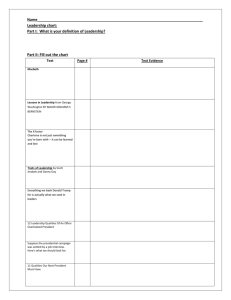

Case Study Turnaround Analysis of

advertisement