Environmental Scan - North West College

advertisement

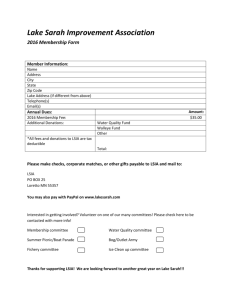

Environmental Scan 140214 North West Regional College Windows User A. Saskatchewan Overview Population Maintaining the momentum gained over the last six years, the provincial population continued to grow in 2013. At the end of October, the population was 1,114,000 (Figure 1). Fig. 1. Saskatchewan Population, 1971 to 2013. Over the five years from 2007 to 2012, Saskatchewan’s growth averaged 2.3% which is the highest among the provinces. International Migration While immigration continues to provide a net gain of residents into the province its pace has slowed. The first half of 2013 had 7% fewer people immigrate to the province compared to the same period in 2012. Nevertheless, a net of 868 interprovincial and 7,266 international migrants maintained a high level of newcomers to the province with help from the Saskatchewan Immigrant Nominee Program. There are currently over 16,000 temporary foreign workers. The province’s “2013 Progress Report on the Saskatchewan Plan for Growth”, reported that over 9,000 nominees became permanent residents in 2012, compared to 960 in 2006. This boosted progress to the province’s goal to increase employment by 60,000 workers before the year 2020. There were 142 unique individuals who received LINC training at North West Regional College in the 2012-13 year. Seventy-eight percent were in the 25 to 44 age group. The same proportion was married or in a common-law relationship. Those with 12 years of high school or less made up 45% of these newcomers; 18% had a trade; 11% a diploma; and 15% had a degree. Over 25% had neither French nor English ability. In December 2012, there were 5,675 international students in the province, an increase of 2,158 since 2007. With the attention the province is receiving in the world with respect to employment and growth prospects, recruitment of international students may be a viable consideration for Battlefords and Meadow Lake campuses. 1 Interprovincial Migration In total, international and interprovincial migration has resulted in 100,000 additional people residing in the province since 2006. Saskatoon, Regina, Estevan, and North Battleford had the highest rates of population growth from 2006 to 2011. However, the number of people leaving Saskatchewan is increasing again. Employment After dropping sharply in 2001, employment has steadily risen at an average rate of 1.4%. (Figure 2). This translates into 7,000 per year. Growth in 2012 was the equivalent of 11,200 new jobs. Growth in 2013 was 18,000. This was the highest number of new jobs in one year since the survey began in 1976. Growth in employment in 2012 shows the largest percentage gains were in construction, resources, utilities, and professional, scientific and technical services. Figure 2. Employment in Saskatchewan, 1976 to 2012. Source: Stats Can. Labour Force Survey, and SaskTrends Monitor. In Oct. 2013, there were 9,950 people receiving employment insurance (EI) in Saskatchewan, a drop of 1,400 people (12.3 per cent) compared to October 2012. Aside from this uncertainty surrounding potash, Saskatchewan’s economy remains relatively strong. Saskatchewan continues to enjoy strong job growth and low unemployment as thousands of new jobs are being created in a number of sectors. The November Labour Force Report by Statistics Canada shows Saskatchewan’s unemployment rate is 3.8 per cent. 2 According to the provincial government’s “Industrial Employment Outlook, 2013 to 2017” 94,500 employment opportunities are expected to arise over the five-year period. Of these, 35,000 will result from economic expansion and 59,500 from attrition. These include year-overyear employment increases of 6,800 in transportation and warehousing, 3,600 in professional, scientific and technical services, 1,600 in manufacturing, and 1,400 in agriculture. Figure 3 shows that growth over the next four years is expected to occur across all sectors. In terms of the overall magnitude, total employment opportunities are expected to be highest in ‘other services’, health care and social assistance, and trades, with attrition accounting for more than half in each case. With respect to growth rates, utilities, accommodation and food services, and transportation and warehousing are expected to grow the fastest. Fig. 3. Forecasted expansion of industries, 2013 to 2017. Source: 2013 Employment Forecast, Government of Saskatchewan. 