Chapter 4 - bryongaskin.net

advertisement

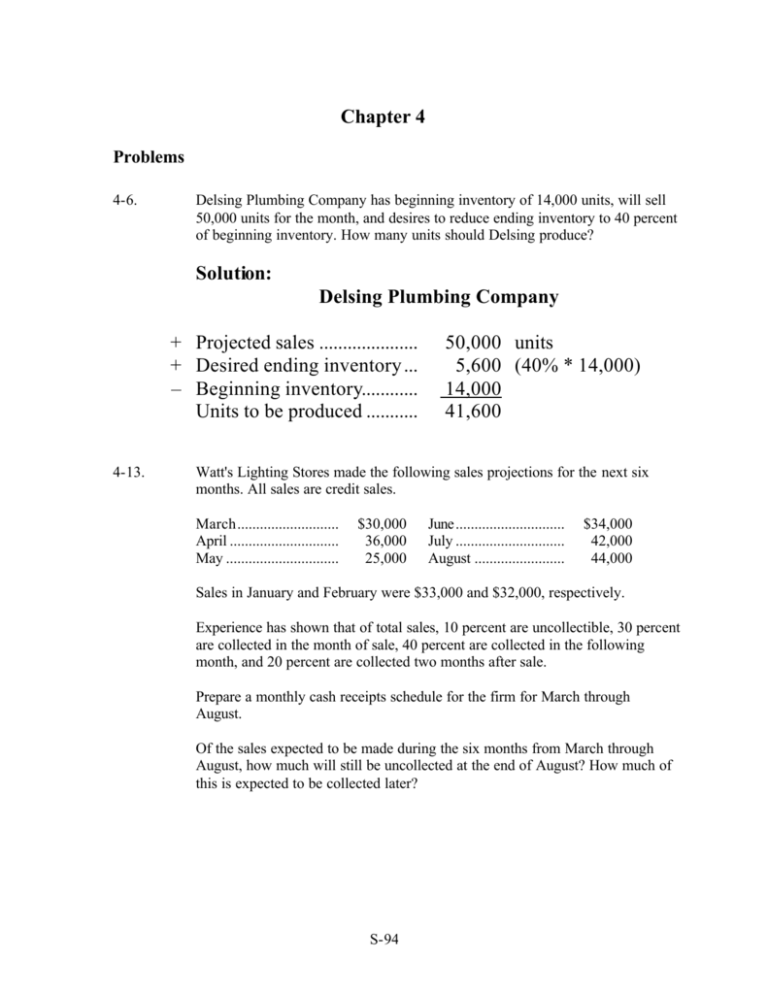

Chapter 4 Problems 4-6. Delsing Plumbing Company has beginning inventory of 14,000 units, will sell 50,000 units for the month, and desires to reduce ending inventory to 40 percent of beginning inventory. How many units should Delsing produce? Solution: Delsing Plumbing Company + Projected sales ..................... + Desired ending inventory ... – Beginning inventory............ Units to be produced ........... 4-13. 50,000 units 5,600 (40% * 14,000) 14,000 41,600 Watt's Lighting Stores made the following sales projections for the next six months. All sales are credit sales. March........................... April ............................. May .............................. $30,000 36,000 25,000 June............................. July ............................. August ........................ $34,000 42,000 44,000 Sales in January and February were $33,000 and $32,000, respectively. Experience has shown that of total sales, 10 percent are uncollectible, 30 percent are collected in the month of sale, 40 percent are collected in the following month, and 20 percent are collected two months after sale. Prepare a monthly cash receipts schedule for the firm for March through August. Of the sales expected to be made during the six months from March through August, how much will still be uncollected at the end of August? How much of this is expected to be collected later? S-94 Solution: Watt's Lighting Stores Cash Receipts Schedule January February March April May June July August $33,000 $32,000 $30,000 $36,000 $25,000 $34,000 $42,000 $44,000 S-106 Sales Collections (30% of current sales) 9,000 10,800 7,500 10,200 12,600 Collections (40% of prior month's 12,800 12,000 14,400 10,000 13,600 sales) Collections (20% of sales 2 6,600 6,400 6,000 7,200 5,000 months earlier) Total cash $28,400 $29,200 $27,900 $27,400 $31,200 receipts Still due (uncollected) in August: Bad debts: ($30,000 + 36,000 + 25,000 + 34,000 + 42,000 + 44,000) × .1 = (211,000) × .1 = $21,100 To be collected from July sales: ($42,000 × .20) = $8,400 To be collected from August sales: ($44,000 × .60) = $26,400 $21,100 + $8,400 + $26,400 = $55,900 due Expected to be collected: $55,900 due – $21,100 bad debts = $34,800 13,200 16,800 6,800 $36,800 4-20. Archer Electronics Company's actual sales and purchases for April and May are shown here along with forecasted sales and purchases for June through September. April (actual) ........................................ May (actual) ......................................... June (forecast)...................................... July (forecast) August (forecast) September (forecast) Sales $320,000 300,000 275,000 275,000 290,000 330,000 Purchases $130,000 120,000 120,000 180,000 200,000 170,000 The company makes 10 percent of its sales for cash and 90 percent on credit. Of the credit sales, 20 percent are collected in the month after the sale and 80 percent are collected two months after. Archer pays for 40 percent of its purchases in the month after purchase and 60 percent two months after. Labor expense equals 10 percent of the current month's sales. Overhead expense equals $12,000 per month. Interest payments of $30,000 are due in June and September. A cash dividend of $50,000 is scheduled to be paid in June. Tax payments of $25,000 are due in June and September. There is a scheduled capital outlay of $300,000 in September. Archer Electronics' ending cash balance in May is $20,000. The minimum desired cash balance is $10,000. Prepare a schedule of monthly cash receipts, monthly cash payments, and a complete monthly cash budget with borrowing and repayments for June through September. The maximum desired cash balance is $50,000. Excess cash (above $50,000) is used to buy marketable securities. Marketable securities are sold before borrowing funds in case of a cash shortfall (less than $10,000). S-119 Solution: Archer Electronics Cash Receipts Schedule S-120 Sales + Cash Sales (10%) Credit Sales (90%) + Collections (month after sale) 20% + Collections (second month after sale) 80% Total Cash Receipts April $320,000 32,000 288,000 May $300,000 30,000 270,000 June $275,000 27,500 247,500 July $275,000 27,500 247,500 Aug. $290,000 29,000 261,000 Sept. $330,000 33,000 297,000 57,600 54,000 49,500 49,500 52,200 