Internal Controls And Fraud - Association of Government Accountants

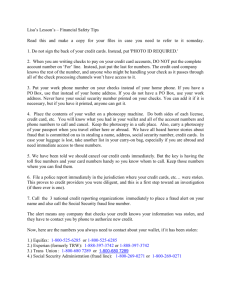

advertisement