3 Forestry • There is a recovery underway in the forestry sector. Exports of forestry products were $1.65 billion in 2012 compared with $0.9 billion in 2010. The value of wood products manufactured in the province is up 38% in the first three quarters of 2013 1. • With housing in the US beginning to recover and demand from Asia increasing, there are good reasons for confidence in Saskatchewan forestry. • Paper Excellence owns two pulp mills in Saskatchewan, one in Meadow Lake and one in Prince Albert. Meadow Lake is currently the province’s only operating pulp mill. Meadow Lake Mechanical Pulp produces pulp used in printing and in some composite materials. The mill in P.A. is to be reopened after it reconfigures to a dissolving pulp for diaper manufacturing. • Carrier Forest Products owns sawmills in P.A. and in Big River. Delays at the P.A. Pulp Mill are affecting sawmill operations because P.A. is the preferred destination for wood chips. • NorSask’s sawmill in Meadow Lake produces construction lumber and has over 100 staff and plans to hire an additional 25 in the next few months. In 2012, they also started manufacturing softwood pellets from planer shavings. • L&M Wood Products in Glaslyn continues to treat lumber, fence posts and poles. • Owned by MLTC and Tolko, the OSB mill has been running steadily since 2003. A new screening process is to be implemented in early 2014 to help production. Meadow Lake OSB currently employs 155 staff. Mining • Although employment opportunities were forecast in mining, recent lay-offs will temper the optimism in the mining sector. Several potash developments could face delays due to economic outlooks, high construction costs, risk of over-supply, and price fluctuations. • A Potash marketing cartel in Belarus broke up in July. One of the member companies raised production and created lower prices on the world market. In December, Potash Corp. of Saskatchewan announced over 1,000 lay-offs as a result of excess supply and lowered commodity prices. Almost half of these layoffs were in Saskatchewan and estimates are that these layoffs may be longer term rather than shorter. Despite this set back, BHP Billiton has continued construction on its new mine which indicates long term confidence in the commodity. • Uranium projects valued at $4.5B include Midwest, Cigar Lake, Legacy, Millennium and McClean Lake. After flooding problems in 2006, Cigar Lake mine will be producing ore in the first quarter of 2014. A total of 250 employees will be working at the mine site. 1 Sask Trends Monitor. Nov. 2013. 30(11)p. 8. 4 Oil and Gas • Energy exports totaled $10.3 billion in the first 10 months of 2013, up 3.4 percent from the same period last year, and a record for this period. • Oil and gas contributes 21% of the GDP. • 474,000 barrels of oil per day. • 34,000 direct and indirect jobs. • A total of 1,300 employment opportunities in oil and gas extraction are expected in the next four years. • The December sale of petroleum and natural gas rights brought in $13.9 million in revenue for the province. • Calendar year total revenue from the six land sales held in 2013 was $67.4 million. The highest price on a per-hectare basis was for a 129.5-hectare lease south of Maidstone 2. • The US government will not make a decision about Keystone XL pipeline until early 2014, following an environmental assessment and a determination whether it is in their national interest. The pipeline project is estimated at $5.3 billion, the largest infrastructure project currently proposed. If approved, welders, mechanics, electricians, pipefitters, labourers, safety coordinators, and heavy equipment operators, among others, will be in high demand. • Power engineers, heavy equipment operators, and petroleum engineers are predicted to be a large part of the demand in the oilsands during the next ten years. The greatest demand in the oil sands sector over the next decade will be for power engineers. Although power engineers are hired across the sector, growth of in situ operations and, more specifically, the use of SAGD is the driver behind much of the hiring requirements. • Bayshore Petroleum announced they plan to build a pilot upgrader at Meota with a capacity of 350 barrels per day. During the construction phase welders will be required. Transportation and Warehousing • 6,800 jobs are forecast for the next four years, primarily related to export, travel, accommodation and food, wholesale trade, and construction. • Activities in this sector include the transport of passengers and cargo, and warehousing and storage. Prospects for stronger U.S. economy and a weaker Canadian dollar are expected to improve the volume of exports and investment activity. Utilities • The utilities industry consists of businesses that provide electricity, natural gas, steam supply, water supply and sewage removal services. • Total opportunities are projected to increase by 1,700 over the forecast period. 