Supplier Relationship Management How key suppliers drive

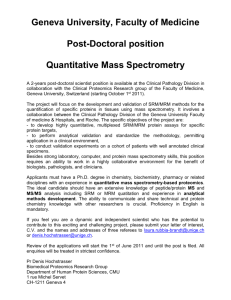

advertisement