Summer 2010 - Monument Bank

advertisement

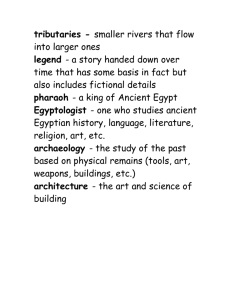

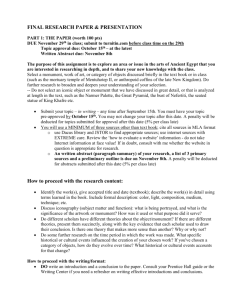

MonumentNews Your Quarterly Newsletter from Monument Bank Summer Issue July 2010 Letter from the President A Look Inside the eBanking Department The eBanking staff begins each day by checking incoming emails and faxes from bank customers and employees that arrived since the end of the previous workday. This two-person department, comprised of Aashish Ponniah and Teresa Avant, is responsible for the implementation and servicing of the Bank’s Convenience Banking services. The team is also the resource for general customer service, research requests and requests for information on additional services. Their day is filled with assisting and educating customers, processing transactions and implementing services for new and existing clients. Our Convenience Banking services include online banking and bill pay for businesses and consumers, Live Wire Notification and Express Deposit. Online banking and bill pay have become familiar services, growing rapidly in their use since the concept first began in the late 1980’s. In fact, it is possible to conduct virtually all of one’s financial transactions online. Not as commonplace yet is Live Wire Notification and Express Deposit, two services that the Bank’s eBanking Department also implement and support. Express Deposit enables business customers, using a small desk-top scanner, to deposit checks directly into their Dear Friends, As we complete the first six months of 2010 and the first several months of recovery, we continue to be optimistic about the near-term. My colleagues at other locally-based banks are feeling better about the future, much more so now than at this time last year. Expectations about the impact of defaults under commercial mortgage-backed securities have not yet materialized and talk about the “double-dip” has recently lessened, at least within the circles I travel. As a result of the sheer volume and speed of information that bombards us from hundreds of sources, it is bothersome to realize that we can actually think ourselves into a second dip. However, at Monument Bank, we like to plan for success rather than dwell too much upon factors we cannot control. The Bank has fared well in the first half of the year as total assets grew to $277 million from $232 million compared to June 30, 2009, an increase of 19%. In the same period, loans grew to $198 million from $167 million, also an increase of 19% while deposits and repurchase agreements grew to $229 million from $185 million, an increase of 24%. After-tax profit for the first six months of the year totaled $695 thousand compared to $499 thousand for the same period last year, an increase of 39%. A solid continuation of the way we started the year 2010! Our Silver Spring branch opened on May 26th and already has deposits of $13 million. The SBA program continues to show progress, so much so that we have recruited Ron Warrick to give it full-time attention. By July 31st we expect to have the operations of our new residential mortgage department running smoothly so we can turn our efforts to developing the volume that we believe will be a significant contributor to the Bank’s profitability. Referrals and introductions continue to be the fuels that run our engine. Please keep them coming and know that your friends, family or business associates will receive the special attention that will make you glad you referred them to us. And, as always, feel free to call me or any of my staff if we can assist you in any way. (continued on page 4) In this issue Escrow Manager Saves Money 2 Celebrating Good Works 3 Five Tips from SCORE 3 Your Direct Line to Service 4 H. L.Ward President & CEO 1 Your Quarterly Newsletter from Monument Bank Second Branch Opens in Silver Spring Escrow Manager Can Increase Your Bottom Line The saying goes that time is money. What if you could use a service that greatly reduces the administrative burden and associated personnel costs of managing multiple (maybe hundreds) checking accounts? Meet Escrow Manager. Every day law firms, title companies, property managers and municipalities are faced with making decisions on how to streamline operations. Just as time is money, improved technology can improve profitability. Escrow Manager enables you to efficiently record account data, accelerate account processing and accurately report account performance. This is how