2 http://www.gov.sk.ca/news?newsId=75f4cc73-1825-4744-9a2f-52a30f48476a. 5 Retail and Wholesale Trade • Wholesale trade in Saskatchewan was $2 billion in Oct. 2013, a jump of 12.4 percent over last year, and more than three times the national increase of 3.5 percent. • An additional 10,900 job opportunities are expected in this sector over the four-year period, with more than two -thirds resulting from attrition. • Growth in the retail trade industry is supported by increased housing activity, vehicle sales, and general consumer spending. • Continued growth in the agricultural supplies industry, which accounts for one -third of wholesale sales, will encourage growth of employment opportunities in this industry. Accommodation and Food Services • A total of 7,000 job opportunities are expected over the next four years, 4,800 of which will be due to economic expansion. • Since 2009, employment levels in the industry have remained relatively stable with some modest growth occurring, but the forecast annual growth in employment by 2017 is expected to be the highest of all sectors. Construction • Employment opportunities totaling 5,500 are forecast to come primarily from attrition. Employment levels are expected to remain relatively stable over the next few years as major projects currently underway are completed. • October was a busy month for construction companies in the province as building permits totaled a record $371 million. Month-over-month, building permits were up by 26 per cent between September 2013 and October 2013, the highest percentage increase among the provinces and well ahead of the seven per cent posted nationally. Manufacturing • A total of 4,000 employment opportunities are expected in the next four years. Economic expansion will result in 1,200 opportunities. • Major projects planned or underway over the forecast period include a $300M conversion of a pulp mill to a dissolving pulp mill in Prince Albert. • Led by food and chemical production, manufacturing shipments are, on a year-over-year basis, up by 11 per cent in the province. Agriculture • with limited growth in terms of expansion, employment in the sector will remain close to current levels • a total of 4,700 job opportunities are expected, mostly due to attrition. Financial, Real Estate, Insurance and Leasing • Job opportunities in this industry are expected to total 5,700 over the forecast period with approximately one-third due to economic expansion. 6 Educational Services • Employment opportunities are expected to total 8,200, with attrition accounting for two thirds. • In 2012, there were the highest number of births in 22 years. With a continuation of large numbers of international migrants coming to the province, demand is expected to increase for education jobs. Health Care and Social Services • Over the period 2013-2017, employment opportunities are expected to total 13,000. • Saskatchewan’s aging population will contribute to the demands on health care. Public Admin • An additional 5,800 job opportunities are expected over the next few years. Between 2013 and 2016, attrition will account for roughly 80% of these openings. Other Services • This industry group includes management of companies, administrative and other support services, professional scientific and technical services, information, culture, and recreation, and other services not included elsewhere. Businesses in this industry are engaged in managing companies, performing professional, scientific and technical activities that generally require a high degree of expertise and training. • The industry is expected to create 16,700 job opportunities between 2013 and 2017. Economic expansion is expected to create 7,400 of those opportunities. 7 Employment by Education The highest rate of employment growth in the past five years has been for those with a university degree. Figure 4 shows that those with less than a high school diploma have lost job opportunities. The categories that had increased jobs required grade 12, certificates, diplomas or degrees. Figure 4. Employment by Completed Education, 2007 to 2012. 8 Employment for Off-reserve Aboriginal Population Employment growth in the off-reserve Aboriginal population was strong in 2012 (Figure 5). It accounted for 30% of the employment gains. Figure 5. Average Annual Growth in Employment, 2007 to 2012. 9 Wage Rate by Education While high school grads have a good chance of attaining employment, higher wages are earned by those with post-secondary education. In 2012, a worker with a certificate or diploma earned 20% more than a high school grad. Similarly, those with a degree earned 20% more, on average, than those with a certificate or diploma. Figure 6 shows the difference in wage rates by education level completed. Figure 6. Average Hourly Wage Rates by Level of Completed Education, 2012. 