Standards and Regulations in the Trans

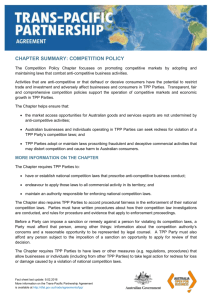

advertisement