it works: You deposit all funds into a single Escrow Fund Manager Checking Account at Monument Bank, thereby eliminating the need for your company staff to maintain individual checking accounts for each client. A sub-account is established for each escrow relationship and there is no limit to the number of sub-accounts you can create under the master account. Each sub-account receives a monthly statement and is separately FDIC-insured. At year-end, the Bank produces a 1099 for each sub-account. One of our customers, Steven Landsman, President of Abaris Realty, was so pleased with how Escrow Manager helped his staff manage hundreds of individual accounts, he wrote a testimonial for our ad campaign that you can see in the Montgomery Business Gazette and Washington Business Journal! While Larry Bolton and Debbie Keller are busy calling on customers and prospects outside the office, Mardi Novik and Heather Ellis take care of business at Monument Bank’s new branch that opened on May 26th in Silver Spring. Newly-hired Mardi is a career banker who brings many years of experience to her title of Assistant Vice Presient. Heather, the Branch Representative, was already an employee of the Bank who worked at the Main Office in Bethesda. This team of four bankers represents 98 years of combined banking experience. Larry “The Banker” and Debbie “The Banker” alone contribute 65 years to that number. . . .most of which has been in the Silver Spring area. Ike Leggett was the guest of honor for the branch’s grand opening ribbon cutting held on July 20th. Enthusiastic guests joined in the celebration with great food, beverage, camaraderie and a door prize drawing for a Bentley for a weekend. The Bentley was donated by EuroMotor Cars. Refreshments were provided by The Bean Bag. The branch is located at 8602 Colesville Road. Hours are Monday through Thursday from 8:30 until 3:00 and Friday from 8:30 until 5:00 pm. Come visit us soon! Left: Steve Landsman gave testimonial about the convenience of the Bank’s Escrow Manager. Whether you have 10 or 10s of hundreds of accounts to manage, ask us about how Escrow Manager can save you time and money. 2 Above: Surrounded by Bank staff and local dignataries, guest of honor Ike Leggett cuts the red ribbon to celebrate the opening of Monument Bank’s second branch office. Photo: www.clarkwdayphoto.com www.monumentbank.com Summer Edition July 2010 Celebrating Good Works Director Walks 39 Miles for a Good Cause For two days in May 2010, Monument Bank Director Larry Rosenblum put his walking where his mouth was and raised $12,500 for a good cause in the process. Why? When Larry learned in 2000 that the Avon Foundation was planning its first Washington Area Breast Cancer Walk, he immediately thought of one of his favorite relatives. In 1982, his cousin Hayda was diagnosed with breast cancer and unfortunately lost her battle a few years later at the age of 37. Always wanting to remember her in a special way, Larry decided to walk the walk in her memory and help make a difference. For the eleventh year, he participated in the Avon Walk for Breast Cancer, one of approximately only 150 men out of 3,000 walkers. For the last two years, he has walked with his sweetheart, Nancy Brooks. Since Larry started walking 11 years ago, he has raised over $80,000 for this cause and despite this down economy, 2010 was his best year ever. For more information about the Avon Walk for Breast Cancer, look for Larry’s page at www.avonwalk.org or go to www.inittoendit.org. Left: Larry Rosenblum stands next to tent commemorating his cousin, Hayda, who died of breast cancer. He has already signed up for the 2011 walk. Five Tips for Getting Noticed Online 1. Get your Web site listed on major search engines, such as Google or Yahoo! Two sites, Search Engine Watch at www.searchenginewatch.com and the Web Marketing Info Center at www.wilsonweb.com/webmarket, offer guidance. Markiewicz Supports American University Win Matthew Markiewicz, a Monument Bank commercial lender, was one of seven professionals from local companies who mentored the winning team for NAIOP’s first annual 2010 Capital Challenge Intercollegiate Real Estate Case Competition. Three area universities who have graduate real estate programs - Georgetown, University of Maryland and American University - participated in the competition to complete a case study of an actual development site in the greater Washington, D.C. region. Matthew, as the financial mentor who