10 According to the provincial government’s “Occupational Employment Outlook, 2013 – 2017” the 30 most in-demand occupations are forecast to account for almost half of the total employment opportunities over this period. These occupations are listed in Table 1. Table 1. Top Opportunities, 2013 to 2017. Automotive service technicians, truck and bus mechanics, and mechanical repairers Bookkeepers Carpenters Community and social service workers Cooks Early childhood educators and assistants Elementary and secondary school teacher assistants Elementary school and kindergarten teachers Farmers and farm managers Financial auditors and accountants Financial managers Food and beverage servers Food counter attendants, kitchen helpers and related occupations General office clerks Heavy equipment operators Information systems analysts and consultants Janitors, caretakers and building superintendents Light duty cleaners Nurse aides, orderlies and patient service associates Principals and administrators of elementary and secondary education Registered nurses Restaurant and food services managers Retail salespersons and sales clerks Retail trade managers Sales, marketing, and advertising managers Secondary school teachers Secretaries (except legal and medical) Truck drivers Welders and related machine operators 11 B. Regional Perspective Educational Attainment Educational attainment levels were obtained from the National Household Survey (NHS). The discontinuation of the census’ long form survey resulted in many communities not having enough responses to effect the release of their data. Using communities with information available, Table 2 shows the educational attainment in the region, compared to provincial figures. Table 2. Educational Attainment for Population aged 25 to 64 years by highest education. NWRC Region Saskatchewan Educational Attainment Level (%) (%) No certificate, diploma or degree 25 16 High school diploma or equivalent 27 27 Postsecondary certificate or diploma 35 38 Degree 12 19 population available by NHS 100 100 High school graduation rates in the region were the same as in the province, and similar graduation rates for those attaining a certificate or diploma. However, there were fewer university grads in the region, and a higher proportion of those without high school credentials when compared to other parts of the province. Major Projects in the Region A number of construction projects are underway in the region. Table 3 shows some of these construction projects underway or in the planning phase. Table 3. Major Projects. Company Project Kramer agriculture implement facility Co-op gas bar/convenience store LMG oil tank manufacturing plant Tim Hortons restaurant construction Meadow Lake Tribal Council biomass power generator Meadow Lake Co-op fertilizer blending plant Northwest Community Futures conference centre Wal-Mart 32,000 sq ft addition Battlefords Tribal Council hotel 600653 SK franchise hotel Co-op eight lane cardlock BTEC education facility Sask Health Sask Hospital Husky heavy oil thermal projects Adapted from http://economy.gov.sk.ca/2013-MPI. Community Battleford Meadow Lake North Battleford Projected Cost ($ million) 7 6 5 2 150 2 4 6 16 10 2 3 NA Edam & Vawn 12 One of the largest projects under development is MLTC’s goal to break ground on the biomass power generator this spring. The plant will be capable of producing 35 megawatts, which can provide enough electricity for 30,000 homes. During the three-year construction more than 200 jobs will be created. At completion the facility will employ 25 staff. City of North Battleford Surveys The City of North Battleford’s conducted two surveys in May 2013. Their “Retail and Service Industry Survey, 2013” reported 31% of respondents found the availability of skilled labour to be poor. The City also polled manufacturing and industrial businesses. In 40% of the cases, respondents in the “2013 Industrial Survey” reported poor availability of skilled labour. Try-a-Trade Event In May 2013 during the coordination of the College’s Try-a-Trade event, staff received the following training needs from her contacts with the business community: • insurance adjuster training • graphic technician program • automotive service technician • vet tech • entrepreneurship & small business • business marketing • human resource management • power engineer • boiler/steam course • institutional meat cutting • institutional cooking or professional cooking • broadcasting/journalism • RN and • carpentry. Many of the business were having issues with staff retention. Several were hiring immigrants and stressed the need for ESL Training. 