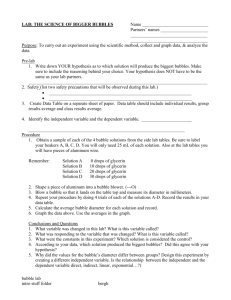

Understanding Economic Bubbles

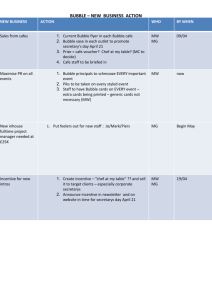

advertisement