assisted with the loan underwriting portion of the case study, joined forces with professionals from six other industries to support a team of graduate students from the Kogod School of Business at American University. The case study site is located at the intersection of North Capitol Street and New York Avenue NE, a heavily traveled corridor in the area known as NoMa. The assignment was to formulate a long term development and investment strategy as well as the appropriate uses for the 236,000 square foot site. To learn about NAIOP go to www. naiop.com. CSAAC is Beneficiary of Golf Tournament 2. Join a “banner exchange,” and trade advertising banners with other web sites. Look under “banner exchange” on search engines. 3. Visit sites similar to or related to yours and offer to exchange links with them. 4. Write useful articles for other sites and include your web address. 5. Get more online marketing help from such sites as www.zdnet.com/eweek/, workz. com and www.bcentral.com. The source of this article is SCORE, a resource partner with the U.S. Small Business Administration (SBA). If you own your own business and haven’t visited their site at www. score.org, you are missing out on an excellent resource. Not only do they have an exhaustive list of FREE services, but the site has been developed by skilled, retired businesspeople who have experienced the challenges of starting, growing and exiting a business. www.monumentbank.com Above: For the fourth consecutive year, Monument Bank was Title Sponsor for the Bethesda-Chevy Chase annual golf tournament. Inset: H.L. Ward and Ayda Sanver, representing CSAAC (Community Services for Autistic Adults and Children), this year’s beneficiary. Photo by Eric Myers. 3 Summer Edition July 2010 Your Direct Line to Service MANAGEMENT H. L. Ward President & CEO Karen Grau EVP & CFO Loren Geisler EVP & CLO Tracy Berriman EVP & COO Lena Marcellino Corp. Secretary & Investor Relations 301.841.9555 hlward@monumentbank.com 301.841.9595 kgrau@monumentbank.com 301.841.9510 lgeisler@monumentbank.com 301.841.9541 tberriman@monumentbank.com 301.841.9551 lmarcellino@monumentbank.com BETHESDA BRANCH 301.841.9700 Yee Yee Tun Branch Manager Margaret Ladd Asst. Branch Manager 301.841.9530 ytun@monumentbank.com 301.841.9531 mladd@monumentbank.com Your Quarterly Newsletter from Monument Bank A Look Inside the eBanking Department (contd. from pg. 1) Monument Bank account that can be credited up to 6:00 pm on the same day. Live Wire Notification offers up-to-the minute, automatic notification of incoming and outgoing wires to both businesses and consumers, even after bank business hours. The first quarter of 2011 will bring improved services to our Convenience Banking package. Watch for more details that will follow. SILVER SPRING BRANCH Larry “The Banker” Bolton Senior Vice President Debbie Keller Vice President & Branch Mgr. Mardi Novik Assistant Vice President eBANKING Main number Aashish Ponniah eBanking Manager Teresa Avent eBanking Specialist 301.841.9576 lbolton@monumentbank.com 301.841.9577 dkeller@monumentbank.com 301.841.9578 mnovik@monumentbank.com ebanking@monumentbank.com 301.841.9521 301.841.9524 aponniah@monumentbank.com 301.841.9522 tavent@monumentbank.com BUSINESS DEVELOPMENT Patrick van der Ham Senior Vice President Debbie Colliton Senior Vice President Clyde Garrett II Vice President 301.841.9526 pvanderham@monumentbank.com 301.841.9563 dcolliton@monumentbank.com 301.841.9564 cgarrett@monumentbank.com CONSUMER LENDING Harvey Dickerson Vice President 301.841.9511 hdickerson@monumentbank.com COMMERCIAL LENDING Steven Brunn Senior Vice President Ted Coleman Senior Vice President Matthew Markiewicz Vice President 301.841.9512 sbrunn@monumentbank.com 301.841.9515 tcoleman@monumentbank.com 301.841.9516 mmarkiewicz@monumentbank.com RESIDENTIAL MORTGAGE LENDING Clark Goldstein Vice President Allan Bernstein Assistant Vice President Dan Caplan Sr. Mortgage Consultant George Matthews Sr. Mortgage Consultant 4 301.841.9582 cgoldstein@monumentbank.com 301.841.9584 abernstein@monumentbank.com 301.841.9583 dcaplan@monumentbank.com 301.841.9587 gmatthews@monumentbank.com Did you know. . . . That since Monument Bank started its SBA lending program less than a year ago, it has made five loans totaling $2,662,000 to small businesses? For more information on our SBA loan programs, including 7(a) and 504 loans, contact Ron Warrick at 301.841.9518 or rwarrick@monumentbank.com. www.monumentbank.com