13 NWRC Business Survey In November 2013, businesses in the region with five or more employees were surveyed by NWRC. The following are the highlights from the responses. • Although a relatively small sector based on the number of employees, the automotive industry was well represented in the number of responses. This is an indicator of a strong demand for automotive service technicians and autobody technicians and related occupations such as parts techs and service writers. This demand is compounded by the reported lack of student interest in these trades. Customers are putting a downward pressure on repair costs while employers are trying to attract and retain staff. • Although few employers in manufacturing responded, the two that did represented large shops. Process operators, millwrights and electricians were most in demand. • Similarly, there were few responses from the education sector to the survey yet, given the large size of the employers, demand for Educational Assistants and Teachers was strong. • Other sectors that had high response rates to the survey were health, and retail and business services. Special care aides and continuing care assistants were needed in the largest quantities. Cooks also emerged as a need. There were three dental offices indicating a need for dental therapists/assistants and concern was expressed about the closure of P.A.’s training centre. • The business sector’s needs were varied, but production of Office Education and Business grads will help alleviate their demand for front line staff. • Community services employers indicated Early Childhood diplomas and Youth Care Workers are needed. 14 Student Recruiter Findings The College’s student recruiter received a number of inquiries during her student recruitment travels. Some of the programs students were looking include: • Addictions counselor • Art programs or Music through U of R or U of S • Bridging from LPN to RN • Construction worker • Cooking classes • Custodian program • Digital camera classes • Engineering classes • Fitness Recreation Coordinator • Gel Nail course, and Eyelash Extension • Landscaping • Marketing classes • Massage Therapy • Paramedic • RN program • Rural Municipality Administration (6 course program through U of R) • Water Treatment classes Better Business Trade Show NWRC marketing staff received some interest in the following programs from attendees at the Better Business Trade show in North Battleford: • Cake decorating • Carpentry (Level 2) • LPN bridging program • MBA and Edwards School of Business classes • Pharmacy Tech • Photography • PVC course for glass manufacturers • Shipping and receiving course • Simply Accounting and QuickBooks • Small business weekend session (law, insurance, marketing…) • University law classes 15 Regional Health Sector Health regions in the northwest are posting fewer jobs on their websites than the same time last year. Table 4 shows a summary of their online job postings. 2 1 1 1 2 1 1 1 1 2 3 2 1 2 4 1 1 1 3 1 1 1 1 3 3 1 Total Unity Wilkie Shellbrook 1 Turtleford 1 Loon Lake Edam 1 St. 2 1 Cut Knife Addictions Counselor CCA Client care coordinator Cook EMR Environmental services Food services worker Home care manager Home care scheduler LPN Maintenance worker Mental health therapist Office assistant Pharmacist Radiologist RN Meadow L. Occupation Battlefords Table 4. Occupations advertised on Health Regions’ websites, Dec. 2013. 2 6 1 4 1 1 1 1 2 3 3 1 2 2 1 17 The strongest need is for RNs. Seventeen jobs were posted and the demand was reported in communities throughout the region. All four health regions that operate in the college’s region have increased their staff numbers since 2006-07 (Table 5). Table 5. Number of FTE in Regional Health Authorities Health Authority 2006-07 2010-11 Saskatoon 8411 9430 Heartland 1020 1087 Prince Albert Parkland 1644 1922 Prairie North 1937 2191 % change 9 7 17 13 16 Although provincial in scope, the update of the Health HR Plan also provided a forecast for the number of employees required in the next ten years. Table 6 is an excerpt of this forecast to highlight selected occupations as an indicator of what is also likely to be in demand within the College region. Table 6. Projected number of FTEs required by the year 2021. Profession Projected # of FTEs # training seats, 2012-13 required by 2021 Diagnostic Medical Sonographer 25 4 Health Records Clerk 79 13 Home Care/ Special Care Aide 2546 250 LPN 936 350 Medical Laboratory Technologist 251 20 Medical Radiation Technologist 66 12 Nurses 3415 725 Respiratory Therapist 77 8 Excerpt from “Saskatchewan’s Health Human Resource Plan, Appendix B Forecast Update”. Jan. 2013. Medical Lab Tech was the only profession without sufficient training capacity in the province to meet the projected demand for staff in the next ten years. If all twenty grads remained in the province each year for the next ten years there would be 200 grads. This would not provide all of the 251 needed MLTs. The occupations impacted the most by increased demand, retirements and attrition are • nurses, • home care/special care aides, • medical lab techs, • addiction counselors, • occupational therapists, • respiratory therapists, • speech language pathologists and • public health inspectors. Oil and Gas - Major Project • Husky Energy Inc. is going ahead with two new heavy oil thermal projects that will deliver 20,000 barrels per day. Husky has begun engineering on the Edam East project and will start on the Vawn project later this year. It expects both to be in production by 2016 3. 