Engro Foods Limited - Investor Guide Pakistan

advertisement

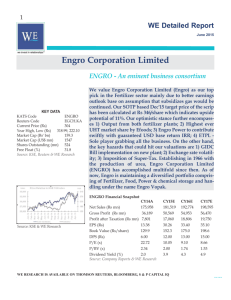

1 WE Detailed Report March 2013 Engro Foods Limited EFOODS - A seed turning into fruition KEY DATA KATS Code EFOODS Reuters Code ENFL.KA Current Price (Rs) 124.5 Year High, Low (Rs) 134 , 92.33 Market Cap (Rs' bn) 95 Market Cap (US$ mn) 957 Shares Outstanding (mn) 761 Free Float (%) 12 Source: KSE, Reuters & WE Research We initiate the coverage of Engro Foods Limited (EFOODS) with a Dec'13 Target Price of Rs 161/share, offers an upside of 29% -BUY. We have used (DCF, P/S ratio, P/E ratio and P/BV method) to arrive the target price as it's a food group company and major players of the group are NESTLE, UNILVER, MFFL & NATF. Our bullish view is on back of increasing market share, uptick in milk prices, diversion of masses towards UHT milk from unprocessed milk, followed by in-house milk procurement through Nara farm and continuous expansion in other food group segments. We estimate top line average growth of 22.21% (2013-2015), gross margins to average at 27% (2013-2015), average market share of 56% (20132015), and milk price to grow at a CAGR of 5% (2013-2015). The key risks to our estimates are 1) No barriers to entry in the segment, 2) Upsurge in discount rate, 3) Failure of new business lines and 4) high inflationary environment. CY13: A Booming Year Price Relative to KSE 100 Index Inde x PKR 140 18,000 KSE 100 INDEX Mar-13 Jan-13 EFOODS Feb-13 Dec-12 Oct-12 Nov-12 Sep-12 Jul-12 Aug-12 Jun-12 Apr-12 20 May-12 50 10,000 Mar-12 80 12,000 Jan-12 110 14,000 Feb-12 16,000 l l l l l l l l We expect CY13 to be a booming year for Efoods as they are planning to re-launch juice segment and further new products are in the pipeline Earnings to zoom +45% YoY in CY13 translating into PAT of Rs 3,769 million (EPS: Rs 4.95) and ROE to clock in at 37.50% We expect Nara Farm and Ice-cream segment to come into operating profit and would support the bottom-line Going forward launch of powdered milk plant would result cost efficien cy and would help reaping higher margins Source: KSE EFOODS Financial Snapshot CY12A CY13E Net Sales (Rs mn) 40,169 53,570 Profit after Taxation (Rs mn) 2,595 3,769 EPS (Rs) 3.41 4.95 Book Value (Rs/share) 13.21 18.16 DPS (Rs) P/E (x) 35.83 24.67 P/BV (x) 9.25 6.73 P/S (x) 2.31 1.74 EBITDA Margin (%) 18.40 19.60 ROE (%) 25.8 27.3 ROA (%) 11.70 13.87 Source: Company Reports & WE Research CY14F 62,396 5,308 6.97 25.13 1.00 17.52 4.86 1.49 22.40 27.7 16.52 CY15F 72,881 7,212 9.47 34.61 2.00 12.89 3.53 1.28 25.10 27.4 19.01 2 WE Detailed Report March 2013 Valuation: BUY with a Target Price of Rs 161 We have used 4 different valuation methods to arrive at a consensus target price. Our valuations in detail would be as follows which are based on Discounted Cash Flows, Price to Sales Ratio, Price to Book Value and Price to Earnings multiple. Method 1: Discounted Cash Flow Rs in million CY13E Net Income 3,769 Non Cash Expense 1,446 Change in Working Cap 1,474 CAPEX (2,738) Free Cash Flow to Equity 3,581 Discounted Free Cash Flow 3,581 Terminal Value 98,674 PV Terminal Value 80,280 Shares Outstanding 761 Target Price Dec'13 (Rs) 106.02 Source: WE Estimates CY14F 5,308 1,685 (327) (2,440) 3,262 2,842 CY15F 7,212 1,909 (332) (2,439) 4,187 3,179 CY16F 10,859 2,133 (365) (2,441) 8,124 5,376 Method 2: Price to Sales Ratio (Comparison with peers) Sector P/S ratio 2.34 Efoods CY13E Sales/share 70.39 Target Price 165 Source: WE Estimates Method 3: Price to Earnings Ratio (Comparison with peers) Sector P/E ratio 25.92 Efoods CY13E EPS 4.95 Target Price 128.34 Source: WE Estimates Method 4: Price to Book Ratio (Comparison with peers) Sector P/B ratio 27.09 Efoods CY13E BV/share 18.16 Target Price 491.91 Source: WE Estimates Final Valuation DCF P/S Ratio P/E Ratio P/BV Ratio Target Price Source: WE Estimates Fair Value Weightage % Contribution in TP 106.02 50% 53.01 164.71 20% 32.9 128.34 20% 25.7 491.91 10% 49.19 160.8 3 WE Detailed Report March 2013 Earnings growth came from increase in top line by +35% YoY with support from increase in volumetric milk sales by 25% YoY, increase in market share to 51% and increase in gross margins to 25.7% from 22.2% in CY11. EFOODS is importing powdered milk plant in CY13 and as per our information plant likely to be commissioned between July-Aug'13, this would help company to improve cost efficiencies resulting in better gross margins. A quick look to CY12 Engro Foods has posted PAT of Rs 2,595 million (EPS: Rs 3.40) up side of +191% YoY in bottom line versus PAT of Rs 891 million (EPS: Rs 1.17) in CY11. Earnings growth came from increase in top line by +35% YoY with support from increase in volumetric milk sales by 25% YoY, increase in market share to 51% and increase in gross margins to 25.7% from 22.2% in CY11. EFOODS juices segment still incurring losses but company is working in back yard to change their strategy for expansion. Ice cream business is incurring gross loss but volumes and value