Leaders in Compliance

The Next Generation

Where will the next generation

of compliance leaders come

from, what competencies will

they need, and how will aspiring

leaders acquire those skills?

Leaders in Compliance

The Next Generation

Sharply rising demand for compliance

additional professionals, in a variety of disciplines, who

talent, the absence of a clear career path

organizations.

can make compliance a central concern at all levels of their

in the discipline, and greater need for

Some formidable obstacles stand in the way of meeting

compliance executives with leadership

this demand. Because there has been no traditional career

and influencing skills are creating difficult

path for working in compliance, few guidelines exist for

challenges for organizations seeking to

in the function, and what competencies augur success.

what to look for in a candidate, how to pursue a career

identify and retain talent in a world of

In addition, most graduate business schools and law

increasing regulation.

the subject, and students pondering their careers have

Where will the next generation of compliance leaders

schools have not offered classes specifically focused on

regarded the field as a back-office function.

come from, what competencies will they need, and

To discuss perceptions of the role and the state of the

how will aspiring leaders acquire those skills? To further

compliance leader today, Heidrick & Struggles convened

explore these topics we convened top representatives

a roundtable discussion that included Chief Compliance

from leading global banks, financial services companies,

Officers (CCOs) and other senior compliance executives

insurance organizations, business schools and law schools

from leading financial institutions and representatives

to discuss careers in compliance and the factors essential

from leading business schools and law schools. Prior to

for success.

attending the event, “Leaders in Compliance: The Next

Since the financial crisis of five years ago, increased

regulation around the world has been driving demand for

compliance professionals. In the wake of the Dodd-Frank

Act and other regulation, many organizations have had to

comply with complex new rules governing banking, the

derivatives market, foreign tax accounting, and more. And

with many regulations still under construction, and others

scheduled to go into effect soon, more implementation

challenges lie ahead – and thus more demand for

Generation,” participating CCOs and General Counsels

completed a survey about the sourcing of compliance

talent in their organizations and the competencies

required for success. Taken together, the results of the

survey and the candid discussion at the event paint a

mixed picture of both challenge and opportunity:

•

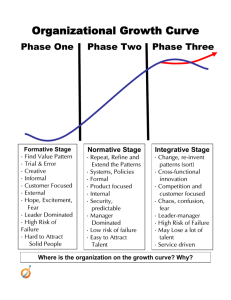

Compliance roles are in a pronounced state of flux.

•

Softer skills like leadership, influencing, and

relationship building are emerging as key

compliance talent.

Meanwhile, serious and widely publicized compliance

breaches, followed by massive fines and pledges to

competencies for success in those roles.

•

to better prepare their students for careers in

improve performance, have forced many institutions

compliance.

to take a hard look at operationalizing compliance and

deciding who in their organizations will lead the charge.

Law schools and business schools have an opportunity

•

Identifying candidates for top compliance roles

This suggests, too, that in order to achieve compliance

requires skill in assessing their experience and

while advancing their business goals, they will seek

leadership competencies.

2 Leaders in Compliance: The Next Generation

Survey results

Key findings

Nearly half of the respondents indicated

that their internal talent pool does not

meet the organization’s current or future

needs in compliance (fig 1)

Participants in the event who responded

to the pre-event survey are highly

experienced in senior positions. Nearly

a quarter have been in their roles for a

Some 47% of respondents do not believe that their

decade or more, 40% have been for 6-10

internal talent pool is sufficient for current needs, and

years, with the remainder having served

a total of 48% do not believe it is sufficient for future

needs. Although those numbers are nearly identical, the

2-5 years.

overall results may contain even more foreboding about

the future: while 48% indicated that internal talent could

meet current needs, only 24% agreed that it could do so in

the future.

figure 1

The compliance talent pool internally meets the

organization’s current compliance needs

47% Disagree

48% Agree

5% Neither Agree nor Disagree

The compliance talent pool internally meets the

organization’s future (next 3 years) compliance needs

43% Disagree

5% Strongly Disagree

28% 24% Agree

Neither Agree nor Disagree

Heidrick & Struggles 3

figure 2

figure 3

Where have you traditionally

sourced your talent?