3 http://www.huskyenergy.com/news/release.asp?release_id=1796776. 17 Regional Population and Demographics Covered population counts from the Ministry of Health provides the most up-to-date estimate of population (June 30, 2013), based on eligibility for health insurance benefits in Saskatchewan. All residents of Saskatchewan are included except members of the Canadian Armed Forces, Royal Canadian Mounted Police, and inmates of federal prisons, all of whom are covered by the federal government; and people not yet meeting the residency requirement. Coverage begins on the first day of the third calendar month following their move to Saskatchewan. Saskatchewan residents moving elsewhere remain eligible for coverage for the same period. In the case of death, people who had coverage any time in June are included. Table 7 shows the covered population counts for towns in the College’s region. Forty-seven of the fifty communities increased their population between 2010 and 2013. While Krydor remained the same size, the population in the two largest communities, Meadow Lake and North Battleford, diminished. Table 7. Covered Population for Cities, Towns and Villages in NWRC’s Region. City, Town, Village Population City, Town, Village 2010 2013 Battleford 3,569 4,645 Maymont Big River 1,268 1,472 Meadow Lake Blaine Lake 616 751 Medstead Borden 414 505 Meota Canwood 558 609 Mervin Chitek Lake 150 192 North Battleford Cochin 274 543 P.A. National Park Cut Knife 873 897 Paradise Hill Debden 608 763 Parkside Denholm 86 138 Paynton Dorintosh 277 382 Pierceland Duck Lake 382 565 Rabbit Lake Edam 615 703 Radisson Glaslyn 421 520 Richard Goodsoil 625 669 Rosthern Hague 1,513 1,737 Ruddell Hafford 595 723 Shell Lake Hepburn 657 934 Shellbrook Krydor 51 51 Speers Laird 315 390 Spiritwood Leask 614 655 St. Walburg Leoville 500 626 Turtleford Loon Lake 475 675 Unity Makwa 239 260 Waldheim Marcelin 257 307 Wilkie Total Population 2010 2013 139 216 7,675 7,324 308 348 451 611 228 257 17,917 16,621 79 172 791 861 183 204 220 292 974 1,103 136 179 546 667 124 144 1,645 1,994 33 47 387 589 1,558 1,938 133 150 1,357 1,463 1,040 1,117 776 957 2,759 3,067 1,066 1,339 1,459 1,463 57,936 62,835 18 In 2013, an additional 4,899 people were living in cities, towns and villages than in 2010. This was in spite of the 1647 people no longer counted in Meadow Lake and North Battleford. Table 8 shows the population of rural municipalities (RMs) in the region. Only six of the 30 RMs experienced a decrease in population. Overall, population in RM increased 12.8% over the past three years. Table 8. Covered Population for RMs in NWRC’s Region. RM 2010 2013 RM Population Population Battle River RM #438 589 619 Medstead RM #497 Beaver River RM #622 347 390 Meeting Lake RM #466 Big River RM #555 193 224 Meota RM #468 Blaine Lake RM #434 100 106 Mervin RM #499 Buffalo RM #409 332 330 North Battleford RM #437 Canwood RM #494 576 715 Parkdale RM #498 Cut Knife RM #439 215 276 Paynton RM #470 Douglas RM #436 111 126 Redberry RM #435 Duck Lake RM #463 744 720 Rosthern RM #403 Frenchman Butte RM#501 756 1,132 Round Hill RM #467 Great Bend RM #405 161 191 Round Valley RM #410 Laird RM #404 826 775 Shellbrook RM #493 Leask RM #464 215 232 Spiritwood RM #496 Loon Lake RM #561 220 266 Turtle River RM #469 Mayfield RM #406 351 336 Total Meadow Lake RM #588 1,077 1,272 2010 Population 198 281 181 697 250 451 107 98 557 262 122 1,275 453 162 11,907 2013 Population 263 306 187 944 311 411 110 117 664 234 138 1,317 516 200 13,428 Table 9 presents the covered population counts for first nation communities, based on the Sask Health’s methodology of, where possible, utilizing the residence address. In three years, there were almost 800 fewer residents on-reserve. Table 9. Covered Population of First Nation Communities in NWRC’s Region. First Nation 2010 2013 First Nation Population Population Ahtahkakoop 1,554 1,491 Onion Lake Beardy’s and Okemasis 1,847 1,842 Pelican Lake Big Island Lake 806 828 Poundmaker Big River First Nation 1,914 1,932 Red Pheasant Flying Dust 671 619 Saulteaux Island Lake 978 1,005 Sturgeon Lake Little Pine 791 768 Sweetgrass Makwa Sahgaiehcan 1,057 1,059 Thunderchild Mistawasis 864 825 Wahpeton Dakota Nation Moosomin 898 797 Waterhen Lake Mosquito 703 688 Witchekan Lake Muskeg Lake 475 435 Total 2010 Population 3,339 952 718 855 640 1,445 917 1,154 157 744 555 24,034 2013 Population 3,458 928 641 772 644 1,191 875 1,080 87 728 543 23,236 19 Table 10 summarizes the change in population by community type. Rural municipalities grew the most, on a percentage basis. While both cities lost population, the category of cities, towns and villages grew by 8.5% overall. First nations lost 3.3 