have improved, moreover market share is increasing gradually as Omore brand has established its significant presence in the market. Company's indoor milk production farm finally made some gain but a good gesture for contribution in 2013 is expected. What we see in 2013 and beyond EFOODS is importing powdered milk plant in CY13 and as per our information plant likely to be commissioned between JulyAug'13, this would help company to improve cost efficiencies resulting in better gross margins. Moreover company is also considering launch of Halal meat Canada's product into local market in order to tap the growing potential of packaged meat needs. In its analyst briefing, company revealed that it is planning to improve its market share in ice cream and juice businesses which still need to shoulder the single-handed growth from milk business. We believe 2013 will be the big year for EFOODS in terms of profitability and further diversification in food business. Foreigners Interest in Strategic Investment? De-listing of UNILVER Pakistan is helping the company's presence in the exchange, and foreigners are taking their positions in the stock along with big local institutions despite low free float of 12%. Lately there were rumours of Al Marai- KSA taking exposure in EFOODS but still no clarification from the management. We believe any stake sell off by the ENGRO Corp would be above Rs120/share particularly based on growth potential in the company. 4 WE Detailed Report March 2013 Previously dairy sector was dominated by Nestle and other small/medium size players across the country because at the time market had little space. Since launch of Efoods the sector dynamics have changed, it has created public awareness towards processed milk which resulted in CAGR of 10% (20062012) in UHT milk market which jumped up from 515mn litres annual sales to 919mn litres in CY12. Efoods has changed the dynamics of the sector Engro Foods since entering in 2005 has shown a tremendous growth ever witnessed by a company in Pakistan's history. Previously dairy sector was dominated by Nestle and other small/medium size players across the country because at the time market had little space. Since launch of Efoods the sector dynamics have changed, it has created public awareness towards processed milk which resulted in CAGR of 10% (2006-2012) in UHT milk market which jumped up from 515mn litres annual sales to 919mn litres in CY12. Whereas Efoods has shown CAGR of 41% (2006-2012), consequently now it holds market share of 51% in CY2012 up from 12% in CY06. The major turnaround has been in tea whitener (Tarang) it's the leader in tea whitener segment and then followed by product DAIRY OMUNG (cheaper than unprocessed milk) which resulted in lifting market share. Other players in the industry also jumped in by launching their products which has developed new market for UHT milk producers. Source: We Research Margins improved significantly Source: We Research Source: We Research Efoods is part of FMCG sector where volumetric growth is the key factor that drives the profitability. Efoods volumetric sales improved significantly over the years followed by higher inflation scenario in last few years which forced milk prices to tick up continuously (unprocessed and processed). Company has formed its own Nara farm with more than 3,900 herds along with continuous CAPEX to make the whole process more efficient. By launching various product lines other than UHT milk (Olpers) i.e. TARANG, OLWEL, OLPERS LIGHT, OMUNG and Flavored Milk the average sale price per litre comes up above Rs95/ litre currently, whereas milk processing cost remains unchanged. Similarly expansion of ice cream business supports the milk sale indirectly. Consequently company's Gross, EBITDA and Net margins have shown tremendous growth over the years and likely to inch up. On other side marketing expense ratio is on the declining side down to 11% in CY14E from 16% in CY06, whereas both operating profit and volumetric sales increasing YoY. 5 WE Detailed Report March 2013 Key Risk No barriers to enter into milk/dairy business Pakistan's is the 6th largest milk producer in the world and the local market is growing rapidly but still sizeable share is of unprocessed milk (88%) where as other private sector players are jumping into the business every year on medium to large scale. Pakistan is agrarian economy thus it naturally supplement the business along with support from govt in terms of taxation and financing. We believe expansion from Nestle or entry of any other big player international/local player would hurt the market share of Efoods. Initially no one expected that Efoods would replace Nestle in term of market share but now it's a reality. We cannot rule out the fact that market share can be cut down for new entry of any medium scale player as well. Upsurge in discount rate Pakistan is most likely expected to go for another IMF loan program that would result in upward move in discount rate, our