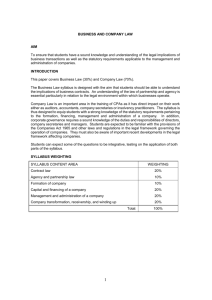

THE COMPANIES ACT, 1965 COMPANY LIMITED BY

advertisement