percent of their population. The region overall gained six percent in the three year period. Table 10. Covered Population in NWRC’s Region. Community Type 2010 2013 Population Population City, Town, Village RM First Nation Total 57,936 11,907 24,034 93,877 62,835 13,428 23,236 99,499 Percent Change 8.5 12.8 -3.3 6.0 The areas selected in figure 7 were arbitrary and created just to provide some perspective as to where the population is located within the region. • The greatest concentration of residents is within 100 km radius of the Battlefords • Meadow Lake area has half the population density of the Battlefords area • Strong growth in the Turtleford and Rosthern zones was experienced over the past 3 years • Growth in the Rosthern zone was concentrated in the towns • There was a general trend of declining populations in First Nation communities Figure 7. Covered Population Counts for Selected Trading Areas in the College’s region. 20 Communities in the Selected Trading Areas Table 11. Battlefords Area Community 2010 pop’n 2013 pop’n % change Battleford 3,569 4,645 30 Battle River RM #438 589 619 5 Blaine Lake 616 751 22 Blaine Lake RM #434 100 106 6 Borden 414 505 22 Buffalo RM #409 332 330 -1 Cochin 274 543 98 Cut Knife 873 897 3 Cut Knife RM #439 215 276 28 Denholm 86 138 60 Douglas RM #436 111 126 14 Great Bend RM #405 161 191 19 Hafford 595 723 22 Krydor 51 51 0 Little Pine 791 768 -3 Mayfield RM #406 351 336 -4 Maymont 139 216 55 Meota 451 611 35 Meota RM #468 181 187 3 Moosomin 898 797 -11 Mosquito 703 688 -2 North Battleford 17,917 16,621 -7 North Battleford RM #437 250 311 24 Paynton 220 292 33 Paynton RM #470 107 110 3 Poundmaker 718 641 -11 Radisson 546 667 22 Red Pheasant 855 772 -10 Redberry RM #435 98 117 19 Richard 124 144 16 Round Hill RM #467 262 234 -11 Round Valley RM #410 122 138 13 Ruddell 33 47 42 Saulteaux 640 644 1 Speers 133 150 13 Sweetgrass 917 875 -5 Unity 2,759 3,067 11 Wilkie 1,459 1,463 0 Total Population 38,660 39,797 3 Communities highlighted in red lost population between 2010 and 2013. Those in green increased by 24% or more in the same period. 21 Table 12. Meadow Lake Area Community 2010 pop’n 2013 pop’n % change Beaver River RM #622 347 390 12 Big Island Lake 806 828 3 Big River First Nation 1,914 1,932 1 Big River 1,268 1,472 16 Big River RM #555 193 224 16 Canwood 558 609 9 Debden 608 763 25 Dorintosh 277 382 38 Flying Dust 671 619 -8 Goodsoil 625 669 7 Island Lake 978 1,005 3 Loon Lake 475 675 42 Loon Lake RM #561 220 266 21 Makwa 239 260 9 Makwa Sahgaiehcan 1,057 1,059 0 Meadow Lake 7,675 7,324 -5 Meadow Lake RM #588 1,077 1,272 18 P.A. National Park 79 172 118 Pierceland 974 1,103 13 Waterhen Lake 744 728 -2 Total Population 20,875 21,752 4 Communities highlighted in red lost population between 2010 and 2013. Those in green increased by 24% or more in the same period. Table 13. Turtleford Area Community 2010 pop’n 2013 pop’n % change Edam 615 703 14 Frenchman Butte RM #501 756 1,132 50 Glaslyn 421 520 24 Medstead 308 348 13 Mervin 228 257 13 Mervin RM #499 697 944 35 Onion Lake 3,339 3,458 4 Paradise Hill 791 861 9 St. Walburg 1,040 1,117 7 Thunderchild 1,154 1,080 -6 Turtle River RM #469 162 200 23 Turtleford 776 957 23 Total Population 10,287 11,577 13 Communities highlighted in red lost population between 2010 and 2013. Those in green increased by 24% or more in the same period. 22 Table 14. Shellbrook Area Community 2010 pop’n 2013 pop’n % change Chitek Lake 150 192 28 Ahtahkakoop 1,554 1,491 -4 Canwood 558 609 9 Canwood RM #494 576 715 24 Leask 614 655 7 Leask RM #464 215 232 8 Leoville 500 626 25 Marcelin 257 307 19 Medstead RM #497 198 263 33 Meeting Lake RM #466 281 306 9 Mistawasis 864 825 -5 Muskeg Lake 475 435 -8 Parkdale RM #498 451 411 -9 Parkside 183 204 11 Pelican Lake 952 928 -3 Rabbit Lake 136 179 32 Shell Lake 387 589 52 Shellbrook 1,558 1,938 24 Shellbrook RM #493 1,275 1,317 3 Spiritwood 1,357 1,463 8 Spiritwood RM #496 453 516 14 Sturgeon Lake 1,445 1,191 -18 Wahpeton Dakota Nation 157 87 -45 Witchekan Lake 555 543 -2 Total Population 15,151 16,022 6 Communities highlighted in red lost population between 2010 and 2013. Those in green increased by 24% or more in the same period. Table 15. Rosthern Area Community 2010 pop’n 2013 pop’n % change Beardy’s and Okemasis 1,847 1,842 0 Duck Lake 382 565 48 Duck Lake RM #463 744 720 -3 Hague 1,513 1,737 15 Hepburn 657 934 42 Laird 315 390 24 Laird RM #404 826 775 -6 Rosthern 1,645 1,994 21 Rosthern RM #403 557 664 19 Waldheim 1,066 1,339 26 Total Population 9,552 10,960 15 Communities highlighted in red lost population between 2010 and 2013. Those in green increased by 24% or more in the same period. 23 Figure 8 shows the covered population counts in the region for those under 65 years. Figure 8. Population in NWRC region, by selected age categories. 