DRAFT An Analysis of Residential Market Potential

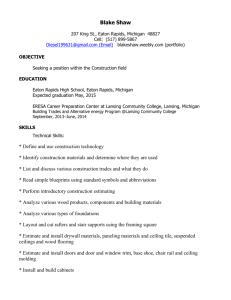

advertisement

DRAFT An Analysis of Residential Market Potential Michigan Street Corridor Study Area City of Grand Rapids Kent County, Michigan November, 2011 Conducted by ZIMMERMAN/VOLK ASSOCIATES, INC. P.O. Box 4907 Clinton, New Jersey 08809 On Behalf of The City of Grand Rapids 1120 Monroe Avenue NW Grand Rapids, Michigan 49503 ZIMMERMAN/VOLK ASSOCIATES, INC. P.O. Box 4907 Clinton, New Jersey 08809 908 735-6336 www.ZVA.cc • info@ZVA.cc Research & Strategic Analysis DRAFT STUDY CONTENTS AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL Market Potential 1 4 —Draw Areas and Market Potential— Where will the potential market for housing in the City of Grand Rapids move from? Market Potential for the Michigan Street Corridor Study Area Where will the potential market for housing in the Michigan Street Corridor Study Area move from? How many households have the potential to rent or purchase new or existing dwelling units within the Michigan Street Corridor Study Area each year over the next five years? What are their housing preferences? Target Market Analysis 4 4 6 6 6 6 9 Who is the potential market? 9 The Current Context 13 What are the alternatives? —Multi-Family Rental Properties— —Multi-Family and Single-Family Attached For-Sale Properties— Market-Entry Rent and Price Ranges: The Michigan Street Corridor Study Area What is the market currently able to pay? —Multi-Family Rental Distribution— —Multi-Family For-Sale Distribution— —Single-Family Attached For-Sale Distribution— —Single-Family Detached For-Sale Distribution— How fast would the unit lease or sell? —Absorption Forecasts— Study Area Building and Unit Types 13 13 14 15 16 16 17 18 19 21 21 25 —Multi-Family— —Single-Family Attached— —Single-Family Detached— —Miscellaneous Building Types— 25 32 35 39 Methodology 40 Assumptions and Limitations Rights and Study Ownership 49 50 o ZIMMERMAN/VOLK ASSOCIATES, INC. P.O. Box 4907 Clinton, New Jersey 08809 908 735-6336 www.ZVA.cc • info@ZVA.cc Research & Strategic Analysis DRAFT AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 The purpose of this study is to examine the market potential for newly-introduced housing units— created both through adaptive re-use of existing non-residential buildings as well as through new construction—that could be leased or sold in the Michigan Street Corridor Study Area over the next five years. In general, the approximate boundaries of the Study Area are the Grand River to the west, the East Beltline to the east, Leonard Street to the north, and Fulton Street to the south. The Study Area encompasses most of Downtown Grand Rapids, the Miracle Mile, the neighborhoods of Belknap Lookout and Highland Park north of Interstate 196, and the neighborhoods of Heartside, Heritage Hill, Midtown, Fulton Heights, and Michigan Oaks south of the Interstate. The remarkable transformation of American households (particularly the emerging predominance of one- and two-person households) over the past decade, combined with steadily increasing traffic congestion and rising gasoline prices, has resulted in significant changes in neighborhood and housing preferences, with major shifts from predominantly single-family detached houses in lowerdensity suburbs to a diverse mix of higher-density apartments, townhouses, and detached houses in downtowns and walkable, mixed-use traditional neighborhoods. This fundamental transformation of American households is likely to continue for several decades, representing an unprecedented demographic foundation on which cities can re-build their downtowns and in-town neighborhoods. However, the current constrained market—characterized throughout most of the United States by weak housing prices; higher than typical levels of unsold units, both builder inventory units as well as foreclosed and/or abandoned houses; and high levels of mortgage delinquencies by speculators and DRAFT Page 2 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 investors as well as homeowners—has resulted in restrictive development financing and mortgage underwriting, taking a significant percentage of potential homebuyers out of the market and preventing numerous developments from going forward. These market constraints do not reduce the size of the potential market; however, depending on the timing of market entry, the initial percentage of the potential market able to overcome the constraints of the deep recession and restrictive mortgage underwriting could be reduced. The extent and characteristics of the potential market for new and existing housing units within the Study Area were therefore identified using Zimmerman/Volk Associates’ proprietary target market methodology. This methodology was developed in response to the challenges that are inherent in the application of conventional supply/demand analysis to urban development and redevelopment. Supply/demand analysis ignores the potential impact of newly-introduced housing supply on settlement patterns, which can be substantial when that new supply matches the housing preferences and economic capabilities of the draw area households in ways that existing housing choices in the market do not. In particular, supply/demand analysis will tend to underestimate demand for higherquality housing when, as is often the case, the supply of new housing is limited, as it is along the Corridor. In contrast to conventional supply/demand analysis, then—which is based on supply-side dynamics and baseline demographic projections—target market analysis determines the depth and breadth of the potential market derived from the housing preferences and socio-economic characteristics of households in the defined draw areas. Because it considers not only basic demographic characteristics, such as income qualification and age, but also less frequently analyzed attributes such as mobility rates, lifestyle patterns and household compatibility issues, the target market methodology is particularly effective in defining a realistic housing potential for urban development and redevelopment where often no directly-comparable properties exist. American households, more than any other nation’s, have always been extraordinarily mobile. However, because of the impact of the recession on household mobility, in 2010 less than 15 percent of American households moved from one dwelling unit to another, a considerably lower mobility rate than in previous years. In general, household mobility is higher in urban areas; a greater ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 3 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 percentage of renters move than owners; and a greater percentage of younger households move than older households. Based on the target market methodology, then, this study determined: • Where the potential renters and buyers for new and existing housing units in the Michigan Street Corridor Study Area are likely to move from (the draw areas); • How many have the potential to move to the Study Area if appropriate housing units were to be made available (depth and breadth of the market); • What their housing preferences are in aggregate (rental or ownership, multi-family or single-family); • How quickly they will rent or purchase the new units (market capture/absorption forecasts over the next five years); • Who currently lives in the draw areas and what they are like (the target markets); • What their alternatives are (the greater Downtown Grand Rapids market context); and • What they will pay to live in the Michigan Street Corridor Study Area (market-entry rents and prices). The target market methodology is described in detail in the METHODOLOGY section at the end of this study. ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 4 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 MARKET POTENTIAL From the market perspective, considerable demand continues to exist for new housing, both new construction and adaptive re-use of existing buildings, in Downtown Grand Rapids housing. The challenge will be to extend market interest to new units located further east along the Michigan Street Corridor Study Area. —DRAW AREAS AND MARKET POTENTIAL— Target market analysis determines the specific target markets for the Michigan Street Corridor Study Area by filtering the overall market as follows: 1. Identifying the annual market potential for the City of Grand Rapids as a whole; 2. Narrowing the focus to market segments that prefer downtown, in-town, and mixed-use neighborhoods (filtering out housing consumers who would prefer Grand Rapids neighborhoods that are considerably more suburban or even rural in character); 3. Identifying households seeking to live in higher-density housing (filtering out housing consumers who would prefer to live in single-family detached houses on large lots); and 4. Identifying those households with incomes sufficient to afford leases and mortgages required for newly-created quality housing. Where will the potential market for housing in the City of Grand Rapids move from? As derived from the most recent migration and mobility data—taxpayer records compiled by the Internal Revenue Service from 2004 through 2008 and data from the 2008-2010 American Community Survey estimates for the City of Grand Rapids and for Kent County—the principal draw areas for new and existing housing units located in the City of Grand Rapids include the City itself, the balance of Kent County, and the adjacent counties of Ottawa and Allegan. This analysis also factors in the market potential from households currently living in all other counties represented in Kent County migration. Based on the analyses described above, then, the draw areas for the City of Grand Rapids and the Michigan Street Corridor Study Area have been delineated as follows: ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 5 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 • The primary draw area, covering households in market groups with median incomes above $45,000 currently living within the Grand Rapids city limits. • The local draw area, covering households in market groups with median incomes above $45,000 currently living in the balance of Kent County. • The regional draw area, covering households in market groups with median incomes above $45,000 that are likely to move to the City of Grand Rapids from Ottawa and Allegan Counties. • The national draw area, covering households in market groups with median incomes above $45,000 and with the potential to move to the City of Grand Rapids from all other U.S. counties (primarily counties in Michigan, although approximately 30 percent are households currently living outside the state). As derived from the updated migration and mobility analyses, then, the draw area distribution of market potential (those households with the potential to move within or to the City of Grand Rapids) is therefore as follows: Table 1 Market Potential by Draw Area All Neighborhoods and Housing Types City of Grand Rapids, Kent County, Michigan City of Grand Rapids: Balance of Kent County: Regional Draw Area (Ottawa and Allegan Counties): Balance of US: 44.2% 29.9% 5.1% 20.8% Total: 100.0% SOURCE: Zimmerman/Volk Associates, Inc., 2011. ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 6 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 MARKET POTENTIAL FOR THE MICHIGAN STREET CORRIDOR STUDY AREA Where will the potential market for housing in the Michigan Street Corridor Study Area move from? The target market methodology also identifies those households with a preference for living in downtowns, in-town and other urban or mixed-use neighborhoods, such as those that are located along Michigan Street. After discounting for those segments of the city’s potential market that would typically choose suburban or rural locations, the distribution of draw area market potential for new and existing units within the Study Area is summarized as follows: Table 2 Annual Residential Market Potential by Draw Area MICHIGAN STREET CORRIDOR STUDY AREA City of Grand Rapids, Kent County, Michigan City of Grand Rapids: Balance of Kent County: Regional Draw Area (Ottawa and Allegan Counties): Balance of US: 43.3% 20.6% 2.8% 33.3% Total: 100.0% SOURCE: Zimmerman/Volk Associates, Inc., 2011. How many households have the potential to rent or purchase new or existing dwelling units within the Michigan Street Corridor Study Area each year over the next five years? As determined by the target market methodology, which accounts for household mobility within the City of Grand Rapids and the balance of Kent County, as well as migration and mobility patterns for households currently living in all other cities and counties, approximately 5,510 younger singles and couples, empty nesters and retirees, and traditional and non-traditional families, in market groups with annual incomes above $45,000, represent the potential market for new and existing housing units within the Michigan Street Corridor Study Area each year over the next five years. What are their housing preferences? The housing preferences of the 5,510 draw area households that represent the annual potential market for new and existing housing units within the Study Area—according to tenure (rental or ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 7 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 ownership) choices and broad financial capacity—are in line with the recent findings from other urban studies undertaken by this firm and are outlined as follows: Table 3 Annual Potential Market MICHIGAN STREET CORRIDOR STUDY AREA City of Grand Rapids, Kent County, Michigan NUMBER OF HOUSEHOLDS PERCENT OF TOTAL Multi-family for-rent (lofts/apartments, leaseholder) 2,585 46.9% Multi-family for-sale (lofts/apartments, condo/co-op ownership) 755 13.8% Single-family attached for-sale (townhouses/rowhouses, fee-simple/ condominium ownership) 895 16.2% Low-range single-family detached for-sale (houses, fee-simple ownership) 470 8.5% Mid-range single-family detached for-sale (houses, fee-simple ownership) 435 7.9% High-range single-family detached for-sale (houses, fee-simple ownership) 370 6.7% Total 5,510 100.0% HOUSING TYPE SOURCE: Zimmerman/Volk Associates, Inc., 2011. The continuing weak for-sale housing market has been the impetus for a significant shift in market preferences from home ownership to rental dwelling units over the past three years, particularly among younger households. This results in a higher share of consumer preference for multi-family rentals even among relatively affluent consumers than would have been typical just three years ago. From the perspective of draw area target market propensities and compatibility, and within the context of the new housing marketplace in the greater Downtown Grand Rapids market area, the potential market for new housing units within the Study Area could include the full range of housing types, from rental multi-family to for-sale single-family detached. However, within the Study Area, new development should concentrate for the most part on the highest-density housing types, which support transit and urban development and redevelopment most efficiently as well as providing the greatest fiscal, economic and social/lifestyle benefit. Exceptions would include the ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 8 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 construction of new detached houses on selected vacant single-family lots in the neighborhoods adjacent to Michigan Street. Recommended housing types therefore include: • Rental lofts and apartments (multi-family for-rent); • For-sale lofts and apartments (multi-family for-sale); • Townhouses, live-work (single-family attached for-sale); and • Urban detached houses (single-family detached for-sale on small lots). Excluding large-lot single-family detached units, then, this analysis has determined that an annual average of 4,660 households currently living in the defined draw areas represent the pool of potential renters/buyers of new and existing housing units within the Study Area each year over the next five years. As derived from the tenure and housing preferences of those draw area households, the distribution of housing types would therefore be as follows: Table 4 Annual Potential Market for Higher-Density Housing MICHIGAN STREET CORRIDOR STUDY AREA City of Grand Rapids, Kent County, Michigan NUMBER OF HOUSEHOLDS PERCENT OF TOTAL Multi-family for-rent (lofts/apartments, leaseholder) 2,585 55.5% Multi-family for-sale (lofts/apartments, condo/co-op ownership) 755 16.2% Single-family attached for-sale (townhouses/live-work, fee-simple/ condominium ownership) 895 19.2% Urban single-family detached (houses, fee-simple ownership) 425 9.1% Total 4,660 100.0% HOUSING TYPE SOURCE: Zimmerman/Volk Associates, Inc., 2011. ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 9 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 TARGET MARKET ANALYSIS Who is the potential market? As noted earlier in this report, the increasing market interest in urban neighborhoods—walkable, with a mix of uses and a variety of housing types—is the result of significant changes in American households, the growing cost of commuting by private automobile, and the profound impact of the Great Recession, which began in 2007, on both households and builder/developers. The changing composition of American households may have the most lasting influence, however, because of the changing housing preferences of the two largest generations in the history of America: the Baby Boomers (currently estimated at 77 million), born between 1946 and 1964, and the estimated 78 million Millennials, who were born from 1977 to 1996 and, in 2010, surpassed the Boomers in population. The Millennials are demonstrating a strong preference for downtowns and walkable neighborhoods, particularly those served by transit. In contrast to the traditional family, i.e.