Allowable expenditures policy

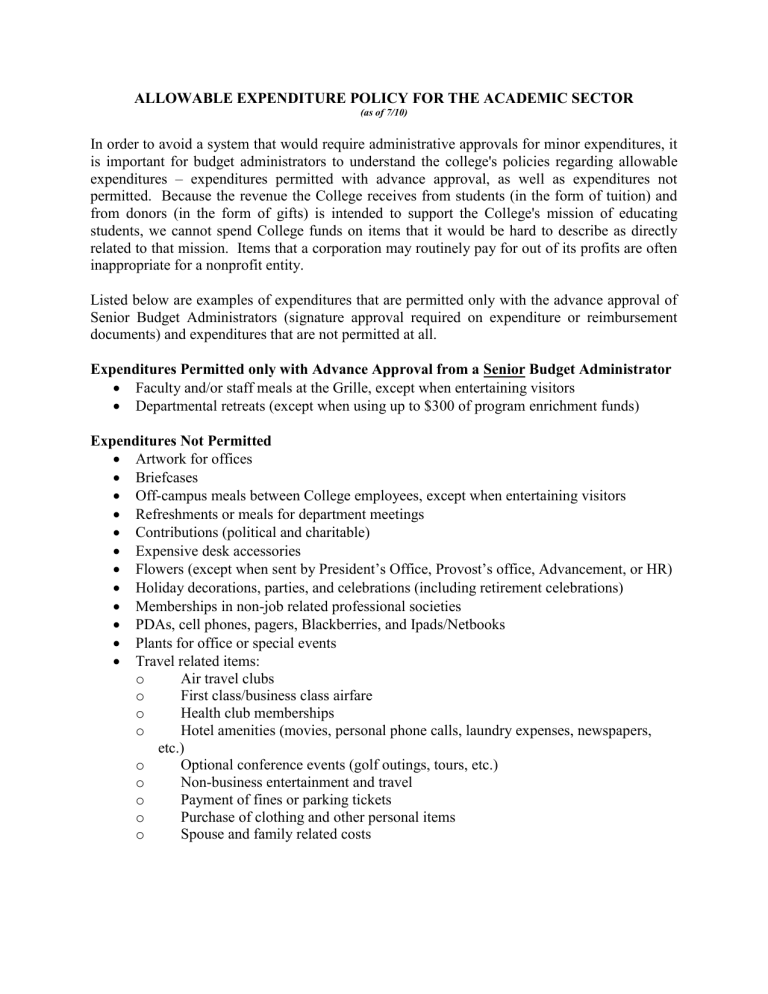

ALLOWABLE EXPENDITURE POLICY FOR THE ACADEMIC SECTOR

(as of 7/10)

In order to avoid a system that would require administrative approvals for minor expenditures, it is important for budget administrators to understand the college's policies regarding allowable expenditures – expenditures permitted with advance approval, as well as expenditures not permitted. Because the revenue the College receives from students (in the form of tuition) and from donors (in the form of gifts) is intended to support the College's mission of educating students, we cannot spend College funds on items that it would be hard to describe as directly related to that mission. Items that a corporation may routinely pay for out of its profits are often inappropriate for a nonprofit entity.

Listed below are examples of expenditures that are permitted only with the advance approval of

Senior Budget Administrators (signature approval required on expenditure or reimbursement documents) and expenditures that are not permitted at all.

Expenditures Permitted only with Advance Approval from a Senior Budget Administrator

Faculty and/or staff meals at the Grille, except when entertaining visitors

Departmental retreats (except when using up to $300 of program enrichment funds)

Expenditures Not Permitted

Artwork for offices

Briefcases

Off-campus meals between College employees, except when entertaining visitors

Refreshments or meals for department meetings

Contributions (political and charitable)

Expensive desk accessories

Flowers (except when sent by President’s Office, Provost’s office, Advancement, or HR)

Holiday decorations, parties, and celebrations (including retirement celebrations)

Memberships in non-job related professional societies

PDAs, cell phones, pagers, Blackberries, and Ipads/Netbooks

Plants for office or special events

Travel related items: o Air travel clubs o o o

First class/business class airfare

Health club memberships

Hotel amenities (movies, personal phone calls, laundry expenses, newspapers, etc.) o o o o o

Optional conference events (golf outings, tours, etc.)

Non-business entertainment and travel

Payment of fines or parking tickets

Purchase of clothing and other personal items

Spouse and family related costs