CPCU 500 Chapter 3 – Risk Control Educational Objectives

advertisement

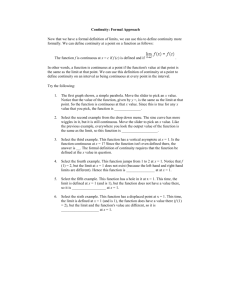

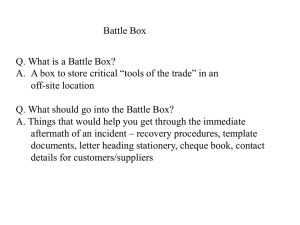

10/2/2012 CPCU 500 Chapter 3 – Risk Control Presented by Cathy Jo Morris, CPCU, FLMI, ACS Educational Objectives 1. Describe the six categories of risk control techniques in terms of the following: • Whether each reduces loss frequency, reduces loss severity, or makes losses more predictable • How each can be used to address a particular loss exposure • How they differ from one another Educational Objectives 2. Explain how an organization can use risk control techniques and measures to achieve the following risk control goals: • Implement effective and efficient risk control measures • Comply with legal requirements • Promote life safety • Ensure business continuity 1 10/2/2012 Educational Objectives 3. 4. Explain how risk control techniques can be applied to property, liability, personnel, and net income loss exposures. Describe business continuity management in terms of its scope, the process used to implement it, and the contents of a typical business continuity plan. EO#1 Risk Control Techniques Risk control is a conscious act or decision not to act that reduces the frequency and/or severity of losses or makes losses more predictable. Risk control techniques can be classified using these six broad categories: Avoidance Loss prevention Loss reduction Separation Duplication Diversification EO#1 Avoidance -Avoiding one loss exposure can create or enhance another -Complete avoidance is not the most common risk control technique and is typically neither feasible nor desirable. -Loss exposures arise from activities that are essential to individuals and organizations. It is not possible to avoid these core activities 2 10/2/2012 EO#1 Loss Prevention • Loss prevention – reduces frequency, may also affect loss severity, usually implemented before a loss occurs • As with avoidance, loss prevention measures may reduce the frequency of losses of one loss exposure but increase the frequency or severity of losses from other exposures EO#1 Loss Reduction Loss reduction is a risk control technique that reduces the severity of a particular loss Two broad categories: – Pre-loss measures – reduce the amount or extent of property damaged and the number of people injured or the extent of injury incurred from a single event – Post loss measure typically focus on emergency procedures, salvage operations, rehab activities, public relations, or legal defenses to halt the spread or to counter the effects of loss EO#1 Separation • Separation is a risk control technique that isolates loss exposures from one another to minimize the adverse effect of a single loss • The intent of separation is to reduce the severity of an individual loss at a single location Completed Fireworks! • Separation can increase loss frequency 3 10/2/2012 EO#1 Duplication • Duplication is a risk control technique that uses backups, spares, or copies of critical property, information, or capabilities and keeps them in reserve EO#1 Diversification • Diversification is a risk control techniques that spreads loss exposures over numerous projects, products, markets or regions • More commonly applied to managing business risks, rather than hazard risks EO#2 Risk Control Goals Risk control techniques are used to support the following risk control goals: Implement effective and efficient risk control measures Comply with legal requirements Promote life safety Ensure business continuity 4 10/2/2012 EO#2 Risk Control Goals • Effective – Enables an organization to achieve the risk management goal. – Based on both quantitative and qualitative measures • Efficient – Least expensive of all possible measures – Cash flow analysis helps a risk manager choose the most efficient alternative • See page 3.15 for an example of a cash flow analysis EO#2 Risk Control Goals Cash Flow Analysis Advantages: • Same basis of comparison • Increase efficiency by reducing unnecessary expenditures Disadvantages: • Making assumptions • Accurate estimates • Organization has other goals EO#2 Comply with Legal Requirements • An organization may be required to implement certain risk control measures by state or federal statute mandates. – The cost of adhering to legal requirements becomes part of the cost of risk • State laws and regulations are amended frequently and it is important for the risk management professional to stay apprised of any amendments. 5 10/2/2012 EO#2 Promote Life Safety • Life safety is the portion of fire safety that focuses on the minimum building design, construction, operation and maintenance requirements necessary to assure occupants of a safe exit from the burning portion of the building EO#2 Ensure Business Continuity • Risk control should aim to ensure business continuity – that is to minimize or eliminate significant business interruptions • Business continuity is designed to meet both the primary risk management program post-loss goals of survival and continuity of operations • Because each organization is unique in its potential losses, each must also be unique in its application of risk control measures to promote business continuity EO#3 Risk Control Techniques Explain risk control techniques for: property liability personnel net income 6 10/2/2012 EO#3 Property Loss Exposures • Property loss exposures are generally divided into two categories: – Tangible – Intangible • Risk control techniques applicable to property loss exposures vary by – Type of property – Cause of loss • Insurance professionals commonly examine commercial property loss exposures based on – – – – Construction Occupancy Protection External Environment EO#3 Liability Loss Exposures • Exposures include premises, operations, products, work comp, professional, completed operations, auto, watercraft and management • Three risk control techniques can be used to control liability losses ① Avoid the activity that creates the exposure ② Decrease the likelihood of the loss occurring ③ Minimize the effect of the loss on the organization After a liability loss has occurred, measures to reduce the severity should be implemented Properly respond to Consult with the liability Participate in an attorney claim and to alternative for guidance dispute the claimant through the resolution in order to legal steps avoid feelings of ill will 7 10/2/2012 EO#3 Personnel Loss Exposures • Involve preventing and reducing workplace injury and illness • Loss prevention measures typically involve education, training and safety measures • Organizations may use separation, such as restricting the number of key employees who can travel on the same aircraft • Loss reduction measures include emergency response training and rehab management EO#3 Net Income Exposures • Separation and duplication measures that enable an organization to reduce net income losses by maintaining operations or quickly resuming operations following a loss • Diversification helps to ensure that an organization’s entire income is not dependent on one product or customer EO #4 Business Continuity Describe business continuity management in terms of its scope, the process used to implement it and the contents of a typical business continuity plan – Post-loss goals of survival and continuity of operations – A planned response the organization will follow once a loss has occurred 8 10/2/2012 EO#4 Scope of Business Continuity Management • The business continuity process involves these six steps Identify the organization’s critical functions Identify the risks to the organization’s critical functions Evaluate the effect of the risks on those critical functions Develop a business continuity strategy Develop a business continuity plan Monitor and revise the business continuity process EO#4 Scope of Business Continuity Management • Business continuity management plans have been expanded to help an organization handle interruptions from these: – Property losses – IT problems – Human failures – Loss of utility – Reputation losses – Human asset losses (personnel losses) Most business continuity plans contain the following: Strategy the organization is going to follow to manage the crisis Information about the roles and duties of various individuals in the organization Steps that can be taken to prevent any further loss or damage Emergency response plan to deal with life and safety issues Crisis management plan to deal with communication and any reputation issues Business recovery and restoration plan Access to stress management and counseling for affected parties 9 10/2/2012 The difference between ordinary and extraordinary is that little extra. - Unknown 10