—a married couple with children—that comprised the typical post-war American household, Millennials are predominantly younger singles and couples. As determined by the target market analysis, then, and reflecting national trends, the annual potential market, characterized by lifestage, for new and existing units within the Michigan Street Corridor Study Area is shown on the following table: Table 5 Housing Preferences by Household Type MICHIGAN STREET CORRIDOR STUDY AREA City of Grand Rapids, Kent County, Michigan PERCENT OF TOTAL RENTAL MULTI-FAM. FOR-SALE MULTI-FAM. FOR-SALE SF ATTACHED FOR-SALE SF DETACHED Empty-Nesters & Retirees 18% 11% 21% 22% 49% Traditional & Non-Traditional Families 11% 9% 3% 15% 22% Younger Singles & Couples 71% 80% 76% 63% 29% Total 100% 100% 100% 100% 100% HOUSEHOLD TYPE SOURCE: Zimmerman/Volk Associates, Inc., 2011. ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 10 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 • The largest general market segment continues to be younger singles and couples. Among the principal factors in the larger share of the market held by younger singles and couples are: • Their higher mobility rates—young people tend to move much more frequently than older people; • The reduced mobility of older singles and couples because of their inability, or reluctance, to sell their existing units in the current housing recession; and • The strong preference of younger households for mixed-use walkable neighborhoods. Approximately 40 percent of these younger households would be moving to the Study Area from another dwelling unit in Grand Rapids, another 20 percent would be moving from elsewhere in Kent County, four percent from the region, and the remaining 36 percent from outside the region. Since younger singles and couples typically choose to live in neighborhoods that contain a diverse mix of people, housing types, and uses, places for social interaction are significantly more important to them than they are to either families or empty nesters and retirees. This market segment chooses neighborhoods with a “sense of place,” with outdoor public spaces and neighborhood amenities that reflect their interests. To many of these households, the public realm can be more important than the dwelling unit itself. The continuing challenge in capturing this potential market is to produce new units that are attractive to young people (lofts, not suburban-style apartments), at rents and prices that they can afford, within a vibrant neighborhood with a varied mix of uses, services and activities. ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 11 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 • The next largest market segment is comprised of older households (empty nesters and retirees). Nearly a third of these households are currently living in Grand Rapids. Empty nesters and retirees— of which the largest target groups are, in order of median income, Urban Establishment, New Empty Nesters, No-Nest Suburbanites and MiddleAmerican Retirees—represent just 18 percent of the potential market for the Study Area, in part, as noted above, because of their inability to sell—or reluctance to sell at a loss—their existing housing units. However, as the national, regional, and local housing markets begin to stabilize, and with the introduction of new units in a broad range of rents and prices, older households are likely to become a larger share of the potential market. • The third, and smallest, general market segment is comprised of family-oriented households (traditional and non-traditional families), representing just 11 percent of the market for new housing in the Study Area. Depending on housing type, family-oriented households, many of whom are single parents with one or two children, make up between just three percent (for-sale multi-family) and 22 percent (for-sale single-family detached) of the market for new housing units in the Michigan Street Corridor Study Area. Outside of New York City, very few traditional families choose to live in multi-family dwelling units, in large part because of the lack of private outdoor space in which their children can play unsupervised. Over 60 percent of the traditional and non-traditional family households that represent the potential market for new housing in the Study Area currently live in either Grand Rapids or elsewhere in Kent County; just two percent would be moving to the Study Area from the region, and more than 37 percent from elsewhere in the U.S. ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 12 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 The primary target groups, their median and range of incomes, and median home values, are: Table 6 Potential Housing Market (In Order of Median Income) MICHIGAN STREET CORRIDOR STUDY AREA City of Grand Rapids, Kent County, Michigan HOUSEHOLD TYPE MEDIAN INCOME BROAD INCOME RANGE MEDIAN HOME VALUE (IF OWNED) Empty Nesters & Retirees Old Money Urban Establishment Small-Town Establishment Cosmopolitan Elite Suburban Establishment New Empty Nesters Affluent Empty Nesters Cosmopolitan Couples Mainstream Retirees Middle-Class Move-Downs No-Nest Suburbanites Middle-American Retirees Multi-Ethnic Retirees $157,300 $121,300 $113,600 $107,100 $98,800 $97,700 $97,700 $77,500 $71,800 $70,900 $69,100 $67,000 $55,900 $100,000–$250,000 $75,000–$175,000 $75,000–$150,000 $75,000–$150,000 $65,000–$135,000 $60,000–$140,000 $55,000–$145,000 $50,000–$100,000 $45,000–$100,000 $50,000–$95,000 $45,000–$90,000 $45,000–$85,000 $45,000–$70,000 $433,600 $299,300 $245,100 $211,600 $197,400 $161,200 $209,100 $196,800 $147,500 $120,800 $115,500 $112,200 $121,400 Traditional & Non-Traditional Families Unibox Transferees Full-Nest Urbanites Multi-Ethnic Families Multi-Cultural Families $114,800 $75,900 $71,400 $47,900 $80,000–$165,000 $50,000–$95,000 $45,000–$95,000 $45,000–$55,000 $195,900 $188,000 $123,200 $95,400 Younger Singles & Couples The Entrepreneurs e-Types Fast-Track Professionals The VIPs Upscale Suburban Couples New Bohemians Twentysomethings Suburban Achievers Small-City Singles Urban Achievers $141,900 $118,200 $101,200 $100,300 $93,500 $74,200 $69,500 $67,100 $54,500 $48,400 $75,000–$200,000 $70,000–$165,000 $55,000–$150,000 $55,000–$145,000 $50,000–$140,000 $45,000–$125,000 $45,000–$95,000 $45,000–$90,000 $45,000–$70,000 $45,000–$55,000 $325,700 $336,400 $242,500 $203,100 $160,800 $257,000 $137,700 $148,100 $103,800 $200,500 NOTE: The names and descriptions of the market groups summarize each group’s tendencies—as determined through geo-demographic cluster analysis—rather than their absolute composition. Hence, every group could contain “anomalous” households, such as emptynester households within a “full-nest” category. SOURCE: Zimmerman/Volk Associates, Inc., 2011. (Reference APPENDIX THREE, TARGET MARKET DESCRIPTIONS, for detail on each target group.) ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 13 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 THE CURRENT CONTEXT What are the alternatives? —Multi-Family Rental Properties— Rents at most of the rental properties included in the survey in 2004 and the update in 2008 have continued to rise through 2011. Of the properties covered in all three surveys, and excluding properties with income restrictions, rents for studios have risen from $500 a month in 2008 (from $425 in 2004) to $695 per month in 2011, for units generally containing between 400 and 600 square feet (with a current general range of $1.13 to $2.04 per square foot, considerably higher than in 2008). Again excluding properties with income restrictions, rents for one-bedroom apartments now generally start nearly $900 per month, with the highest one-bedroom rent at $1,300 per month. The one-bedroom size range is from approximately 600 to 1,000 square feet of living space ($0.93 to $2.07 per square foot). Two-bedroom units now start at around $950, up from $650 per month in 2008; two-bedroom penthouse rents are as high as $2,700 a month. In general, two-bedroom unit sizes range between 780 and 1,800 square feet (generally $1.06 to $2.04 per square foot in 2011, from $0.80 to $1.29 per square foot in 2008). Three-bedroom apartments now rent for $1,000 to $2,500 per month, up from around $925 to nearly $2,000 per month in 2008. Unit sizes range between 1,300 and 2,2275 square feet (approximately $0.86 to $1.93 per square foot in 2011, from $0.80 to $0.86 per square foot in 2008). Occupancy rates continue to be very high, ranging between 95 and 100 percent (functional