Incentives for the Preservation and Rehabilitation of Historic Homes

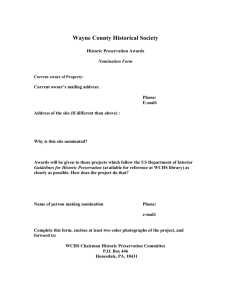

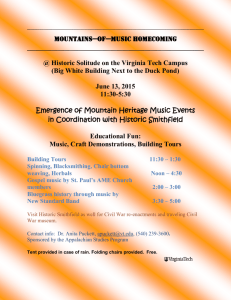

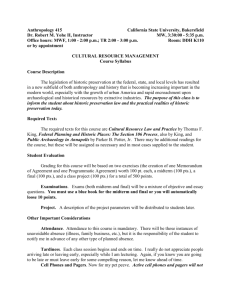

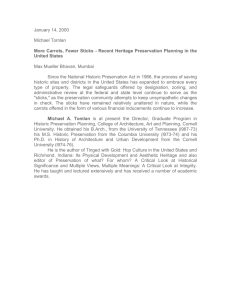

advertisement