If you traditionally source your talent internally, from

which function does this person typically come?

Internally 15%

Legal 25%

Regulators 15%

Asset Management 12%

Law Firms 12%

Other 11%

Compliance 18%

Operations 16%

Risk 14%

Investment Banking 8%

Audit 12%

Law Schools 8%

Business units 5%

Wealth Management 6%

Other 5%

Commercial / Consumer 6%

Finance 3%

Universal Bank 6%

Regionally 1%

4 Leaders in Compliance: The Next Generation

IT 2%

Respondents said that their organizations

draw compliance talent from a wide

variety of sources, with no one source

clearly dominant (fig 2)

The most important competencies needed

by senior compliance executives are

influencing skills, followed by knowledge

of regulation (fig 4)

Though no one source of external talent dominated,

While compliance executives need deep expertise in

law firms and law schools together constituted the chief

technical fields like surveillance, monitoring, and privacy,

source of such talent for 20% of respondents. “Other”

top compliance executives increasingly need leadership

sources of compliance talent included MBA programs,

skills such as the ability to influence others, communicate

the insurance industry, and audit and risk management

effectively, and build relationships. Influencing and

functions internally and externally. Strikingly, only 15%

communication skills are particularly critical for leaders

of respondents said that they traditionally sourced

who must win buy-in from executives over whom they

compliance talent internally, perhaps reflecting the sharp

may have no direct authority. In addition, compliance

upsurge in demand for such talent over the past several

leaders must be able to engage fruitfully with regulators

years, which has compelled many organizations to look

and other external stakeholders.

outside.

Organizations that source compliance

talent internally have drawn most often

from the legal function

The roles of the compliance executive and

the compliance function will continue to

grow in complexity

Asked what their compliance group needs in order to

Just as a plurality of organizations sources external

meet the demands of the organization in the future,

compliance talent from the legal area, a plurality of

respondents specified a wide range of technical capacities,

internal talent is drawn from the legal function (fig 3). What

subject matter expertise, talent requirements, and

the numbers do not show – and our experience affirms – is

leadership competencies. Among technical capacities

that the percentage of compliance talent drawn from the

named were enhanced surveillance and monitoring

legal profession has been dropping as compliance itself

capability and the ability to quickly manage data/

has risen as a distinct function.

information and operationalize the necessary components

throughout the firm. Future needs in subject matter

expertise include the areas of privacy, global regulatory

developments, and data analytics.

figure 4

What are the most important competencies (knowledge, skill or ability)

needed by Compliance Executives to succeed?

Influencing 18%

FCPA 9%

Regulations (Dodd-Frank, etc) 17%

Surveillance monitoring 8%

Partnership Behavior 12%

Training 8%

AML 11%

Other 6%

OFAC 11%

Heidrick & Struggles 5

What compliance leaders

and educators say

Key themes

The participants, representing a cross-

However, observed the CCO of a global bank, compliance

section of interested parties – companies,

should be a “melting pot” that includes people with

teams should not be composed entirely of lawyers but

educators, and executive search

backgrounds in risk, operations, and other areas. Agreeing

professionals – engaged in a wide-

that more balance is required – on teams and in the

ranging and candid discussion.

services firm observed, “Young compliance professionals

Participants agreed that a career in

compliance can be rewarding, but

turnover is frequent in the most visible

compliance roles at the top

For example, of the 54 largest banks 17 have experienced

turnover in the role of CCO in the past two years, a number

competencies of individuals – the CCO of a global financial

are really surprised to find that compliance is both legally

intensive and operationally focused.”