full occupancy) ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 14 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 —Multi-Family and Single-Family Attached For-Sale Properties— Most of the condominium housing developments, both adaptive re-use and new construction, that were marketing units in 2008 are sold out or are nearing sell-out, or continue to lease unsold units. Base prices for Downtown units now start at around $125,000 (Boardwalk). The remaining units at the 39-unit Fitzgerald, the renovation of a former YMCA, are priced between $179,900 for a 754square-foot one-bedroom apartment to just under $600,000 (down from $1 million in 2008) for a 3,500-square-foot penthouse. Nine units remain to be sold, and the property has averaged the sale of just under one unit per month. River House, the 34-story tower located on Bridge Street, has now sold 159 of its 207 units, for an average sales pace of 4.4 units per month. The remaining 48 units are priced between $179,995 for a 915-square-foot one-bedroom apartment to over $767,000 for a 4,650-square-foot “white box” penthouse. Base prices per square foot for the remaining units range between $150 and $262. Most average sales paces are continuing to fall as fewer sales are achieved in the continuing soft market, and many unsold units continue to be rented. ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 15 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 MARKET-ENTRY RENT AND PRICE RANGES: THE MICHIGAN STREET CORRIDOR STUDY AREA From the perspective of the housing consumer, the major challenges to new residential development in the Michigan Street Corridor Study Area include: • High rents and prices: The high costs of land and site assembly, buildings, materials and labor, in addition to the typically high cost of adaptive re-use, are, without incentives or subsidies, likely to drive rents and prices beyond the reach of many potential residents of new units within the Study Area. • Financing challenges: Mortgages are still difficult to obtain for many potential buyers, and restrictive mortgage underwriting and development finance continues to be a challenge to developers. • Neglected or vacant properties: Vacant properties and empty lots are a deterrent to potential residents, as they contribute to the perception that those areas are neglected and/or dangerous neighborhoods. • High traffic volumes, particularly along the western portion of Michigan Street: Because of the noise and exhaust generated by automobiles and trucks, few households choose to live directly on a street with significant amounts of traffic unless there is a significant buffer between the dwelling units and the arterial. From the perspective of the housing consumer, the assets of the Michigan Street Corridor Study Area that make the neighborhoods within it attractive places to live include: • Easy access to Downtown Grand Rapids. • Easy access to the major medical and religious institutions located within the Study Area. • Easy access to many of the cultural venues of the region, such as the Van Andel Arena, the Civic Theatre, and the Children’s Museum. ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 16 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 What is the market currently able to pay? —Multi-Family Rental Distribution— Based on the annual incomes and financial capabilities of the households that represent the target markets for new and existing rental units in the Study Area, the distribution of annual market potential by rent range would be summarized as follows: Table 7 Rent Ranges Based on Incomes of Annual Potential Market Multi-Family For-Rent Units MICHIGAN STREET CORRIDOR STUDY AREA City of Grand Rapids, Kent County, Michigan MONTHLY RENT RANGE ANNUAL POTENTIAL MARKET $500–$750 $750–$1,000 $1,000–$1,250 $1,250–$1,500 $1,500–$1,750 $1,750–$2,000 $2,000 and up Total: PERCENTAGE 537 654 662 399 181 86 86 20.8% 25.3% 25.6% 15.4% 7.0% 3.3% 2.6% 2,585 100.0% SOURCE: Zimmerman/Volk Associates, Inc., 2011. ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 17 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 —Multi-Family For-Sale Distribution— Based on the annual incomes and financial capabilities of the households that represent the target markets for new and existing for-sale multi-family units (condominiums) in the Study Area, the distribution of annual market potential by price range would be summarized as follows: Table 8 Price Ranges Based on Incomes of Annual Potential Market Multi-Family For-Sale Units MICHIGAN STREET CORRIDOR STUDY AREA City of Grand Rapids, Kent County, Michigan MONTHLY RENT RANGE ANNUAL POTENTIAL MARKET $100,000–$150,000 $150,000–$200,000 $200,000–$250,000 $250,000–$300,000 $300,000–$350,000 $350,000–$400,000 $400,000–$450,000 $450,000 and up Total: PERCENTAGE 75 251 238 92 56 20 13 20 9.9% 33.3% 31.5% 12.2% 7.4% 2.7% 1.7% 1.3% 755 100.0% SOURCE: Zimmerman/Volk Associates, Inc., 2011. ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 18 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 —Single-Family Attached For-Sale Distribution— Based on the annual incomes and financial capabilities of the households that represent the target markets for new and existing for-sale single-family attached units (townhouses) in the Study Area, the distribution of annual market potential by price range would be summarized as follows: Table 9 Price Ranges Based on Incomes of Annual Potential Market Single-Family Attached For-Sale Units MICHIGAN STREET CORRIDOR STUDY AREA City of Grand Rapids, Kent County, Michigan MONTHLY RENT RANGE ANNUAL POTENTIAL MARKET $100,000–$150,000 $150,000–$200,000 $200,000–$250,000 $250,000–$300,000 $300,000–$350,000 $350,000–$400,000 $400,000–$450,000 $450,000 and up Total: PERCENTAGE 80 219 264 142 106 38 23 23 8.9% 24.5% 29.5% 15.9% 11.8% 4.2% 2.6% 2.6% 895 100.0% SOURCE: Zimmerman/Volk Associates, Inc., 2011. ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 19 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 —Single-Family Detached For-Sale Distribution— Based on the annual incomes and financial capabilities of the households that represent the target markets for new and existing for-sale urban single-family detached units (houses) in the Study Area, the distribution of annual market potential by price range would be summarized as follows: Table 10 Price Ranges Based on Incomes of Annual Potential Market Urban Single-Family Detached For-Sale Units MICHIGAN STREET CORRIDOR STUDY AREA City of Grand Rapids, Kent County, Michigan MONTHLY RENT RANGE ANNUAL POTENTIAL MARKET $100,000–$150,000 $150,000–$200,000 $200,000–$250,000 $250,000–$300,000 $300,000–$350,000 $350,000–$400,000 $400,000–$450,000 $450,000 and up Total: PERCENTAGE 15 78 100 68 63 55 24 22 3.5% 18.4% 23.5% 16.0% 14.8% 11.9% 5.7% 5.2% 425 100.0% SOURCE: Zimmerman/Volk Associates, Inc., 2011. ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 20 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 Based on the tenure preferences of draw area households and their income and financial capabilities, then, the general range of rents and prices for newly-developed residential units within the Michigan Street Corridor Study Area that could currently be sustained by the market is as follows: Table 11 General Rent, Price and Size Ranges Newly-Created Housing (Adaptive Re-Use and New Construction) MICHIGAN STREET CORRIDOR STUDY AREA City of Grand Rapids, Kent County, Michigan RENT/PRICE RANGE SIZE RANGE Open Lofts * $625–$1,200/month 500–1,000 sf $1.20–$1.25 psf Soft Lofts † $750–$1,600/month 550–1,200 sf $1.33–$1.36 psf $1,150–$2,100/month 750–1,400 sf $1.50–$1.53 psf HOUSING TYPE RENT/PRICE PER SQ. FT. FOR-RENT (MULTI-FAMILY)— Luxury Apartments FOR-SALE (MULTI-FAMILY)— Open Lofts * $110,000–$195,000 750–1,400 sf $139–$147 psf Soft Lofts † $145,000–$265,000 850–1,600 sf $166–$171 psf $225,000–$435,000 950–1,800 sf $237–$242 psf Luxury Condominiums FOR-SALE (SINGLE-FAMILY ATTACHED)— Rowhouses $175,000–$245,000 1,100–1,600 sf $153–$159 psf Live-Work $235,000–$285,000 1,500–1,750 sf $157–$163 psf 1,000–1,800 sf $164–$165 psf FOR-SALE (SINGLE-FAMILY DETACHED)— Urban Houses $165,000–$295,000 * Unit interiors of “open lofts” typically have high ceilings and commercial windows and are either minimally finished, limited to architectural elements such as columns and fin walls, or unfinished, with no interior partitions except those for bathrooms. † Unit interiors of “soft lofts” may or may not have high ceilings and are fully finished, with the interiors partitioned into separate rooms. SOURCE: Zimmerman/Volk Associates, Inc., 2011. The aforementioned rents and prices are in year 2011 dollars, are exclusive of consumer options and upgrades, or floor or location premiums, and cover a broad range of rents and prices for newlydeveloped units currently