valuations would go south in such scenario and we believe the discount rate has bottomed out. Failure of business line Efoods profitability mainly comes from milk business where as other segments juice/flavored milk and ice-cream have either made losses or struggling. Especially Efoods has rolled back its juice segment which is likely to be re-launched in future. We believe other product lines would be introduced in next 2 years and big failure from new products would limit the profitability growth to some extent. High inflation Rising energy cost to affect the general price level of commodities and would also affect the margins of the company along with other than milk products volumetric sale. 6 WE Detailed Report March 2013 Company Introduction Engro Foods started its business in CY05 and its principal business is to produce process and sell dairy and other food products. Efoods has established plants at Sukkur and Sahiwal for processing and selling branded UHT milk. It has a powdered milk plant in Sukkur (with an annual capacity of 5,000 tons) and another is being built in Sahiwal (with an annual capacity of 10,000 tons). It has an ice cream manufacturing facility in Sahiwal, which has an annual capacity of 36m litres. It also has a fruit juice plant, a dairy farm and more than 1,300 milk-collection centres spread across the provinces of Punjab and Sindh. Efoods has attained clear market leadership in the Pakistan UHT industry, with a share of 51% at the end of 2012. It has launched multiple new products, including ice cream, flavored milk, fruit juices and milk powders that show significant potential. As part of its growth strategy, Efoods is looking to become a diversified food company with a complete range of products in all major segments, from confectionary to culinary, infant foods and ready-to-cook meals. Efoods intends to become the premier food company in Pakistan. Source: Company Report 7 WE Detailed Report March 2013 Valuation EFOODS - Financial Highlights EPS (Rs) Book Value (Rs/share) DPS (Rs) P/E (x) P/BV (x) P/S (x) Source: WE Research & Company Reports CY12A 3.41 13.21 35.83 9.25 2.31 CY13E 4.95 18.16 24.67 6.73 1.74 CY14F 6.97 25.13 1.00 17.52 4.86 1.49 CY15F 9.47 34.61 2.00 12.89 3.53 1.28 CY12A 1.76 25.8 11.70 25.69 12.00 18.50 6.46 34.53 191.27 CY13E 1.70 27.3 13.87 26.39 12.70 19.70 7.36 33.36 52.03 CY14F 1.68 27.7 16.52 27.02 14.31 22.70 8.78 16.48 38.92 CY15F 1.65 27.4 19.01 27.08 15.91 25.30 10.09 16.80 34.24 CY12A 40,169 29,848 10,321 4,709 741 430 4,823 903 3,921 1,326 2,595 CY13E 53,570 39,435 14,135 6,428 830 473 6,805 1,007 5,798 2,029 3,769 CY14F 62,396 45,535 16,861 6,864 967 520 8,932 766 8,166 2,858 5,308 CY15F 72,881 53,141 19,739 7,288 729 572 11,593 498 11,095 3,883 7,212 Key Ratios Analysis Current Ratio (x) ROE (%) ROA (%) Gross Margin (%) Operating Margin (%) EBITDA margin (%) Net Margin (%) Sales Growth (%) PAT Growth (%) Source: WE Research & Company Reports Income Statement Rs in million Sales Cost of Sales Gross Profit Distribution & marketing. Expenses Administrative Expenses Other Operating Expenses Operating Profit Finance Cost Profit before Taxation Taxation Profit after Taxation Source: WE Research & Company Reports 8 WE Detailed Report March 2013 Balance Sheet Rs in million Share Capital Shareholder Equity Non Current Liabilities Current Liabilities Total Liabilities Non Current Assets Current Assets Total Assets Source: WE Research & Company Reports CY12A 7,616 10,054 7,693 4,441 12,134 12,676 9,513 22,189 CY13E 7,616 13,823 8,017 5,335 13,351 13,968 13,206 27,174 CY14F 7,616 19,131 6,787 6,209 12,996 14,722 17,404 32,126 CY15F 7,616 26,342 3,920 7,674 11,593 15,252 22,684 37,936 CY12A 2,898 (3,138) 1,726 1,486 1,645 3,131 CY13E 4,037 (2,738) (369) 930 3,131 4,061 CY14F 5,564 (2,440) (1,758) 1,366 4,061 5,427 CY15F 7,352 (2,439) (2,944) 1,969 5,427 7,396 Cash Flow Statement Rs in million Cash from Operations Cash from Investing activities Cash from Financing Net change in Cash Beginning Cash balance Ending Cash balance Source: WE Research & Company Reports WE Financial Services Corporate Office 506, Fifth Floor, Karachi Stock Exchange Building, Stock Exchange Road, Karachi - 74000, Pakistan URL: www.we.com.pk Disclaimer: All information contained in this publication has been researched and compiled from sources believed to be accurate and reliable at the time of publishing. However, we do not accept any responsibility for its accuracy & completeness and it is not intended to be an offer or a solicitation to buy or sell any securities. WE Financial Services & its employees will not be responsible for the consequence of reliance upon any opinion or statement herein or for any omission. All opinions and estimates contained herein constitute our judgment as of the date mentioned in the report and are subject to change without notice. For live markets, historical data, charts/graphs and investment/technical analysis tools, please visit our website www.weonline.biz URL: www.we.com.pk