Risk Management 101 Workshop

Workshop Agenda

Introductions

General/Safety

Cell Phones

Purpose

Approach

Q & A Time

Evaluations

Workshop Materials Used

Old

New

Borrowed

And True

Organizational Objectives

Profit

Operating Efficiency

Continuous Operations

Stable Earnings or

Revenue Stream

Growth

Legal Compliance

Humanitarian Concerns

Reputation

Risk Management

A system for planning, organizing, leading, and controlling the resources and activities that an organization needs to protect itself from the adverse effects of accidental losses.

Goal- To reduce the exposure to loss for the organization.

Risk Management Objectives

Pre-Loss

Economy of RM

Operations

Tolerable

Uncertainty

Legality

Ethical Approach

Social

Responsibility

Post-Loss

Survival

Continuity of

Operations

Profitability

Stable

Earnings/Revenue

Social Responsibility

Growth

Risk Management Responsibilities:

Strategy/General

Communication

Safety/Loss Control

Claims

Management

Claims Analysis

Risk Financing

Management Reporting

RM Advice

Key Partnership Building

Executive Management

Internal Audit

Operations/Unions

Human Resources

Benefits

Safety/Security

Planning

Construction

Real Estate

Contracts Admin.

Risk

Management

(Traditional

Role)

Legal

Regulatory

Compliance

Insurers

3 rd Party

Administrators

Finance

Accounting

Brokers

Major Types of Exposures

Property

Buildings-Business Personal Property

Rolling Stock- Personal Property of Others

Liability

Legally Enforceable Obligation

Personnel

Key Personnel and Officers and Directors

Net Income

Revenue Reduction/Expense Increase/Both

Basic Risk Management

Decision-Making Process

1.

Identify Exposures to Loss. (Analyze)

2.

Examine Feasibility of Alternative Techniques

3.

Select Most Suitable Technique

4.

Implement Chosen Technique

5.

Monitor and Evaluate Performance of the Risk

Management Program. Modify as needed.

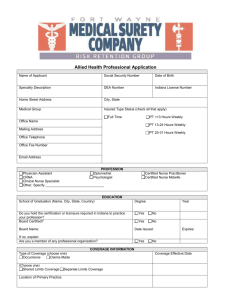

Step 1-Identify/Analyze

Exposures to Risk

Standardized

Surveys/Questionnaires

Financial Statements

(Budget-P&L-CAFR)

Records and Files

Flowcharts (Fault Tree

Analysis)

Personal Inspections

Experts (Internal &

External)

Benchmarking

Step 1-Identify/Analyze

Exposures to Risk

“Benchmarking is the practice of being humble enough to admit that someone else is better at something, and being wise enough to learn how to match or even surpass them at it.”

Unknown

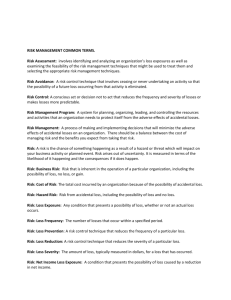

Risk Management Techniques

Avoidance- Ceasing or not undertaking an activity that creates exposures to loss.

Loss Prevention- A technique that reduces frequency of a particular loss.

Loss Control - A technique that reduces the severity of a particular loss.

Risk Transfer - Shifts the financial consequences of loss to another party or insurer.

Risk Finance - An conscious act or decision not to act that generates the funds to pay for losses.

Step 2-Examine Feasibility of

Alternative Techniques

Loss Frequency

Loss Severity

Maximum Possible

Loss (MPL)

Probable Maximum

Loss (PML)

Loss Frequency and Loss Severity

Interaction

Basic Approach

Frequency and Severity Interaction

Frequency Severity

High High

High

Low

Low

Low

Low

High

Remedy

Avoid

Retain

Retain

Transfer

Risk Mapping Approach

Frequency and Severity Interaction

5

High Severity

High Impact

Low Likelihood

Transfer

High Impact

High Likelihood

Avoid

2.5

Low Severity

0

0

Low Impact

Low Likelihood

Retain

Low

Frequency

2.5

Low Impact

High Likelihood

Retain

High

Frequency

5

Too Late For A Break?