sustainable by the market in the Study Area. With the exception of singlefamily units, parking is not included in the rents or prices; single-family prices include a one-car garage. For the most part (and depending on location), these rents and prices cannot be achieved by the development of one or two infill units, but require that projects be of sufficient size to achieve development efficiency and to support a high-impact marketing campaign. Location will also have a ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 21 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 significant impact on rents and prices; projects situated within a short walking distance of high-value amenities, such as restaurants, theaters, shops, or transit will likely command rents and prices at the upper end of values. Those projects that are located on the outer edges of the Study Area are likely to command rent and prices at the lower end of values. How fast would the units lease or sell? —ABSORPTION FORECASTS— As noted in the Introduction to this study, the current constrained market is characterized in many locations by reduced housing prices, high levels of unsold units, high levels of mortgage delinquencies and foreclosures, and restrictive mortgage underwriting and development finance. Also, as noted previously, these market constraints do not reduce the size of the potential market, but, depending on the timing of market entry, they do reduce the initial percentage of the potential market able to overcome those constraints. After more than two decades’ experience in various markets across the country, and given current economic conditions, which are not likely to improve significantly over the near term, Zimmerman/Volk Associates has determined that for new construction, an annual capture of up to 8.5 percent of the potential market for each for-sale housing type could be achievable. (Nationally, prior to the housing collapse in 2008, newly-constructed dwelling units represented 15 percent of all units sold; in the first quarter of 2011, newly-constructed dwelling units represented just 8.5 percent of all units sold.) For new multi-family rentals, an annual capture of up to 10 percent of the potential market is likely to be achievable. Based on those capture rates, the Michigan Street Corridor Study Area should be able to support 435 new units (new construction or adaptive re-use of existing buildings) per year over the next five years, as outlined on the following page. ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 22 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 Table 12 Annual Market Capture New Construction MICHIGAN STREET CORRIDOR STUDY AREA City of Grand Rapids, Kent County, Michigan NUMBER OF HOUSEHOLDS HOUSING TYPE Rental Multi-Family (lofts/apartments, leaseholder) 2,585 For-Sale Multi-Family (lofts/apartments, condo/co-op ownership) CAPTURE RATE NUMBER OF NEW UNITS 10% 259 755 8.5% 64 For-Sale Single-Family Attached (townhouses/rowhouses, fee-simple ownership) 895 8.5% 76 For-Sale Urban Single-Family Detached (houses, fee-simple ownership) 425 8.5% 36 Total 4,660 435 SOURCE: Zimmerman/Volk Associates, Inc., 2011. NOTE: Target market capture rates are a unique and highly-refined measure of feasibility. Target market capture rates are not equivalent to—and should not be confused with— penetration rates or traffic conversion rates. The target market capture rate is derived by dividing the annual forecast absorption—in aggregate and by housing type—by the number of households that have the potential to purchase or rent new housing within a specified area in a given year. The penetration rate is derived by dividing the total number of dwelling units planned for a property by the total number of draw area households, sometimes qualified by income. The traffic conversion rate is derived by dividing the total number of buyers or renters by the total number of prospects that have visited a site. Because the prospective market for a location is more precisely defined, target market capture rates are higher than the more grossly-derived penetration rates. However, the resulting higher capture rates are well within the range of prudent feasibility. ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 23 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 In general, redevelopment locations within the Michigan Street Corridor Study Area should be evaluated relative to the following criteria for successful urban housing initiatives: (a) Advantageous adjacency. It is critical to “build on strength,” not only to provide maximum support for any proposed housing initiatives, but also, conversely, so that housing initiatives will reinforce existing or proposed adjacent developments (commercial, retail, or residential). (b) Building and/or land availability. At present, several buildings or parcels within the Study Area are underutilized or vacant. Under-used surface parking lots are better utilized as sites for new infill mixed-use development, not only to enhance the city’s tax base, but also to provide a more inviting and interesting pedestrian experience for residents and visitors. (c) Potential for expansion. Each housing initiative should be located in a location where, at the successful completion of the initial project, adjacent or nearby buildings and/or land appropriate for the continuation or extension of the redevelopment, either through new construction or adaptive re-use would potentially be available. Each housing initiative should be viewed not as a “stand-alone” project, but rather as a potential catalyst for additional residential development in surrounding areas. (d) Anchors/linkage. Each housing initiative must be seen as part of an overall urban strategy to build a critical mass of both housing and related non-residential uses along Michigan Street and within the Study Area. “Anchor” locations establish the potential for economic activity in an underutilized area; “linkage” locations build on the strength of two or more established, but disconnected assets. ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 24 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 Since the Study Area is largely built out, with little undeveloped land remaining for development, vacant lots, vacant and/or dilapidated buildings, and large open parking lots, particularly if owned by a public entity, represent the best opportunities for new housing or mixed-used buildings within the Study Area. If feasible from the development perspective, examples of potential redevelopment locations could include the Eastern Elementary School in Highland Park; the vacant and underutilized parcels in the vicinity of Bradford and Lafayette Streets in the Belknap Lookout neighborhood; the open parking lot on Plymouth Avenue which is currently used as off-site parking for the hospital; and the vacant industrial building on Leffingwell Avenue close to Michigan Street. ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 25 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 STUDY AREA BUILDING AND UNIT TYPES Building and unit types most appropriate for the Michigan Street Corridor Study Area include: —MULTI-FAMILY— • Loft Building: Either adaptive re-use of older warehouse or manufacturing buildings or a new-construction building type inspired by those buildings. The new-construction version usually has double-loaded corridors. Loft building ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 26 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 • Open Loft: Unit interiors typically have high ceilings and commercial windows and are minimally finished (with minimal room delineations such as columns and fin walls), or unfinished (with no interior partitions except those for bathrooms). Open Loft ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 27 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 • Soft Loft: Unit interiors typically have high ceilings, are fully finished and partitioned into individual rooms. Units may also contain architectural elements reminiscent of “hard lofts,” such as exposed ceiling beams and ductwork, concrete floors and industrial finishes, particularly if the building is an adaptive re-use of an existing industrial structure. Soft Loft ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 28 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 • Luxury Apartment: A more conventionally-finished apartment unit, typically with completely-partitioned rooms.