In addition to technical and operational

competencies, top compliance leaders will

need influencing and other ‘soft’ skills in

order to be effective

of them in the wake of major compliance failures. Even

As participants agreed, senior compliance executives must

when top compliance executives are blameless they often

have a broad set of leadership skills – including influencing

become the scapegoat when failures occur. As the CCO

ability, communication skills, and great tact and

of one of the world’s largest financial services companies

diplomacy. Such skills are indispensable for winning buy-

observed: “Over the course of five or six years in a dynamic

in on compliance throughout the organization, presenting

company, something is inevitably going to occur, and it

persuasively to the board, and working effectively with

may cost the compliance executive’s job.”

the CEO, General Counsel, and colleagues on the front

Participants in the discussion saw both

advantages and disadvantages in a legal

background for compliance talent

Thirty-two of the CCOs of those 54 banks – or about 60% –

hold law degrees, a figure that is not surprising in view of

the historical tendency to source compliance talent from

the legal field. The COO of a major insurer, remarking on a

high-profile violation by one of the world’s largest banks,

said, “It’s not that the bank made a mistake – it’s that they

persisted in making the mistake. That’s why I like lawyers –

they pay attention to detail; they can analyze mistakes and

uncover persistent trends that have to be addressed.”

6 Leaders in Compliance: The Next Generation

lines of daily operations. “We need people with emotional

intelligence,” said the COO of a bank holding company.

““They must not only know the rules, but communicate

the dynamics between the rules and the business.”

In addition, top compliance leaders must bring their

influencing and communication skills to bear with

regulators, for whom the compliance function is

increasingly the point of contact with many companies. In

that capacity an adept and compelling compliance officer

can not only respond to regulations but also influence the

shape they take in the future.

Preparing students to meet the

dual demands of legal intensity and

operational effectiveness in compliance

will require action by business and legal

educators and greater cooperation

between them

As a senior partner of a leading global law firm observed,

“There is nothing on the bar exam about legal risk

The conditions for success are favorable. Although

senior compliance roles call on a broad range of talents,

complicating the identification of the right candidates,

the fact that there is no one ideal model widens the talent

pool, while the clear leadership qualities required help

winnow it. And if the deep engagement of the participants

in the discussion is any measure, the next generation of

top compliance leaders will be better prepared than ever

for their critical roles.

practice.” To date, most law schools have done little to

make compliance a distinct part of the curriculum. But that

is beginning to change, according to the dean of a top-ten

law school. “Courses that integrate law and business are

being developed, as well as scholarships for people to

earn degrees in both fields.” Further, stronger connections

between businesses and law schools could help students

begin to acquire what a partner in a leading global law

firm said they now most conspicuously lack: operational

management experience.

An experienced executive search firm can

help organizations meet the challenge

of assessing and selecting senior

compliance leaders

Because the compliance role is fluid, the career path is

“Because the compliance role is

fluid, the career path is unclear, and

competencies required are broad,

many organizations have difficulty

defining precisely what they should

be looking for in a candidate.”

unclear, and competencies required are broad, many

organizations have difficulty defining precisely what they

should be looking for in a candidate. “There is no perfect

candidate,” as one participant put it. But there are the right

candidates. Identifying those candidates requires expertise

in assessing the experience and competencies that are

critical for such leadership roles, especially the ability to

influence others, communicate a compelling vision, and

lead a function that encompasses people of widely diverse

technical skills.

Heidrick & Struggles 7

T H E L E A D E R S H I P C O M PA N Y ®

T H E L E A D E R S H I P C O M PA N Y ®

Heidrick & Struggles is a premier provider of senior-level

Executive Search, Culture Shaping and Leadership Consulting

services. For more than 60 years we have focused on quality

service and built strong relationships with clients and individuals

worldwide. Today, Heidrick & Struggles leadership experts

operate from principal business centers globally.

www.heidrick.com

Victoria Reese

Managing Partner

vreese@heidrick.com

Paul Gibson

Partner

pgibson@heidrick.com

Copyright ©2014 Heidrick & Struggles International, Inc. All rights reserved.

Reproduction without permission is prohibited. Trademarks and logos are

copyrights of their respective owners.

201402JNTSRG111