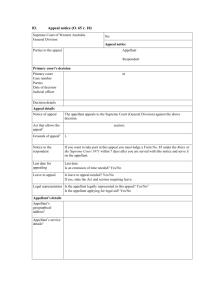

high court of australia

advertisement