—trim, interior doors, kitchens and baths are fitted out with higher-end finishes and fixtures. Luxury Apartment ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 29 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 • Liner Building: An apartment building with apartments and/or lofts lining two to four sides of a multi-story parking structure. Units are typically served from a single-loaded corridor that often includes access to parking. Ground floors typically include a traditional apartment lobby and can also include maisonette apartments, retail or some combination of the two. Liner buildings ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 30 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 • Maisonette Apartment Building: A three- or four-story building with an elevation that resembles a row of townhouses; the interior, however, combines single-level and two-level apartments. Each unit has its own street entrance and attached garage, accessed from the rear of the building. Maisonette apartment buildings ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 31 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 • Mixed-Use Building: A pedestrian-oriented building, either attached or free-standing, with apartments and/or offices over flexible ground floor uses that can range from retail to office to residential. Mixed-use buildings ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 32 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 —SINGLE-FAMILY ATTACHED— • Rowhouse: Similar in form to a conventional suburban townhouse except that the garage— either attached or detached—is located to the rear of the unit and accessed from an alley or auto court. Unlike conventional townhouses, urban townhouses conform to the pattern of streets, typically with shallow front-yard setbacks. Rowhouses ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 33 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 • Duplex: A two-unit rowhouse with the garage—either attached or detached—located to the rear of the unit and accessed from an alley or auto court. Like the rowhouse, urban duplexes conform to the pattern of streets, typically with shallow front-yard setbacks. In a corner location, the units can each front a different street. Corner duplex ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 34 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 • Live-work: A unit or building type that accommodates non-residential uses in addition to, or combined with living quarters. The typical live-work unit is a building, either attached or detached, with a principal dwelling unit that includes flexible space that can be used as office, retail, or studio space, or as an accessory dwelling unit. Live-work units ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 35 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 —SINGLE-FAMILY DETACHED— • Bungalow Court Houses: Relatively small, one- or one-and-a-half-story single-family detached houses—each with its own small yard—arranged in a U-shape enfronting a small common or green. The bungalows are separated from the common area only by a sidewalk, path or other non-vehicular way. Parking is from rear lanes, alleys or in a common, rear- or side-loaded lot. A bungalow almost always includes a large porch. Bungalow court ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 36 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 • Cottage: A small one-, one-and-a-half- or two-story single-family detached house on a small lot, usually with alley-loaded parking. Cottage ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 37 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 • Village House: A one-and-a-half- or two-story single-family detached house on a small lot, often with alley-loaded parking with attached, detached, or open parking—whether alleyloaded or not—set well back from the front façade; in many instances, the garage is framed by a porte-cochère. Village house with porte-cochère carport Village house with porte-cochère and garage ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 38 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 • Neighborhood House: A two- or three-story single-family detached house relatively close to the street with attached, detached, or open parking—whether alley-loaded or not—set well back from the front façade; in many instances, the garage is framed by a porte-cochère. Neighborhood house with porte-cochère and garage ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 39 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 —MISCELLANEOUS BUILDING TYPES— • Accessory Unit: A secondary dwelling unit associated with a principal residence on a single lot. An accessory unit is typically located over the garage, attached or detached, of a rowhouse or detached house. Also known as “garage apartment,” “ancillary apartment,” “accessory apartment,” “granny flat,” “outbuilding” when detached, and “backbuilding” when attached to the principal residence. ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 40 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 METHODOLOGY The technical analysis of market potential for the Michigan Street Corridor Study Area included confirmation of the draw areas—based on the most recent migration data for Kent County, and incorporating additional data from the 2009 American Community Survey for the City of Grand Rapids—as well as compilation of current residential rental and for-sale activity in the greater Downtown area. The evaluation of the city’s market potential was derived from the updated target market analysis of households in the draw areas, and yielded: • The depth and breadth of the potential housing market by tenure (rental and ownership) and by type (apartments, attached and detached houses); and • The composition of the potential housing market (empty-nesters/retirees, traditional and non-traditional families, younger singles/couples). NOTE: The Appendix Tables referenced here are provided in a separate document. DELINEATION OF THE DRAW AREAS (MIGRATION ANALYSIS)— Taxpayer migration data provide the framework for the delineation of the draw areas—the principal counties of origin for households that are likely to move to the City of Grand Rapids. These data are maintained at the county and “county equivalent” level by the Internal Revenue Service and provide a clear representation of mobility patterns. The migration data for the city has been supplemented by mobility data from the 2009 American Community Survey. Appendix One, Table 1. Migration Trends Analysis of the most recent Kent County migration and mobility data available from the Internal Revenue Service—from 2004 through 2008—shows that the county continues to experience net migration losses, with net out-migration ranging from a loss of 1,050 households in 2004 to a loss of nearly 1,800 households in 2007. In 2008, the county’s net loss dropped to 1,045 households. (See Appendix One, Table 1.) ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 41 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 Annual in-migration into Kent County ranged from 10,690 households in 2006, (the lowest inmigrating total over the study period) to 10,900 households in 2005 (the highest in-migrating total). Between 16 and 17 percent of the county’s in-migration is from Ottawa County, the adjacent county to the west, with another four to five percent from Allegan County to the southwest. Annual out-migration from Kent County ranged between the low of 11,885 households in 2004 to the high of nearly 12,700 households in 2007. Approximately 16 to 18 percent of the out-migration is also to Ottawa County; collectively, the majority of out-migration is to other Michigan counties. However, even though net migration provides insights into a city or county’s historic ability to attract or retain households compared to other locations, it is those households likely to move into an area (gross in-migration) that represent that area’s external market potential. Based on the updated migration data, then, the draw areas for the City of Grand Rapids have been confirmed as follows: • The local draw area, covering households in market groups with median incomes above $45,000 currently living within the Grand Rapids city limits and the balance of Kent County. In 2010, the mobility rate for households moving within the city was just under eight percent. For households moving from the balance of the county to the city, the mobility rate was 4.4 percent. • The regional draw area, covering households in market groups with median incomes above $45,000 and with the potential to move to the City of Grand Rapids from Ottawa and Allegan Counties. As noted above, households moving from Ottawa County now comprise more than 17 percent of total Kent County in-migration. Households moving from Allegan County continue to represent just under five percent of total Kent County in-migration. • The national draw area, covering households in market groups with median incomes above $45,000 and with the potential to move to the City of Grand Rapids from all other U.S. counties (primarily counties in Michigan). Anecdotal information obtained from real estate brokers, sales persons, leasing agents, and other knowledgeable sources corresponded to the migration data. ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 42 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 Migration Methodology: County-to-county migration is based on the year-to-year changes in the addresses shown on the population of returns from the Internal Revenue Service Individual Master File system. Data on migration patterns by county, or county equivalent, for the entire United States, include inflows and outflows. The data include the number of returns (which can be used to approximate the number of households), and the median and average incomes reported on the returns. TARGET MARKET CLASSIFICATION OF CITY AND COUNTY HOUSEHOLDS— Geo-demographic data obtained from Nielsen Claritas, Inc. provide the framework for the categorization of households, not only by demographic characteristics, but also by lifestyle preferences and socio-economic factors. For purposes of this study, only those household groups with median incomes above $45,000 are included in the tables. An appendix containing detailed descriptions of each of these target market groups is provided along with the study. Appendix One, Tables 2 and 3. Target Market Classifications Of the estimated 72,125 households living in the City of Grand Rapids in 2011 (Nielsen Claritas’ estimates), over 71 percent, or 51,365 households, are in target market groups with median incomes above $45,000. (Reference Appendix One, Table 2.) Nearly 57 percent of these households can be classified as traditional and non-traditional families (up from just over half in 2007), another 27.8 percent are empty nesters and retirees (up from 22.5 percent), and 15.6 percent are younger singles and couples (down from 27.2 percent). Approximately 72 percent, or 164,000 households, of the 227,725 households estimated to be living in Kent County in 2011 (again, Nielsen Claritas’ estimates) are in target market groups with median incomes above $45,000. (Reference Appendix One, Table 3.) Just over 48 percent of Kent County’s “market-rate” households are classified as traditional and non-traditional families (up from 45 percent in 2007), another 33.6 percent are empty nesters and retirees (up from 27.1 percent), and the remaining 18.2 percent are younger singles and couples (down from 27.8 percent). ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 43 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 Target Market Methodology: The proprietary target market methodology developed by Zimmerman/Volk Associates is an analytical technique, using the PRIZM NE household clustering system, that establishes the optimum market position for residential development of any property—from a specific site to an entire political jurisdiction—through cluster analysis of households living within designated draw areas. In contrast to classical supply/demand analysis—which is based on supply-side dynamics and baseline demographic projections—target market analysis establishes the optimum market position derived from the housing and lifestyle preferences of households in the draw area and within the framework of the local housing market context, even in locations where no close comparables exist. Clusters of households (usually between 10 and 15) are grouped according to a variety of significant “predictor variables,” ranging from basic demographic characteristics, such as income qualification and age, to less-frequently considered attributes known as “behaviors,” such as mobility rates and lifestyle choices. Zimmerman/Volk Associates has refined the analysis of these household clusters through the correlation of more than 500 data points related to housing preferences and consumer and lifestyle characteristics. As a result of this process, Zimmerman/Volk Associates has identified 41 target market groups with median incomes that enable most of the households within each group to qualify for market-rate housing, and an additional 25 groups with median incomes in which a much smaller number of households is able to qualify for market-rate housing. The most affluent of the 66 groups can afford the most expensive new ownership units; the least prosperous are candidates for the least expensive existing rental apartments. Once the draw areas for a property have been defined, then—through field investigation, analysis of historic migration and development trends, and employment and commutation patterns—the households within those areas are quantified using the target market methodology. The potential market for new market-rate units is then determined by the correlation of a number of factors— including, but not limited to: household mobility rates; median incomes; lifestyle characteristics and housing preferences; the location of the site; and the competitive environment. ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 44 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 The end result of this series of filters is the optimum market position—by tenure, building configuration and household type, including specific recommendations for unit sizes, rents and/or prices—and projections of absorption within the local housing context. DETERMINATION ANALYSIS)— OF THE POTENTIAL MARKET FOR THE CITY OF GRAND RAPIDS (MOBILITY The mobility tables, individually and in summaries, indicate the number and type of households that have the potential to move within or to the City of Grand Rapids each year over the next five years. The total number from each city/county is derived from historic migration trends; the number of households from each group is based on each group’s mobility rate. Appendix One, Table 4. Internal Mobility (Households Moving Within the City of Grand Rapids)— Zimmerman/Volk Associates uses U.S. Bureau of the Census data, combined with Nielsen Claritas data, to determine the number of households in each target market group that will move from one residence to another within a specific jurisdiction in a given year (internal mobility). Using these data, Zimmerman/Volk Associates has determined that up to 7,240 households in market groups with median incomes above $45,000 living in the City of Grand Rapids have the potential to move from one residence to another within the city each year over the next five years. Over 45 percent of these households are likely to be younger singles and couples (as characterized within eight Zimmerman/Volk Associates’ target market groups); another 44 percent are likely to be traditional and non-traditional families (in 10 market groups); and the remaining 10.9 percent are likely to be empty nesters and retirees (in 12 market groups). Appendix One, Table 5. Internal Mobility (Households Moving To the City of Grand Rapids from the Balance of Kent County)— The same sources of data are used to determine the number of households in each target market group that will move from one area to another within the same county. Using these data, up to 4,910 households, in market groups with median incomes above $45,000 and currently living in the balance of Kent County, have the potential to move from a residence in the county to a residence in ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 45 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 the City of Grand Rapids each year over the next five years. Up to 45.7 percent of these households are likely to be traditional and non-traditional families (in 11 market groups); 36.8 percent are likely to be younger singles and couples (in seven groups); and the remaining 17.5 percent are likely to be empty nesters and retirees (in 14 groups). Appendix One, Tables 6 and 7. External Mobility (Households Moving To the City of Grand Rapids from Outside Kent County)— These tables determine the number of households in each target market group living in each draw area county that are likely to move to the City of Grand Rapids each year over the next five years (through a correlation of Nielsen Claritas data, U.S. Bureau of the Census data, and the Internal Revenue Service migration data). Appendix One, Table 8. Market Potential for the City of Grand Rapids— Appendix One, Table 8 summarizes Appendix One, Tables 4 through 7. The numbers in the Total column on page one of these tables indicate the depth and breadth of the potential market for new and existing dwelling units in the City of Grand Rapids each year over the next five years originating from households currently living in the draw areas. Up to 16,395 households in target market groups with median incomes over $45,000 have the potential to move within or to the City of Grand Rapids each year over the next five years. Younger singles and couples are likely to account for 42.9 percent of these households (in 12 market groups); another 41.3 percent are likely to be traditional and non-traditional families (in 13 groups); and 15.7 percent are likely to be empty nesters and retirees (in 16 groups).. The distribution of the draw areas as a percentage of the potential market for the City of Grand Rapids is as follows: Market Potential by Draw Area City of Grand Rapids, Kent County, Michigan City of Grand Rapids (Local Draw Area): Balance of Kent County (Local Draw Area): Ottawa and Allegan Counties(Regional Draw Area): Balance of US (National Draw Area): 44.2% 29.9% 5.1% 20.8% Total: 100.0% SOURCE: Zimmerman/Volk Associates, Inc., 2011. ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 46 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 DETERMINATION AREA— OF THE POTENTIAL MARKET FOR THE MICHIGAN STREET CORRIDOR STUDY The total potential market for the new and existing housing units within the Michigan Street Corridor Study Area also includes the local, regional, and national draw areas. Zimmerman/Volk Associates uses U.S. Bureau of the Census data, combined with Nielsen Claritas data, to determine which target market groups, as well as how many households within each group, are likely to move to the Study Area in a given year. Appendix One, Tables 9 through 11. Market Potential for the Michigan Street Corridor Study Area— As derived by the target market methodology, over 5,500 households have the potential to move to the Michigan Street Corridor Study Area each year for the next five years. (Reference Appendix One, Table 9.) Over 64 percent of these households are likely to be younger singles and couples (in 10 market groups); another 23.3 percent are likely to be empty nesters and retirees (in 13 groups); and 12.3 percent are likely to be traditional and non-traditional family households (in four groups). The distribution of the draw areas as a percentage of the market for the Michigan Street Corridor Study Area is shown on the following page: Market Potential by Draw Area MICHIGAN STREET CORRIDOR STUDY AREA City of Grand Rapids, Kent County, Michigan City of Grand Rapids (Local Draw Area): Balance of Kent County (Local Draw Area): Ottawa and Allegan Counties(Regional Draw Area): Balance of US (National Draw Area): 43.3% 20.6% 2.8% 33.3% Total: 100.0% SOURCE: Zimmerman/Volk Associates, Inc., 2011. The 5,510 draw area households that have the potential to move within or to the Study Area have been categorized by tenure propensities to determine renter/owner ratios. Nearly 47 percent of these households (or 2,585 households) comprise the potential market for new market-rate rentals. The remaining 53.1 percent (or 2,925 households) comprise the market for new market-rate for-sale (ownership) housing units. (Reference Appendix One, Table 10.) ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 47 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 Of these 2,925 households, 25.8 percent (or 755 households) comprise the market for multi-family for-sale units (condominium apartments and lofts); this is a smaller percentage of the market than in 2007. Another 30.6 percent (895 households) comprise the market for attached single-family (townhouse or duplex) units. The remaining 43.6 percent (or 1,275 households) comprise the market for all ranges and densities of single-family detached houses. (Reference Appendix One, Table 11.) —Target Market Data— Target market data are based on the Nielsen Claritas PRIZM geo-demographic system, modified and augmented by Zimmerman/Volk Associates as the basis for its proprietary target market methodology. Target market data provides number of households by cluster aggregated into the three main demographic categories—empty nesters and retirees; traditional and non-traditional families; and younger singles and couples. Zimmerman/Volk Associates’ target market classifications are updated periodically to reflect the slow, but relentless change in the composition of American households. Because of the nature of geo-demographic segmentation, a change in household classification is directly correlated with a change in geography, i.e.—a move from one neighborhood condition to another. However, these changes of classification can also reflect an alteration in one of three additional basic characteristics: • Age; • Household composition; or • Economic status. Age, of course, is the most predictable, and easily-defined of these changes. Household composition has also been relatively easy to define; recently, with the growth of non-traditional households, however, definitions of a family have had to be expanded and parsed into more highly-refined segments. Economic status remains clearly defined through measures of annual income and household wealth. A change in classification is rarely induced by a change in just one of the four basic characteristics. This is one reason that the target household categories are so highly refined: they take in multiple characteristics. Even so, there are some rough equivalents in household types as they move from one ZIMMERMAN/VOLK ASSOCIATES, INC. DRAFT Page 48 AN ANALYSIS OF RESIDENTIAL MARKET POTENTIAL The Michigan Street Corridor Study Area City of Grand Rapids, Kent County, Michigan November, 2011 neighborhood condition to another. There is, for example, a strong correlation between the Suburban Achievers and the Urban Achievers; a move by the Suburban Achievers to the urban core can make them Urban Achievers, if the move is accompanied by an upward move in socio-economic status. In contrast, Suburban Achievers who move up socio-economically, but remain within the metropolitan suburbs may become Fast-Track Professionals or The VIPs. Household Classification Methodology: Household classifications were originally based on the Nielsen Claritas PRIZM segmentation system that was established in 1974 and then replaced by PRIZM NE revised household classifications are based on PRIZM NE geo-demographic in 2005. The which was developed through unique classification and regression trees delineating 66 specific clusters of American households. The system is now accurate to the individual household level, adding self-reported and list-based household data to geo-demographic information. The process applies hundreds of demographic variables to nearly 10,000 “behaviors.” Over the past 23 years, Zimmerman/Volk Associates has augmented the PRIZM cluster systems for use within the company’s proprietary target market methodology specific to housing and neighborhood preferences, with additional algorithms, correlation with geo-coded consumer data, aggregation of clusters by broad household definition, and unique cluster names. For purposes of this study, only those household groups with median incomes with median incomes above $45,000 are included in the tables. o ZIMMERMAN/VOLK ASSOCIATES, INC. ZIMMERMAN/VOLK ASSOCIATES, INC. P.O. Box 4907 Clinton, New Jersey 08809 908-735-6336 info@ZVA.cc • www.ZVA.cc Research & Strategic Analysis ASSUMPTIONS AND LIMITATIONS— Every effort has been made to insure the accuracy of the data contained within this analysis. Demographic and economic estimates and projections have been obtained from government agencies at the national, state, and county levels. Market information has been obtained from sources presumed to be reliable, including developers, owners, and/or sales agents. However, this information cannot be warranted by Zimmerman/Volk Associates, Inc. While the methodology employed in this analysis allows for a margin of error in base data, it is assumed that the market data and government estimates and projections are substantially accurate. Absorption scenarios are based upon the assumption that a normal economic environment will prevail in a relatively steady state during development of the subject property. Absorption paces are likely to be slower during recessionary periods and faster during periods of recovery and high growth. Absorption scenarios are also predicated on the assumption that the product recommendations will be implemented generally as outlined in this report and that the developer will apply high-caliber design, construction, marketing, and management techniques to the development of the property. Recommendations are subject to compliance with all applicable regulations. accounting, tax, and legal matters should be substantiated by appropriate counsel. o Relevant ZIMMERMAN/VOLK ASSOCIATES, INC. P.O. Box 4907 Clinton, New Jersey 08809 908 735-6336 www.ZVA.cc • info@ZVA.cc Research & Strategic Analysis RIGHTS AND STUDY O WNERSHIP— Zimmerman/Volk Associates, Inc. retains all rights, title and interest in the methodology and target market descriptions contained within this study. The specific findings of the analysis are the property of the client and can be distributed at the client’s discretion. o ZIMMERMAN/VOLK ASSOCIATES, INC., 2011