230,400 $311,900 216,000 $293,000 198,000 $276,500 198,000 $283,200 Archer Electronics (continued) Cash Payments Schedule S-121 Purchases Payments (month after purchase—40%) Payments (second month after purchase— 60%) Labor Expense (10% of sales) Overhead Interest Payments Cash Dividend Taxes Capital Outlay Total Cash Payments April $130,000 May $120,000 June $120,000 July $180,000 Aug. $200,000 Sept. $170,000 52,000 48,000 48,000 72,000 80,000 78,000 72,000 72,000 108,000 27,500 12,000 30,000 50,000 25,000 27,500 12,000 29,000 12,000 33,000 12,000 30,000 $270,500 $159,500 $185,000 25,000 30,000 $588,000 Archer Electro nics (continued) Cash Budget S-122 Cash Receipts............................................... Cash Payments ............................................. Net Cash Flow.............................................. Beginning Cash Balance ............................. Cumulative Cash Balance........................... Monthly Borrowing or (Repayment) ......... Cumulative Loan Balance........................... Marketable Securities Purchased (Sold) Cumulative Marketable Securities............. Ending Cash Balance .................................. *Cumulative Marketable Sec. (Aug) Cumulative Cash Balance (Sept) Required (ending) Cash Balance Monthly Borrowing June $311,900 270,500 41,400 20,000 61,400 --11,400 11,400 50,000 $236,400 –254,800 –10,000 –$28,400 S-123 July $293,000 159,500 133,500 50,000 183,500 --133,500 -144,900 50,000 August September $276,500 $283,200 185,000 588,000 91,500 (304,800) 50,000 50,000 141,500 (254,800) -*28,400 -28,400 91,500 --- (236,400) 236,400 -50,000 10,000 4-22. The Manning Company has the following financial statements, which are representative of the company's historical average. Income Statement Sales .......................................................................... Expenses.................................................................... Earnings before interest and taxes ............................ Interest....................................................................... Earnings before taxes................................................ Taxes ......................................................................... Earnings after taxes ................................................... Dividends .................................................................. $200,000 158,000 $ 42,000 7,000 $ 35,000 15,000 20,000 $ 6,000 Balance Sheet Assets Cash........................... $ 5,000 Accounts receivable .. 40,000 Inventory................... 75,000 Current assets .......... $120,000 Fixed assets ............... 80,000 Total assets ................ $200,000 Liabilities and Stockholders' Equity Accounts payable .............. $ 25,000 Accrued wages .................. 1,000 Accrued taxes .................... 2,000 Current liabilities ............. $ 28,000 Notes payable .................... 7,000 Long-term debt .................. 15,000 Common stock................... 120,000 Retained earnings .............. 30,000 Total liabilities and stockholders' equity......... $200,000 The firm is expecting a 20 percent increase in sales next year, and management is concerned about the company's need for external funds. The increase in sales is expected to be carried out without any expansion of fixed assets, but rather through more efficient asset utilization in the existing store. Among liabilities, S-124 through more efficient asset utilization in the existing store. Among liabilities, only current liabilities vary directly with sales. Using the percent-of-sales method, determine whether the company has external financing needs, or a surplus of funds. (Hint: A profit margin and payout ratio must be found from the income statement.) S-125 Solution: Manning Company Profit margin = Payout ratio = Earnings after taxe s $20,000 = = 10% Sales $200, 000 Dividends $6, 000 = = 30% Earnings 20,000 Change in Sales = 20% × $200,000 = $40,000 Spontaneous Assets = Current Assets = Cash + Acc. Rec. + Inventory Spontaneous Liabilities = Acc. Payable + Accr. Wages + Accr. Taxes S-126 RNF = = Α (∆S) − L (∆S) − PS2 (1 − D) S S $120,000 ($40,000) − $28,000 ($40,000) − .10($240,000)(1 − .30) $200,000 $200,000 = .60($40,000) − .14($40,000) − .10($240,000)(.70) = $24,000 − $5,600 − $16,800 RNF = $1,600 The firm needs $1,600 in external funds. S-127