Risk Management Techniques

Loss Prevention- Pre-Loss Activity

Loss Prevention

System and Behavioral Safety

Training

Good Housekeeping and Proper Storage

Practices

Proper Installation and Maintenance of

Equipment

Accepted Procedures for Welding, Hazardous

Material Handling

Adherence to Safe Work Procedures

Machinery Guards

Improved Building Materials

Risk Management Techniques

Loss Control- Concurrent Loss Activity

Loss Control Devices/Materials - Products that are triggered during a loss or are made with special material to control severity of injury and/or destruction of property.

Separation - Disperses a particular asset or activity over several locations.

Duplication - Uses back-ups, spares or copies of critical property, information or capabilities and keeps them in reserve.

Risk Management Techniques

Risk Transfer

Contractual Risk Transfer-

Indemnity Agreements

Hold Harmless

Agreements

Insurance Requirements

OCIPS and CCIPS

Financial Capacity of

Insurers

Additional Insured

Agreements

Waivers of Subrogation

Proof of Coverage

Certificates

Insurance Policy

Endorsements

Obtaining Certified Copies of Policies

Risk Management Techniques

Risk Transfer

Insurance- A technique that transfers the potential financial consequences of certain specified loss exposures from the insured to the insurer at a guaranteed cost.

Declarations

Insuring Agreements

Conditions

Exclusions

Risk Management Techniques

Common Insurance Coverages

Liability

Auto Liability

Privacy and Security

Liability (Cyber)

Workers’

Compensation

Employer’s Liability

Employment Practices

Liability

Environmental Liability

Property

Earthquake

Flood

Business Travel

Accident

Builder’s Risk

Railroad Protective

Crime

Risk Management Techniques

Risk Finance

Insurance- Used as a finance technique for catastrophic losses.

Self-Insurance- A technique that described special situations in which risk retention has been consciously selected as the appropriate risk management technique.

Large Deductible Program- insurer assumes full statutory liability while employer retains a significant portion of the risk.

Factors in Designing

Risk Financing Programs

Expected Losses

Market Conditions

Corporate Philosophy

Risk Control

Commitment

Financial Position

Geographical Locations

Loss Payout Patterns

Effective Tax Rate

Corporate Ownership

Cash Flow Comparisons

Factors in Designing

Risk Financing Programs

Net Present Value

Today’s $ is worth more than tomorrow’s $ because of investment income implications.

Net Present Value Cash Flow Versus

Guaranteed Cost Comparison

$1,600,000

$1,400,000

$1,200,000

$1,000,000

$800,000

$600,000

$400,000

$200,000

$0

972,424

$428,825

972,424

$787,871

$1,505,963

972,424

Optimistic Expected Pessimistic

Loss Scenario

Self Insurance

Guaranteed Cost

Qualified Self Insurance

Formalized retention program

Excess insurance purchased for losses exceeding limit

Qualification requirements vary by state

Positive cash flow

Ability to influence program costs

Unbundled services

Administrative requirements

Definition of Large Deductible Program

A policy in which the insurer assumes full statutory liability to all workers within the scope of coverage, in the same manner as any other workers’ compensation policy, while the employer assumes a contractual obligation to the insurer under which the employer retains a significant portion of the risk.

Large Deductible

Loss retention plan

Excess insurance covers losses above deductible

Positive cash flow

Ability to influence program costs

Access to insurer services

Collateral requirements

Tax deduction disadvantage

Costs Included

Expected losses

Primary and excess premiums

Claims handling

Taxes

Assessments

Loss Control

Broker fees

Collateral

Fronting costs

Residual market loads

Boards and bureaus

State funds