60 to 64 55 to 59 50 to 54 Age Categories 45 to 49 40 to 44 35 to 39 30 to 34 25 to 29 20 to 24 15 to 19 10 to 14 5 to 9 <5 0 1000 2000 3000 4000 5000 6000 7000 8000 The baby boom generation is still evident in the fifty to sixty age group. What is more dramatic is the solid wave of young’uns under 25. In recent years, this advantage of a burgeoning youth was credited to the Aboriginal community. In figures 10 and 11, RMs, towns and cities are also now seeing an increase in the number of toddlers under that age of five. While some Aboriginal youth may have moved from First Nation communities to towns, RMs and cities, there also has been an increase in immigration from other provinces and other countries. Many immigrants bring young families and add to them after arrival. The prospects of gainful employment relative to the lack of opportunities elsewhere has perhaps given people the confidence to start families in this region. While figure 10 shows the age distribution in RMs is still top heavy with seniors, the younger generations are most prominent in the First Nation but also increasingly evident in other community types in the region. 24 Figure. 9. Covered Population Counts in First Nations Communities in NWRC’s Region. Age Categories 60 to 64 55 to 59 50 to 54 45 to 49 40 to 44 35 to 39 30 to 34 25 to 29 20 to 24 15 to 19 10 to 14 5 to 9 <5 0 1000 2000 3000 4000 5000 6000 7000 8000 Figure. 10. Covered Population Counts in RMs in NWRC’s Region 60 to 64 Age Categories 50 to 54 40 to 44 30 to 34 20 to 24 10 to 14 <5 0 1000 2000 3000 4000 5000 6000 7000 8000 Age Categories Figure. 11. Covered Population Counts in Towns and Cities in NWRC’s Region 60 to 64 50 to 54 40 to 44 30 to 34 20 to 24 10 to 14 <5 0 1000 2000 3000 4000 5000 6000 7000 8000 25 Communities that grew their population by 24% or more between 2010 and 2013 are highlighted in green in Figure 12. As during the intercensal period from 2006 to 2011, growth in the southeast part of the region, near Saskatoon, continued. Hague and Rosthern also grew but not enough to earn a green dot. Communities that lost population in the same period are indicated by the red dot. Figure 12. Map of Region. Many first nations lost population while neighbouring small towns increased in size by 24% or more. The two largest communities, Meadow Lake and North Battleford, lost population from 2011 to 2013. Battleford increased its population as did several satellite communities surrounding North Battleford. 26 High School Enrolments The number of students in grades 10, 11 and 12 within regional school divisions provides a proxy to indicate the number of high school grads expected in the next three years. Students enrolled in grades 10, 11, and 12 within the region are presented in Table 16. Table 16. Enrolment Statistics for High Schools in Regional School Divisions, 2013-14. School Division Light of Christ School Name Gr 10 to 12 Gr 10 Gr 11 Gr 12 John Paul II Collegiate 436 190 93 153 Cut Knife High School 51 23 14 14 Hafford Central School 36 15 12 9 5 1 3 1 Leoville Central School 36 15 9 12 Maymont Central School 37 11 15 11 McLurg High School 76 16 27 33 Heritage Christian School Living Sky Medstead Central School Northwest Prairie Spirit Sask Rivers 30 9 12 9 North Battleford Comp 553 198 157 198 Sakewew High School 144 71 34 39 Spiritwood High School 128 51 31 46 Unity Composite 127 39 40 48 Carpenter High School 458 173 135 150 Ernie Studer School 38 12 11 15 Glaslyn Central School 18 6 5 7 Goodsoil Central School 33 14 10 9 H. Hardcastle School 50 22 14 14 Hillmond Central School 43 19 10 14 Paradise Hill School 60 23 20 17 Pierceland Central School 41 14 13 14 St. Walburg School 51 11 19 21 Turtleford School 85 28 24 33 Blaine Lake School 46 18 13 15 Borden School 28 10 12 6 Hague High School 91 32 28 31 Hepburn School 51 13 17 21 Leask Community School 59 31 20 8 Rosthern High School 60 20 22 18 Stobart Community School 80 22 36 22 Waldheim School 83 24 31 28 Big River High School 47 14 17 16 Canwood School 32 14 7 11 Debden School 46 24 7 15 94 3,253 31 1,214 40 958 23 1,081 W.P. Sandin Composite Region Total 27 Enrolment stats in Table 16 do not include on-reserve high schools: Chief Little Pine, Chief Poundmaker, Pelican Lake School, Se Se Wa Hum School (Victoire), Chief Napew Memorial School (Pierceland), and Island Lake School, Waweyekisik Education Centre (Waterhen), Eagleview Comprehensive (Onion Lake) and Piyesiw Awasis (Thunderchild). However, they provide an approximation of the number progressing through their final years of high school, and prime candidates for entry into college. A decrease in the number of grads is expected in 2015 following the larger graduation class of 2014. While 1,214 students are currently in Grade 10, not all of these students will graduate from high school. A drop-out rate of 15% will provide a grad class comparable in size of the 2014 cohort. 28