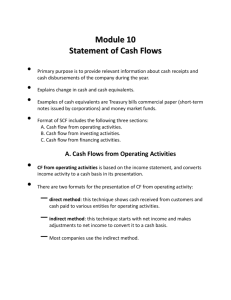

Chapter 21 The Statement of Cash Flows Revisited

advertisement