INSU 2500 Chapter 3 Topic Objectives Risk Management Defined

advertisement

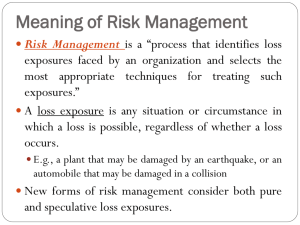

Risk Management Defined • Process to identify loss exposures and selection of techniques to deal with them. • Can encompass both pure risks and speculative risks. • We will focus on pure risks but “new” philosophy integrates management of both. • Personal risk management is important too. 3 INSU 2500 Chapter 3 Sept. 5 & 7 Risk Management Characterized Topic Objectives • Defining risk management. • Describing risk management process and options. • Evaluating loss potential. • Explaining enterprise risk management. • Corporate and personal risk management. 2 • Stresses identification and analysis of pure risks. • Various methods of dealing with risk, including but not confined to insurance. • Periodic evaluation of all techniques dealing with risk. • Involves many people and effects extend beyond insurance per se. 4 1 Evaluating Potential Losses Risk Management Process Concepts • Identifying potential losses • Loss Frequency: the number of losses • Loss Severity: the amount of loss for each occurrence • Evaluating potential losses • Selecting appropriate techniques • Implementing program Measuring Severity • distribution of possible losses • maximum possible loss • maximum probable loss 5 Types of Potential Losses • physical damage • loss of income • liability lawsuits • death or disability 7 Insurance Loss Distribution Probability • work injuries • fraud, crime, dishonesty • employee benefits loss exposures • international loss exposures Low Probability of High Losses Max probable loss Max possible loss 6 $0 8 $900,000 $1,000,000 2 Likelihood (Frequency) Risk Map: Implications Personal Risk Management • Personal Risks Prevent Share loss of income due to premature death insufficient income/assets during retirement catastrophic medical bill/income loss due to disability loss of income from unemployment Avoidance Reduction Transfer Retention Impact (Severity) • Property Risks direct physical damage to property indirect losses theft • Liability Risks personal acts libel, slander, etc. negligence business related legal costs 9 Enterprise Risk Management 11 Risks Faced by Firms • Property Exposures • Expand and coordinate identification and management of all firm risks: pure, speculative, strategic, operational. • Examples: fire, liability suits, economic changes, new competition. • Emphasis on risk financing as well as risk transfer; range of tools. • Consider interdependence of risks: opportunities to diversify, hedge. • New insurance products to stabilize performance, e.g., profits, revenues. Direct Indirect • Liability Exposures product premises and operations managerial errors & omissions • Personnel Exposures employee benefits • Financial Exposures • Strategic Exposures 10 12 3 Firestone Tire Recall Risk Management • What risks do Firestone & Ford face? • What risk management techniques are applicable? • How well have they managed their risk? • The logical development and implementation of a plan to deal with potential losses. – Insurance is just one option. – Financing and controlling loss exposures. • Making pre-loss arrangements for post- loss resources • Read the “Texas Bank Tornado” case on pp.64. 13 Please Read the Tornado Case Now 15 RM at UNT • P. 64 • We will use this real-world case as we cover the principles of risk management’ Chapter 3. • UNT Risk Management Services • Yes, we do have a risk manager at UNT. – Doug Welch • http://web2.unt.edu/riskman/index.php?se ction=index 14 16 4 The RM Function Better Definition of RM • Skip, but fun reading material… • An ongoing process that requires the organization to identify the level of risk it wants to maintain, to identify the risk it currently retains, and to make insurance and other financial arrangements to make the desired and the actual level of risk the same. 17 The RM Process RM Step 1 1. Identify & Measure (evaluate) potential • Use the __________ as our organization. • Direct property losses: loss exposures 2. Choose most efficient tool(s) for • • 19 Loss Control Loss Financing – Checklists – Flow Charts – Questionnaires 3. Implement and review (monitor) • Indirect losses • Key personnel Fig. 3-3 on pp. 61 (excellent illustration!) 18 20 5 Liability Losses RM Step 2 • Construct a RM program for handling loss: • Examples of loss sources – Bodily injury or personal injury – Property damage to real or personal property – Intentional damage to reputation – Wrongful hiring, firing, sexual harassment, invasion of privacy, age discrimination – Vicarious liability – Products, environmental, workers’ compensation – Loss Control • Risk Avoidance (ZERO COL!) • Don’t do it. • No flight zone. – Loss Prevention (reduces frequency) • Defensive driving, bank security guard. – Loss Reduction (reduces severity) • Seat belt, fire walls. 21 Estimation of Loss 23 Homework • Frequency and Severity. • Maximum Possible Loss • Read Chapter 3 (p. 54) – Federal Loss Control Regulation – The absolute maximum dollar amount of damage (the worst circumstances). • OSHA • The Consumer Products Safety Act of 1972 • Other regulations • Maximum Probable Loss – Who benefits from these Federal Regulations? – A conservative estimate of what is likely to occur in a worst case loss (the average circumstances). • Emergency Planning – Disaster Recovery 22 24 6 Risk Financing Self-Insurance • RF determines when and by whom loss costs are borne. – Risk assumption – Risk transfer other than insurance – Self-insurance – Insurance • Do-it-yourself. • The pooling and funding of the cost of losses take place within one business entity. • Must meet all criteria for any insurance system. – What are the criteria? Hint: Chapter 2 25 Risk Assumption/Retention 27 The Captive Insurance Company • The consequences of a loss will be borne by the party exposed to the chance of loss (COL). • Co-pay/deductible • How does it work? • Potential advantages?? • What’s the catch??? – Self-defined loss – Lowers premium 26 28 7 Risk Transfer RM Step 3 • Definition: • Implement the RM plans • Examples: • Regular Review of the RM Program – Hedging • Derivatives Securities – Financial Risk Management 29 Q1 RM Tools Direct property losses would include each of the following except: a. Losses to owned buildings. b. Losses to leased buildings. c. Losses of inventory. d. Loss of income after inventory is destroyed by fire. Frequency Low S e v e r i t y L o w Assume loss prevention loss reduction H i g h Insure risk transfer loss reduction loss prevention 31 High Loss Prevention loss reduction assume risk Avoid loss prevention loss reduction 30 32 8 Q2 Q4 Typical sources of liability losses include all the following except: a. A worker allows a machine to be destroyed by improper maintenance. b. Losses caused to workers injured on the job. c. Losses caused to the real property of others. d. Losses caused by bodily injury to customers in a store. “The logical development and carrying out of a plan to deal with potential losses” is the definition of: a. Loss control b. Risk management c. Emergency response team d. Risk financing using derivative options 33 Q3 35 Q5 Risk avoidance: a. Means measures are taken to eliminate the loss exposure. b. Means measures are taken to reduce loss severity. c. Means insurance has been purchased and the risk transferred to an insurance company. d. Is never a useful risk management tool. 34 Business firms face liability lawsuits when their: (choose best answer) a. products injure consumers b. customers steal their inventory c. unions go on strike d. attorneys fail to file legal documents 36 9 Q6 The Cash America Building The federal law that promotes a safe working environment for workers is: a. Superfund b. Equal Opportunity Act c. OSHA d. CERCLA 37 The Bank One Tower 39 The Matlock Tower 38 40 10 41 43 42 44 11