareinc.com/code). You will be asked to enter an access code. Enter the following code: BYUIS200 and click submit. Follow the prompts to finalize your purchase. After you have purchased the software, go to http://www.businesslearningsoftwareinc.com/cloudapp (http://www.businesslearningsoftwareinc.com/cloudapp) and login. Follow prompts to watch a lesson. We strongly recommend you watch the following short training video. This video will instruct you on how to use the software and the Learning Resource Packet effectively. Please go to: http://youtu.be/bR--PijjrbU (http://youtu.be/bR--PijjrbU) If you have already bought the software through the BYU bookstore, go to http://www.businesslearningsoftwareinc.com/cloudapp (http://www.businesslearningsoftwareinc.com/cloudapp) and use the access code provided with the software to login. Software Plug-in for Adjustable Speeds on DVD Audio/Video Presentations The ability to control the speed of the audio and video presentations in these DVDs will be of great value to you. The 2xAV plug-in from Enounce Inc. provides this speed control and will greatly enhance your learning experience. Most students develop the ability to watch the lessons at two times the normal speed (or faster) with no learning loss. That means it is possible for you to watch an hour lecture in 30 minutes while retaining all necessary information. You will love this feature! When you begin to install this plug-in during the automatic install function, you will notice a document that appears. Please read this document in its entirety. This document will explain everything you need to know about the Enounce plug-in. Windows XP Users Users running Windows XP and Windows Media Player 9.0 can use an integrated VSP (variable speed playback) module built right into the interface of the main program. This VSP module functions much like the Enounce plugin except it can only accelerate the audio/video to 2 times the original speed (the Enounce plug-in can achieve 2.5 times the original speed). Unlike the Enounce plug-in, this module will never time out and stop working. When you open the accounting software, you will notice a rate box above the volume control. To increase or decrease the rate of the lessons, simply click the up or down arrows. You can use the Enounce plug-in and the integrated VSP module simultaneously to achieve playback rates faster than 4 times the original speed. However, we suggest you watch the lessons at those speeds only when reviewing previously learned material. When viewing a lesson for the first time, your comprehension of the material greatly diminishes past 3 times the original speed. (Back to top) Inappropriate Use of Course Content All course materials (e.g., outlines, handouts, syllabi, exams, quizzes, media, lecture content, audio and video recordings, etc.) are proprietary. Students are prohibited from posting or selling any such course materials without the express written permission of BYU Independent Study. To do so is a violation of the Brigham Young University Honor Code.