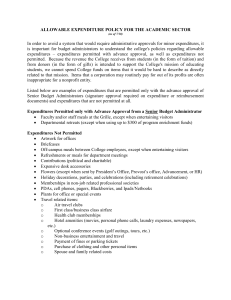

budget and accounting manual

advertisement